Summary:

- Google’s Q3 earnings are expected to show growth in revenue and earnings, with estimates of 10% and 36% YoY growth respectively.

- Factors driving this growth include accelerated growth in Search and YouTube, improved profitability in Google Cloud, and progress in the commercialization of Gen AI products.

- Other topics of interest for Q3 include cost restructuring, CAPEX investments, share buybacks, and updates on the ongoing Department of Justice trial.

- I remain Buy rated on Google stock going into Q3.

400tmax

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is set to report its Q3 2023 earnings on October 24th after the market closes. Despite the still somewhat pressured macro backdrop, I am bullish on Google’s earnings outlook going into the reporting data. In my opinion, there are multiple levers driving a likely strong Q3, notably an acceleration of growth in Search and YouTube, profitability expansion in Google Cloud, and guidance on commercialization progress of the company’s Gen AI product map.

Going into Q3 earnings, I reaffirm my thesis that Google’s stock is currently undervalued; and accordingly, I maintain a ‘Buy’ rating with a target price equal to $156 per share.

For context, Google’s stock has performed well since the beginning of 2023, with year-to-date gains of approximately 52%, outperforming the S&P 500 (SP500) by a factor of more than 5x.

Google Q3 Earnings Preview

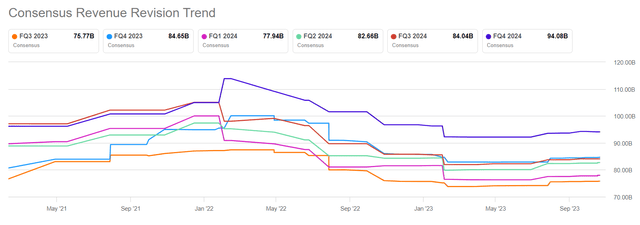

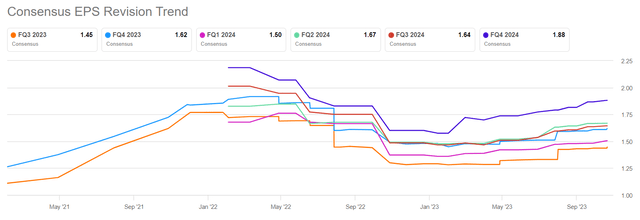

Based on data compiled by Seeking Alpha as of October 21st, a total of 34 analysts have provided their forecasts for Google’s Q3 results. Their predictions indicate that Google’s total sales for the quarter are expected to fall in the range of $72.86 billion to $77.59 billion, with an average estimate of approximately $75.77 billion. Taking the average analyst consensus estimate as the reference point, it suggests that Google’s revenue is anticipated to increase by almost 10% year over year compared to the same quarter in 2022, bringing Google’s top-line growth almost back to double digit territory again. As an additional note on analyst consensus on revenue, it is noteworthy that analysts revisions have gradually started to trend upward again, following a 12 to 14 months period of declines, suggesting that sentiment is finally strengthening.

Also with regard to profitability estimates are trending upwards: For Q3 2023, analysts now expect a 36% year over year jump in EPS, anchored on a $1.45 EPS consensus estimate (Range is $1.27 to $1.55).

Likely Upside In Search & YouTube

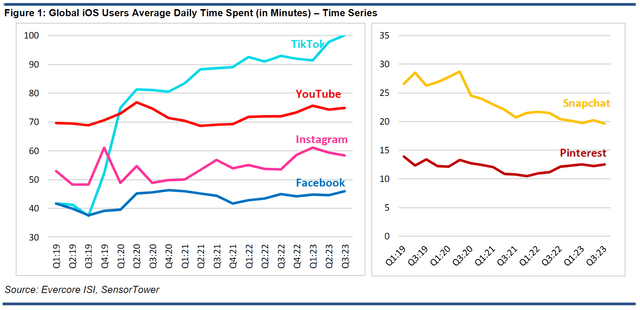

Referencing uptrending revenue estimates, I see multiple factors driving this. First and foremost, I see accelerated growth in Google’s Search Ads business. Specifically, the prevailing macro environment for Search and YouTube ads in the third quarter appeared stable to slightly better than the second quarter. This, coupled with favorable YoY comparisons, is anticipated to drive close to double-digit YoY growth rates in the third quarter, likely also extending into the fourth quarter. This assumption has been broadly confirmed through expert calls conducted by Evercore (Advertising uptick into Q3 – key takes from ad channel check w/ skai) and TD Cowen (3Q23 digital ad expert call: GOOGL, META, & AMZN to accelerate on better pricing). Second, also YouTube appears to have done very well in Q3. According to Evercore both DAUs and DAU engagement showed a nice uptick vs the respective 2022 benchmark. (Where Has All The Time Gone? Q3:23 Social Media Pulse, dated 11th October). Specifically, YouTube engagement increased by 4% YoY, while YouTube’s daily active users increased by 7% YoY and 1% QoQ, now topping the 2 billion DAUs milestone. Furthermore, it is estimated that in August, YouTube accounted for 9% of total U.S. TV viewing hours, securing its position as the leading streaming video channel on CTV. That said, YouTube’s viewership is one percentage point ahead of Netflix (NFLX), a company that is valued close to $200 billion.

Third, there is of course also the tailwind from cloud growth and Gen AI. Although I see a deceleration in Google’s cloud business, in line with previous quarters (26-27% YoY growth estimated), growth in mid-twenties is still very accretive to the conglomerate’s overall topline expansion rate. Moreover, investors should also consider that Google’s cloud business is now profitable (operating break-even); and thus, I am more interested to see how profitability YoY rates are trending upwards, than estimating whether topline is growing 25% or 29%. In the analyst conference call, I am interested to hear about Google’s progress in commercializing Duet AI and Vertex AI within Google Cloud, and how this is expected to drive growth and profits through the fourth quarter and early 2024. In that context, getting more color on the impact of Generative AI on Google Search and other businesses remains a subject of debate, with a strong focus on the timing of the Gemini launch. Needless to say, building more confidence about Gemini could help Google close the perceived gap compared to rivals like OpenAI and Microsoft, which would be a positive development for the company’s shares.

Cavenagh’s Take On Other Key Topics To Watch

In addition to the major commercial levers, Search, YouTube, Cloud and Gen AI, I also expect Google to share insights on operating and financial trends.

One of the key topics that I am strongly interested in relates to Google’s ability and willingness to re-engineer the company’s cost base. In that context, I see two levers: Firstly, leveraging artificial intelligence (AI) and automation to enhance productivity and broader infrastructure efficiency; and secondly, optimizing employee work arrangements (job cuts, etc.) and locations.

As Google is building out Gen AI products, I expect the company will guide investors towards an intensification of CAPEX outlays. For Q3, I suggest investors should brace for Google reporting more than $10 billion of CAPEX, which would reflect a more than 30% YoY jump. For CAPEX investments in Q4 and FY 2024, I don’t expect Google management to give precise number; however, a rough guidance would be appreciated and investors should watch for qualitative indications.

Google’s CAPEX investments are important as a ramp-up in capital outlays would impact the company’s ability and willingness to spend cash on share buybacks — another topic to watch in Q3. Personally, I expect $15 billion in share buybacks for the third quarter, in line with the second quarter. Everything below this number would be a disappointment, especially as revenue and earnings growth accelerates.

Lastly, I have previously covered in detail the ongoing Department of Justice (DOJ) trial concerning Google’s commercial agreements with Search distribution partners. In the Q3 conference call, I expect some guidance point on how management feels about the trial and likely impact of a verdict so far.

Conclusion

Google is about to reveal its Q3 2023 earnings, and despite the ongoing challenging market conditions, there are several factors that indicate a strong Q3. The consensus among 34 analysts suggests Google’s revenue and earnings will grow about 10% and 36% YoY, respectively. Specifically, I see an acceleration of growth in Search and YouTube, improved profitability in Google Cloud, and updates on the progress of Gen AI products’ commercialization. Other topics of interest for Q3 relate to cost restructuring, CAPEX investments, and share buybacks. Additionally, the ongoing Department of Justice trial regarding Google’s commercial agreements is a key topic to watch during the Q3 earnings call. Going into Q3 earnings, I reaffirm my thesis that Google’s stock is undervalued; and I maintain a ‘Buy’ rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.