Summary:

- Tesla stock has failed at its most important support level, leading to a downgrade to a sell position.

- The U.S. consumer cyclical sector is showing signs of weakness, hinting at a broader cooldown in relevant industries.

- There are two likely scenarios for Tesla: a continuation of the downtrend, or a retracement to fill a gap but with massive overhead resistance.

- I discuss important price levels and metrics that Tesla investors could consider for gaining an edge on the stock’s likely price action.

Dmitriy83/iStock via Getty Images

Tesla (NASDAQ:TSLA) stock had been forming what I suggested could be the last two legs of a promising upward movement, but the stock failed at its most important support level, invalidating my previous assumption. Both the relevant market situation and the stock’s technical circumstances have radically changed, leading me to update my analysis and review my contingency plan. In this article, I explain the factors that have led me to downgrade TSLA to a sell position, while I also discuss a potentially profitable outlook for investors interested in scaling into the stock and the elements that would support such a decision.

A quick look at the big picture

On a yearly time frame, the U.S. technology sector is still the top performer, while the U.S. consumer cyclical sector isn’t growing that fast but has shown significant resilience. In fact, the U.S. consumer has been strong in the past 12 months, supported by a stronger-than-expected labor market with growing wages, a strong housing market, and spending on credit. However, the macroeconomic framework. with tightening financial conditions, steep mortgage rates, and tendentially gloomy global forecasts, are hinting at the end of this strength.

The strong negative performance of the tech sector over the past month is a warning sign. At actual interest rates, both the U.S. public and consumer spending appear unsustainable in the long run, and inevitably the economy will cool down with a sequential negative effect on consumer cyclicals, the real estate sector, and investments in the industrial sector, leading to increased unemployment.

The auto manufacturing and dealership industries have suffered the largest losses in the past month, with increased worries about the sustainability of the demand, and headwinds from tighter financial conditions, with car loan interest rates reaching a peak not seen since 2007, leading to monthly bills of over $1’000 for at least 20% of consumers who took a loan to buy a car, and the average credit cards interest rate surging to a record 28.93%.

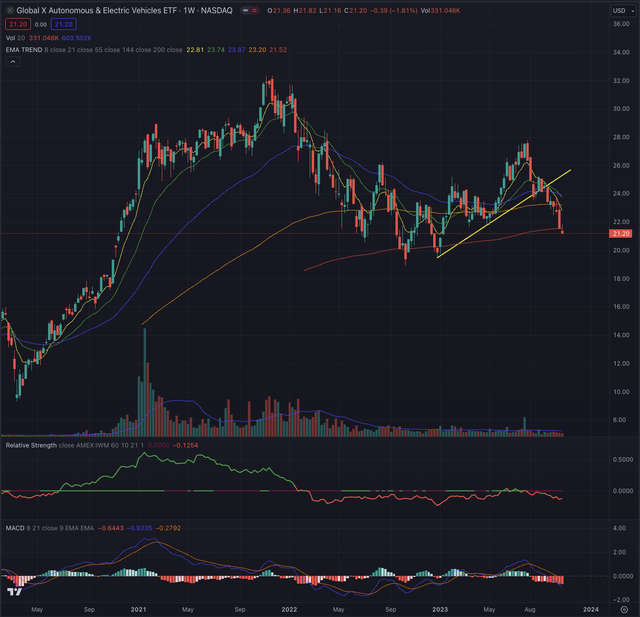

The Global X Autonomous & Electric Vehicles ETF (DRIV) has been rejected at the important 0.618 Fibonacci retracement, measured from the peak in November 2021. After failing multiple attempts to overcome that important price area, even with surging volume, DRIV crashed significantly and has now formed two legs down on its weekly chart. The first leg retraced until the EMA21, as I suggested in my former analysis, but the buy-interest wasn’t strong enough to allow for a rebound from the trendline, and the second leg led DRIV to its most important support level at the EMA200, which has been tested for the third time in the past 12 months.

Both the rejection and the selloff happened with relatively low volume, while the MACD signaled the intensity of the negative trend, which gained momentum after DRIV broke under the ascending trendline, also observed in the buildup in relative weakness, when compared to the broader stock market, the iShares Russell 2000 ETF (IWM). DRIV is now in a crucial situation. If the benchmark finds support around the EMA200, a test of the previous high could be the target, while a breakdown and continuation of the strong negative trend, would most likely see it testing the low at $18.91.

Where are we now?

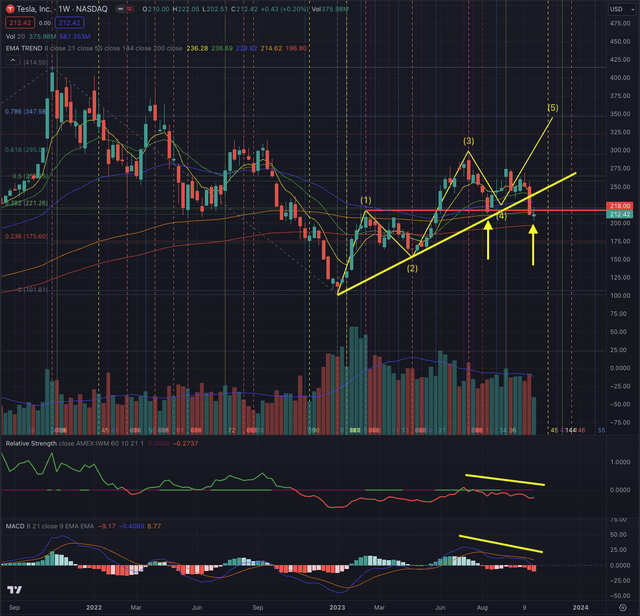

In my article “Tesla Is In Charging Mode,” published on July 28, 2023, I suggested TSLA would try to form wave 4 of its upward impulse sequence, while I underscored the importance of not seeing the stock breaking under a crucial price level.

As a shareholder, I would certainly hold TSLA until the chart will show me a clearer picture of the price action, but I would sell the stock if it falls under $218 and break into the territory of wave 1, as this would imply a more bearish scenario and would invalidate my assumption of a new impulse sequence.

The weekly chart shows that TSLA broke under that level twice, violating the cardinal rule of wave 4, and refuting my assumption of an upward impulse sequence. It’s also important to consider, that despite the first rebound from the support area happening on increasing volume, the price action was choppy, with mostly doji bars and even a gap-up that got filled immediately. The rebound formed a lower high, and broke down on growing negative momentum, until testing the support again, and even closed the past week below it.

TSLA has been increasingly relatively weak against the broader equity market, and as observed in the industry analysis, this weakness seems to hint at a broader cooldown in the relevant sectors. The present critical situation is worth exploring further, especially as the stock broke the upward trendline, and investors might want to reconsider their contingency plan.

What is coming next?

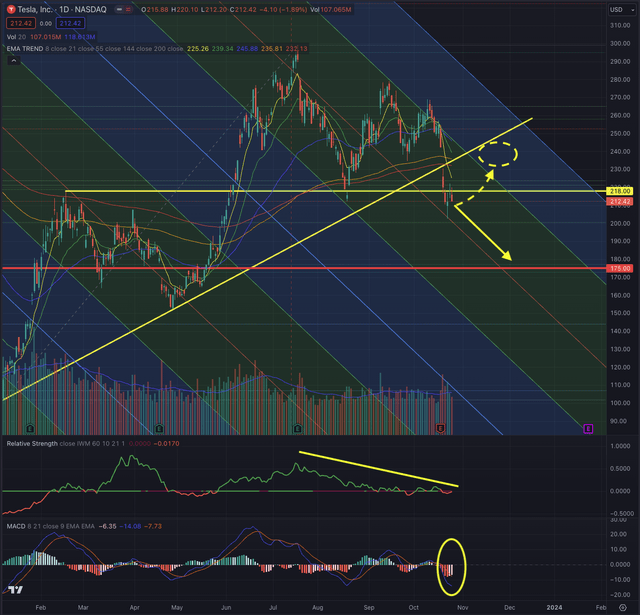

After observing TSLA’s weekly chart, it’s now important to focus on the daily chart, a time frame I often use to define the next tactical steps in my investment strategy.

The breakdown from the uptrend happened within the disappointing Q3 earnings release post-market on October 18, with a significant opening gap down. TSLA found some support around $202 and rebounded by testing the former support at $218, which acts now as resistance and rejected the stock in the last trading session. The sharply falling MACD, and the relative weakness of the stock, are underscoring the strong negative momentum.

TSLA right now is a falling knife that just broke multiple supports and dropped into a downtrend. In this situation, I see two likely scenarios that I consider in my contingency plan.

The first scenario is a continuation of the downtrend towards the next strong support area between $173 and $177. This area would become a highly likely target if the actual support at $202 would break. From that price range, TSLA could try to rebound, or the stock might consolidate and form a sideways trading range in which swing traders could find their sweet spot. This scenario implies significant losses for actual shareholders, who might want to set their stop-losses under $202 to avoid being trapped in a major downtrend.

The second scenario is what many would expect to happen with such a sizeable gap open. TSLA could retrace from the recent drop and while trying to enter again the ascending trendline, fill the gap between $230.61 and $242.08. Observing TSLA’s historical daily chart, we can spot a significant number of gaps the stock opened, while many of them either took long to close or are still unfilled. It is also very common, that when such a gap gets closed, the stock retraces immediately and continues toward the gap, which in this case could see the stock testing the trendline and being rejected into the downtrend. To overcome the massive overhead resistance, TSLA would need a significant tailwind, but the odds are now against it.

As I observed earlier, the overall relevant market situation isn’t painting a favorable picture, and the stock’s technical condition is even worse. The first scenario involving a continuation of the downtrend, is more likely, and I would certainly not buy TSLA or keep the stock under the discussed support level at $202. These circumstances led me to review my rating on TSLA and downgrade the stock to a sell rating. While this could have been an overreaction to disappointing fundamentals, technically the stock is showing no mercy for any support and I would not like to be trapped if the stock heads toward testing its next powerful support.

Long-term-oriented shareholders, or new investors interested in adding Tesla shares, could wait for a better entry, which I define as either at around $175, or if the stock breaks out above the trendline, and confirms the breakout from the downtrend. Investors should watch out for strength in a new upward movement defined by a trending price action, supported by significant volume, and relative strength compared to the market.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

The overall relevant market situation has become more cloudy. Despite the technology sector still leading other groups, in the past month the consumer cyclical sector reported notable signs of weakness, and what initially seemed a small retracement has become a more significant pullback. TSLA’s stock has slipped below the price that defined my assumption of more upside potential and broke into a downtrend.

The technical situation isn’t favorable from a Tesla, Inc. investor’s point of view, and despite the possibility that the recent decline could be an overreaction, the stock would need to overcome massive overhead resistance before being considered a safer investment. All elements considered, I lower my rating on Tesla, Inc. stock to a sell position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.