Summary:

- Roku stock has collapsed nearly 40% from its August highs, stunning late buyers. However, given its no-moat leadership, investors shouldn’t be surprised.

- The company’s market leadership has failed to gain a sustainable competitive advantage, leading to a lack of a profitability moat.

- Roku investors are heading into its upcoming Q3 release with much less optimism than its previous quarter, as the summer optimism dissipated.

- Management must convince investors it’s on track to meet positive adjusted EBITDA profitability estimates in 2024. Investors are likely worried Roku could fall short.

- I argue why investors should remain on the sidelines of this no-moat leader. Given the recent market pullback, capitalize on the high-quality leaders instead.

JHVEPhoto/iStock Editorial via Getty Images

I last updated Roku, Inc. (NASDAQ:ROKU) investors in May 2023, encouraging them to avoid (Hold rating) chasing the “pain train.” While ROKU outperformed the S&P 500 (SPX) (SPY), investors who chased its highs between August and September have suffered. Accordingly, ROKU has plunged nearly 40% from its early August highs toward last week’s lows. As such, ROKU has fallen back to levels last seen in early June 2023, stunning these late buyers.

When did Roku report its second-quarter or FQ2 earnings release? Well, as a reminder, ROKU reported its Q2 earnings in late July, as astute sellers drew these late buyers into a well-laid trap before digesting their gains. As such, it’s a timely reminder for investors not to get caught up in momentum spikes, particularly for no-moat companies like Roku.

Roku Bulls could argue that the company is recognized as the ad-supported streaming platform leader in the US. However, it’s also clear its leadership has failed to gain a sustainable competitive advantage, leading to a solid profitability moat.

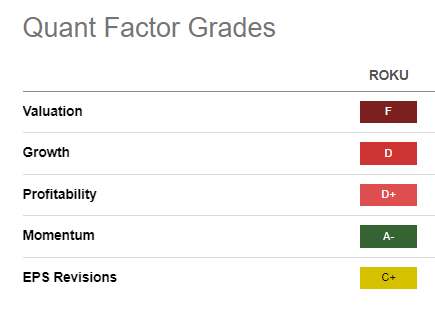

ROKU Quant Grades (Seeking Alpha)

Seeking Alpha Quant rated Roku with a “D+” profitability grade. It’s not something I would usually associate with a market leader. However, given its no-moat leadership, I’m not surprised that Roku has failed to convince investors its leadership could translate into a profitability moat.

Recall that Roku upgraded its guidance in early September, including a headcount optimization. While that led to a momentary surge in its shares, it also formed a bull trap (more on that later), as sellers again used the opportunity to take profit. Buyers have attempted to help stage a further recovery above ROKU’s $100 level, but they haven’t muster sufficient momentum.

Recent analysts’ updates suggest that the scatter market could remain weak in Q4, impacting Roku’s revenue reacceleration potential. As such, it could also hurt its gross margins, suggesting a potentially delayed profitability push in FY24. I believe investors need to consider its upgraded guidance for Q3 as a possible one-off occurrence, given its expense optimization.

Therefore, for Roku to convince investors its profitability push remains on track, management must telegraph sufficient confidence to meet analysts’ profitability estimates in FY24. Accordingly, Wall Street expects Roku to post a positive adjusted EBITDA profitability next year.

However, with ROKU down nearly 40% from its early summer highs, I believe the market is likely pricing in potentially downbeat commentary by management at its upcoming Q3 earnings call. As such, investors are urged to pay close attention as Roku inches closer to its Q3 earnings release on November 1.

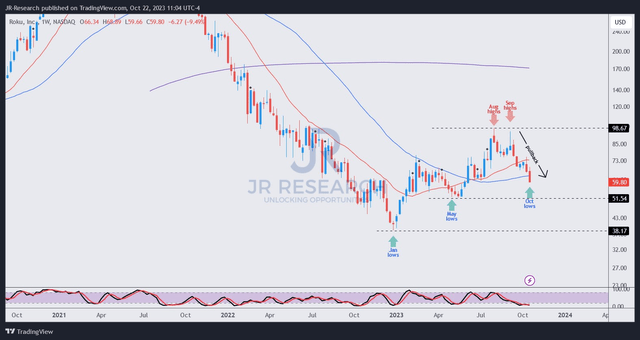

ROKU price chart (weekly) (TradingView)

ROKU’s nearly 40% battering likely surprised investors, particularly if they added close to the $100 level. Those moments coincided with Roku’s Q2 earnings release and guidance update, leading to an unsustainable buying frenzy.

As such, Roku is heading into its Q3 release with much less optimism than the previous quarter, foreboding well for a potential beat-and-raise.

However, I’m less optimistic about that because Roku had already raised its guidance in September (which led to the surge). Therefore, I assessed it’s unlikely for management to promulgate another one so soon.

Market participants are likely assessing higher execution risks from Q4, potentially putting Roku’s adjusted EBITDA profitability push at risk. While some Roku Bulls could be tempted to pull the Buy trigger at its recent pullback, I prefer to strike at higher-quality stocks with a defensible profitability moat.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!