Summary:

- There are several things to watch going into Amazon’s Q3 release.

- Watch long-term performance indicators like free cash flow and service revenue.

- Plus, here are three reasons that Q3 could surprise to the upside.

10’000 Hours/DigitalVision via Getty Images

When Does Amazon Report Earnings?

Amazon (NASDAQ:AMZN) will report Q3 earnings on Thursday, October 26, after the market closes. The earnings call will occur at 5:30 P.M. Eastern, and interested investors can tune in here. Seeking Alpha will also post a transcript of the call here shortly after. Listening to comments by management is a terrific way to stay up to speed on your investments, and they often drop interesting tidbits or information that helps to read between the lines.

What to expect from Amazon’s earnings.

There are three important reasons to be bullish about Q3:

- Macroeconomic factors indicate top-line growth;

- Digital advertising tailwinds; and

- AWS could turn the tide on increasing data spending.

First, a little housekeeping.

Quarterly earnings are excellent barometers but are tricky to trade around (stock can be up or down big after hours, only to reverse course the very next day) and not make-or-break for long-term shareholders. Instead, consider looking for long-term trends.

There are two trends that I consider critical key performance indicators (KPIs) for Amazon:

- Free cash flow; and

- Diversity of revenue streams.

Free cash flow

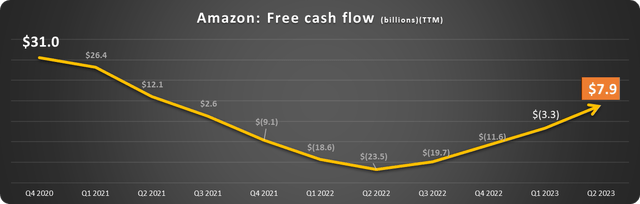

Amazon’s trailing twelve-month [TTM] free cash flow rocketed to $31 billion as of Q4 2020 on the back of COVID-19 from the increase in online shopping and piles of government stimulus.

Then it cratered for the next six quarters due to:

- Massive demand for AWS forced Amazon to spend a combined $125 billion on equipment (CapEx) in 2021 and 2022, up from just $57 billion over 2019 and 2020; and

- Skyrocketing costs for labor and logistics due to the boomerang effect of COVID-19.

Free cash flow is back on the rise, as depicted below.

It finally broke through the surface in Q2 and should continue its rise.

Increased service revenue

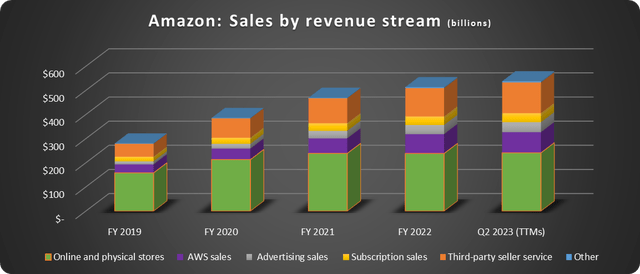

Amazon has done a terrific job moving away from reliance on low-margin retail sales and towards higher-margin service-based revenues, as shown below:

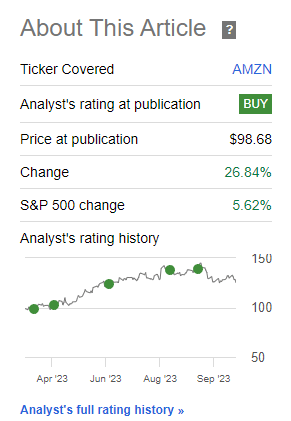

I covered the decline in cash flow and service revenue overtaking Amazon’s retail revenue in detail back here. Both KPIs are trending up this year, and so is the stock, rising 27% since the article compared to 6% for the S&P 500.

Seeking Alpha

Will Amazon Beat Earnings Expectations?

Here are the three signs that Q3 could be favorable.

Top-line growth

Amazon stock has always traded based on its sales growth.

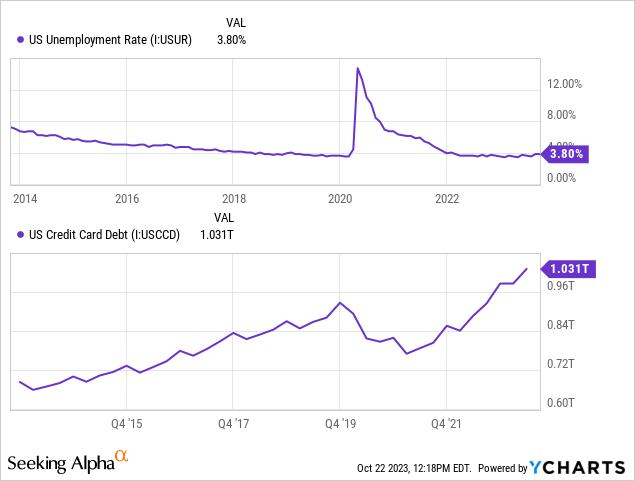

Macro data indicates that consumer spending isn’t lagging (yet!) despite high interest rates, inflation, and low consumer confidence. One reason is that unemployment is just 3.8%. CNBC recently reported that 60% of us live paycheck to paycheck. Another way to look at it is that many people spend pretty much everything they make. These two factors combined are encouraging for Amazon’s retail sales.

One reason consumers have kept their spending habits steady despite inflation is their reliance on credit cards. Many paid them down when government stimulus flowed, but balances have ratcheted back up.

Unemployment and credit card debt are depicted below.

Increased debt is concerning for the economy in the long run but looks positive for Amazon’s top-line sales.

Finally, student loan payments restarted but were still paused in Q3.

Digital advertising

An article posted today by Seeking Alpha shows digital advertising sales accelerating. Data shows 9% growth in Q2, which should continue in Q3. Advertisers continue to shift from broadcast to digital to meet consumers where they are. These shifting budgets should also benefit Amazon’s product placement and pay-per-click ads.

Advertising sales grew 22% year-over-year (YOY) last quarter to $10.7 billion and $41 billion over the TTMs. Amazon doesn’t break out operating income for advertising sales, but it’s an excellent bet that this is a high-margin operation.

Can AWS turn the tide?

Amazon Web Services (AWS) sales growth fell from over 30% in prior years to just 16% in Q1 and 12% in Q2. Many investors and commentators are distraught by this, but calm is in order for long-term investors.

Many executives were preparing for a recession in 2023 and scaled back budgets for data. AWS makes money based on how much data customers use. Simply put, it operates much like a utility. Amazon actively assisted its clients with scaling back to keep them as customers long-term. It’s rough for AWS this year but it’s a smart move.

Now, artificial intelligence [AI] has taken center stage. AI workloads need massive cloud resources, and many companies will increase their budgets in this area. Amazon is working hard on generative AI offerings and foundational models. It remains to be seen how AI will affect many industries, but you can bet corporations will spend to find out.

Amazon did not provide AWS guidance for Q3 but did mention that it expects revenue to stabilize. It will be a huge plus if AWS growth stabilizes or exceeds Q2.

Is Amazon stock a buy?

The bullish case for Amazon stock over the long haul is solid. The FTC case is mildly concerning but probably years away from concluding. Secular trends in advertising sales, AI, and cloud computing should carry the company for many years. We could also see movement in 2024 as companies again dedicate more spending to data.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the reader's part. Each investor should consider their unique situation and perform their own due diligence.

The author is short the following option: AMZN Jan 2024 $150 CALL and may close this contract at any time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.