Summary:

- Q3 results were in line with our expectations, exceeding forecast only on free cash flow aspect.

- Netflix is showing stable organic user growth base. Churn remain low despite paid sharing initiatives.

- Negative ARPU effect will be offset by near-term price increases.

- Recent news shows management’s intentions to enter the cloud gaming market. We believe this can add $5 to $50 to the current price target.

Giuliano Benzin

Investment Thesis

Netflix (NASDAQ:NFLX) pleased investors again with Q3 earnings – company showed stable organic user base growth and it seems that management has been developing for last 2 years to work really well. We maintained BUY rating and there is still upside with potential development of the gaming segment.

Q3 FY2023 earnings summary, updates on user base estimate

We’ve been covering Netflix in Seeking Alpha since 2022. Our previous article with a Hold rating from July can be found here. The 3Q 2023 report is generally in line with our expectations, beating the forecast only on free cash flow aspect.

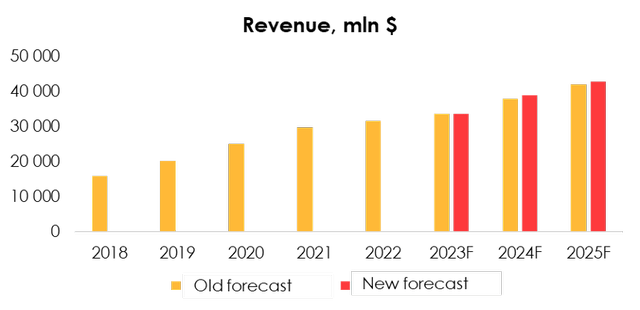

- Revenue totaled $8 542 mln (+7.8% y/y), in line with our forecast of $8 512 mln.

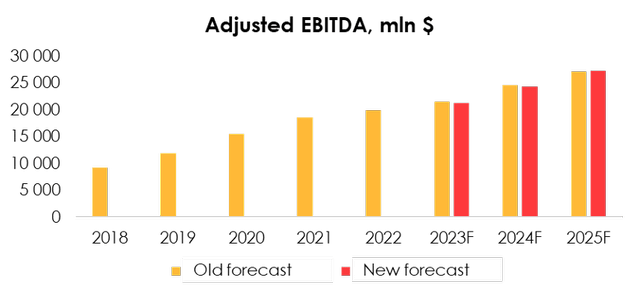

- The company’s adjusted EBITDA totaled $5 580 mln (+5.9% y/y), also in line with our forecast of $5 575 mln.

- Free cash flow in the period totaled $1 888 mln, compared with our forecast of $300 mln. The difference was driven by lower spending on content ($2 884 mln versus the forecast of $4 377 mln), as some of the filming had to be moved back due to the strikes by actors and screenwriters.

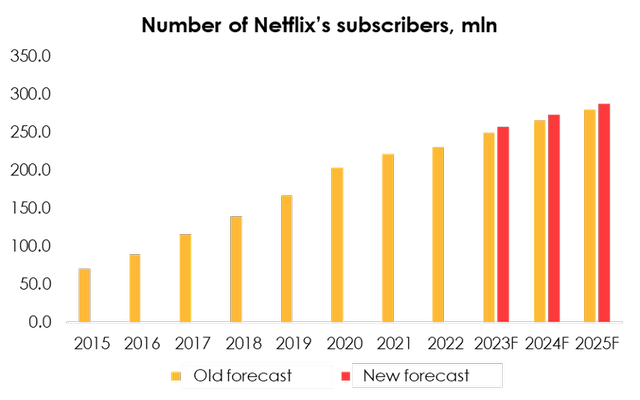

The third quarter again proved to be a success for Netflix from the perspective of expanding its subscriber base. The number of US accounts reached 77.3 mln (compared with our forecast of 77.0 mln), and international accounts 169.8 mln (compared with the forecast of 166.5 mln).

The monetization of subscription sharing continues to deliver solid results, but the strong increase of the subscriber count was described by management as largely organic as the number of users of the subscription option jumped by 70% q/q (chiefly due to the effect of a low base), while churn remained low. Therefore, Netflix’s strategy that seeks to target the more price-sensitive users is working out.

We see good conditions for the company’s audience to expand further, as the fourth quarter is set to be packed with new content. Plans for the last three months of 2023 include the releases of new seasons of popular series (such as The Crown and Berlin, a spinoff in the Money Heist universe) and standalone feature movies from internationally acclaimed directors, such as David Fincher and Bradley Cooper.

Given the rich portfolio of future releases and the success of the cheaper subscription plans, we are raising the forecast for the subscriber count from 249.7 mln (+8.2% y/y) to 257.1 mln (+11.4% y/y) for 2023, and from 265.3 mln (+6.2% y/y) to 273.0 mln (+6.2% y/y) for 2024.

Average revenue per user & financial model adjustments

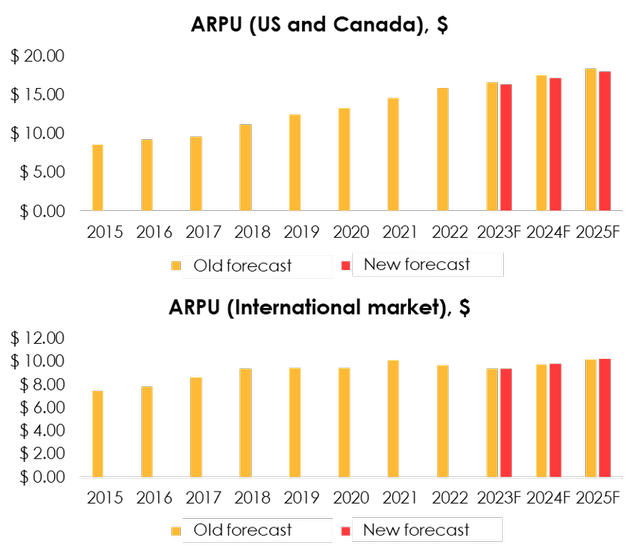

The negative impact that cheap accounts made on ARPU was slightly stronger than we had expected. In the US and Canada the metric totaled $16.29 (-0.5% y/y), down from the forecast of $17.06 (+4.2% y/y), and internationally it totaled $9.88 (+2.7% y/y), compared with the forecast of $9.92 (+2.0% y/y), given the positive influence of the lower dollar index.

Nevertheless, the company raised the price of its Basic and Premium plans in the US, UK and France by about 10%. That will help make up for the negative impact in 2024.

We have introduced relevant adjustments into the model and lowered the forecast for ARPU in North America from $16.63 (+4.8% y/y) to $16.32 (+2.9% y/y) for 2023 and from $17.56 (+5.6% y/y) to $17.19 (+5.4% y/y) for 2024. But we have raised the forecast for the international business from $9.23 (-1.9% y/y) to $9.25 (-1.2% y/y) for 2023 and from $9.61 (+4.1% y/y) to $9.69 (+4.7% y/y) for 2024.

There’s speculation that the company could further raise subscription rates in 2024 to offset the increased costs resulting from the agreement with the unions of screenwriters and actors. Because the management did not mention this at the conference call and in the letter to shareholders, we have not included any potential price increases in 2024 in the base-case scenario.

Therefore, we are raising the revenue forecast from $33 520 mln (+6.0% y/y) to $33 653 mln (+6.4% y/y) for 2023, and from $37 910 mln (+13.1% y/y) to $38 827 mln (+15.4% y/y) for 2024.

We have raised the forecast for gross costs, excluding content amortization, from $5 159 mln (+7% y/y) to $5 630 mln (+17% y/y) for 2023 and from $5 687 mln (+10% y/y) to $6 219 mln (+10% y/y) for 2024, given the high seasonal expenses on labor and commissions in 4Q.

We have also raised the forecast for R&D spending in 2024 from $2 881 mln (+7.6% y/y) to $3 339 mln (+24% y/y) in connection with the company’s plans to intensify the development of its gaming business. While requiring greater investment, the potential entry to the market of cloud-based gaming shouldn’t in general take a toll on the company’s margins.

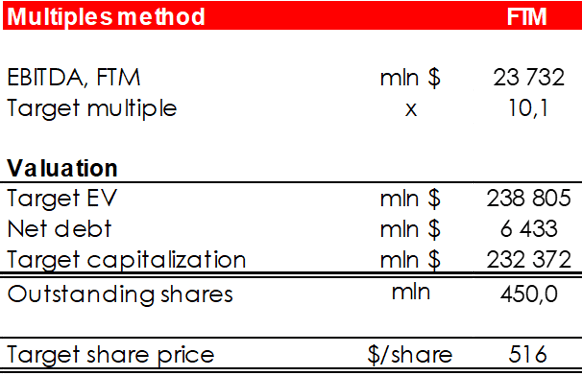

As such, we are lowering the forecast for adjusted EBITDA from $21 515 mln (+6.7% y/y) to $21 324 mln (+6.6 % y/y) for 2023 and from $24 563 mln (+15.0% y/y) to $24 311 mln (+14.0% y/y) for 2024.

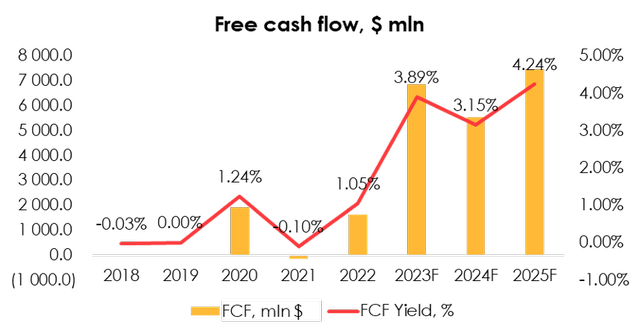

We have also made changes to the free cash flow forecast. Due to the strikes in the movie industry, some filming was moved back to 2024. Netflix will spend about $13 bln on content in 2023, but the number will rise sharply to $17 bln in 2024.

Therefore, we are raising our free cash flow forecast for 2023 from $4 566 mln to $6 850 mln. The management’s target of $17 bln is broadly in line with our previous expectations, so the FCF forecast for 2024 remains largely unchanged at $5 547 mln.

In 3Q, Netflix allocated $2.5bn (~1.6% of current capitalization) for share repurchases, setting a record for the size of the buyback since the company was established. Netflix also increased the program from $5 bln (of which $4.1 bln of purchases have been authorized since the beginning of 2021) to $10 bln, but the timing of the next repurchases is unclear. The management is guided by how much cash it has on the company’s accounts, which makes it hard to come up with a schedule for repurchases.

Given that Netflix has already achieved a stable cash flow, we believe that the company will be able to fully complete the program during 2024 without compromising its cash liquidity.

Possible revaluation trigger

Since Netflix is also focusing on the video games industry, the launch a new product (such as cloud gaming) can significantly affect market sentiment and valuation target.

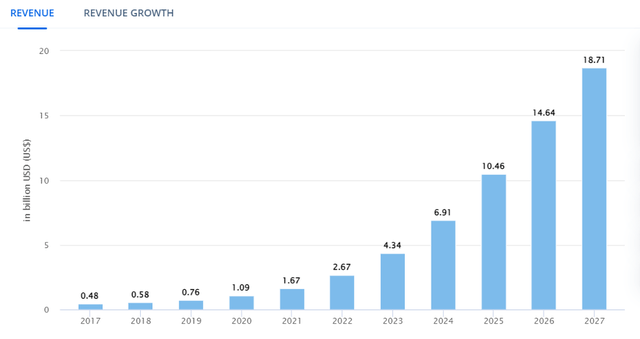

According to Statista, although the cloud gaming market is relatively small, it is expected to grow at a CAGR of 44% in the medium term. Although Netflix’s server capacity may not be effective enough to support AAA projects for the majority of subscribers, a unique product for streaming services will both increase customer loyalty and create a new revenue & EBITDA stream.

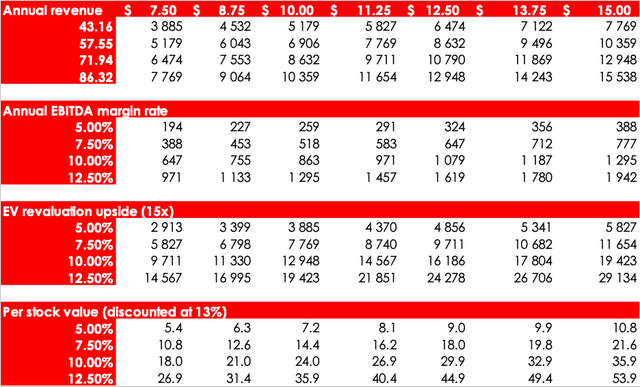

While it’s not yet clear how the monetization for Netflix’s gaming segment would work, we’ve used rough assumptions to estimate the potential valuation impact:

- An average FWD 2025 EV/EBITDA multiple of GOOGL & NVDA (since they’re the most obvious proxies for the cloud gaming market) gives us a number of around 15x.

- Target audience of 15 to 30% of 2025 user base estimate, which gives us a number of 43 to 86 mln.

- Additional gaming ARPU of $7.50 to $15.00. Estimate is based on current rates from GeForce NOW, Amazon Luna, Xbox Game Pass with projected price increases & discounts of approximately 50% due to inability to execute AAA projects.

- New stream EBITDA margin of 5% to 12.5% (based on 2021-early 2022 cloud players margin rates).

With these rough assumptions we’ve added an average of $20.4 in upside potential. Note: we do not include the impact of potential cloud gaming adoption in current valuation due to lack of certainty. Calculations have been made for general understanding of the potential impact on the target share price.

Valuation

Based on the new assumptions rating for the shares is BUY and price target is 516

Invest Heroes

Conclusion

Netflix’s growth rates continue to show attractive momentum both operationally and financially. We feel positive about organic user base growth and ARPU’s initiatives and believe there’s more upside for the stock. Entering the cloud gaming market will boost the company’s share price, as Netflix already has a huge audience ready to be monetized and market sentiment on the fast-growing industry will be positive multiples. After Q3 results we’re raising the rating to BUY again.

To manage your position, we suggest keeping an eye on Netflix’s financial statements and industry research from JustWatch, Nielsen, and Parrot.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.