Summary:

- Bank of America helped rehabilitate some businesses it got from the Federal Reserves back in 2008 that are now subsidiaries.

- “Mark-to-market” valuations have little effect on the bank’s business as long as a going concern is assumed and holds the securities to maturity.

- “Mark-to-market” valuations represent an opportunity cost that the certainty of future profits requires the company in question to give up.

- The bank focuses on matching cash inflows and outflows to make profits, rather than worrying about market conditions.

- The bank stress test is what matters and that test considers all liquidity sources (not just the securities under water).

brunocoelhopt

Bank of America (NYSE:BAC) is a bank that the Federal Reserve relied upon during the big meltdown in 2008. Many remember that with aid from the Federal Reserve, this company picked up a lot of things to turn around. In the present, all that got accomplished and more as the bank was growing. Yet, the market is still confused when talking about “mark-to-market” valuations. Any mark to market has little to no effect on the business as long as a going concern is assumed. This often gets confused with risk assessment or stress testing, which is a total business process. The result is that perfectly healthy companies often get “dinged” with a “potential loss” when there is no loss to speak. This is “the elephant in the room”.

A Simple Example

Most people own a home, and many of us remember some absurd prices for houses around 2006 before the big crash. Mine, for example, head up to roughly $450,000 in theory and was worth $125,000 during the crash. Most of us did not move out of our houses at the top of the market (unless we retired or had to move for business reasons (or something similar). Instead, we kept going to work and lived a normal life through the ups and downs in the housing market. I still live in the same house. I did not move into an apartment at the market top after selling my house and then re-purchase the same house at the market bottom. Not many of us would. We have other priorities that amount to our personal “going concern” business.

David Dreman in his book “Contrarian Investment Strategies: The Psychological Edge” noted that too much information often reduces our ability to make an optimal decision because we actually make more mistakes while feeling more confident. For many people, the home they live in often has the highest percentage return in their lifetime simply because the house is not listed on the stock market pages online or in the newspaper every day. The fact that investors do not buy and sell their houses like they do their investments often turns out to be quite an advantage. It is also behind the investment strategy known as “buy-and-hold”. The continuous listing of stock prices turns out to be a disadvantage for many investors.

It is the same for business. Assets vary with market values all the time. But if the ongoing business uses that asset (in this case government securities) either to maturity (like bonds) or until it wears out, then many times the market value does not matter. What does matter is: did the asset make a profit?

Security Analysis

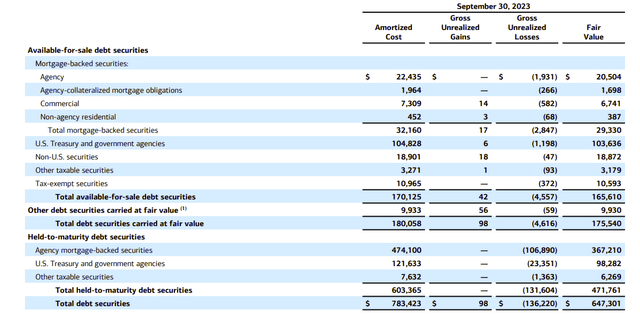

The big deal is the supposedly big loss shown in one part of the bank.

Bank of America Available for Sale Debt Securities (Bank of America Third Quarter 2023, Supplemental Materials)

There is some market assumptions that the loss shown of roughly $136 million is “real”. But the book value will vary over time with market conditions. The bank frankly does not care about “market conditions” because banking is about matching outflows to inflows over time. Then the bank diversifies to minimize errors or assumptions that looked reasonable but turned out “otherwise” (shall we say?).

If you believe in going concern, then what you really want to know is how much money those securities are making for the banks. Let’s admit that if we all knew the future, we probably would not be bankers. I personally would have retired much earlier and been a lot richer. Therefore, the decision was made based upon the choices available at the time to match cash inflows and outflows as bankers would normally do.

That $136 million really says that if we had perfect information about the future, then we could have made more money. But expecting the bank to guess the future interest rate and market conditions ignores the risk of being wrong. In this business, that risk can be very expensive. You therefore cannot state there is more money to be made unless you also account for that risk. Usually, the risk turns the project deep into negative territory.

What The Bank Says

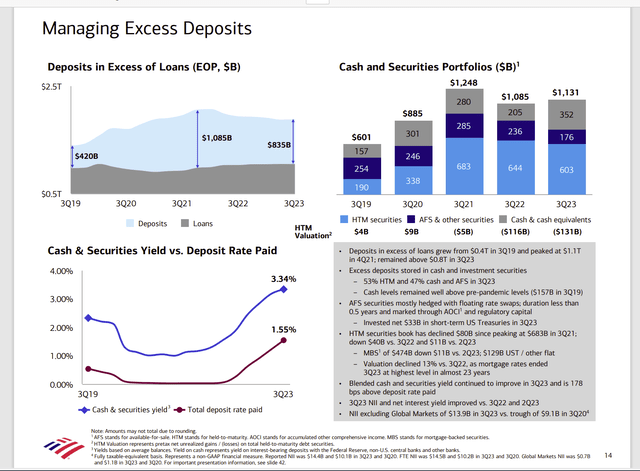

“In late 2020 and into 2021, we concluded that additional stimulus was going to remain in client accounts for an extended period, and we increased the hold-to-maturity securities portion so we could lock in value from those deposits. And we made these investments given the core nature of our customers’ deposits.”

Source: Bank of America Third Quarter 2023, Earnings Conference Call Transcript

So, the slide shown above is not even the full picture. It is one side of the picture, and only part of one side at that. For a going concern, the choice of those investments has to make money on the interest “spread” meaning the bank has to pay less than what they are making on those securities.

Bank of America Deposits In Excess Of Loans Highlights (Bank of America Third Quarter 2023, Earnings Conference Call Slides)

It turns out that money was made with “excess deposits” and the bank determined that they did not need that much money on hand to run the company or to keep as reserves. They therefore put that money to work. The $603 million that the market is so concerned about is shown in the slide above in light blue. It is already down about $80 million from one year ago. More importantly as shown above it is the biggest part of a total plan involving some other investments.

Using incremental accounting, it is quite possible that since the bank was already profitable, at least some consideration would have been that any costs of the money were already paid for. Therefore, any reasonable investment in context with the bank guidelines in the earnings conference call would just head to the bottom line with minimal additional costs.

You may not agree with that and want to use a cost assumption based on the slide above. Either way, the bank is adding to its profits by investing in those securities shown before as long as the bank holds to maturity.

Keep in mind, the decision was made before anyone had any idea there would be inflation. As long as the bank continues as a going concern and holds the securities to maturity, the bank will not lose a penny. What that valuation represents is an opportunity cost to make more money had things been done differently and the future more accurately known. That is nothing close to a cash cost.

Also keep in mind that all the bank did was use excess cash (not cash raised through a bond offering or a stock offering) to invest. That idle cash investment makes the cash received as liabilities (checking and savings, for example) more profitable with little downside risk.

In summary, since the securities are going against deposits, this is actually quite a profitable venture for the bank, and it was a reasonable choice at the time given the constraints of banking in general.

That Money Cost

Below is a sample of the cost of that money (if you do not want to do it with incremental accounting):

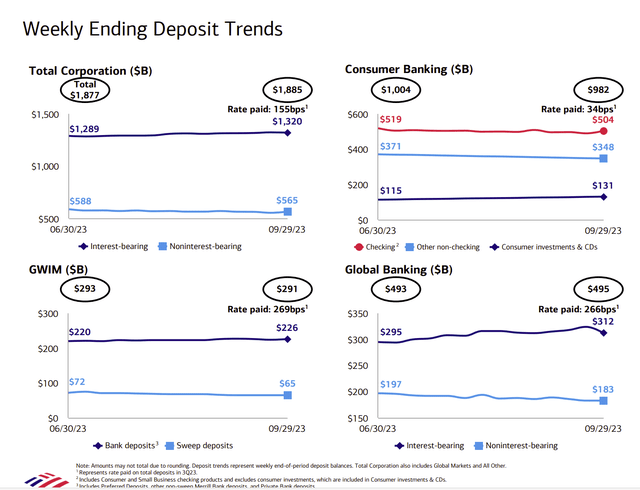

Bank of America Payment Highlights Of Deposits (Bank of America Third Quarter 2023, Earnings Conference Call Slides)

The cost of that money looks pretty low based upon what the bank is paying as shown above. It also resembles my savings and checking account statement.

Banking is all about locking in profits, which looks like exactly what was done here while minimizing risks. Since the bank is holding to maturity and much of what was invested was either government treasuries or other low risk products, the safety factor looks pretty well covered.

Investors can be sure that the market value of the securities is covered in the “stress test” that banks go through. But that “stress test” looks at the whole business. With more than $3 trillion in assets, there is a whole lot of possibilities for the bank to achieve necessary financial “stress test” quality. As long as the bank is strong and not overloaded with one type of risk, then the fact that some securities are underwater should be of no concern to the investment community.

Actually, It’s The Liquidity That Matters

“You’ll note that we’re now paying 155 basis points all-in for deposits, which is up 31 basis points from last quarter. Best that you remember 2 things when you think about the deposits. The rate remains low relative to many because of the transactional nature of our deposit relationships, with $565 billion in noninterest bearing deposits. And you can see in the upper right alone, in low-interest and no-interest checking, there’s $504 billion in Consumer. We remember the importance of the spread against the quarter’s average Fed funds rate. This position is very advantaged compared to past cycles because the transactional accounts in the current cycle are a much higher mix of Bank of America’s deposits. I would also add that while we maintain discipline in deposit pricing, we paid competitive rates to customers with excess cash seeking higher yields across all the businesses, if rates fall, those particular products will see the rates come down also.”

Source: Bank of America Third Quarter 2023, Earnings Conference Call Transcript

The point of the quote is something of that size (notice the “billions” above in the quote while the total assets is past $3 trillion) is offset somewhere else. The bank has so much liquidity lately that they purchased some short-term government securities that mature in months to help with the situation. But the key is the conversation above. The bank is in a better position than it was in previous business cycles. In another part of the conversation, the discussion covered nearly $1 trillion in liquidity. But that comes from all sources, not just those securities everyone is so worried about.

Going Forward

The bank has enough shareholders’ equity to already meet the potentially increasing requirements to decrease bank leverage. The bank does want a cushion, so there would be a further equity build.

The bank is also diversified geographically and makes non-interest income from both subsidiaries and from fee income. Some of this may not be available to smaller banks and remains a competitive advantage due to the diversification of income sources it provides.

Income was actually up by double digits as compared to the previous year. For a bank like this, that is likely to continue. A bank like this is a “one-stop” shop for a lot of things financial.

Because of all this and more, the bank will hold the securities in question to maturity. The chances of the bank actually losing money on the securities is probably close to zero. For this reason, I was never a fan of “mark-to-market” in any industry that holds to maturity.

Banks will always be subject to bank runs, and the reasons can vary when one happens. It is a known risk of banking. But this bank has a lot of resources to draw upon should it ever come to that, and it would likely be one of the last banks to be subject to such an event.

In the meantime, the money center banks like this one will likely outperform the industry for a few years to come. Keep in mind, a large business like this one would likely be a growth and income idea that would offer a combined yield in the low teens long-term from both the dividend and capital appreciation. There may be a little extra appreciation when interest rates come down. For many investors, this idea is a strong buy and could well be a core portfolio holding.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to do their own research that includes the review all company documents, and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.