Summary:

- Tesla, Inc. Q3 earnings showed a decline in earnings, margins, and free cash flow, causing a decline in the company’s share price.

- Despite the negative earnings report, Tesla has several catalysts coming up, including the Cybertruck launch which is a long-term catalyst for free cash flow growth.

- The market overreacted to CEO Elon Musk’s comments about the Cybertruck ramp, in my opinion, and investors should focus on the long-term free cash flow ramp.

Xiaolu Chu

Shares of Tesla, Inc. (NASDAQ:TSLA) slumped after the electric vehicle (“EV”) company submitted its third-quarter earnings sheet on October 18, 2023, which showed a steep Q/Q decline in earnings, margins and free cash flow. Comments about the Cybertruck ramp from CEO Elon Musk also didn’t help.

Nonetheless, Tesla has a number of catalysts for free cash flow growth, and investors appeared to overreact to Elon Musk’s Cybertruck comments, the margin downtrend, as well as the company’s CapEx situation. Long-term investors may want to hold on to their shares and not sell into the weakness!

Rating progression

I rated Tesla a sell in July — Tesla Has A New Fear Factor — due to fears over lower operating and gross margins. Tesla has been cutting prices for its EV models across the board in a bid to spur demand and has paid the price in terms of lower margins for its electric vehicle line-up. While margins are still under pressure, as the Q3’23 report has shown, I believe investors have turned too bearish too quickly. It should not have been big news that the Cybertruck ramp will take a while and free cash flow (and margin) recovery could drive a revaluation of Tesla’s shares. Investors that bought Tesla previously should not sell into the weakness, in my opinion.

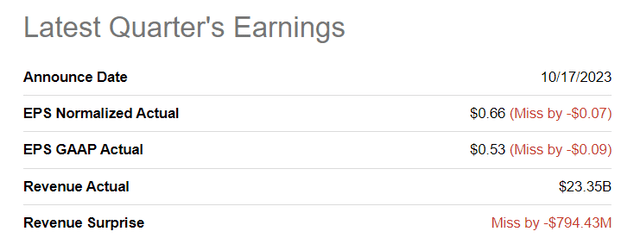

Tesla missed on both the top and the bottom lines

Tesla’s Q3 ’23 report was not great, and this was reflected in the electric vehicle company missing on both the top and the bottom lines. Tesla achieved revenues of $23.4B in the third-quarter, missing expectations by roughly $800M. Adjusted earnings came in at $0.66 per-share, missing the consensus estimate by $0.07 per-share.

Source: Seeking Alpha

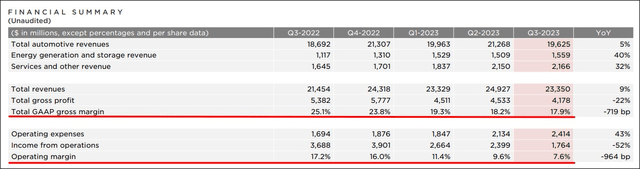

Margin situation appears exaggerated

Tesla’s gross and operating margins have declined consistently throughout the last year as the company prioritized (delivery) growth over short-term profitability. This trend, unfortunately, continued in Q3 ’23: in the third-quarter, Tesla reported a gross margin (on a GAAP basis) of just 17.9%, which showed a 0.3 PP decline quarter-over-quarter, and it was the fourth consecutive quarterly gross margin decline since Q3 ’22. Tesla’s operating margin in Q3 ’23 fell to just 7.6%, showing a decline of 2.0 PP compared to Q2 ’23 and it was also the fourth straight quarterly margin decline. The decline in margins was the primary driver of Tesla’s Q3 ’23 earnings shrinking 44% year-over-year to $1.9B.

Source: Tesla

Tesla has been cutting prices aggressively, especially in China, to stimulate demand and deliveries. And while margins may be down, deliveries were up significantly in the third-quarter… which is something that I value more highly than a short term deterioration in the margin picture.

The free cash flow situation is set to improve, market overreacted to the Cybertruck comments

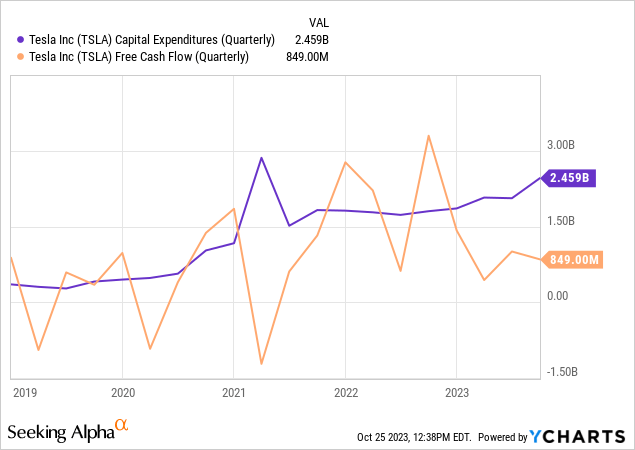

Tesla’s share price decline was driven by Elon Musk’s remarks about the Cybertruck ramp. Tesla’s CEO warned that it will be a tough operational challenge to ramp up production of the Cybertruck and that investors should expect an 18-months period until the new EV model production produces positive cash flow. Tesla further said that it expects $9.0B in capital expenditures in FY 2023 as it starts production of the Cybertruck.

Tesla’s capital expenditures have increased in the long term and occasionally spiked (when Tesla expanded production for new EV models). While the capex forecast, Elon Musk’s comments on Cybertruck ramp as well as the decline in free cash flow in Q3’23 were seen as negative events for the share price, I believe that Tesla represents exceptionally strong free cash flow value for long-term investors.

Tesla generated $848M in free cash flow in Q3 ’23, showing a drop of 74% Y/Y, largely due to soaring capital expenditures… which are necessary to get Tesla’s latest product ready for mass production.

In the long term, these temporary cash outflows should translate into significant free cash flow growth: Elon Musk said that the Cybertruck now has more than 1M reservations (Source).

Tesla’s capital expenditures was up 36% in Q3 ’23 to $2.5B, showing a $700M increase year over year. If it wasn’t for the Y/Y increase in capital expenditures, Tesla would have reported free cash flow of $1.5B (a FCF margin of 6.4% and sequential FCF growth). Instead, Tesla’s free cash flow margin dropped 0.4 PP Q/Q. However, investors should expect a strong increase in long-term free cash flow margin as Cybertrucks get delivered to customers.

| $ in millions | Q3’22 | Q4’22 | Q1’23 | Q2’23 | Q3’23 | Y/Y Growth |

| Total revenues | $21,454 | $24,318 | $23,329 | $24,927 | $23,350 | 8.8% |

| Net cash from operating activities | $5,100 | $3,278 | $2,513 | $3,065 | $3,308 | -35.1% |

| Capital expenditures | ($1,803) | ($1,858) | ($2,072) | ($2,060) | ($2,460) | 36.4% |

| Free cash flow | $3,297 | $1,420 | $441 | $1,005 | $848 | -74.3% |

| Free cash flow margin | 15.4% | 5.8% | 1.9% | 4.0% | 3.6% | -76.4% |

| OCF-FCF conversion | 64.6% | 43.3% | 17.5% | 32.8% | 25.6% | -60.3% |

(Source: Author.)

With over a million reservations and an estimated price of $50 thousand per unit, Tesla’s free cash flow is set to increase drastically even without consideration of new product launches, higher average selling prices, or volume growth for non-Cybertruck models.

Not all of the reservations will convert into sales, of course, but assuming that 75% of reservation holders will follow through and ultimately buy a Cybertruck (although the percentage could be much higher), Tesla is poised to generate some serious free cash flow growth in the coming years. Assuming a 80% conversion rate of a 1M reservation book at an average $50 thousand price (a low estimate) and applying a free cash flow margin of 5%, the Cybertruck alone could add $2.0B in free cash flow going forward. Again, this estimate does not include FCF upside tied to volume growth from other models.

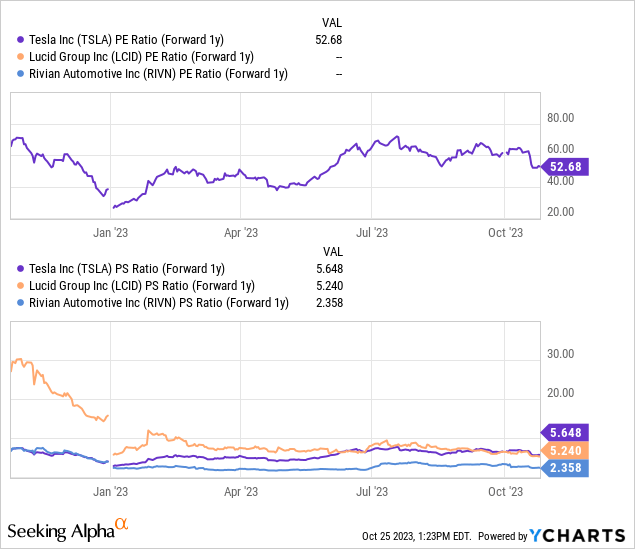

Tesla’s valuation vs. U.S.-based EV rivals

Tesla should continue to grow rapidly, and top line estimates suggest that analysts expect Tesla to achieve new revenue records. Tesla is projected to generate $97.3B in revenues in FY 2023 and $121.0B in FY 2024, implying a year-over-year top line growth rate of 24%.

Tesla is currently valued at 5.7X FY 2024 revenues, which makes Tesla the highest-valued U.S.-based EV company. However, no other U.S.-based EV company even comes close to Tesla’s delivery volume (Tesla confirmed that it still targets to deliver a total of 1.8M electric vehicles this year) or is already as profitable as Tesla. The firm’s valuation, in my opinion, underestimates the free cash flow growth potential that is linked to Tesla’s Cybertruck launch.

Lucid Group (LCID), which can count itself lucky if it manages a 10 thousand annual production volume in FY 2023, is trading at a 5.2X P/S ratio. Rivian Automotive (RIVN) is trading at 2.4X… which I consider to be exceptional value as well: Rivian posted impressive Q/Q production growth in the last quarter.

Tesla headwinds and risks

I have already discussed the margin situation, which has become a weight for Tesla shares. Additional price cuts for key models should be expected to worsen Tesla’s margin situation. However, on the other hand, Tesla is nearing an all-time delivery record and is facing two new major product launches in China and the U.S. Since Tesla is valued as a growth stock, I believe the accomplishments on the delivery front should outshine the development on the margin front.

Slowing EV demand would be a major negative issue for Tesla, as would be higher interest rates which negatively affect car affordability. The biggest risk, at least in the short term, is a continual erosion of Tesla’s gross and operating margins. The firm also disclosed other issues such as DOJ investigations (related to FSD, personnel benefits, etc.) which could negatively impact investor sentiment and lead to fines going forward.

Closing thoughts

There are two developments at odds here. On the one hand is a declining margin trend… which is the result of aggressive price cuts and stronger competition in the EV market. On the other hand, Tesla is by far the largest EV maker, with no other company coming even close. The firm is nearing record delivery volumes, and the Cybertruck comments appear to have been taken a bit out of context. All production ramps are challenging, and no new EV product launch leads to immediate cash flow profitability.

Investors that bought at a higher price than $215 — which is where Tesla is trading now — should not, in my opinion, sell into the weakness, but hold on to their shares. I personally have aggressively bought the Q3 ’23 earnings drop, but investors that have purchased shares of Tesla above this price should focus on the big picture: a massive multi-year Cybertruck ramp as well as long-term free cash flow growth. The Cybertruck alone has considerable potential to drive Tesla’s free cash flow growth, a potential that I believe is currently not fully reflected in the company’s share price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.