Summary:

- Vale’s Q2 2023 performance fell short of expectations due to lower iron ore and nickel prices.

- The company is focusing on value creation in Energy Transition Metals, with significant growth in copper production.

- Vale’s strategic partnerships and commitment to sustainability position it for operational growth and stability.

- China’s move to ease housing policies, aiming to boost demand and stabilize the property sector, could positively affect Vale’s iron ore demand.

Monty Rakusen/DigitalVision via Getty Images

Investment Thesis

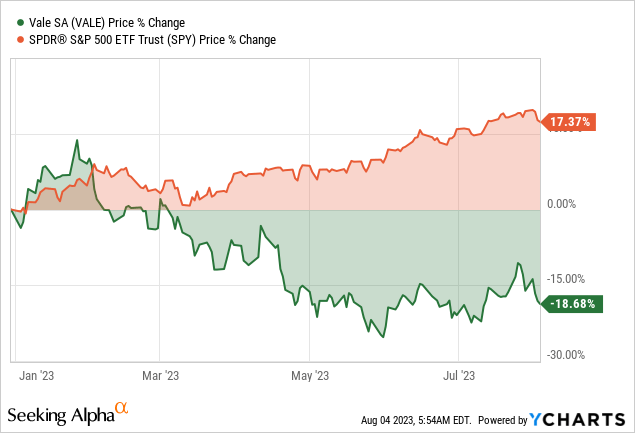

Vale S.A. (NYSE:VALE) is a commodity-driven stock and highly cyclical that trades in tandem with iron ore prices. In the last analysis we discussed why iron ore prices will experience volatility and eventually drop due to slower demand. Not surprisingly, Vale’s second quarter performance was significantly affected by market prices, as its earnings fell short of expectations due to lower iron ore and nickel prices.

However, as the dust settles on the financial setback, investors should focus on Vale’s progress on value creation, especially in Energy Transition Metals, as exemplified by the resounding growth in copper production through projects like Salobo III. The article explores how Vale navigates the complex terrain of commodity markets for strategic growth.

Vale’s Q2 2023 Performance Misses Expectations

Vale reported its Q2 2023 performance as missing its top-line and bottom-line expectations. It reported earnings per share (EPS) of $0.23, which missed the street expectations by $0.37, derived from the revenue of $9.67 billion, with a negative surprise of $309.17 million.

In detail, EBITDA stood at $4.1 billion, showing a decline of $1.4 billion compared to the same period in 2022. The decrease was attributed to lower realized prices for iron ore and nickel, with iron ore fines and nickel prices dropping by $15 per ton (QoQ) and $3,000 per ton, respectively, due to market fluctuations since Q2 2022.

Further, the impact of costs and expenses on EBITDA was minimal, totaling $96 million, mainly linked to nickel business maintenance and higher third-party feed purchases. In the face of year-on-year inflationary pressure, iron ore and copper costs and expenses contributed a positive EBITDA impact of $218 million. Sales volumes and by-products further boosted EBITDA by $154 million, driven by initiatives to enhance asset reliability.

Iron Ore Prices (tradingeconomics.com)

Additionally, the EBITDA breakeven for iron ore was $53 per ton, relatively unchanged year-on-year, and $5.2 per ton lower quarter-on-quarter due to a better product mix and increased volumes. Iron ore all-in cost guidance was adjusted to $52 to $54 per ton for the year, influenced by market conditions and currency effects.

Regarding iron ore costs, the C1 cash cost per ton reached $23.50, slightly down from the previous quarter. Adjustments for the Brazilian currency appreciation prompted a revised C1 guidance of $21.50 to $22.50 per ton for the year, suggesting a sub-$22 C1 in H2 2023, driven by increased Northern System production and productivity gains.

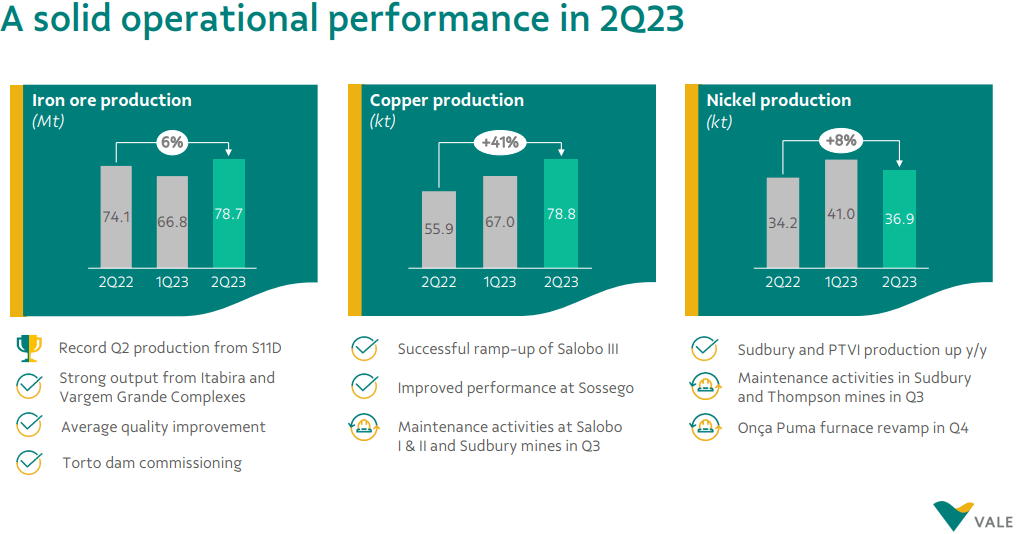

Vale’s operational performance demonstrates robust production figures and favorable cost trends. In the Iron Solutions division, the quarterly output grew year-on-year, accompanied by a yearly and quarterly decrease in all-in costs. For instance, in Q2, there was a new production record at S11D with decisive performances in Itabira and Vargem Grande. The commissioning of the Gelado dam is expected to enhance pellet feed availability for Brucutu operations and elevate portfolio quality.

Earnings Presentation (Vale)

Moreover, operational highlights are impressive. Iron Solutions has set production records driven by asset reliability initiatives. Energy Transition Metals witnessed notable growth in copper production, and nickel output also demonstrated year-on-year improvement. The ramp-up of Salobo III positions Vale for substantial future copper output.

Furthermore, copper production gains from Salobo and Sossego, coupled with favorable gold prices and tax credits, led to a Q2 all-in cost of just over $3,000 per ton, significantly lower than Q1. Nickel operations experienced a YoY increase in COGS due to feed availability issues, contributing to a slightly higher all-in cost of just over $17,000 per ton. The 2023 all-in cost guidance for nickel was revised to $15,500 to $16,000 per ton.

Cash Flow Mastery: Vale’s Value-Creation Strategy

Regarding liquidity, Q2’s free cash flow was affected by higher accrual sales volumes in iron ore and Brumadinho-related commitments. The company raised $1.5 billion through bond issuance, mainly for debt reduction and share buybacks. Vale’s capital allocation strategy involves a $1.7 billion capital distribution and ongoing share buybacks.

Likewise, Vale’s disciplined capital allocation is evident through the substantial shareholder remuneration of $1.74 billion announced, further solidifying the company’s commitment to value creation. Share buyback programs have led to a 27% yield to shareholders since 2021, showcasing Vale’s value-sharing track record.

Also, Vale’s disciplined capital allocation strategy is demonstrated by the clarity in the allocation of funds from the transaction. For instance, the delineation of funds staying with VBM and returning to Vale indicates a deliberate approach to funding business operations and capitalizing on value-creating opportunities. The allocation of funds within Vale’s capital allocation framework underpins its commitment to shareholder value.

Regarding the dividend policy, Vale’s approach involves EBITDA minus sustaining CapEx. If iron ore prices decline, potentially impacting EBITDA, the company may maintain operational integrity despite challenges. While flexibility exists to reduce sustaining CapEx, there’s a lower limit to maintaining operations and assets. The potential for a lower free cash flow yield than dividend yield due to external factors is acknowledged. Lastly, Vale’s strong balance sheet offers resilience, although changes to the dividend policy are not the immediate focus.

Earnings Presentation (Vale)

Energy Transition Metals

Regarding Energy Transition Metals, the Salobo III project is progressing ahead of schedule, contributing significantly to copper growth year-to-date. In nickel, Vale remains on track to meet annual targets. The company’s commitment to global tailing management standards (GISTM) is evident as prioritized structures conform to the standard, promoting safety and responsible practices.

Further, Vale’s transaction involving the base metals division is a pivotal move that underscores the company’s commitment to unlocking value and strengthening operations. The strategic partnership with Maaden and PIF will enhance governance, expertise, and ESG credentials, aligning well with Vale’s energy transition ambitions. These partnerships provide validation, long-term investment, and sector experience, likely contributing to operational stabilization and growth acceleration.

Finally, transitioning to production, Vale recently received licenses to operate the Torre de Pedra complex. While it will take time to ramp up production to previous levels due to waste disposal requirements, the improved quality of existing production will contribute positively to the company’s financials.

Accelerating Growth & Sustainability Initiatives

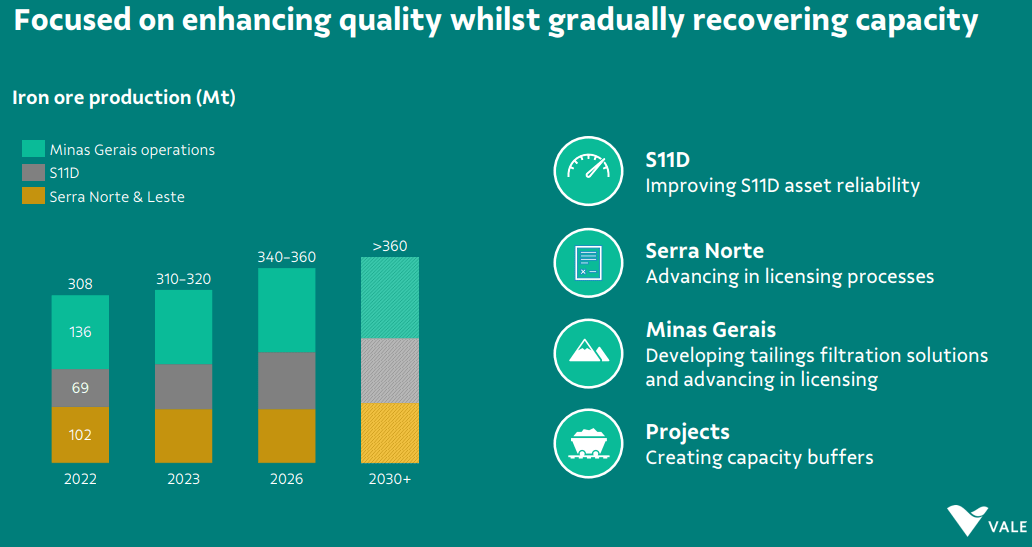

Recent developments reveal Vale’s strategic shift to enhance operational efficiency, value creation, and long-term growth prospects. The company’s focus on cost optimization, particularly in the Northern system, is evident, with C1 costs expected to improve as more volume from the North contributes to the overall mix. However, currency exposure remains a concern, with a clear sensitivity to BRL appreciation affecting C1 costs.

However, Vale has achieved a significant milestone by signing a strategic partnership with renowned, diversified investors in the energy transition metal (ETM) business. This partnership underscores the recognition of the value-generation potential of Vale’s assets in this sector. The collaboration signifies the initiation of a growth-oriented platform.

In terms of financial projections, the partnership is anticipated to drive substantial mineral endowment and resource growth, with investments of up to $30 million over the next decade. This could increase copper production to 900 kilotons per year and nickel production to 300 kilotons per year.

Notably, the company’s focus on sustainable practices is apparent through adopting the GISTM and ongoing risk reduction strategies for tailing facilities. Vale’s partnership with strategic investors in the ETM business highlights the company’s forward-looking stance and commitment to sustainability.

For the long term, the company’s orientation toward value creation without the need for large-scale M&A is notable. Management believes their existing resources are sufficient to drive future growth and returns, focusing on mid-to-high double-digit returns. This underscores a disciplined approach to capital allocation and operational efficiency.

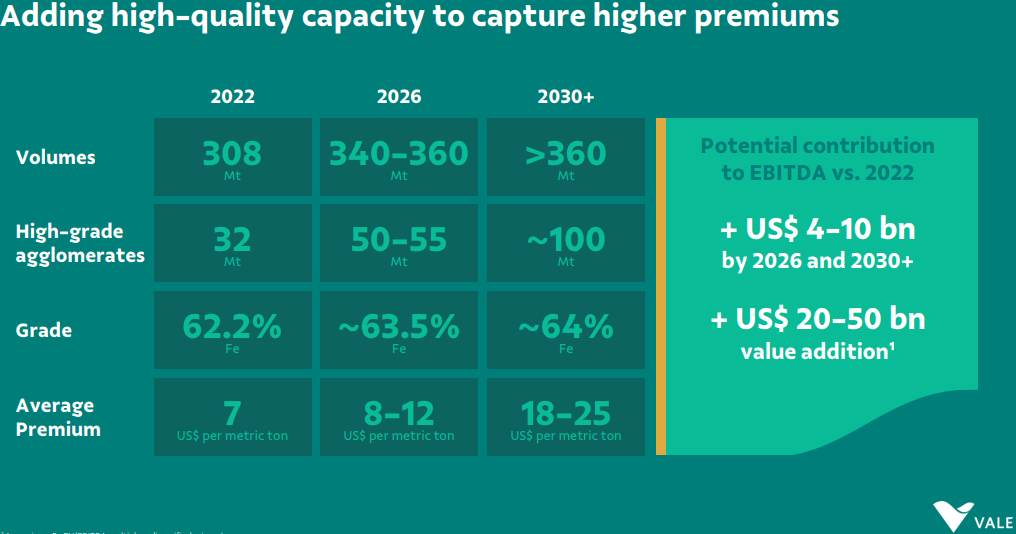

Also, Vale reveals a strategic focus on significant growth targets, particularly in the base metals sector (especially Iron ore production). Management’s ambition is evident in their plans to triple copper and double nickel production. While the $1 billion investment might seem modest given the scale of their goals, it aligns with a ramp-up profile that recognizes the time required to materialize opportunities fully.

Earnings Presentation (Vale)

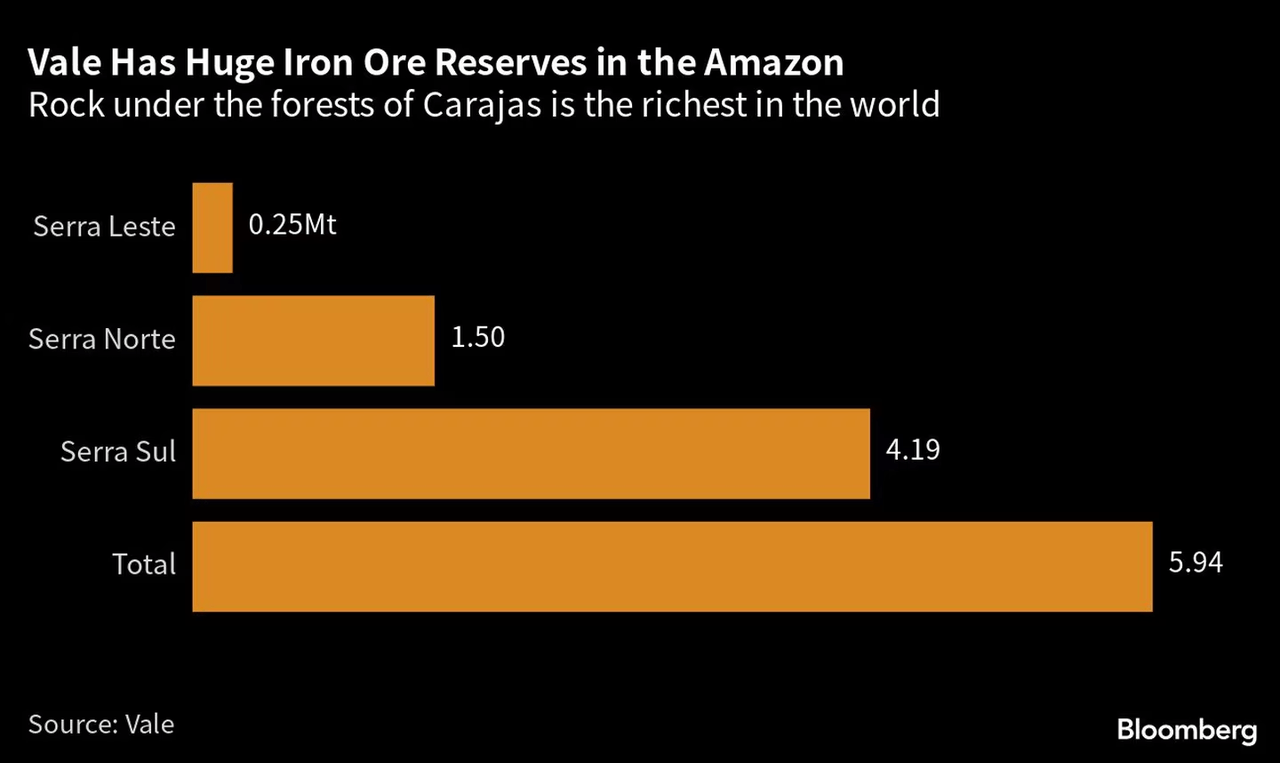

Moreover, Vale’s strengths lie in its abundant mineral resources in key jurisdictions like Brazil (Carajas), Canada, and Indonesia, forming a solid foundation for unlocking value. This resource endowment positions the company well for continued stabilization of current operations and the subsequent development of its mineral assets.

Interestingly, the nickel assets in Canada, specifically Voisey’s Bay, and Sudbury, are acknowledged as being in a multi-year process. Despite the appearance of underperformance, the company asserts that progress is aligned with the plan, with challenges arising from maintenance activities and transitions. Mark Cutifani’s presence and collaborative approach involving industry experts indicate a concerted effort to enhance performance and extract value from these assets.

bloomberg.com

Additionally, Engine No. 1’s involvement in Vale’s base metals sector is seen as a positive strategic move with the potential to provide valuable insights and contribute to long-term value creation. The alignment of visions between the two entities is expected to drive growth and operational excellence.

Looking ahead, Vale’s path forward involves executing existing assets efficiently and accelerating growth. The establishment of a dedicated and fit-for-purpose organization, along with the addition of experienced talents, is expected to drive operational excellence and expansion. The optionality created by the transaction opens doors for potential IPOs, mergers, and capital allocation opportunities, enhancing Vale’s growth trajectory.

Possible Push From China’s Housing Market

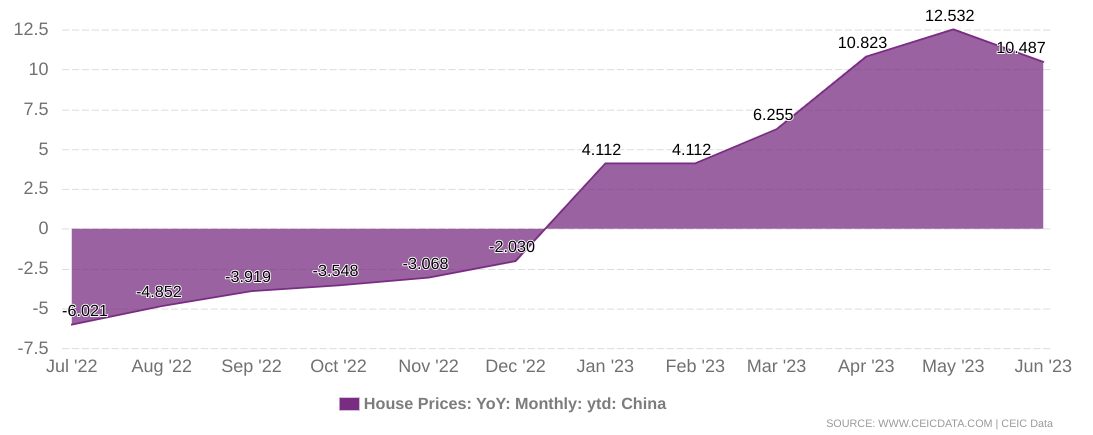

China’s housing ministry’s shift towards easing property policies is a notable change in response to concerns about the real estate market’s impact on economic growth. The decision to ease purchase restrictions for second homes and reduce down payment ratios for first-time buyers reflects a deliberate effort to stimulate demand and stabilize the property sector. The policy change is a response to China’s housing market slump, intensified by stricter regulations to reduce speculation. Although comparatively, housing prices are still strong (YoY) in China.

Also, the move aligns with Beijing’s broader strategy to support economic recovery, particularly considering the property sector’s historical significance in driving economic growth. By targeting housing demand rather than solely focusing on supply-side measures, the government aims to reignite purchasing activity and encourage property investment.

However, the effectiveness of these policy adjustments remains to be determined. While the easing measures might attract some buyers, other factors like household income growth, employment stability, and consumer confidence influence purchasing decisions. Moreover, concerns about overleveraged developers and default risk could continue to dampen investor sentiment. Inevitably, the policy changes in China’s housing market will likely have indirect but potentially significant implications for Vale over the long term.

China House Prices Growth (ceicdata.com)

As China’s housing market stabilizes and gains momentum due to the eased property policies, there could be an increased demand for steel, thus boosting demand for iron ore. The construction and real estate sectors are major consumers of steel, and any rebound in these sectors could drive up demand for iron ore, benefiting companies like Vale.

However, this impact might take time and effort to quantify. It depends on factors such as the pace of policy implementation, the speed at which the property market responds, and the overall health of the global economy. Additionally, the iron ore market dynamics, including supply and demand from other regions, will play a role.

Therefore, while Vale might experience a positive influence on its business due to a potential increase in iron ore demand resulting from a revival in China’s property sector, it’s important for the company to closely monitor market trends, steel production, and infrastructure investment to capitalize on these potential opportunities fully.

Takeaway

In conclusion, While Vale’s Q2 2023 earnings encountered turbulence due to lower iron ore and nickel prices, the company’s steadfast commitment to disciplined capital allocation and shareholder value remains unshaken.

Pushing into Energy Transition Metals, exemplified by Salobo III’s impressive copper growth and fortified by strategic partnerships such as the collaboration with Maaden, the company propels towards operational growth and stability. Finally, Vale’s resolute focus on sustainability practices and forward-oriented strategies shines through, setting the stage for a bullish trajectory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.