Summary:

- Market downturns create opportunities for value investors with longer time horizons, as may be the case for Comcast after the recent dip.

- Comcast’s profitability and cash-rich broadband business set it apart from its peers.

- Anticipated sale of stake in Hulu and potential growth in theme parks business are potential catalysts for Comcast’s stock.

Daniel Grizelj

Market downturns can be a great thing for value investors who like to buy quality companies on the cheap. That’s because while institutional investors like hedge funds are focused on short-term results to make their quarterly statements look pretty, retail value investors can take advantage of ‘time arbitrage’ by having a longer time horizon.

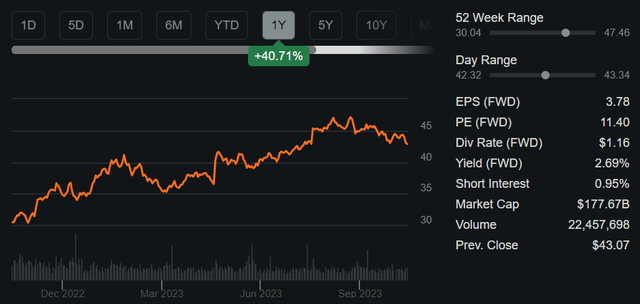

This brings me to Comcast (NASDAQ:CMCSA), which I last covered here back in June of this year, noting its undervaluation and underlying strengths in its connectivity business. Despite the recent downturn, CMCSA is still up since my last piece, giving investors a 9% total return, which far surpassed the 1% decline in the S&P 500 (SPY) over the same timeframe.

CMCSA’s shares have climbed meaningfully since being dirt cheap 12 months ago, and in this piece, I discuss why CMCSA remains an attractive buy at present levels after the recent dip, so let’s get started!

Why CMCSA?

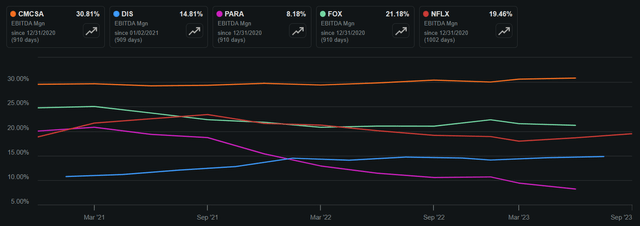

Comcast is often compared to the likes of Disney (DIS) and Paramount Global (PARA), and Fox Corporation (FOX) due to its media assets, and this segment has seen its fair share of challenges due to the Netflix (NFLX) effect. However, what sets CMCSA apart from its peers is that beyond its NBCUniversal segment, it has a cash-rich broadband, wireless, and video delivery arm through Xfinity, Comcast Business, and Sky.

The high margins coming from the cable and broadband business result in industry-leading profitability for Comcast, as reflected by its A+ Profitability Grade. As shown below, CMCSA has a track record of carrying an EBITDA margin, which at 31%, sits well above that of its aforementioned peers, including Netflix, as shown below.

CMCSA vs. Peers’ EBITDA Margin (Seeking Alpha)

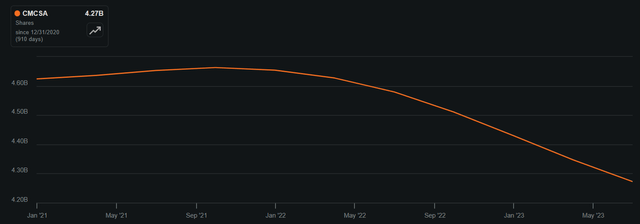

Investors shouldn’t underestimate the importance of high profitability, as this contributes to higher capital returns to shareholders. While CMCSA isn’t known for being a high dividend-yielding stock, management has opted for a dual-pronged approach of returning capital through share buybacks alongside dividends. This includes $3.2 billion of capital returns during Q2 alone, consisting of $1.2 billion in dividends and $2 billion worth of share buybacks.

Savvy investors know that share buybacks are a tax efficient way of capital returns, since dividends are taxable in non-retirement accounts. This form of capital return is even more productive when the share price is down, resulting in a higher earnings yield for every dollar spent on buybacks, as in the case for CMCSA since the start of 2022. As shown below, management has reduced CMCSA’s share count by 7.6% over the past 3 years.

CMCSA Outstanding Shares (Seeking Alpha)

While CMCSA’s performance in the last reported quarter weren’t stellar, they weren’t bad either. This is reflected by revenue growth of 1.7%, and adjusted EBITDA and EPS growth of 4.2% and 11.9% YoY, respectively, during the second quarter, driven in large part to around 4% EBITDA growth in the connectivity segment. While media profitability has seen challenges stemming from lower advertising, with adjusted EBITDA declining by 18% YoY, this was partially offset by robust 32% EBITDA YoY growth from theme parks.

Looking ahead to Q3 results and beyond, I would expect to see continued strong performance from the theme parks business. This is considering the ‘real’ opening of Universal Studios in China, since the original opening took place during the pandemic in Beijing. Plus, Super Nintendo World in Hollywood could be a big growth driver for this segment, especially considering the success of the Super Mario Bros. movie this year. Management highlighted on its opportunity with the Nintendo franchise during last month’s industry conference:

And then you see, if you look at something like Nintendo, some of the product offerings that we’ve developed, that are high-margin products that really broaden out that experience, have become very, very productive. And I think you’ll see us continue to lean into that. Historically, wands in Harry Potter were a good example of that. With Nintendo, it’s these Power-Up Bands. These are really, really productive revenue drivers within the park. Our culinary work in our restaurant business, very, very productive as well.

Another potential catalyst for CMCSA is the anticipated sale of its one-third stake in the Hulu streaming platform, with a minimum valuation of $27.5 billion. Two investment banks have been retained by Disney and Comcast to come up with valuations on Hulu, with the expectation of an offer by Disney to take full-ownership of Hulu by November 1st. Management has stated that they expect to utilize the minimum $9.2 billion payment from Disney to return capital to shareholders, and final valuation is something worth paying attention to.

Risks to the thesis include a potential for hard landing to the economy, which could pressure theme park visits and result in lower advertising revenue for the media business. Higher rates could also mean higher interest expense, but CMCSA remains in relatively good position by maintaining a strong A- credit rating from S&P and has a highly manageable net debt to EBITDA ratio of 2.4x.

This is considering CMCSA’s high free cash flow of $3.4 billion in the last reported quarter, of which $2 billion was used for share buybacks. FCF could be easily pivoted towards debt paydown in lieu of share buybacks to minimize debt refinancing risk.

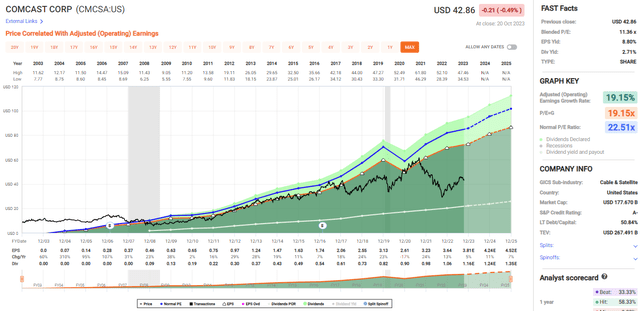

While CMCSA’s 2.7% dividend yield isn’t particularly high, it’s well protected by a 29% payout ratio and has a 5-year CAGR of 9.4%. I also see value in CMCSA at the current price of $42.86 with a forward PE of 11.3, sitting far below its normal PE of 22.5, as shown below.

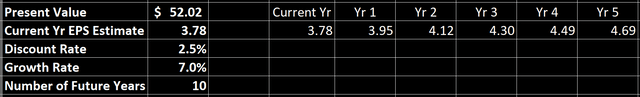

Applying the following NPV analysis, I arrive at a fair value of $52, giving the stock 21% upside potential from the current price. This bakes in a 7% annual EPS growth rate, which is below the 9-14% annual growth rate that analysts expect over the next four years and a 2.5% discount rate, which sits higher than the long-term 2% inflation target by the Federal Reserve.

NPV Analysis (Produced by Author)

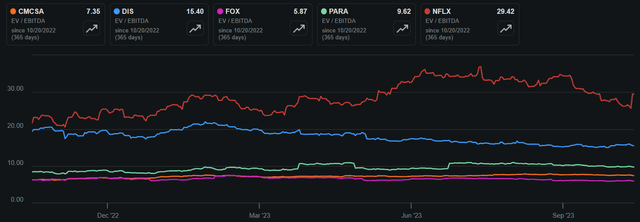

Last but not least, CMCSA trades at a meaningful discount to all of its peers except for Fox. With an EV/EBITDA of 7.35, CMCSA is noticeably cheaper than Disney, Paramount Global, and Netflix, despite having higher profitability and a growing theme parks business.

CMCSA vs. Peers EV/EBITDA (Seeking Alpha)

Investor Takeaway

All in all, I see value in CMCSA for its strong financials and potential catalysts for shareholder accretion in the theme park business and the anticipated sale of its stake in Hulu to Disney. Its dual-pronged approach to returning capital to shareholders is also appealing for savvy investors looking for tax-efficient ways of receiving capital returns.

With a solid balance sheet and free cash flow, CMCSA’s undervaluation relative to peers and my fair value target makes it a solid choice for value investors focused on total returns. As such, I maintain my ‘Strong Buy’ rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!