Summary:

- U.S. restrictions on semiconductor exports to China pose a significant concern for Nvidia Corporation, which derives a substantial portion of its revenue from the Chinese market.

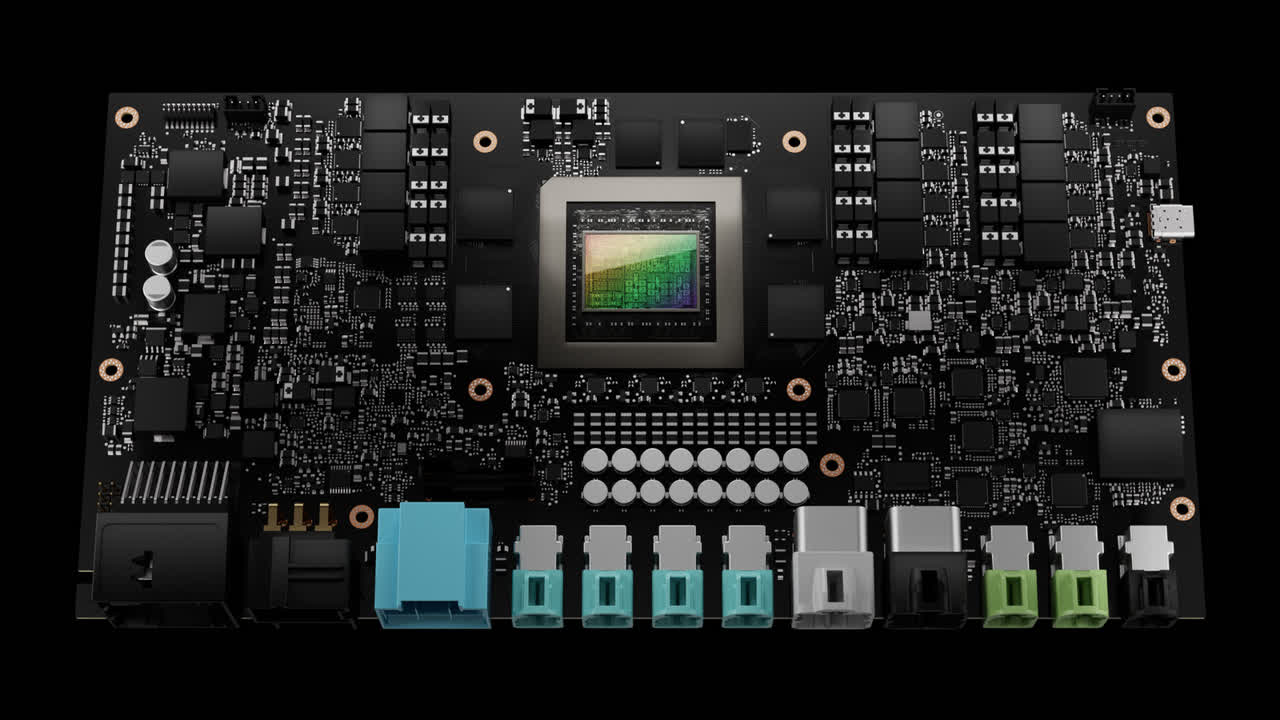

- With partnerships with global automakers and Foxconn, Nvidia’s DRIVE Orin and DRIVE Thor Superchips are leading the way in AI car computer technology.

- Nvidia’s collaboration with Anyscale and its tailored solutions, such as TensorRT-LLM and Triton Inference Server, enhance generative AI development and offer flexibility for different user needs.

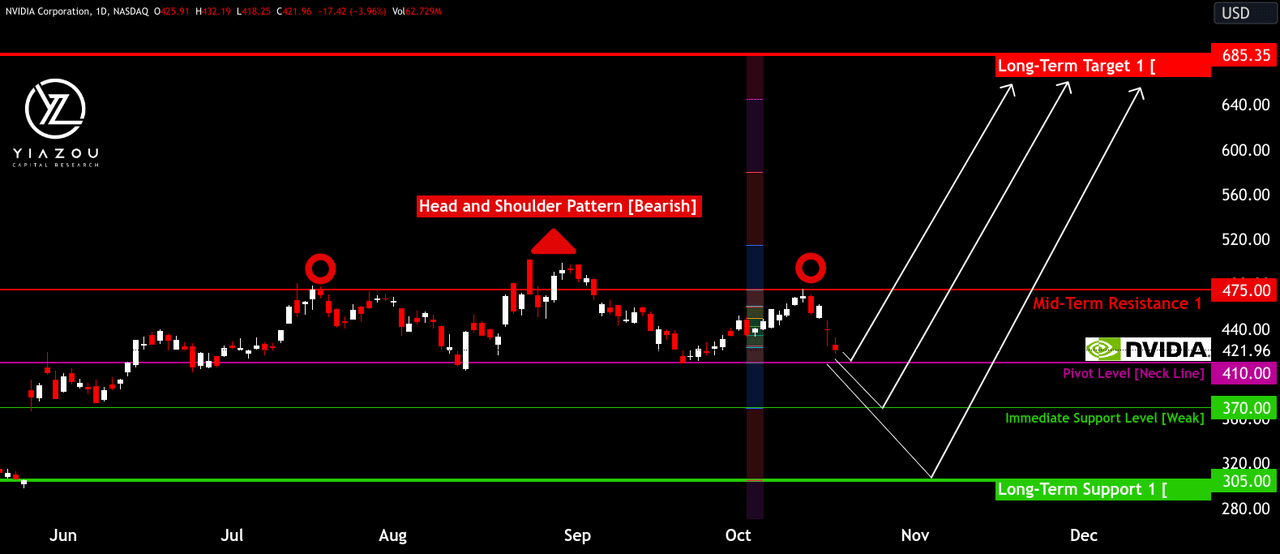

- In the short term, technical analysis suggests three possible scenarios as we approach Nvidia Corporation earnings.

Jonathan Kitchen/DigitalVision via Getty Images

Introduction

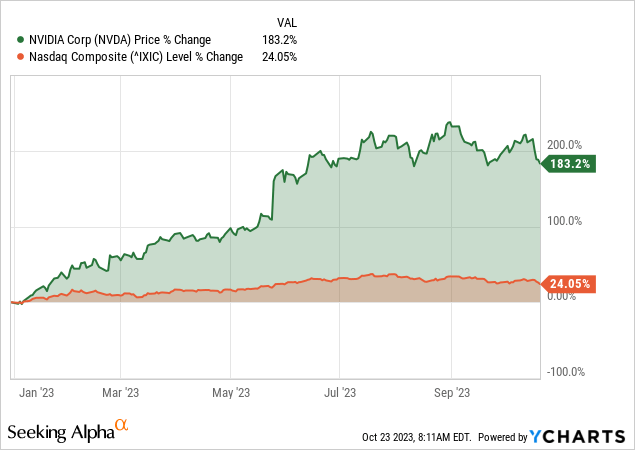

Caught in geopolitical tensions, Nvidia Corporation (NASDAQ:NVDA), a giant in artificial intelligence (“AI”) and semiconductor technology, faces a high-stakes showdown. As the U.S. tightens its grip on semiconductor exports to China, Nvidia’s rapid growth potential hangs in the balance. With a significant portion of its revenue flowing in from the Chinese market, recent restrictions have sent shockwaves through the company.

U.S. Restricts Made-for-China AI Chips

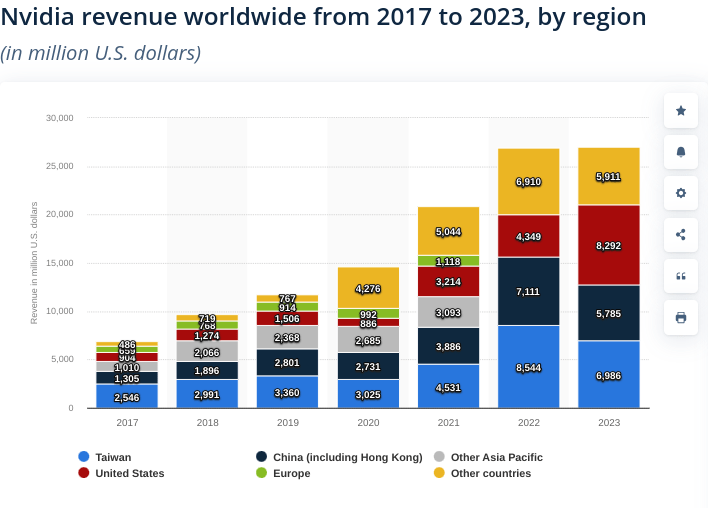

Nvidia faces a fundamental issue with its rapid value growth potential due to recent U.S. restrictions on semiconductor exports to China. The conglomerate derives a substantial portion of its revenue from the Chinese market, amounting to an estimated 20–25% of the company’s revenue. The significance of this contribution cannot be overstated, making any disruption in this market a critical concern for Nvidia.

The AI industry is also experiencing rapid growth across various sectors, including retail, healthcare, and more. There is an immense market opportunity for companies like Nvidia, which provides AI-related products and services. The demand for advanced semiconductors to power AI systems is soaring.

China has invested in AI and aspires to establish global leadership in technology. Consequently, a substantial demand for advanced semiconductors drives AI development in China. Nvidia’s products have fostered AI applications in China, including developing AI chatbots used by companies such as ByteDance and Baidu (BIDU).

Statista

In response to previous restrictions, Nvidia introduced specialized chips tailored for the Chinese market. These chips were adapted to function at slower speeds but remained suitable for training AI models. The newly imposed rules are anticipated to limit the sale of these specialized chips, which could hinder Nvidia’s ability to cater to the specific demands of the Chinese market.

While Nvidia may attempt to offset some losses in the Chinese market by tapping into other regions, it faces fierce competition from other semiconductor manufacturers worldwide. The data underscores the challenge of preserving its global market presence and adapting to evolving geopolitical dynamics. These restrictions go beyond revenue; they limit Nvidia’s ability to provide critical technologies to the global market, especially those instrumental in advancing cutting-edge AI applications.

Finally, The tensions between the U.S. and China form a crucial element of this issue. The U.S. government’s apprehensions about the potential military applications of AI technology exported to China significantly impact Nvidia’s business operations.

DRIVE: The Future of AI in Automotives

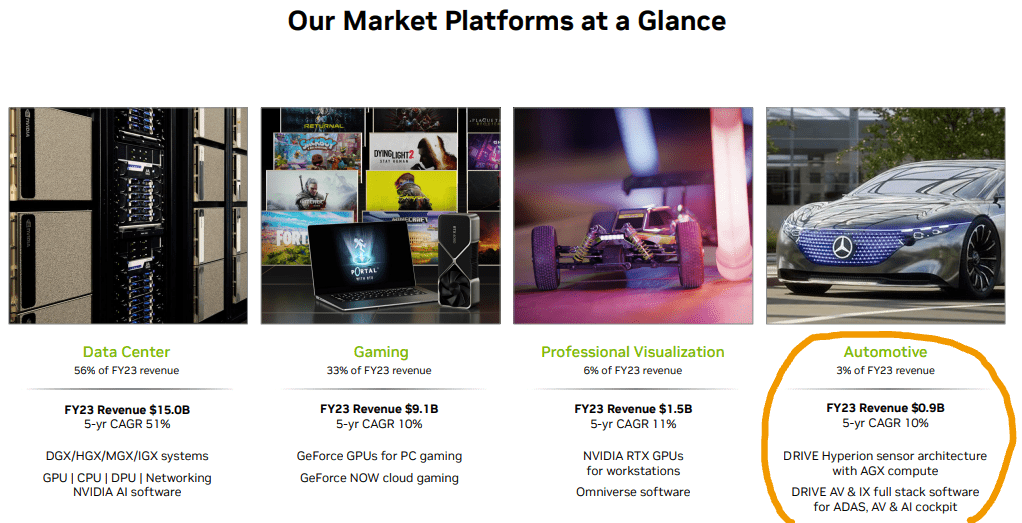

Nvidia’s DRIVE Orin and the upcoming DRIVE Thor superchip are at the forefront of AI car computer technology. More than 25 global automakers are already using DRIVE Orin, and it’s known for its high-performance computing capabilities.

DRIVE Thor is expected to deliver a remarkable 2,000 teraflops of high-performance computing power, crucial for enabling highly automated and fully self-driving vehicles. These advanced AI capabilities are rooted in the technology deployed in Nvidia’s Grace CPUs and Hopper and Ada Lovelace architecture-based GPUs.

Fundamentally, Nvidia’s partnership with Foxconn (OTCPK:FXCOF) for developing intelligent electric vehicle (EV) platforms is a strategic move. Foxconn, a leading electronics manufacturer, is working with Nvidia to realize its EV vision using Nvidia’s DRIVE solutions. This collaboration includes the existing DRIVE Orin and the forthcoming DRIVE Thor.

Furthermore, Foxconn will manufacture electronic control units (ECUs) featuring DRIVE Thor. Partnering with a major electronics manufacturer like Foxconn increases the distribution of Nvidia’s technology and strengthens the company’s position in the EV market.

The DRIVE Hyperion 9 platform, powered by DRIVE Thor, features a qualified sensor architecture with a diverse range of high-resolution cameras, radar, lidar, and ultrasonic sensors. This sensor array is crucial for highly automated and autonomous vehicles, enabling them to navigate their surroundings safely.

Additionally, the quality and diversity of the sensor architecture in DRIVE Hyperion make it a valuable solution for autonomous vehicles, a rapidly growing market. The platform’s compatibility across generations makes it cost-effective and efficient for manufacturers.

DRIVE Hyperion’s compatibility across different generations, retaining the same compute form factor and application programming interfaces, is essential for automotive manufacturers. This seamless transition from DRIVE Orin to DRIVE Thor and beyond can significantly reduce development times and costs.

Finally, Nvidia’s solutions’ compatibility and ease of transition can lead to higher efficiency in the development process and cost savings, which can be attractive to manufacturers, which can be observed in the 10% annual growth rate of DRIVE-generated revenues.

Nvidia

Powering the AI Frontier with Seamless Scalability & Tailored Solutions

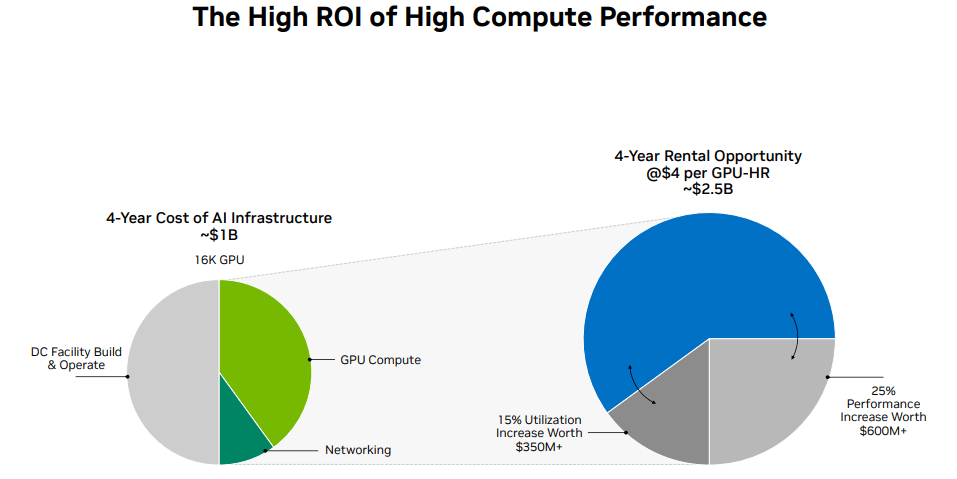

Nvidia’s partnership with Anyscale is a critical strength. Anyscale is known for its open-source unified computing framework for scalable computing. Developers can accelerate generative AI development by integrating Nvidia AI software with the Anyscale platform. This collaboration represents Nvidia’s strategic approach to enhancing its offerings by aligning with leading technology providers.

Nvidia’s role is vital in speeding up generative AI development. This is achieved by leveraging Anyscale’s platform and integrating Nvidia AI, allowing developers to work with popular open-source models more efficiently. Nvidia’s involvement in boosting security for production AI is a specific strength. This is essential, as AI applications must ensure data security and privacy, especially in enterprise settings. Integrating Nvidia AI offers security enhancements for proprietary and open-source Large Language Models (LLMs).

Moreover, the transition from open-source development to deploying production AI at scale is made seamlessly through Anyscale’s platform. Developers can work with open-source tools or opt for the supported Anyscale Platform, demonstrating Nvidia’s flexibility to cater to different user needs.

Nvidia’s technology is built to run on accelerated computing from leading cloud providers, offering hybrid and multi-cloud compatibility. This compatibility is critical in today’s cloud-driven landscape, enabling developers to choose the most suitable cloud environment and scale up as their computational requirements grow.

Nvidia’s TensorRT-LLM is a newly announced open-source software designed to supercharge LLMs. This software significantly improves LLM performance by running models in parallel over multiple GPUs. Notably, this results in up to 8x higher performance on Nvidia H100 Tensor Core GPUs than previous-generation GPUs. This performance boost is compelling for AI developers and companies seeking efficiency gains.

Further, Nvidia’s Triton Inference Server is mentioned as a platform that supports inference across various environments, including cloud, data centers, edge, and embedded devices. This flexibility to support multiple deep learning and machine learning frameworks, such as TensorRT, TensorFlow, PyTorch, ONNX, OpenVINO, Python, RAPIDS, XGBoost, and more, is crucial.

Regarding generative AI, Nvidia NeMo allows users to fine-tune and customize LLMs with business data. This customization is valuable as it enables AI models to understand and adapt to individual businesses’ unique requirements and offerings. By offering a framework for customization, Nvidia capitalizes on the need for tailored AI solutions.

Last, Nvidia AI Workbench was introduced to allow developers to build models on their workstations. This feature is invaluable as it simplifies the development process and offers a smooth transition when moving to production. The ability to work locally and then scale to the cloud is a specific strength that caters to developers’ needs.

The increasing demand for generative AI applications globally aligns with Nvidia’s focus on supporting applications such as intelligent chatbots, coding copilots, and search and summarization tools. This strategic alignment positions Nvidia to capture a significant share of the expanding AI market.

Investor Presentation

Nvidia Stock at a Crossroads: A Bullish Bargain or Stormy Seas Ahead?

Technically, the Nvidia stock price is at a critical point, creating an opportunity for bulls to capture the stock at a bargain price.

The stock price has created an absolute head-and-shoulder pattern heading towards the neckline. On the downside, there are three scenarios:

- The first is that the stock price can take support at the neckline near $410 and resume bullish momentum.

- The second is that the price may break the neckline and take support at $370, which can be considered weak support but has not been tested yet, so that it can hold the price for a few weeks.

- Lastly, a rapid downside move to hit $305 and testing the support multiple times to resume the bullish trajectory. It can be materialized near upcoming earnings.

However, a possible recession can take the price below $305, but it is less likely considering the revenue and profitability growth pace of Nvidia, which may not slow in the mid-to-long term.

Takeaway

Nvidia faces challenges due to U.S. restrictions on semiconductor exports to China, with around 20-25% of revenue coming from China. Despite this hurdle, the growing AI industry offers opportunities, especially in automotive technology. Nvidia’s DRIVE Orin and upcoming DRIVE Thor promise advanced AI capabilities for autonomous vehicles. Lastly, partnerships with Foxconn and Anyscale strengthen its EV and AI development market position.

While stock price patterns present opportunities, it’s essential to consider broader market trends and Nvidia’s adaptability to evolving AI needs as geopolitical dynamics continue to impact the company’s future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.