Summary:

- Netflix beat Q3’23 estimates with $8.54B in revenues and $3.73 per-share earnings, causing shares to soar 15%.

- The streaming platform added 8.8M subscribers in the third-quarter, but subscriber additions may be inflated due to the firm’s crackdown on password sharing.

- Netflix is increasing monthly streaming plan prices, providing potential for organic top line and margin growth.

- Nonetheless, shares are expensive and have an unattractive risk profile, in my opinion.

hapabapa

Netflix (NASDAQ:NFLX)’s subscriber additions boomed in the third-quarter and the streaming firm beat top and bottom line expectations as a result. Netflix also said that it is raising prices for its monthly streaming plans in a bid to grow its top line as well as improve margins. While the market cheered the company’s results — shares were up 15% pre-trading on Thursday — the recent boost in subscribers is likely due to the company cracking down on password sharing practices which I would consider to have a limited impact on Netflix’s top line going forward.

I believe that excitement over Netflix’s third-quarter subscriber additions is not really justified and I expect a subsequent slowdown in subscriber growth in the quarters ahead. With shares still being expensive based off of revenues, despite a significant share price decline since July, I believe the risk profile remains unappealing for investors.

Previous rating

I rated shares of Netflix a sell due to valuation concerns — Unattractive Valuation — as the streaming firm was by far the most expensive FAANG investment investors could make at the time. I confirm my sell rating following the Q3’23 earnings report, largely based off of concerns over the sustainability of Netflix’s subscriber growth rates.

Netflix beat Q3’23 estimates

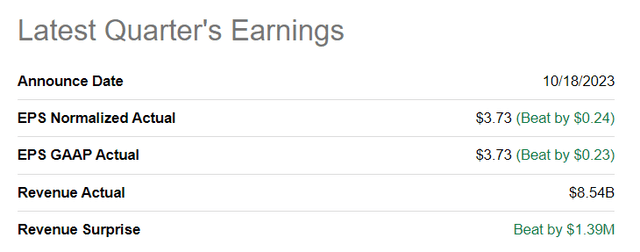

Netflix achieved $8.54B in revenues in the third-quarter which beat the average analyst prediction by $1.4M. In terms of adjusted earnings, Netflix reported $3.73 per-share for Q3’23 which also beat the consensus estimate.

Strong Q3’23 earnings sheet: 8.8M subscriber net additions, subscription plan price increases

When it comes to streaming companies, the most important metric that investors pay attention to is the number of new subscribers that have signed on to a streaming platform. Subscriber growth is the single biggest driver of top line growth, so investors rightfully are preoccupied with this figure.

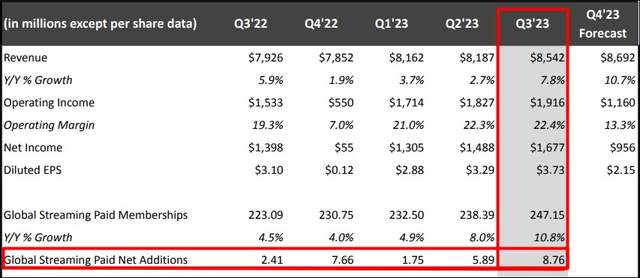

In the third-quarter, Netflix added a massive 8.8M subscribers to its platform which means Netflix ended the third-quarter with a total of 247.15M paying subscribers globally. In total, Netflix grew its accounts 10.8% year over year in Q3’23 and it was the third consecutive quarter of accelerating subscriber growth. The Q3’23 increase in subscribers was also the biggest since the 2020 pandemic.

However, as I said in the introduction, Netflix cracked down on the password sharing practice in the second-quarter which means that the current growth rate in subscribers is likely driven by those users that previously shared passwords.

Netflix’s forecast for the fourth-quarter calls for $8.7B in revenues, potentially showing up to 11% year over year top line growth. The fourth-quarter is typically a strong quarter for streaming companies due to the inclusion of the holiday period.

Prices for Netflix’s monthly streaming plans are going up as well, giving Netflix a catalyst for organic top line as well as margin growth. U.S. streaming prices for the base plan are increasing from $10 to $12 while the premium plan subscription will cost $23 instead of $20. The ad-supported streaming plan will continue to cost $7. Subscription price increases are effective ways for streaming firms to grow revenues and margins effectively. Netflix had an operating income margin of 22.4% in Q3’23 compared to 19.3% in the year-earlier period.

Netflix’s valuation

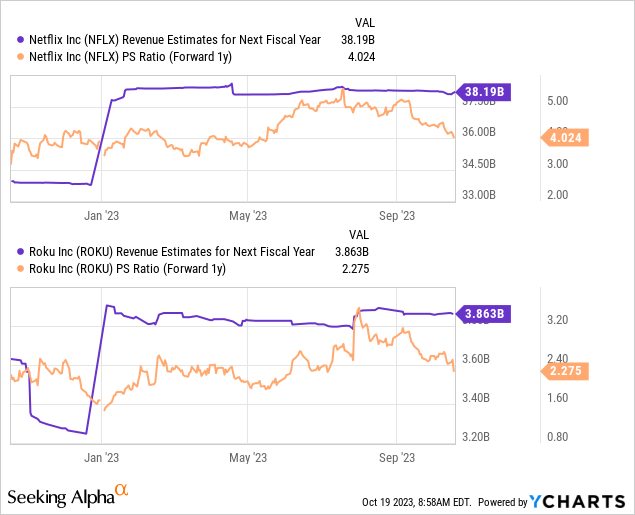

Netflix is still very highly valued and this is despite the company’s shares dropping 29% from their 1-year high in July. Netflix is projected to generate a top line of $33.7B in FY 2023 and $38.2B in FY 2024, implying a year over year growth rate of 14% and there is a good chance that analysts are going to revise their top line estimates to the upside following Netflix’s earnings report. Nonetheless, Netflix is not cheap at all: based off of the FY 2024 top line projection, Netflix is valued at 4.0X revenues while Roku (ROKU), a streaming firm that offers both hardware products as well as streaming services, is currently trading at 2.3X P/S ratio.

Risks with Netflix

The biggest commercial risk for Netflix is a deteriorating outlook for streaming subscriber additions in the fourth-quarter and beyond. The current rate of subscriber growth has been chiefly affected by Netflix’s successful crackdown on households that have shared passwords with friends and families living in other households.

More likely than not, in my opinion, Netflix is going to see a gradual normalization of its subscriber growth rates going forward as this upgrade-effect wears off. However, should Netflix be successful in growing its subscriber base without losing subscribers because of price increases, Netflix may do better than expected and grow into its stretched valuation.

Closing thoughts

Netflix submitted a strong earnings sheet for the third-quarter on Wednesday and the company beat top and bottom line estimates. The streaming platform added almost nine million new subscribers on a global net addition basis, but I believe the number is inflated due to Netflix’s crackdown on password sharing practices which indicates to me that the streaming company is set to see a normalization of subscriber growth rates going forward.

Although Netflix’s valuation has declined significantly since July, I don’t consider the streaming company to be an attractive buy at the current valuation level. While Netflix has potential for top line and margin growth through price increases, the valuation is rich already and I continue to see Netflix as a growth trap!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.