Summary:

- Netflix is still a growing business and since 2021, has been growing free cash flows which is expected to be $6.5 billion for FY23.

- Due to this, the company has been conducting share buybacks, returning cash to its shareholders.

- I expect NFLX to continue growing and could see the company paying a dividend in the foreseeable future.

- Additionally, NFLX has maintained a healthy balance sheet while growing the business.

- One risk the company faces is ongoing negotiations with SAG-AFTRA.

Pascal Le Segretain

Introduction

As a dividend investor I’m constantly on the hunt for dividend stocks trading at attractive valuations like many are now due to the rise in interest rates. I also like to look into well-known companies that don’t pay dividends to see if a potential one could be in its future. I’ve written a few articles on some of them including AutoZone (AZO), Tesla (TSLA), Amazon (AMZN), and Alphabet (GOOG). These are companies that have huge followings and stable cash flows, who could easily pay a dividend, especially AZO, who brought in $2.1 billion in free cash flow this year.

Some prefer to return cash to its shareholders via buybacks, and a lot of investors prefer that. But I also like to conduct research and give a different perspective on these non-dividend paying stocks because maybe someday they will elect to pay one. There are several companies who were public for many years before paying a dividend, such as Microsoft (MSFT). They IPO’d in 1986 and paid its first dividend in 2003. So one could be very well in the works for a growing company like Netflix (NASDAQ:NFLX). But to do that, the business needs to be healthy, and more importantly, have the cash to do so. So let’s get into if a dividend could be in NFLX’s future.

NFLX’s History & Financial Health

Here I want to get into a history of the company’s finances over the last decade and how they have been growing. Netflix was born in 1997 when Reed Hastings & Marc Randolph had an innovative idea to rent DVDs through mail, and the company was underway a year later with the first DVD rental and sales site.

Four years later they made their IPO selling at $1 per share and quickly grew from there. Memberships reached 5 million by 2006 and grew to 25 million just six short years later, and doubled two years later to 50 million subscribers. Since then the company has continued on its path to growth and expanded the platform to what we know it as today.

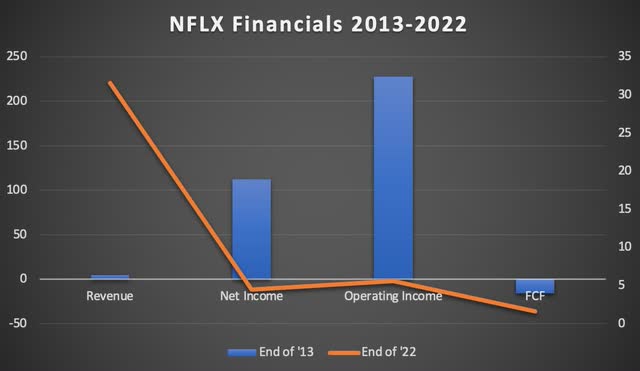

Although some businesses grow exponentially, that growth doesn’t always translate when it comes to finances. Here we take a look at NFLX’s financial growth over time. Over a 9-year span NFLX’s revenue grew from $4.3 billion to $31.6 billion while both net & operating income grew $112 million and $228 million to nearly $4.5 billion & $5.6 billion respectively. FCF grew the most from a negative $16.3 million to $1.6 billion at the end of 2022.

Author creation

COVID Boost

While the pandemic hurt several businesses, it boosted the streaming giant. While many people were forced to stay home during the COVID-19, putting a strain on cash flows for many companies, it greatly benefited NFLX who had the first positive free cash flow year in 2020 since 2013. That year they brought in $1.6 billion in FCF. One explanation for this negative FCF is that the company had been investing more in original content, which weighed on FCF, as cash payments are more front-end loaded than with 2nd run content licenses. However, as the company digests more into originals and grow operating profit margins, they will no longer need to raise external financing.

While they continue to recover in revenue, net income, and operating income, which are all down from last year, FCF is growing strong. This grew more than 230% from $1.6 billion to $5.3 billion in Q3 ’23. So, since NFLX is taking advantage of growing its FCF thanks to the help of COVID, will a dividend be in the company’s future?

I understand they are still a growing business although they’ve been around for a while. Am I am not saying they will pay a dividend in the next year or two. Who knows? Maybe they won’t ever pay one and will prefer to return cash to shareholders with buybacks like AutoZone. But I just like to provide readers and investors a different perspective.

Recent Earnings

NFLX recently reported its Q3 earnings and beat analysts’ estimates on both the top and bottom line. EPS was $3.73, beating estimates by $0.24, while revenue beat estimates by $1.39 million, coming in at $8.54 billion. EPS increased 20% from $3.10 year-over-year while revenue increased roughly 8% from $7.93 billion over the same period.

Furthermore, they added 8.8 million additional net subscribers in the quarter. One way the company continued its growth was price raises on its current plans which have been increasing the last few years. The most recent price increase occurred this month by $2 for their basic plan from $10 to $12, and a $3 increase in its premium plan from $20 to $23. And while this may not sit well with consumers, especially with tighter consumer spending, and consumer credit card debt over $1 trillion, the streaming giant stated they still remain competitive with other streaming services with a low entry price of $6.99.

Future Growth

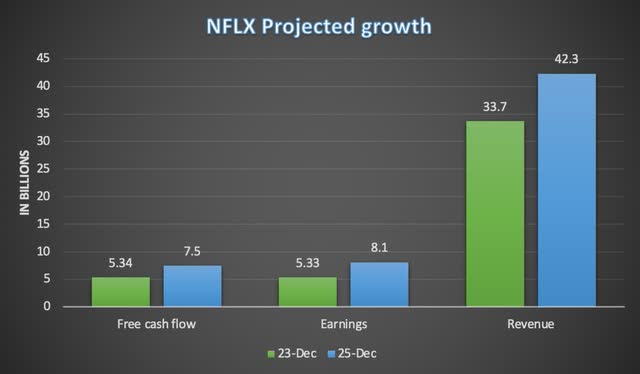

Although NFLX has had some negative cash flow years, I’ve been impressed with their growth. And even though they have been public for a while, it takes time for some companies to become cash flow positive. The company has a market cap of $154 billion at the time of writing so it’s considered a large cap company. But the business is still growing and in my opinion, will likely become a mega cap company in the near future. When looking into growing businesses, I like to see what their projected growth picture looks like.

Free cash flow is expected to grow nearly 40.5% in the next two years to $7.5 billion while earnings & revenue is expected to grow roughly 52% and 25.5% respectively. FCF for FY23 is expected to be $6.5 billion, up from $5 billion prior guidance. Management also stated they plan to spend significantly more on content in 2024, $17 billion to be exact. This is $4 billion more than in 2022. This will likely translate to a rise in memberships for the company as more content becomes available for subscribers.

Author creation

The one thing that impressed me the most about NFLX is how they’ve managed their debt. As businesses grow larger, debt usually follows. And with interest rates to remain high, it’s a legitimate concern among investors. But debt isn’t bad or unusual. Example: Telecom companies, who usually have very high debt loads. So when readers and investors comment on this, I understand it but I don’t get too bent out of shape about it like some others. But it is an important metric to pay attention to. As a company grows, if their debt load grows too large, eventually that company may have to use the cash on its balance sheet to pay back that debt, or refinance it at a higher interest rate depending on the environment. And if they pay a dividend, this could be at risk of getting cut.

Balance Sheet Health & Buybacks

But NFLX’s balance sheet seems to be in good shape. Since the end of 2013, NFLX grew their cash balance from $1.2 billion to $8.6 billion currently. And while debt did increase over that same period, the company has been focused on decreasing this over the past 3 years. Debt decreased by more than $2 billion since the end of 2020 from $16.3 billion to $14 billion. They’ve also been conducting buybacks recently and upped this because of cash on their balance sheet. In Q3 they bought back $2.5 billion worth of shares, and increased their buyback authorization by $10 billion.

Seeking Alpha

Above you can see NFLX’s shares outstanding increased from 417 million to 445 million from 2013 to 2022. Since then shares have decreased and the company currently has 443.1 million shares outstanding. According to their CFO, the company has a better view going forward and because of the cash it has built up, they plan to use this capital to fund growth. One way is by repurchasing shares for the foreseeable future. As management drives the business forward, they plan to grow cash flow & cash on hand, and as excess cash builds on the balance sheet, return this to shareholders. I like what management has been doing. Building excess cash, spending more money on quality content, and upping their buyback program to return cash to its shareholders.

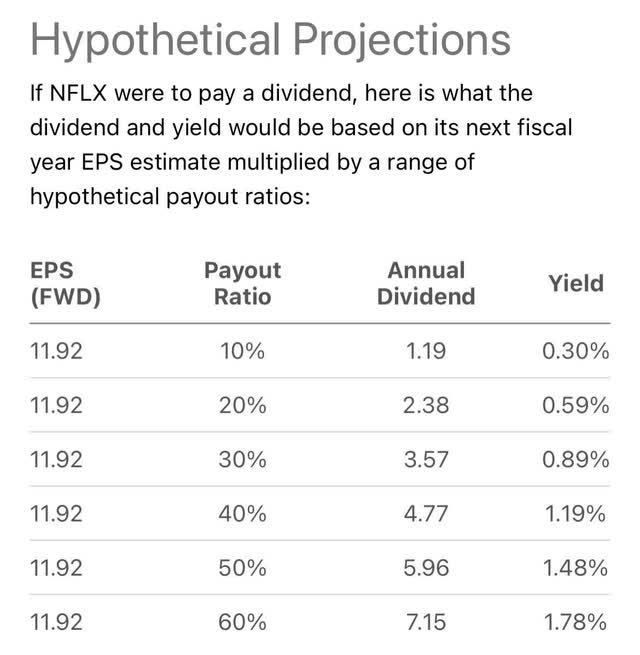

Hypothetical Dividend

Using SA’s hypothetical projections, I went with the lowest yield, 0.30% and an annual dividend of $1.19. This comes out to $0.2975 a quarter. With the current shares outstanding, they would need a cash flow of at least almost $132 million to cover the payment per quarter. Of course we would want them to cover this substantially so they would need at least $250 million in free cash flow. Safe to say the company is surpassing this margin impressively and I expect them to continue growing free cash flows & cash as management has stated this is a priority. As I previously mentioned, FCF is expected to grow to $7.5 billion by December 2025.

Seeking Alpha

I decided to also use a mid-range of the 30% & 40% projections. This total equaled an annual dividend of $4.17, or $1.0425 quarterly. Using the same amount of shares outstanding, this amounted to a total cash flow payout of nearly $462 million, or $1.84 billion annually. For a very comfortable payout ratio, we’ll just use $3.6 billion in FCF annually which NFLX is already surpassing with an expected $6.5 billion for FY23.

Risks & Catalysts

While the last six months have been challenging for NFLX due to the writers and actors strikes, the company did manage to reach an agreement with the WGA. However, negotiations with the SAG-AFTRA are ongoing. And although this remains a headwind, these companies have historically come to an agreement.

A catalysts that could give the company a boost is the forecasted recession. During the GFC NFLX grew its customer base by more than 1/3. If we do enter into a recession, and more pressure on consumer spending due to inflation and high credit card debt, I suspect consumers will cut other streaming services such as Hulu, Sling TV, & Peacock before cutting NFLX. Furthermore, with the company spending more on content this could help the company in the medium to long-term.

Valuation

As I mentioned earlier, NFLX is a business still in its growth stage and I expect this to continue. And while it might slow down and face headwinds in a recession, I think they are trading at an attractive valuation right now despite its P/E of 36x. At the time of writing the stock is trading over $400, but this is due to the recent surge in price where the stock moved $55 in a day because of its Q3 earnings.

Even with that it still offers nearly 15% upside to its average price target. Historically, NFLX has traded at a high P/E, retracting significantly from July of this year. Additionally, the P/E is still lower than its closest peer Disney (DIS). As the business grows, I expect NFLX’s share price to continue growing along with it. I think the stock is a buy now and investors should buy on any signs of share price weakness.

Tipranks

Conclusion

While it may seem NFLX is trading at a steep price, I still think the company’s share price has more room to grow. The business is still in its growth stage and as they continue to expand their financials and subscribers, I expect the share price to reflect this. Additionally, the company has managed to grow its subscribers by cracking down on password sharing, and if we do enter into a recession, they could see a boost in subscribers similar to the GFC. Furthermore, the company continues to deal with the SAG-AFTRA with ongoing negotiations. But despite all of this NFLX has continued to grow its cash flows and business while maintaining a healthy balance sheet in the process. With buybacks now on the table, and growing cash flow, a dividend could be in NFLX’s future. Either way Netflix is a growing business and I think it’s a great addition to any growth portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.