Summary:

- VALE’s financials were impacted by lower iron ore prices in Q2 2023, leading to a decrease in operating cash flow.

- The company’s copper and nickel production exceeded expectations, with plans for further growth in the future.

- China’s economic recovery and its impact on iron ore demand will be a key factor for VALE’s performance.

istock80/iStock via Getty Images

Introduction

Vale S.A. (NYSE:VALE) is a prominent global producer of the metals and mining industry. The company is operating in diverse segments of iron ore, nickel, copper, platinum group metals (PGMs), gold, silver, and cobalt. In my previous update, I investigated VALE’s nickel and copper business. Also, analyzed that the higher the efforts in the Energy Transmission process, the higher the demand for minerals like nickel and copper will be. In this analysis, I go through the effect of lower iron ore prices on VALE’s second-quarter financials and also investigate the iron ore market outlook in the coming years.

VALE financials and business outlook

During the second quarter of 2023, the management completed 69% of their share buyback program, which started in 2021. In the case of copper and nickel production, the company surpassed its production levels considerably. Copper production surged by 41% year over year as compared to 2Q 2022, mainly from the section of Salobo III. It is worth noting that in the first half of 2023, they produced 16 kilotons of copper, and expect Salobo III to add 30,000 to 40,000 kilotons of copper to their total copper production after the end of 2024. Moreover, their nickel production increased by 8% in the recent quarter versus 2Q 2022.

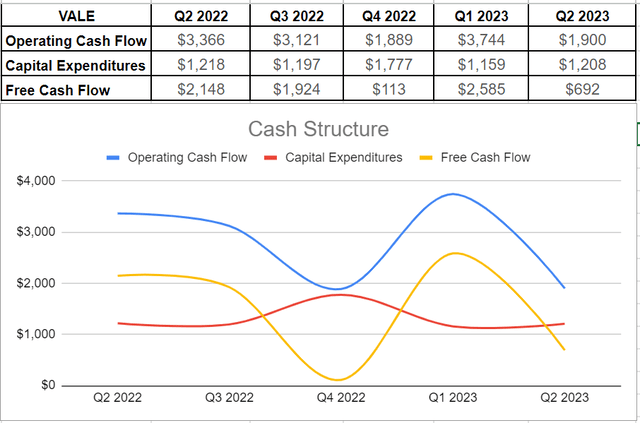

During 2H 2022 and 1H 2023, iron ore and nickel prices plunged, and they were the main reasons for lower operating cash generation and EBITDA amounts in 2Q 2023 versus 2Q 2022. In the second quarter of 2023, VALE’s operating cash flow plunged deeply to $1.9 billion year over year compared with $3.3 billion in 2Q 2022, which mainly was due to a $15 per ton lower iron ore price and a $3000 per ton lower nickel price since the second quarter of 2022. As I will discuss in detail, iron ore prices are anticipated to decline further during the rest of 2023 and even further fall in the long term. I consider a more conservative price of $80 per ton for iron ore by the end of 2023 to be realistic. It is worth noting that the iron ore all-in cost for the company is anticipated to be between $52-54 per ton by the end of 2023, leaving approximately $25 per ton of revenue in iron ore production.

Moreover, their capital expenditures of $1.20 billion remained almost the same as the previous year of $1.21 billion and higher than $1.15 billion at the end of the first quarter of 2023. This higher CapEx was due to 7 million tons of higher iron ore sales volumes that caused an increase in working capital. As a result, led to $690 million of free cash flow (see Figure 1).

Figure 1 – VALE’s cash structure (in millions)

Author

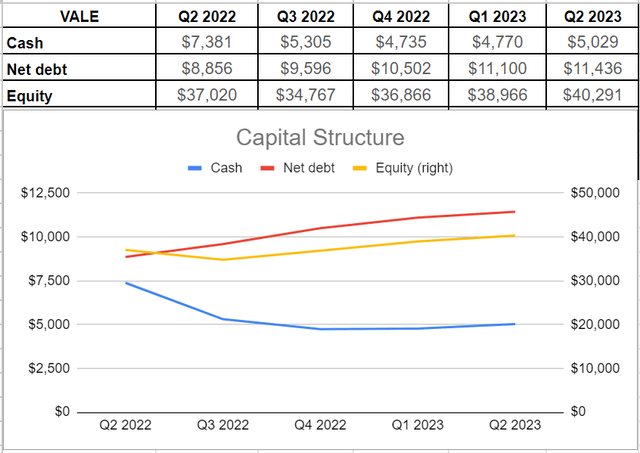

Regarding VALE’s capital structure, we can see that their net debt is inclined, and that was mostly because the company announced to distribute $1.74 billion to shareholders in September 2023 and raised $1.5 billion from bond issuance to repurchase $1.4 billion of shares. As a result, their net debt level sat at $11.4 billion at the end of the recent quarter versus $11.1 billion in the first quarter of 2023. Moreover, lower commodity processes offset higher production partially and led to $5 billion of cash generation that despite being higher than the first quarter of $4.7 billion, is less than year over year $7.3 billion in 2Q 2022. Thankfully, VALE’s equity level is far higher than its debt level, which provides a solid opportunity for more financing and shareholder distributions. The equity has surged considerably during the last year, reaching over $40 billion in 2Q 2023 versus $37 billion in 2Q 2022 (see Figure 2).

Figure 2 – Capital structure (in millions)

Author

China’s economic recovery outlook

Vale’s production and revenues are highly dependent on China’s economic recovery as the company is one of the prominent producers of iron ore, and China is its largest importer. As you may know, China uses iron ore for real estate and industrial park developments. As a result, what begs the question is how fast the company will recover and increase back to its previous economic growth condition.

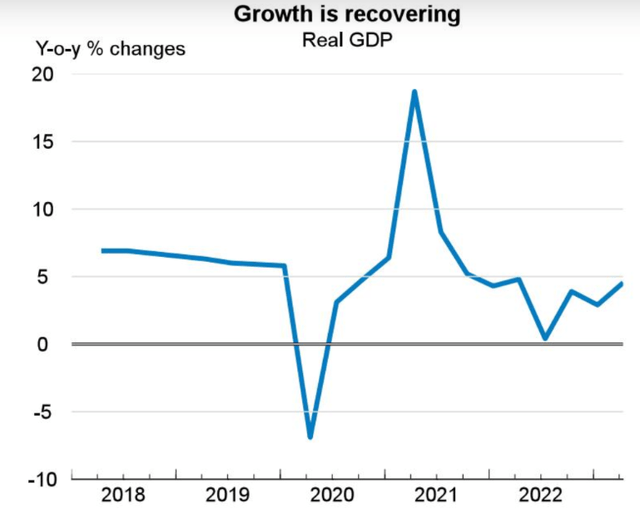

China’s economic growth will rebound to 5.4% by the end of 2023 and slightly lower 5.1% through 2024. In minutiae, aligned with other industries, lifting zero-COVID restrictions surged demand for service industries like tourism and entertainment. Easing restricted prudential regulations will boost constructions to meet new demand in each industry, thereby ending supply-chain restrictions. Also, it is worth mentioning that easing monetary policies from the government has a key role in stimulating the economy. In the wider economy, China has embarked on a series of interest rates and reserve requirement cuts. Additionally, they have implemented tax policies to support small businesses. Notwithstanding speeding up production and construction, what may slow down the demand for consumption is probably high unemployment. Following the reopening, more graduated students are entering the job market, and thus higher unemployment rates may lead to slower consumption growth. Overall, I am encouraged that new investment flows in infrastructures will be overcome, thereby leading to a boost import of iron ore, which is the main element in the steel industry in China. Figure 3 illustrates China’s real GDP ups and downs during the last few years.

Figure 3 – China real GDP trend

OECD

Iron ore market outlook

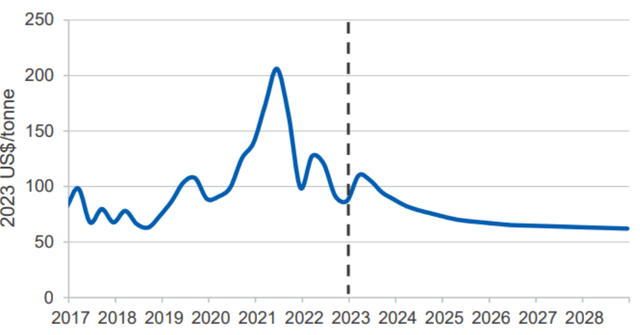

With China’s recovery process, how will the iron ore prices move during the coming years? After a great fall of more than 50% in iron ore prices in the second half of 2022, this market experienced a boost in prices in early 2023 after China’s reopening. However, it goes with no surprise that the boost is expected to ease during the following years, hence reaching a new balance between slower demand and higher supply. As Figure 2 demonstrates, iron ore prices will likely flood between $110 per ton to $125 per ton in 3Q 2023, and this is due to the off-leashed demand after almost four years. However, China has projected a modest decline in its steel production during the next five years because the country aims to reduce its carbon emissions and reach its peak in its steel output by 2030, which will lead to a 0.9% annual growth rate in global iron ore demand.

Figure 2 – Iron ore outlook

Bloomberg

Thankfully, Vale’s diversified productions bring outstanding opportunities for the company to take advantage of the energy transition process in the world. For example, the main portion of Electric Vehicles and offshore wind instruments are from nickel and copper, and Vale has a prominent production facility in these minerals. The management is taking the most advantage of their energy transition metal (ETM) opportunities and investing $25-30 million in the following years to grow their copper production from 350 kilotons per year to 900 kilotons per year. Also, nickel production is planned to surge from 175 kilotons yearly to 300 kilotons yearly.

Risks

The main risk associated with VALE’s performance is related to China’s economic recovery because China is the company’s largest iron ore importer. China’s government is required to cut interest rates to stimulate the economy. Apart from China, slower economic growth will adversely impact demand for iron ore. Although the inflation rates are heading to lower levels and central banks have no reason to keep high interest rates, we do not know if lower interest rates will come soon. Thus, I consider lower revenue for VALE by the end of 2023.

Conclusion

Notwithstanding lower prices in iron ore during the second quarter of 2023 versus the same time last year, the company has invested in higher production levels during the next decade. Thus partially offset the effects of lower prices. VALE’s business is well diversified which will bring bright opportunities for the company’s growth in each business section. For example, their ETM business is improving successfully to meet mineral demand to take advantage of the energy transition process in the world. For example, the main portion of Electric Vehicles and offshore wind instruments are from nickel and copper, and Vale has a prominent production facility in these minerals. Moreover, VALE’s financials are solid and healthy enough to cater to a reliable investment opportunity. As a result, I believe that a buy rating is still appropriate for VALE stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.