Summary:

- Disney’s struggles with turning its streaming business into a profitable venture have led to decade lows for the company.

- ESPN’s profits have been a surprising source of revenue for Disney, generating $2.9 billion in operating income in FY22.

- The reliance on sports programming and affiliate fees highlights the importance of ESPN to Disney’s overall profitability.

- The stock is expensive at 17x FY24 EPS estimates that appear too aggressive.

Jeff Schear/Getty Images Entertainment

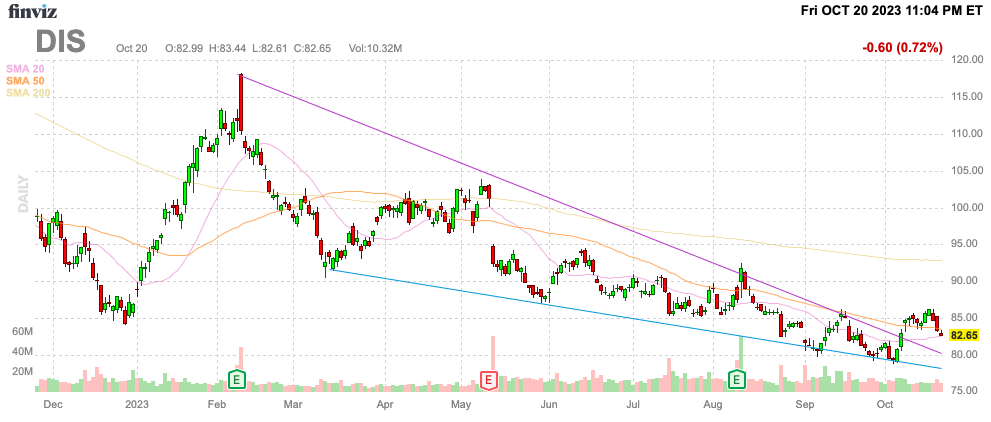

Disney (NYSE:DIS) recently slumped to decade lows due to struggles with turning the streaming business into a profitable endeavor. Disney+ was supposed to be the future of the media empire, but the recent financials breakout highlights the lingering importance of sports to the media giant. My investment thesis turns more Neutral on the stock, especially now seeing how the media business is far less reliant on premium content creation and more reliant on affiliate fees for sports.

Source: Finviz

Shocking ESPN Profits

For years now, a big negative thesis on Disney was the risk of ESPN losing affiliate fees. The business long charged cable viewers up to $10 per month for access to ESPN channels despite a large swath of people not even watching sports programming.

Disney has long been rumored to desire dumping the asset, but ESPN apparently makes far too much in profits to unload. The market thought sports programming was the anchor holding the stock down while in reality ESPN was keeping the media giant very profitable.

According to an SEC filing, ESPN generated $16.0 billion in revenues in FY22 and a shocking $2.9 billion in operating income. The rest of Disney media only produced $2.1 billion in profits during FY22 with the vast majority of profits from the Experiences segment.

ESPN is running at a similar rate for FY23, which ended on October 1. Disney will report those results on November 8.

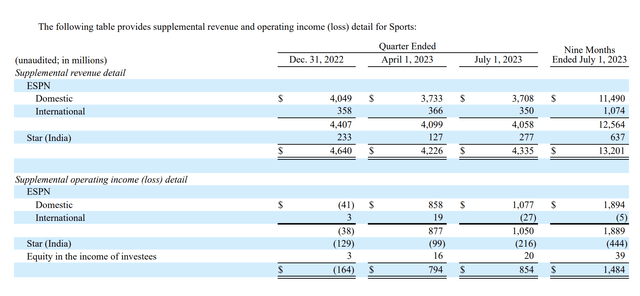

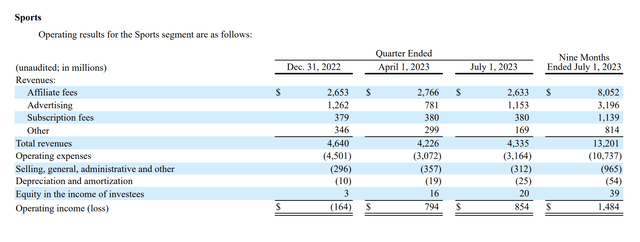

Source: Disney 8-K

The Sports segment, including Star India, obtains the majority of revenues from Affiliate fees at $2.6 billion in FQ3’23. Advertising makes up $1.15 billion of revenues in the quarter leaving just $380 million per quarter in flat subscription revenues.

Source: Disney 8-K

ESPN+ subscribers have flatlined, so flat subscription revenues aren’t surprising here. The company obtains ~$5.45 per month on 25 million ESPN+ subs amounting to only $137 million per month now with a partial amount apparently generated from advertising.

The company is actually reporting growth in ESPN revenues with FQ3 increasing from $4.0 billion in FY22 to $4.06 billion in FY23. Even the operating income grew by $31 million YoY.

In essence, ESPN and Disney have made almost no progress in shifting off the Affiliate fees drugs, and related advertising revenues, of the cable bundle. In reality, most consumers shifting to streaming have only ended up signing up for YouTube TV, owned by Alphabet (GOOG, GOOGL), or fuboTV (FUBO) to gain access to ESPN cable channels. The basic YouTube TV bundle has ESPN, ESPN2, ESPNU, ESPN News and the SEC Network as part of the bundle.

Struggles Ahead

The Disney investor hoped ESPN could be ditched to remove an anchor from the business allowing the media giant to focus on premium content. Sports programming was being viewed as less attractive due to escalating sports content rights costs and the concept of only renting this content in the process.

Now, ESPN generates large amounts of operating income and will only encourage the tech giants to pursue sports rights to a higher degree. Apple (AAPL) recently hit a home run with signing up MLS for Apple TV+ and watching Lionel Messi join the league. At the same time, Alphabet entering the NFL subscription rights business with NFL Sunday Ticket while Amazon (AMZN) was already an NFL license holder with Thursday Night Football.

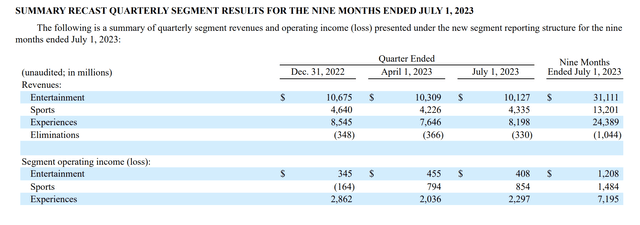

The financials appear to highlight Disney having a harder time earning profits on premium content. The Entertainment business has only earned an operating income of $1.2 billion for the nine months YTD period versus $1.5 billion for the Sports segment while Experiences (aka Parks) is up at a massive $7.2 billion operating income.

Source: Disney 8-K

The DTC Entertainment business has lost $2.1 billion YTD with the quarterly loss down to $505 million in FQ3’23. Still, the Entertainment business is what attracts investors to Disney and the premium content from the House of the Mouse isn’t actually that impressive with all of the profits actually coming from Parks and ESPN.

Again, the major concern is that the main ESPN revenue driver hasn’t actually shifted to the DTC model and the company could incur the same massive losses ramping up the business similar to Disney+. In addition, the sports media segment is only now facing the aggressive entrance of the tech giants pressuring ESPN to either bid up sports rights deals, or avoid them. The upcoming NBA already has ESPN push to reduce the package of games likely in an attempt to lower costs after pushing back on some NFL rights costs.

While Disney trades at decade lows, the stock isn’t cheap due to lower profits from absorbing the DTC losses. Still, analysts forecast a $1+ EPS boost for FY24 leading to the stock trading at 17x EPS targets of $4.79.

The company has 1.8 billion shares outstanding suggesting Disney needs to eliminate all of the DTC losses while not losing any of the profits from ESPN in the process to achieve the $1+ EPS boost next fiscal year. The biggest concern remains that the media company isn’t as reliant on premium content like Disney movies or Star Wars content in generating profits, as much as managing sports rights and Parks.

If anything, the media part of the business is more at risk than appreciated. Even if Disney does recapture over $2 billion in profits in FY24, our confidence in the media company repeating this outcome in FY25 is very low. The stock is at most fairly valued with the risk to the downside that the media company doesn’t boost profits as much as forecast in FY24.

Takeaway

The key investor takeaway is that investors shouldn’t see Disney as cheap just because the stock is at decade lows. The stock appears to have more risk here now realizing the media business is far more reliant on ESPN than originally thought.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.