Summary:

- 3M has started its turnaround story earlier than expected, leading to an upgrade to a buy rating.

- Cost-cutting initiatives and improved profitability are driving the company’s positive performance.

- Lawsuit outcomes have been resolved, reducing uncertainty and improving the company’s future prospects.

josefkubes

Investment Thesis

3M Company (NYSE:MMM) has started its turnaround story much earlier than I anticipated, which made me come off the fence and upgrade the company to a buy because the lawsuit outcomes are out, and cost-cutting initiatives are starting to bear fruit. The company is trading at close to all-time lows, which makes me think that most of the downside is priced in.

Introduction

The last time I covered MMM in May, I had issues with the management, deteriorating margins, and litigation issues leading to a Hold rating. In the next sections, I will be covering the main issues I had and how these have developed over time. I will follow the company’s priorities and examine how these have developed over the last 5 months.

3M priorities (3M Q3 Investor Presentation)

Efficiencies are Showing Up

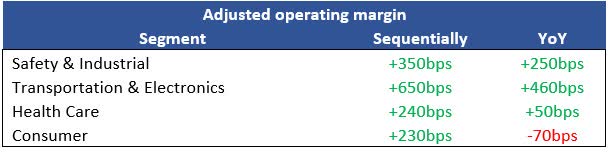

The first big reason I have come off the fence now is because the company’s profitability is starting to improve nicely. In my previous article, I mentioned that in the past, the restructuring plans of ’20 didn’t do much in terms of efficiencies and profitability. Fast forward to the next initiative, the margins have seen major improvements. In my opinion, the biggest improvements came from the restructuring of the company. So far, these actions have affected approximately 5,200 positions at the company with a further 3,300 positions to be affected by the year 2025. So, it looks like the new initiatives are working well this time around and since it is going to continue to ’25, I would expect further improvements. The below improvements are from the company’s latest quarterly report.

Operating Margins by segment (Author)

Healthcare Business Spinoff

The spinoff is due to be completed sometime in H1’24, which shows me that the management is thinking about the company’s future seriously, and focusing on its core products is the way to go in my opinion. We don’t know if this is going to unlock any shareholder value in the end, but I am optimistic. The business segment is around $8B in sales, so it is a substantial piece of MMM’s business. This plays well for the management in general in my opinion, as in my first article on the company I was very skeptical of the guys up in the ivory tower, so it is good to see they’re not just sitting there and getting paid for nothing and are trying to reward its shareholders.

The Lawsuits

Since the last time I covered the company, the lawsuit results have poured in for the two major cases. The PFAS settlement case and the combat arms earplugs case. The company recorded pre-tax charges for these cases of $10.3B in the 2nd quarter for the PFAS case and $4.2B for the earplugs case. I would say these were the big question marks for the company and its future. Many investors tend to avoid such situations, which have brought down the stock quite considerably over time. Now, that these seem to be resolved, without any admission of guilt might I add, the future is looking a little less murky for the company and we will see more investors jumping back in once they see the company’s true potential going forward, which I will touch on in later sections. It’s not an ideal outcome for the company since it has to pay billions of dollars over the next decade or so, however, at least now the company can move forward and focus on improving its operations and getting back its reputation, if possible, which I think it is.

Briefly on Financials

The company’s revenue performance has not been very good for a while now and I mentioned that in my previous article, however, I don’t think this should be the main driver of investment. I believe that as long as the company becomes more profitable and efficient, it will create value for shareholders in the long run and that is exactly what is developing already.

The consumer electronics segment has been underperforming, especially the ones regarding semiconductors, which I am not surprised at, as that segment of the market has been in a negative sentiment for quite a while now. I’ve covered many semiconductor companies in the past and most, if not all, have seen very soft demand due to inventory buildups and macroeconomic headwinds like higher prices due to inflation which deterred many customers. Most of the companies see the demand return very soon, sometime in the first half of ’24, so I believe this segment for MMM will also see a nice boost in sales next as cyclicality shifts.

I am also very impressed with how the company managed to build up a certain revenue segment, which is auto electrification. According to the latest transcript, the segment is on its way to becoming a $600m business, which is quite substantial given the many different segments the company is involved in. It has delivered 30% organic growth YTD.

Let’s look at some financial metrics now to see how the company has progressed.

As of Q3 ’23 just reported o, the company had around $5.2B in cash and marketable securities, against $12.9B in long-term debt, which is around an 8% reduction since December last year. I like seeing that the management is prioritizing paying off the debt here, even though, I don’t mind when companies take on debt to finance their operations, as long as that debt is sustainable. So, is this debt sustainable for MMM? If we exclude the pre-tax charges of the mentioned lawsuit settlements, 9 months ended September interest coverage ratio was around 7x meaning that EBIT can cover interest expense on debt 7 times over. If the company continues to repay the outstanding debt, the interest expense will come down further, so it is safe to say the company is at no risk of insolvency.

The Dividend

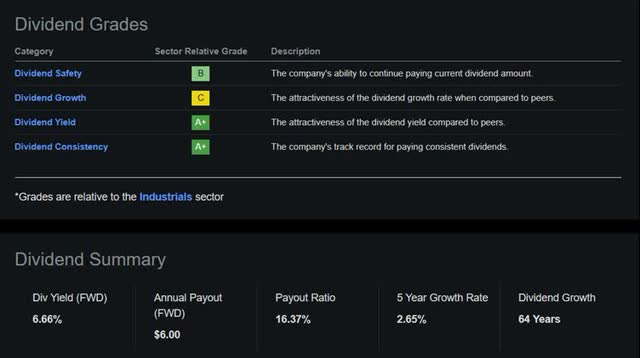

Many people look for a dividend investment and here MMM offers a very enticing return. As of writing the article, the dividend yield stood at around 6.66%, which is fantastic, especially if you’re not superstitious. The company had 64 years of dividend growth which makes it a dividend aristocrat. I wouldn’t be relying on dividends to give me income, especially when things are uncertain, and for MMM it is uncertain if the dividend remains the same or if it increases going forward. The litigation expenses are quite substantial, coupled with more headwinds in the near future, the company may end up cutting the dividend, however, seeing that the company increased for this long, I don’t think that is on their to-do list for now. According to Seeking Alpha, the dividend is safe.

Dividend Grade (Seeking Alpha)

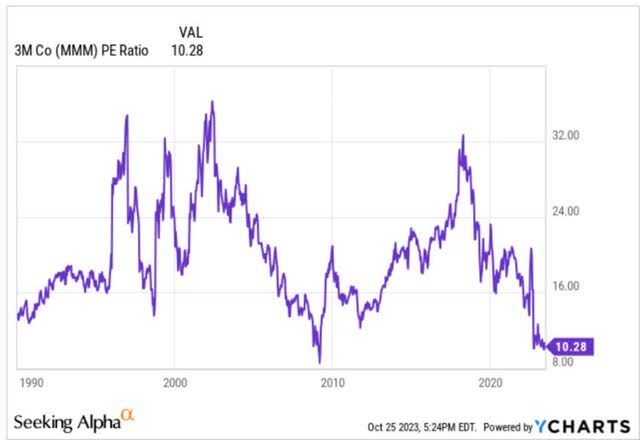

There isn’t much growth going on there, but the yield is very attractive because the price of the shares has come down dramatically over the last 5 years. Because of this negative sentiment, the company is trading at close to its all-time low PE ratio.

PE Ratio Near all-time lows (Seeking Alpha YCharts)

Overall, it looks like the company is managing the debt quite easily, with a decent amount of liquidity on books and the dividend is safe in my opinion, but it is hard to tell. Other metrics that I like to look at are distorted by the pre-tax charges, so ROA, ROE, and ROTC are all very negative right now, which doesn’t represent the company’s actual position, so I didn’t include those here. I do know that the company is more efficient and profitable now than it was before as can be seen from improved margins in the previous section. It looks like a turnaround is in play and I commend the management here because, in my previous article, I didn’t expect such improvements so quickly.

Valuation

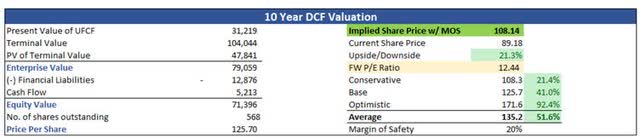

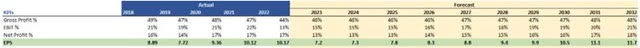

For revenues, I decided to go conservative here, and seeing that the company hasn’t gone anywhere in the last 10 years, I assume very little growth in all 3 scenarios. Below are my estimates for base, optimistic, and conservative.

In terms of EPS and margins, I assumed very little improvements in efficiency and profitability to give myself a larger margin of safety. It looks like the cost-cutting measures are working quite well, so I have no trouble believing that margins will improve to the numbers below. You can also see that my estimates for the next couple of years are lower than what the analysts are estimating, which works better for my margin of safety.

Margins and EPS Assumptions (Author) Analysts’ Assumptions of EPS and Revenue (Seeking Alpha)

For the DCF analysis, I went with the company’s WACC of 8.08% according to my calculations and for the terminal growth rate, I went with 2%, which is slightly lower than what I usually use, which is 2.5%. on top of these estimates, I decided to use a 20% extra margin of safety, which is slightly different from my previous article because I believe that we have more answers now in terms of litigation outcomes and I am not as worried about future improvements on margins as I was back in May. With that said, MMM’s intrinsic value is $108.14 a share, which means that the company is trading at a discount to its fair value.

Risks

Of course, there are always future risks in litigation. The company makes a lot of different products for many different industries and may inadvertently endanger people by contaminating waters again or another earplug incident. This will certainly weigh on the company’s earnings and profitability. The company is involved right now in over 5,900 lawsuits regarding its Bair Hugger patient system. It is not material to the company’s performance as of yet, however, it seems like a big lawsuit that could end up being a drain on the company’s capital if it has to settle once again.

Since the company has had a lot of negative sentiment in the last couple of years, it may continue for a little while longer. These things last longer than anticipated, however, I believe that during times like these, it is not a bad time to start a position and average down if it continues to fall further.

Another risk of poor performance can come from the continual macroeconomic headwinds in the economy. The cost of raw materials stays higher for longer due to inflation being much stickier than predicted earlier. The interest rates will have to stay higher for longer, which will bring further volatility to the markets and lower share prices. Nevertheless, I believe that in the long run, the company will bounce back, and these short-term risks are opportunities to accumulate a larger position.

Closing Comments

It seems that MMM managed to start the turnaround much earlier than I anticipated 5 months ago, which is why I am off the fence and am upgrading the company to a buy from a hold. I believe the management has been doing a lot of things right recently and I will be interested to see how well it is going to turn out in the end. The company’s trading at close to all-time lows, which tells me that a lot of the negativity is priced in. That doesn’t mean that it is out of the woods yet, but the risk/reward is very enticing at these prices.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MMM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.