Summary:

- Amazon investors remain confident despite concerns about the impact of rising bond yields on consumer spending and a possible credit crunch.

- With recent investments in AI company Anthropic, Amazon CEO Andy Jassy aims to reassure investors that Amazon Web Services is still the cloud computing leader.

- Recent recession fears have not crept into AMZN, suggesting a healthy consolidation zone for investors to buy more shares.

- I assessed why AMZN stock could be primed for an epic rally after we get past the transitory downturn fears.

FinkAvenue

Amazon (NASDAQ:AMZN) investors have seen its stock consolidate over the past three months as dip-buyers attempt to hold the $120 robustly. While AMZN has underperformed the S&P 500 (SPX) (SPY) since my August update, buyers haven’t fled to the hills.

Calls for a hard landing have also intensified recently, as investors worry about the bear steepening in the longer-duration yields, which could impact consumer spending on bigger purchases. In addition, the continued surge in long-term bond yields could also lead to a possible credit crunch, resulting in a broad recession.

Fed Chair Jerome Powell’s recent commentary suggests the Fed’s positioning is expected to remain hawkish in response to the economy’s resilience. However, Fed chatter suggests that a possible hike at its upcoming two-day meeting starting on October 31 is likely shelved for now, given the surge in the 10Y yield (US10Y).

Therefore, I can understand why investors are likely worried about the impact of a hard landing on AMZN, given its market-leading exposure in the consumer e-commerce space. Furthermore, the company must convince investors that it could fend off the generative AI threat against Microsoft (MSFT) and Google (GOOGL) in the hyperscaler space. Despite Amazon’s IaaS leadership, Microsoft is assessed as the leader in the AI space by Wedbush. In addition, Google has made a dramatic comeback since its early 2023 fumbles, suggesting it isn’t far behind Microsoft.

Therefore, I’m not surprised that Amazon CEO Andy Jassy likely felt the need to remind the AI community that Amazon Web Services, or AWS, is still the cloud computing leader. Its recent $4B investment in AI company Anthropic is expected to show investors and enterprise customers that AWS remains at the forefront of generative AI.

Furthermore, Amazon seems ahead of Microsoft with its customized Trainium and Inferentia AI chips. Despite that, whether it could confer AWS a distinct advantage against Nvidia’s full-stack AI ecosystem comprising its H100 and CUDA remains to be seen. Nvidia’s DGX Cloud is also suggested as a direct challenge against Amazon’s IaaS leadership. AWS has yet to partner with Nvidia’s DGX cloud, marking a distinct departure from its leading hyperscaler peers.

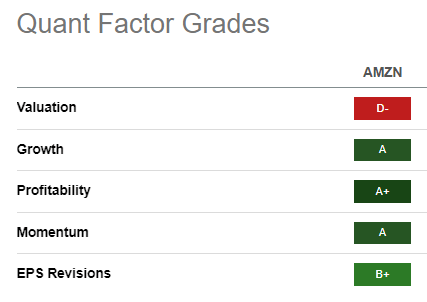

AMZN Quant Grades (Seeking Alpha)

Amazon is scheduled to report its third-quarter or FQ3 earnings release on October 26. Although AMZN has pulled back more than 15% from its September highs at its recent lows, buying sentiments have remained robust (“A” momentum grade).

As such, I assessed that investors are likely confident of constructive forward earnings commentary from management, corroborating its positive “B+” earnings revisions grade.

Accordingly, Amazon is still expected to post significant operating leverage growth over the next two years. Wall Street analysts forecast a 2Y EBITDA CAGR of nearly 19%. Therefore, AMZN remains priced for growth, and execution will be critical as it looks to expand its retail margin.

Amazon is reportedly looking to spruce up its advertising business to expand its ad-supported offerings on its streaming service. As such, it has explored helping merchants to produce their streaming video ad offerings. Given Amazon’s diverse retail base, I believe such an initiative could lift Amazon’s higher margin growth drivers in digital advertising, helping to improve its retail margins.

Moreover, Jassy’s track record of turning its retail business around should validate his execution prowess, as Amazon overspent during the pandemic under Amazon retail head Dave Clark previously. As such, the retail business could still benefit from increased cost synergies as Amazon looks to improve the efficiencies of its delivery promise as it pursues a regionalization strategy.

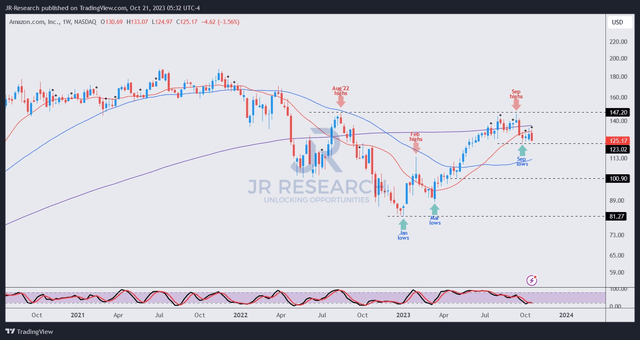

AMZN price chart (weekly) (TradingView)

AMZN buyers are holding the $120 level robustly. Losing that level could open up a further fall toward the $100 zone, which isn’t my base case now.

While the rhetoric of a hard landing has increased, AMZN’s price action shows that buying support remains significant. Therefore, I’m not unduly concerned about near-term volatility in AMZN and believe it represents a golden opportunity to buy more shares.

Rating: Maintain Buy

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!