Summary:

- Amazon.com, Inc. is set to report Q3 results post-market on October 26, 2023. What are the odds of beating the consensus? Read on.

- Amazon Q3 guidance predicts optimistic revenue and profit numbers, but potential challenges include higher gasoline prices and falling inflation.

- The Q4 guidance remains an unpredictable factor that will steer the market’s response. From my perspective, the existing expectations may be somewhat elevated.

- In the long-term, I’m bullish on Amazon stock because I think the company has a really wide moat. However, I see no reason to greatly increase my allocation to this stock ahead of the report.

hapabapa

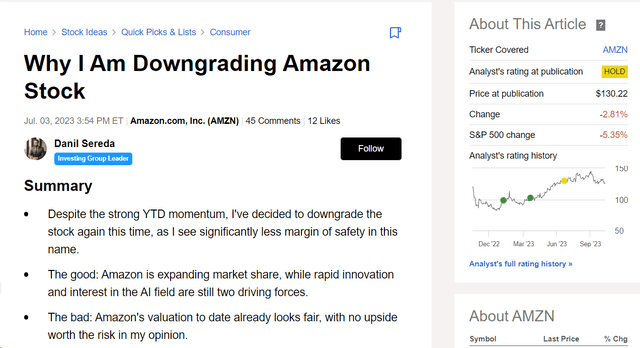

I try to cover Amazon.com, Inc. (NASDAQ:AMZN) regularly here on Seeking Alpha, and the last time I wrote about the company was in early July. At that time, I downgraded the stock from “Buy” to “Hold,” and AMZN has moved rather sideways since then.

Seeking Alpha, author’s previous article on AMZN

The company reports post-market on October 26, just a couple of days away, so I felt it necessary to update my coverage in advance. So let’s get started.

Strong Q2 Results, But Q3 Strength is Questioned

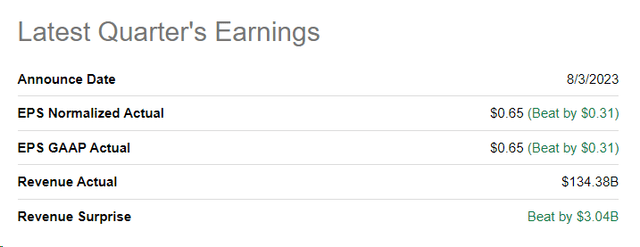

As you may remember, Amazon massively outperformed consensus expectations in Q2 FY2023, showing still solid but slowing revenue growth.

In Q2 FY2023, Amazon reported $134.4 billion in revenue, an 11% YoY increase. Their GAAP gross margin widened to 48.4%, but the operating margin dipped to 5.7%. The problems in maintaining profit margins were probably the reason for the stagnation of the stock despite the stunning earnings beat in the second quarter.

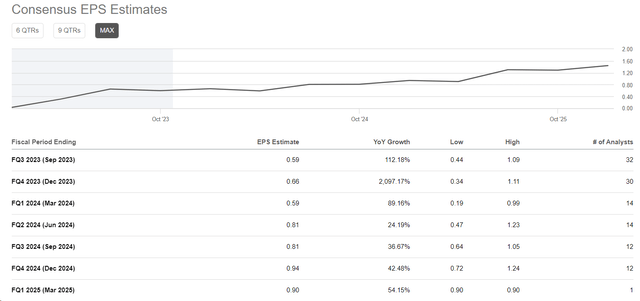

Amazon’s Q3 FY2023 guidance predicted revenue of $138-$143 billion, with a currency tailwind of 120 basis points, according to Argus Research data [proprietary source]. Operating profit was expected to be $5.5-$8.5 billion, with an anticipated GAAP EPS range of $0.45-$0.50. This outlook looks quite optimistic compared to Q3 FY2022 when they earned $0.28 per diluted share.

The market willingly believes in a repeat of the Q2 success and even pays a small premium to the mid-range of management’s guidance (below are Non-GAAP numbers):

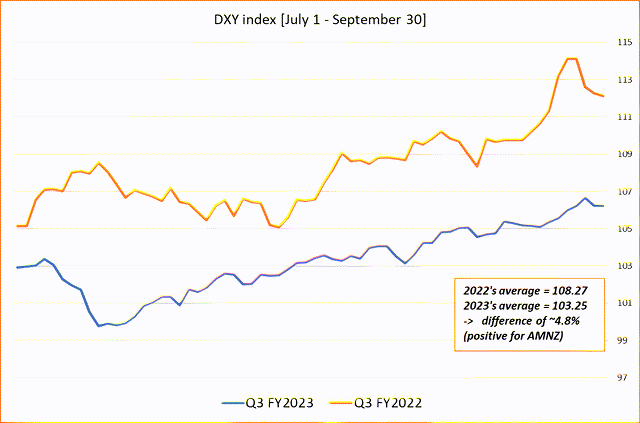

If we look at the factors that could impact the company’s revenue and therefore earnings per share, AMZN’s forecast looks justified in terms of the positive impact of the exchange rate differential – indeed, the company should get positive tailwinds on this front as far as I can see:

Author’s calculations, Investing.com’s data

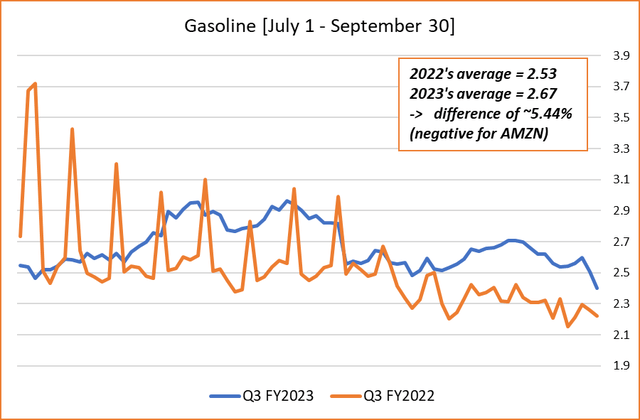

What puzzles me, though, is that gasoline prices this year were significantly higher than last year [comparing Q3 data sets of gasoline futures].

Author’s calculations [Investing.com data, Gasoline prices – GPRX3]

As you may know, Amazon relies on a large network of trucks, vans, and airplanes to deliver its products to customers. So, higher gasoline prices can significantly increase Amazon’s transportation and delivery costs.

Moreover, I am puzzled by falling inflation – let me explain why. When prices of goods do not rise or even fall, consumers may be less willing to spend money. This is because they may feel they will get a better deal if they wait to buy goods until prices fall further. This directly threatens the company’s revenue, because Amazon’s business model is based on selling goods at a higher price than it buys them for.

Also, in recent months, Amazon has made a series of significant announcements indicating its intention to make substantial investments over the next few years, which are expected to have a considerable impact on its free cash flow.

On August 4, 2023, Amazon announced its acquisition of iRobot (IRBT), the maker of Roomba robotic vacuum cleaners, for $1.7 billion. Their business generated adjusted EPS of -$0.66 and revenue of $291.97M in its latest quarter (with revenue down 30% YoY). Although iRobot operates in a very fast-growing market and has high-quality technology, it is not entirely clear how this acquisition will impact AMZN’s EPS in the foreseeable future.

On September 25, 2023, Amazon announced a strategic collaboration with Anthropic to advance “safer” generative AI technology. Amazon will invest up to $4 billion in Anthropic, becoming a minority owner. The deal includes $1.25 billion in initial funding with up to $2.75 billion in additional funding as the collaboration continues. The partnership aims to accelerate Anthropic’s foundation models and provide them to Amazon Web Services (“AWS”) customers. AWS will be Anthropic’s primary cloud provider, and customers will access Anthropic models through Amazon Bedrock.

The collaboration enhances AWS’s generative AI offerings. This is how Jim Kelleher, CFA [Argus Research] put it in his September note:

The greater availability of Anthropic on AWS means that customers will have early access to features for customizing generative AI models, including those from Anthropic. Customers will be able to more easily use their proprietary data to create enterprise-specific models and utilize fine-tuning capabilities via the self-service feature within Bedrock. As part of that deeper collaboration, AWS and Anthropic are committing resources to help customers get started with Claude and Claude 2.

But that aside, these investments need to justify themselves – in a time of high interest rates, this type of long-term investment becomes a costly pleasure for investors. I fear that AMZN’s new investments may repeat the story of Rivian (RIVN) and Ford (F). But of course, this is not about the immediate future, but just a thought.

Summary Thesis

Based on the data analyzed, it is impossible to say definitively how likely it is that AMZN will outperform consensus forecasts for Q3. Mr. Market already prices quite optimistic results, but they are not guaranteed to come true. The stock’s reaction will largely depend on Q4 guidance, but with the economy slowing rapidly, it is difficult to expect excessive optimism.

Long term, I’m bullish on Amazon.com, Inc. stock because I think the company has a really wide moat. However, I see no reason to greatly increase my allocation to this stock ahead of the report – the implied move is 6% [proprietary source] according to analysts at JPM, but it is by no means certain that this move will be to the upside. Therefore, I’m sticking with my current “Hold” rating and look forward to the report.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!