Summary:

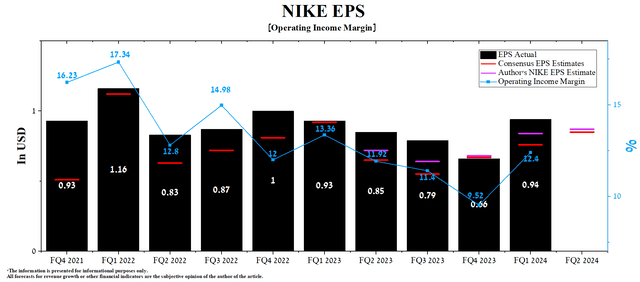

- Financial results for the first quarter of fiscal 2024 look encouraging as Nike’s EPS beat analysts’ forecasts.

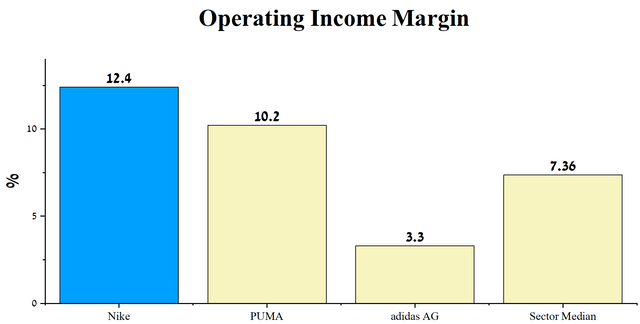

- The company’s operating income margin was 12.4% for the first quarter of fiscal 2024, which is significantly higher than its competitors in the consumer discretionary sector.

- At the end of August, the remaining authorization to repurchase Nike shares amounted to $12.1 billion, which will partially minimize the negative influence of short sellers on its share price.

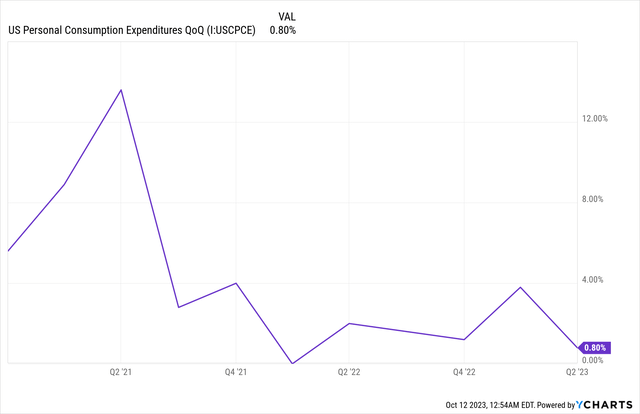

- Increases in interest rates by central banks also lead to increased concerns on the part of financial market participants about a slowdown in the growth rate of consumer spending in the future.

- We initiate our coverage of Nike with a “hold” rating for the next 12 months.

FG Trade Latin/E+ via Getty Images

Nike (NYSE:NKE) is one of the key players in the global sportswear market, headquartered in Beaverton.

Thesis

We highlight two main theses that help maintain interest in Nike and two risks that discourage more conservative financial market participants from adding it to their investment portfolio.

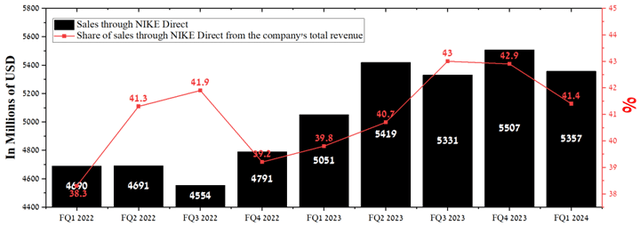

Despite rising inflation and a slowdown in consumer spending worldwide, Nike’s revenue continues to grow year after year, thanks in part to its broad distribution network, which ensures that its products are available to customers even in the most remote corners of our planet. Moreover, an increase in the share of sales through Nike’s direct channels has a beneficial effect on its margins.

Author’s elaboration, based on quarterly securities reports

So, the company’s operating income margin was 12.4% for the first quarter of fiscal 2024, which is significantly higher than its competitors in the consumer discretionary sector.

Author’s elaboration, based on quarterly securities reports

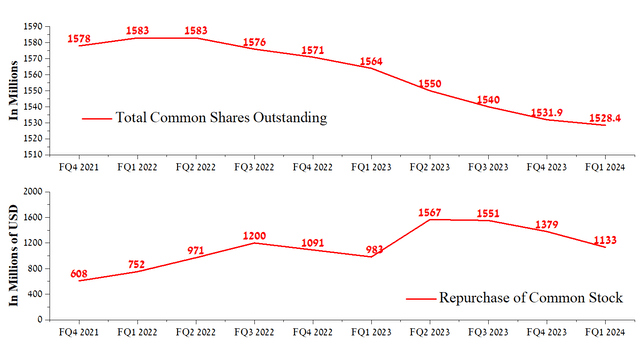

The second thesis is Nike’s active use of a share repurchase program, which also played a crucial role in beating analysts’ consensus estimates in nine of the last ten quarters. The company’s cash flow for this purpose was approximately $1.13 billion for the first quarter of fiscal 2024, an increase of 15.3% year-over-year. Simultaneously, at the end of August 2023, the remaining authorization to repurchase Nike shares amounted to $12.1 billion, which will partially minimize the negative influence of short sellers on its share price.

Author’s elaboration, based on Seeking Alpha

Let’s move on to a discussion of the main risks due to which we initiate our coverage of Nike with a “hold” rating. Increases in interest rates by central banks also lead to increased concerns on the part of financial market participants about a slowdown in the growth rate of consumer spending in the future.

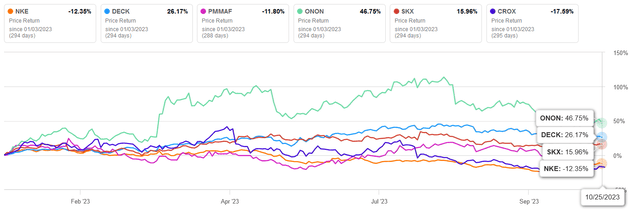

As a result, we believe that institutional investors will not have a significant interest in investing in footwear stocks, which include Nike until central banks start cutting interest rates.

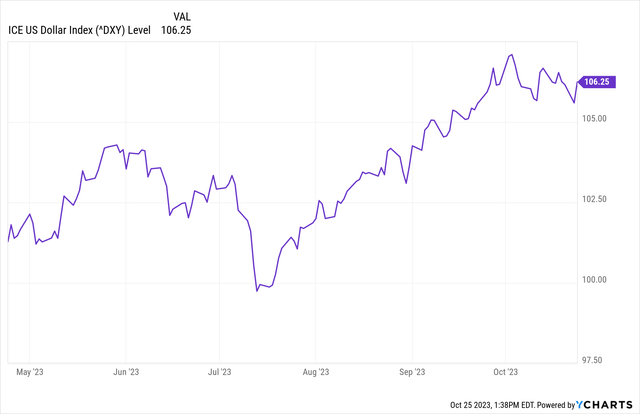

The second key risk is strengthening of the US dollar against foreign currencies, which reduces demand for Nike products in Asia, Latin America, and Europe.

Nike’s Q1 FY24 financial results and outlook for the H2 FY24

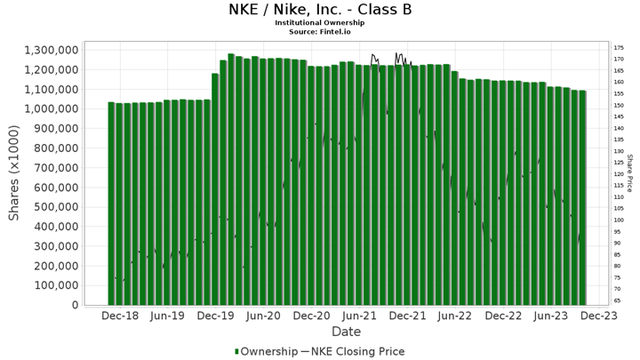

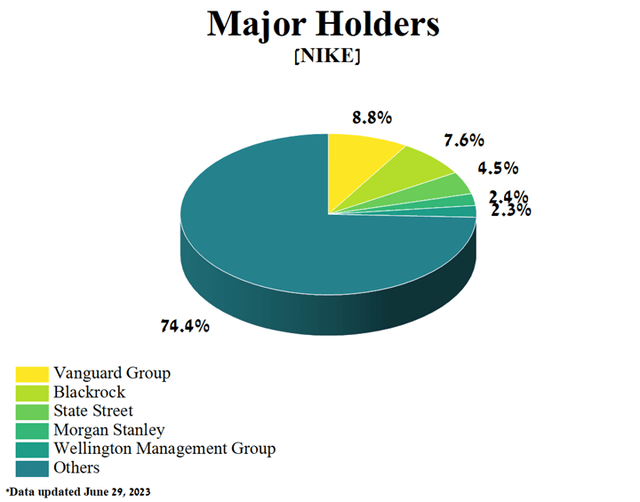

Before jumping directly into our analysis of Nike’s Q1FY24 financial results and our expectations for FY2024, we’d like to draw your attention to its institutional investors.

Major Wall Street giants such as Morgan Stanley, State Street, Vanguard Group, Wellington Management Group, and Blackrock have consistently held significant influence over Nike, collectively owning a substantial 25.62% stake in the company.

Author’s elaboration, based on Yahoo Finance

However, the percentage of Nike shares owned by institutional investors continues to decline, putting further downward pressure on its stock price.

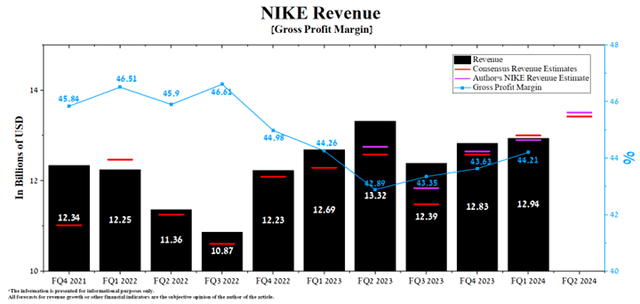

Financial results for the first quarter of fiscal 2024 look encouraging as Nike’s EPS beat analysts’ forecasts. Even though its revenue continues to grow year over year, it fell slightly short of analysts’ expectations. One of the main reasons for this is the low growth rate of sales of products from the Asia Pacific & Latin America operating segment.

Nike is expected to publish its financial report for the second quarter of fiscal year 2024 on December 19. According to Seeking Alpha, Nike’s revenue for the second quarter of fiscal 2024 is expected to be $12.91 billion to $13.61 billion, down 6.7% year-over-year and up 3.2% from analysts’ expectations for the previous quarter. Moreover, according to our model, the company’s total revenue will be above the median of this range and reach $13.51 billion.

Its quarterly revenue growth will be driven by increased demand for sportswear and footwear ahead of the winter holiday season, an expansion of its sports equipment portfolio, and increased sales of Jordan Brand products.

Author’s elaboration, based on Seeking Alpha

Furthermore, we forecast that Nike’s operating income margin will reach 11.6% by fiscal year 2024. At the same time, by the fiscal year 2025, this financial indicator will increase to 13.1%, thanks to the expansion of the company’s product portfolio, lower inflation, higher consumer spending growth rates worldwide, and the weakening of the US dollar against other major currencies.

According to Seeking Alpha, Nike’s second-quarter EPS is expected to be $0.75-$0.95, up 11.8% from the consensus estimate for the first quarter of fiscal 2024.

Also, the company’s Non-GAAP P/E [TTM] is 30.84x, which is 154.78% higher than the sector average and 9.16% lower than the average over the past five years. In contrast, Nike’s Non-GAAP P/E [FWD] is 26.92x.

Author’s elaboration, based on Seeking Alpha

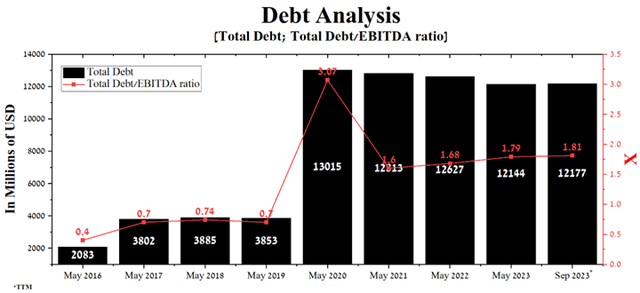

In the fourth quarter of fiscal 2020, Nike issued $6 billion in senior notes, causing its debt to skyrocket. Since then, the company’s total debt has continued to decline at a slow pace and stood at about $12.18 billion at the end of August 2023. Moreover, despite the decline in global consumer spending, Nike’s EBITDA for the first quarter of fiscal 2024 increased relative to the previous year, which was reflected in the stabilization of its total debt/EBITDA ratio of about 1.8x.

Author’s elaboration, based on Seeking Alpha

Conclusion

The company delights millions of people around the world with a diverse portfolio of athletic shoes, apparel, sports equipment, and numerous accessories.

Moreover, Nike actively collaborates with various sports teams and professional athletes, which not only helps promote its products but also contributes to building a positive brand image of the company, thereby increasing consumer trust in it.

On the other hand, Nike’s lower margins for the first quarter of fiscal 2024 compared to the previous year due to rising advertising and promotion costs negatively impacted its share price, which is down more than 12% year-to-date.

Author’s elaboration, based on Seeking Alpha

However, despite the company’s year-on-year revenue growth and its management’s active resort to a share repurchase program, the growing likelihood of another Fed rate hike in the coming months is reducing institutional investors’ interest in footwear stocks.

We initiate our coverage of Nike with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.