Summary:

- Chevron makes an offer for Hess, indicating strong interest in the profitable Guyana project.

- Chevron’s entrance into the Guyana partnership suggests a higher value than previously seen.

- The recent acquisitions by CVX and other insiders indicate better times for the industry and a buyers’ market.

- An industry cyclical top is marked by the entrance of speculative money financing unsound projects and paying large takeover premiums.

- The presence of Chevron in the Guyana partnership may indicate that the project development is about to accelerate.

Mario Tama

Chevron-Hess Deal

Chevron (NYSE:CVX) surprisingly made an offer for Hess (NYSE:HES). This indicates an offer to get involved in the extremely profitable Guyana project. It may mark the start of an acceleration of the project as Chevron can bring considerably more resources to the project than Hess could. I have long stated in my Hess articles that Hess could become a takeover play because it’s the smallest partner by far in the Guyana partnership. But the entrance of Chevron into the partnership indicates a value far beyond what many claim to have seen. The majors do not make acquisitions unless they see a chance for some very material improvements to make the acquisition a bargain.

Cycle Beginning

Chevron has been catching up recently by making acquisitions. This acquisition follows the PDC Energy acquisition that just recently closed. Chevron made another acquisition before that.

Generally, insiders do not overpay for acquisitions. They can make mistakes like anyone else. But the sheer volume of acquisitions would appear to indicate that better times for the industry are underway.

Usually, a market top is marked by the entrance of speculative money with little to no experience that finances projects that do not make sense and will quickly lead to overproduction. That money will also acquire companies “at any cost.” Most of the current deals are done by insiders at very reasonable prices that are going to pay back rather quickly.

There is, for example, the acquisition of TransGlobe Energy by Vaalco (EGY). At the time, I estimated Vaalco got the company for about one times earnings. That is definitely not overpaying by any reason.

Similarly, NYSE listed Baytex Energy (BTE) acquired Ranger Oil (ROCC) for a dirt-cheap cash flow ratio.

The relatively low prices paid would appear to indicate that it’s still a buyers’ market. Most of these companies are dirt cheap and very profitable compared to the market darlings like Netflix (NFLX) which just soared to an absurd price on the latest earnings report. Netflix has an earnings multiple many times a typical oil or gas company and it appears to offer slower growth in the future as well as no dividend. Tesla (TSLA) would appear to be in the same category except TSLA will probably be reporting losses in the future since it began an ill-advised pricing war that is attracting companies with far more resources than Tesla.

What Hess Brings To The Table

We will begin with the obvious and work our way down the list as Hess has a number of things going for it. Guyana has to be a major reason for the offer.

Guyana

Guyana itself may be worth the offer as cash flow rapidly builds and there are indications of a lot more cash flow builds opportunities.

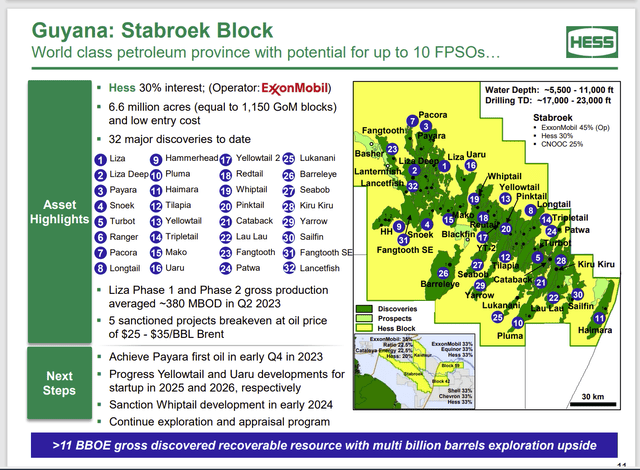

Hess Corporation Map Of Discoveries And Partnership Holdings In Guyana (Hess Presentation At Barclay’s CEO Energy Conference September 2023)

The third floating production platform is about to begin production as shown above. Hess has a 30% interest in the reserves shown above. However, there’s likely to be a revision to that number as Exxon Mobil (XOM) spent the first quarter testing to see what the latest discoveries mean to that figure.

John Hess, CEO, likewise has stated that the current discoveries alone should allow the company to grow cash flow at a 25% compounded return rate at least through 2027. That pace would mean that cash flow should triple every five years. A lot of high-tech companies cannot come close to that.

Several things may well maintain that rate or possibly increase it. First is the very low breakeven point of these FPSO’s proposed or in production make this a “must have project” for a lot of players in the industry.

Secondly, John Hess has noted there is oil at the 18,000 ft level whereas most of the discoveries are at the 15,000 ft level. Therefore, there is a lot of low-risk exploration to be done in an area that already has a lot of discoveries. How much oil is at the 18,000 ft level remains to be seen. But there’s every indication that it is significant if he is saying it.

Furthermore, Exxon Mobil has begun to explore on several other partnership holdings. A discovery on any of them would eventually add material upside to the current scenario.

Suriname

Hess has lease holdings with other partnerships in Suriname as well. Total (TTE) and Apache (APA) have a series of discoveries they’re evaluating. John Hess has mentioned in the past when he gives periodic updates that this discovery is gassier but likewise appears to be viable as the evaluation of the discoveries is positive. He likewise believes the news is good for the acreage that Hess holds in that area. At the same time Hess and its partners are waiting for results on the block that Total operates before doing anything.

Gulf Of Mexico

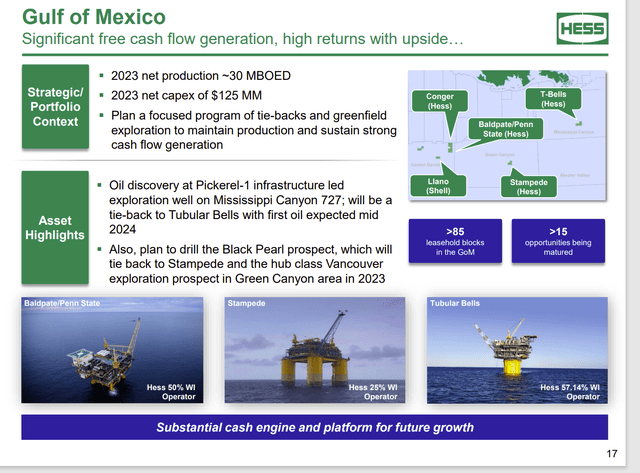

Hess has a robust Gulf of Mexico business that began the year with a significant discovery.

Hess Corporation Summary Of Gulf Of Mexico Business (Hess Presentation At Barclay’s CEO energy Conference September 2023)

Hess actually sold some of this business a few years back to raise money for the platforms in Guyana before Guyana had cash flow. Now with the Guyana cash flow reasonably assured, Hess has begun to become more active in the Gulf of Mexico.

These wells, when successful, tend to be large, and can quickly increase free cash flow.

Bakken

The next significant play is the Bakken. Hess has long been a premier player in the Bakken. This asset is primarily a cash flow generating asset that funded the preliminary expenditures for the Guyana Partnership.

Hess Midstream (HESM) services this area to provide Hess with hookup capabilities to get to various markets. One of the wild cards in this is the fate of Hess Midstream because a major like Chevron can play hardball with a midstream like this one (which is considerably smaller). Risk averse investors may want to reduce or even eliminate their positions in Hess Midstream for that reason. A decision does not have to be made right away. But a relationship with Chevron is not the same as a relationship with Hess for a captive midstream. There are far more risks for this new relationship with Chevron.

Personally, I believe that Chevron is less interested in the Bakken and may well sell it unless it knows how to lower the breakeven of this project. If that is the case, then I will consider selling the Hess Midstream.

Others

Hess also has an Asian project that primarily generates cash flow.

Summary

Chevron is going to be getting some prime projects. Guyana has got world class break-evens and so is far more profitable than many projects out there. It also has an extremely good world-class ESG (pollution) rating because Exxon Mobil reinjects any gas produced to maintain reservoir pressure. That immediately puts a stop to any emissions concerns. It also increases the recovery of oil from each well.

Probably for Chevron, the next interesting business will be the Gulf of Mexico because the Bakken has a higher breakeven point.

In any event Chevron is buying far more potential future cash flow that will probably grow rapidly. It may grow more rapidly than anything in the company portfolio right now. That would be excellent news for Chevron price appreciation and for dividend increases in the future.

I intend to hold Chevron stock I get and will closely monitor the Hess Midstream situation. For me, as a retiree, I will likely exit the midstream investment I have in the future. But I am not rushing to do it now. I will read the prospectus first when I get it.

Hess was one of those rare opportunities that represented big exposure to the emerging Guyana play. Now Chevron investors will get the benefits of that exposure. Chevron is likely a strong buy based upon all the acquisitions that bring a lot of opportunities to the company.

To me the industry acquisitions appear to represent a buyer’s market as the prices are not all that great. Oil and gas usually outperform market downcycles. All the acquisitions appear to point to continued outperformance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HES HESM BTE EGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.