Summary:

- Visa and Mastercard operate in a duopoly which is responsible for processing most of the world’s transactions.

- For the first time in nearly three years, one of them, Mastercard, missed consensus estimates, with a slight revenue miss.

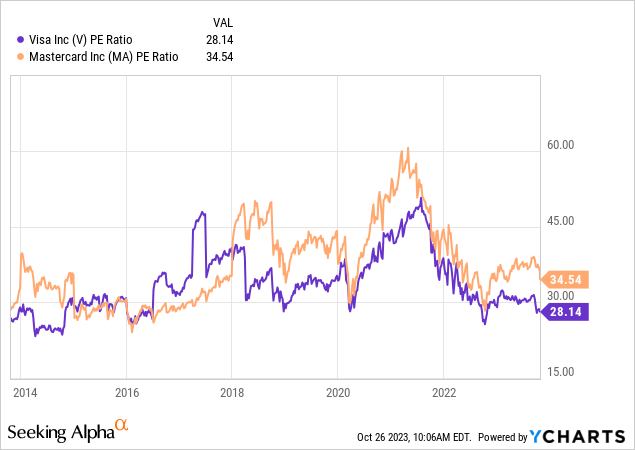

- Both companies trade at historically low valuations, amid a tougher economic environment, growth deceleration concerns, and regulatory pressures, this time in the form of lower interchange fees.

- I still view Visa and Mastercard as two of the strongest businesses in the world, with plenty of growth left coming from new flows and their core consumer payment networks.

- I reiterate Visa as a Strong Buy and Mastercard as a Buy, as I still find Visa the more attractive investment based on its valuation and better profitability.

Justin Sullivan

Visa Inc. (NYSE:V) and Mastercard Incorporated (NYSE:MA) recently announced their calendar third-quarter results. For the first time in nearly three years, one of them missed expectations. Surprisingly to some (but not to us), it wasn’t the supposed slower-growing Visa.

Trading at historically low valuations, two of the most powerful businesses in the world are clearly on sale. That being said, one of them is fundamentally more attractive.

Background

At the beginning of April, I wrote articles covering both Mastercard and Visa. In both articles, I covered the companies’ businesses in-depth, described their complicated revenue streams, and provided comprehensive valuation models.

I urge you to read both articles because this article will be dedicated to comparing the companies’ recent earnings results and providing updated valuation models.

In short, I found Visa a superior investment, after comparing the companies’ margins, growth, and valuations, as Mastercard was trading at what I estimated to be an unjustified premium.

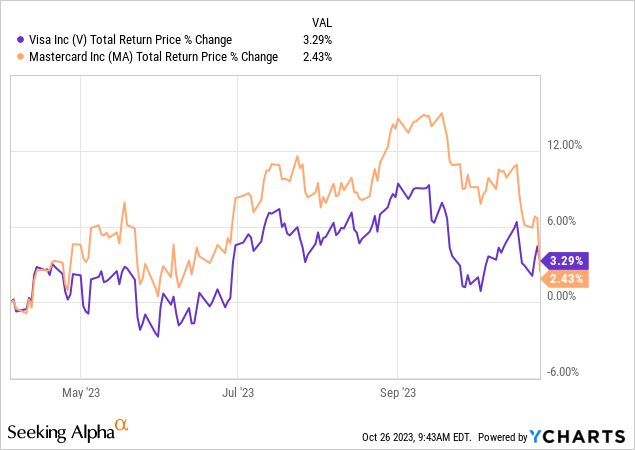

Since I began coverage, Visa slightly outperformed Mastercard, and both companies outperformed the market. So far, we were correct, although the majority of Visa’s outperformance was generated at the time I’m writing this article, as Mastercard is sliding in light of somewhat disappointing results.

So, let’s dig deeper into the third quarter of CY2023, reassess our payment networks investment thesis, and see if we still find Visa as the more attractive investment.

Reaffirming The Investment Thesis In Light Of Recent News

Cash still accounts for trillions of dollars in transactions worldwide. There are still trillions of dollars exchanging hands in less secured forms of money movements in government-to-customer, employer-employee, business-to-business, and a whole lot more non-consumer transactions.

All this remains true, and Visa and Mastercard are still the undeniable leaders of the payment landscape, that are best positioned to capitalize, and essentially drive, the transition to more secure technologies.

Even amid the tougher economic environment we’re in, both Visa and Mastercard are able to deliver above 20% EPS growth, mid-teens revenue increases, and see their respective volumes grow double-digits Y/Y.

With these kind of unstoppable companies, investors must get used to the occasional regulatory headwind. In my previous articles, we discussed the FedNow threat, which has now become a non-issue, reflected by Visa actually partnering with the FedNow network.

This time around, it’s the Federal Reserve’s proposition to lower the cap of debit-card swipe fees. Regarding which, Visa’s CEO said the following:

And just as a reminder, interchange is the exchange value between the merchant and the issuer. And I think what’s notable about our business model is we’ve proven that we can be resilient and have a strong business in regulated interchange markets, not regulated interchange markets, in markets that have higher regulated interchange and lower regulated interchange. So, as you alluded to, a lot going on in the US with Reg II, but we’re all over it and we feel good about our ability to compete.

In short, I am still extremely bullish on Mastercard and Visa, and I believe both are still great investments, with a market-beating future ahead of them. They provide irreplaceable value to their clients, and I believe the lower fee cap won’t have a material effect on the company’s long-term trajectories.

So, let’s go ahead and discuss their results and see who won the calendar third-quarter battle.

Who Won The Earnings Battle In Calendar Q3?

As I wrote in previous articles, Mastercard and Visa are essentially identical businesses. Yes, they have some different clients and some different solutions, but in essence, both companies are qualitatively the same.

Some investors decide to own both, but I see no reason to do so, as I aim for a concentrated market-beating portfolio. As we acknowledged that qualitatively they are almost identical, the only way to differentiate between Visa and Mastercard is by comparing their quantitative aspects.

At the time of writing this article, Mastercard is trading at a 22% premium over Visa, based on the companies’ P/E ratios. In my first Mastercard article, I wrote the following regarding its premium:

In my view, the main reason the market values Mastercard at a premium compared to Visa is simply its size. Generally speaking, if all else is equal, a smaller company has a higher potential to outgrow a larger peer. Looking at 2022, Visa is 1.3X larger than Mastercard in terms of sales. Thus, it’s understandable the market assumes Mastercard will outgrow Visa, meaning that there isn’t a real gap if we’re going to base our multiple on future earnings.

Then, I showed the underlying assumption of the market isn’t supported by the companies’ results, as Visa and Mastercard grew revenues and volumes at a similar pace between 2016-2022.

Let’s see how the companies fared in the three months that ended in September 2023, and find out if my conclusion is still valid. Just one important thing to note beforehand, Visa’s fiscal year is a quarter ahead of Mastercard’s, meaning Visa’s fiscal Q3-23 is comparable to Mastercard’s Q2-23. For convenience, I will refer to calendar periods from now on.

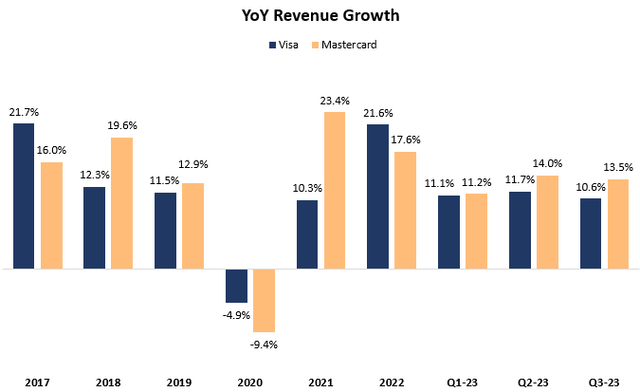

Revenue Growth – Mastercard Wins

Created and calculated by the author using data from the companies’ reports.

In the third quarter of 2023, Mastercard grew revenues by 13.5%, whereas Visa grew by 10.6%. In absolute dollars, Visa outgrew Mastercard by $45M. This is the second quarter in a row that Mastercard outgrows Visa by approximately two percentage points. Thus, Mastercard wins the revenue growth battle.

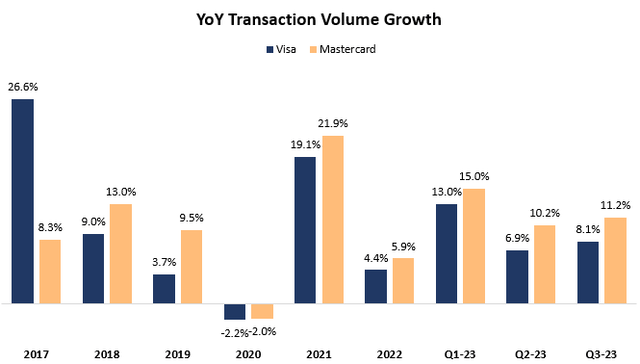

Volume Growth – It’s A Tie

Created and calculated by the author using data from the companies’ reports.

Looking at transaction volume, Mastercard outgrew Visa by 3.1 percentage points on a reported basis and by slightly less than 2.0 percentage points on a constant currency basis. However, in absolute dollars, Visa outgrew Mastercard by $50B, and that’s despite the unfavorable currency impact compared to Mastercard.

Visa still processes a much larger volume of transactions, more than 65% larger than Mastercard. Just to contextualize, at the current pace, it will take Mastercard more than 40 years to surpass Visa, something I highly doubt will ever happen.

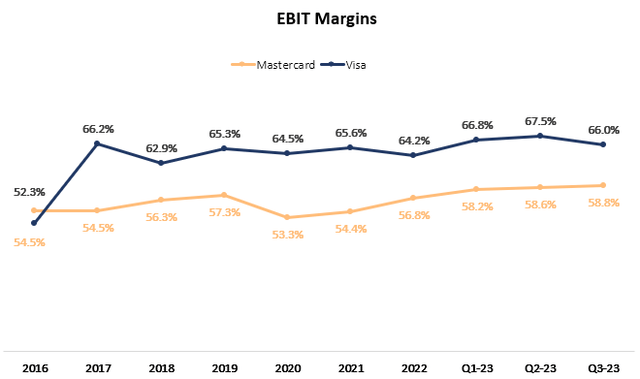

Margins – Visa Wins

Created and calculated by the author based on data from the companies’ reports; Margins are adjusted for litigation expenses.

As we can see, the margin gap narrowed in Q3, reaching what seems like an all-time low. However, the calendar third quarter is seasonally the lowest for Visa in terms of margin, and on the contrary, it’s highest for Mastercard.

Looking at their respective year-to-date margins which offsets the seasonal effects, Mastercard’s margins (adjusted for litigation provisions) stand at 58.5%, whereas Visa’s margins are at 67.5%.

Being less profitable than Visa, Mastercard’s relative revenue growth becomes much more important to justify its premium. To put it simply, for each incremental dollar, Visa makes $0.68 in operating profit, whereas Mastercard makes $0.59. Thus, in order to grow absolute operating profit at the same pace as Visa, Mastercard needs to outgrow revenues by 16%.

The Calendar Q3-23 Battle Is Tied

The premium Mastercard is getting has remained flat since my previous articles. Visa is still growing on par with Mastercard, despite being the larger company. Visa also continues to be more efficient and more profitable, whilst innovating at least at the same level, growing its value-added services by 18% in the quarter, compared to Mastercard’s 17.0%.

Thus, I still find Visa more attractive.

Conclusion

Mastercard and Visa both trade at historically low valuations, in light of higher rates, a tougher consumer environment, and worsening market sentiment amid the recent Federal Reserve’s proposition to lower the cap on interchange fees.

In my view, these are still two of the best businesses in the world. History taught us that ignoring the noise and focusing on their fundamentals is a recipe for market-beating returns.

There’s still plenty of money flows left for the two undeniable leaders to disrupt and take share in, and their core businesses aren’t showing any signs of slowing down.

I reiterate Visa as a Strong Buy and Mastercard as a Buy, as I still find Visa the more attractive investment based on its valuation and better profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.