Summary:

- AbbVie’s Q3 earnings will be announced on October 27th. This blue chip pharma offers a strong >4% dividend yield.

- Despite the challenges presented by Humira’s patent expiration, I consider AbbVie a de-risked investment opportunity with a generous dividend yield.

- The revenue figures of Humira, Skyrizi, and Rinvoq will be crucial in determining ABBV’s stock performance post-earnings.

- The market is demanding better short-term performance – AbbVie is guiding for superior, high-single-digit longer-term revenue growth.

- Humira could face a tricky year-on-year comparison now there are 8 generics/biosimilars on the market, but management’s plans to offset losses with thriving growth in immunology, neuroscience, and oncology look reasonably solid.

vzphotos

Investment Overview

AbbVie (NYSE:ABBV) announces its third quarter earnings for 2023 this Friday, 27th October. From a share price perspective, The Illinois based Pharma has had a difficult year, for a number of reasons, although the primary one will be well known to anybody with a passing interest in the company – the patent expiry of its flagship asset, Humira, the immunology/dermatology drug that earned revenues of $21.2bn last year, and >$100bn over the past 5 years.

In this post, I will preview Q3 2023 earnings, discuss the Humira LOE and the performance of the 2 drugs marked out as the “mega-blockbuster’s” long-term replacement, highlight other issues investors may want to be aware of ahead of the earnings release and call with analysts, and offer some thoughts on how the results may affect AbbVie’s current valuation and share price.

Now that Humira’s LOE has finally arrived (after AbbVie managed to extend its patent protection almost a decade longer than originally expected) management’s detailed product-by-product forecasting, and the fact no other AbbVie drug is expected to lose patent protection this decade, the Pharma is arguably one of the most de-risked investment opportunities in the sector.

Although shares may not have explosive upside potential, and AbbVie does not look to be in possession of another asset with similar earning potential to Humira – unlike, e.g., Eli Lilly (LLY) or Novo Nordisk (NVO) and their “miracle weight loss drugs” expected to become bigger sellers than even Humira, AbbVie’s generous dividend, which currently yields >4%, and has already been increased by 5% this year, and by 270% since AbbVie was spun out of Abbott Laboratories (ABT) in 2012, means that there is rarely a bad time to consider acquiring some AbbVie shares, even if the market demands a premium price at the current time.

AbbVie 1H23 Performance – A New Reality Post Humira LOE With Skyrizi and Rinvoq Key To Valuation

Back in April, when AbbVie issued its first quarter earnings, after much speculation, the market was given a first glimpse at what AbbVie’s performance post Humira’s loss of exclusivity (“LOE”) might look like.

Revenues in Q1 2023 fell 10% year-on-year, to $12.23bn, with Humira revenues falling from $4.74bn in Q1 2022, to $3.54bn as the drug faced competition from generic drugs for the first time in the US. Humira is approved in multiple indications including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Ankylosing spondylitis (“AS”), Psoriasis (“PsO”), Hidradenitis suppurativa (“HS”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”).

The tumor necrosis factor inhibitor – despite a boxed warning from the FDA highlighting risks of serious infection including sepsis and TB, has been a dominant player in each of these markets for more than a decade, but the launch of Amgen’s Humira biosimilar drug Amjevita in February, at a significantly lower price point to Humira, immediately ate into Humira’s revenue generation.

AbbVie’s initial guidance provided when announcing Q1 earnings was that Humira revenues would fall by 37% year-on-year, to somewhere around ~$13.4bn. The company issued guidance for earnings per share (“EPS”) of $10.57 – $10.97, and the market was unimpressed. Prior to the Q1 earnings announcement in late April, AbbVie stock had traded at $165 per share – by late June, its share price had fallen to ~$132, down ~20%.

By the time Q2 earnings were announced, however, despite the number of Humira competitors on the marketplace having grown to eight, AbbVie management was sounding a bit more upbeat, with CEO Rick Gonzalez telling analysts on that quarter’s earnings call:

The U.S. Humira biosimilar impact is playing out as projected and slightly better than our planning assumptions. We are competing very effectively with the various biosimilar offerings. We have exceeded our guidance in burst in second quarters with the overachievement predominantly driven by our growth platform, the base portfolio, excluding Humira which, as you know, is the critical driver in our rapid return to growth in 2025 and beyond.

There are two points to consider here. Firstly, that Humira remains popular with prescribing physicians and the public despite the introduction of so many generics – even with some priced at an 85% discount to the original drug during the call. Management advised during the Q2 earnings call that it now expected Humira revenues to fall 35% year-on-year, as opposed to the 37% announced in Q1.

Secondly, AbbVie’s preparation for, and execution of its post-Humira loss of exclusivity (“LOE”) strategy is proving to be very effective. As mentioned above, out of the >30 major drug products marketed and sold by the pharma company, none, other than Humira, are expected to lose patent protection before the end of the decade.

For some time, management has been very clear about what its post-Humira LOE business will look like, with CEO Gonzalez telling analysts back in February 2022 that:

Following the U.S. Humira biosimilar entry in 2023, we expect to quickly return to growth in 2024 and deliver a high-single-digit growth from 2025 to the end of the decade

More recently, in September at the Morgan Stanley Global Healthcare Brokers Conference. AbbVie’s Chief Operating Officer Rob Michael discussed a “disconnect” between analysts forecasting for AbbVie’s growth to be mid-single-digit post-2023, and management’s insistence that high-single-digit growth is achievable, telling the audience, in response to a question concerning M&A activity. that “we don’t need to do anything to deliver on the high-single-digit growth expectation for the second half of this decade.” Michael continued:

Yes. When I look at sell side consensus from ’24 through ’29, the compound growth is just over 4%, which is lower than our high single-digit guidance we’ve provided. And I’d say the lion’s share of the difference is Skyrizi and Rinvoq, I do see a difference also for Vraylar and Aesthetics. Each about $1 dollars that we’ve said, greater than $9 billion for Aesthetics, the Street’s about $1 billion lower.

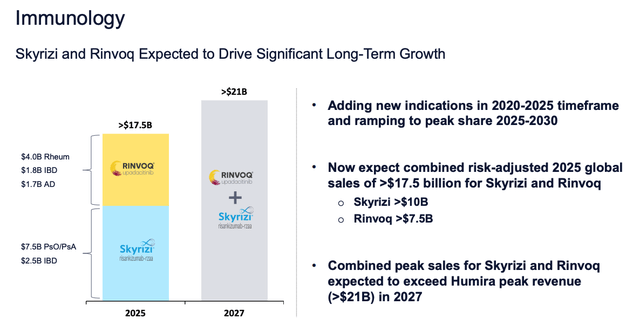

For Vraylar, we saw the peak approaching $5 billion, the Street’s about $1 billion lower. But the lion’s share of the disconnect is Skyrizi and Rinvoq. Not early – I mean 25 right now, actually, The Street is slightly higher than the guidance we’ve given. It’s $17.5 billion, $10 billion for Skyrizi, $7.5 billion for Rinvoq.

The Street’s actually at about 11 now, a little bit higher than 11 for Skyrizi. Below us on Rinvoq, they are $6.5 billion. But net-net is about $18 billion, so ’25 isn’t the issue. It’s the growth beyond ’25. It’s something like low single-digit growth and we expect much more robust growth from Skyrizi and Rinvoq for a few reasons.

Skyrizi and Rinvoq are the 2 drugs – respectively, an interleukin-23 (“IL-23”) inhibitor, and janus kinase (“JAK’) inhibitor, that AbbVie developed to target all of the same indications in which Humira held dominant market share between them.

To date, Skyrizi has won approvals in plaque psoriasis, psoriatic arthritis, and Crohn’s disease, whilst Rinvoq has secured approval in Rheumatoid Arthritis, Psoriatic Arthritis, Atopic Dermatitis, Ulcerative Colitis, Crohn’s Disease, Ankylosing Spondylitis, and Non-Radiographic Axial Spondyloarthritis.

Rinvoq / Skyrizi forecasts (AbbVie presentation)

As we can see from the above slide shared by AbbVie at January’s JP Morgan Healthcare conference, by 2027, management expects Rinvoq and Skyrizi to be outselling Humira at its peak.

Even with some cannibalization of Humira revenues by these two, newer assets, whose safety and efficacy are regarded as superior to their predecessor, and also most of the competition from other Pharmas – i.e., Johnson & Johnson’s >$10bn selling Stelara – within intensely competitive markets, AbbVie believes it has already solved its Humira LOE “crisis”.

As such, when looking ahead to Q3 earnings, we can already identify the three most important numbers to look out for – the revenue figures of Humira, Skyrizi, and Rinvoq. If these numbers disappoint the market, AbbVie stock is likely to be punished with a sell-off. If they exceed the market’s expectations, then AbbVie stock, which has risen 10% since hitting its June lows, will likely become even more buoyant.

AbbVie By The Divisions – A Very Clear Outlook With Few Surprises In Store

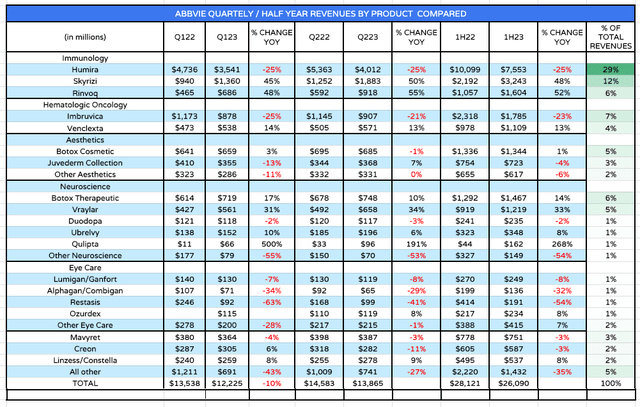

In the table below I have compared AbbVie’s Q1 and Q2 revenues in 2023 against the prior year, by drug product revenues, and also included a 1H23 vs 1H22 comparison, as well as showing the percentage of total AbbVie revenues each AbbVie drug, or division, accounts for.

AbbVie revenues by product historic (AbbVie data)

As we can see above, AbbVie’s immunology division accounted for 48% of AbbVie’s total revenues across the first half of the year, underlining that the Pharma remains a powerhouse in this sector, and given the 48% and 52% growth recorded by Skyrizi and Rinvoq, to a combined $4.85bn, will remain so, although in order to meet management’s expectations of $17bn from these two assets by 2025, both drugs face demanding growth expectations.

Elsewhere, we can see that AbbVie’s oncology division – accounting for ~11% of total revenues – has been suffering as Imbruvica revenues fall. In a way, however, this is another example of management’s good stewardship. The company was cognizant of the fact that imbruvica, approved to treatChronic Lymphocytic Leukemia, would likely be targeted via the Inflation Reduction Act (“IRA”), which has given the government the right to negotiate drug prices alongside Pharma’s, Health Insurers, and Pharmacy Benefit Managers (“PBMs”).

At the end of August, the CMS announced the first 10 drugs that will be subject to negotiation in year one, and Imbruvica was included on the list, however, AbbVie management has been warning for some time that Imbruvica sales would trend downward substantially, and that this would not affect forward guidance.

Going forward, AbbVie’s oncology division could be beefed up by as many as 3 new drugs – Epcoritamab won approval this year in relapsed or refractory Diffuse Large B-Cell Lymphoma (“DLBCL”), whilst Teliso-V, an antibody drug conjugate will read out Phase 2 data in non-squamous non-small cell lung cancer later this year, while Navitoclax also has a key data readout this year in myelofibrosis and could secure an approval next year.

Back in 2020, AbbVie paid ~$66bn to acquire Allergan and its aesthetics and neuroscience assets, and as we can see, Aesthetics now accounts for >10% of revenues, primarily thanks to the injectables botox and juvderm, whilst neuroscience accounts for ~14% of total revenues.

While the aesthetics division performance has been somewhat flat, the neuroscience division has been growing at a double-digit percentage pace, with total revenues from the division growing ~14% in 1H23 versus 1H22. With the likes of Vraylar, indicated for major depressive disorder (“MDD”), expected to become a $5bn per annum selling product, and migraine drug Qulipta pegged for blockbuster (>$1bn per annum) revenues long-term, this division’s performance in Q3 ought to be closely watched, and ought to provide some good growth.

Finally, whilst sales of older eye care assets tumble, as shown in the table above, there is some hope for the division in the form of pipeline assets RGX-314, part of a collaboration between AbbVie and Regenxbio, which began in 2021. This is a gene therapy targeting wet Advanced Macular Degeneration (“AMD”) and diabetic retinopathy – double-digit billion-dollar markets. In Q2, Regenxbio reported that interim data from a Phase 2 study showed the drug was “well-tolerated and with the majority of subjects (11/15, 73%) injection-free through six months”.

Gene therapies are challenging to develop and eye disease markets are competitive, but RGX-314 is arguably as close to an AbbVie outlier that could unexpectedly take the markets by storm as any of the company’s pipeline assets. Any updates related to this “moonshot” asset ought to be worth paying close attention to.

Concluding Thoughts – What To Expect From AbbVie Q3 Earnings? Few Surprises, With Market’s Response Dictated By Immunology Performance

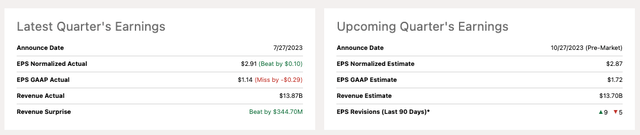

AbbVie earnings past and future (Seeking Alpha)

As we can see above, AbbVie beat on normalized EPS last quarter, missed on GAAP EPS, and outperformed on revenues – a performance that did not materially move the share price at the time. For Q3, analysts expect to see slightly lower normalized EPS of $2.87, GAAP EPS of $1.72, and revenues of $13.7bn.

AbbVie management advised during the Q2 earnings call that in Q3 2023:

We anticipate net revenues of approximately $13.7 billion, which includes U.S. Humira erosion of approximately 40%. And rates, we expect foreign exchange to have a modest unfavorable impact on sales growth. We expect adjusted earnings per share between $2.80 and $2.90.

In terms of the full year 2023, management advised that:

Turning to our financial outlook. We are raising the midpoint of our full year adjusted earnings per share guidance by $0.23 and now expect adjusted earnings per share between $10.90 and $11.10. We now expect total net revenues of approximately $53.4 billion, an increase of $1 billion.

Investors, shareholders and the market can draw several conclusions from this. Firstly, the market and management are reasonably well aligned in terms of outlook, and although management’s long-term revenue expectations are loftier than the market’s, in the short term it may be the market that is demanding to see higher growth.

This does not suggest that the market is likely to respond favorably to management meeting expectations in Q3, but neither does it imply a selloff is likely – unless Humira revenues take a bigger-than-expected hit, or Skyrizi / Rinvoq revenues fail to grow fast enough.

Secondly, it implies that AbbVie’s 2H23 will need to be slightly superior to 1H23 if revenue expectations are to be met, and that overall profitability may need to improve also. Often, a large discrepancy between GAAP EPS and normalized EPS forecasts can be a potential red flag, implying internal guidance if becoming divorced from reality, although given the size and scale of AbbVie, it is probably not wise to read too much into this at the present time.

The final conclusion that may be drawn is not to expect the unexpected. Management has been meticulous in its planning for a post-Humira AbbVie, which, on the plus side, means that the Pharma does not need to spend big on M&A, and is not overly reliant on its pipeline for future growth – at least until the end of this decade.

On the negative side, should the performance of any of AbbVie’s current portfolio of commercialized drugs fail to live up to expectations, it will be immediately obvious to the market that management’s bullish forecast for high single digit growth may be overblown, and the share price will likely suffer. Additionally, AbbVie’s drug pipeline is unlikely to provide many surprises to the upside, RGX-314 aside.

My suspicion is that a tough year-on-year comparison for Humira – likely its worst yet, now that generics have had 9 months to establish market share, and the market’s more demanding growth expectation for Skyrizi and Rinvoq could see a mini-selloff of AbbVie stock. On the other hand, management will be aware of expectations and I believe desperate to put out a very strong set of numbers.

Ultimately, if I were looking to add to my position in AbbVie stock, I would wait until results are released as opposed to buying ahead of time in anticipation of a spike. AbbVie is playing a long-term game that investors can follow by the numbers released each quarter. Q3 is a potential bump in the road, but it won’t derail a strong, dividend-paying blue chip like AbbVie – the world’s fourth largest Pharma by market cap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.