Summary:

- Visa has strong payment volume and processed transactions growth, driven by the widespread adoption of credit cards and the rise of omni-channel strategies.

- Cross-border payment volumes are rebounding, fueled by the growth of the middle-class population and cross-border e-commerce.

- Visa achieved impressive Q4 FY23 results and provided robust guidance for FY24, with anticipated low-double-digit growth in the top line and low-teens growth in EPS. The stock is undervalued.

Nastasic

Visa (NYSE:V) is the global leader in digital payments, facilitating worldwide commerce and money movement. Visa has consistently delivered strong payment volume and processed transaction growth, along with robust cross-border payment recovery, guiding for low-teens adjusted EPS growth for FY24. According to my model, the stock price is undervalued. Therefore, I am initiating coverage on Visa with a ‘Strong Buy’ rating.

Strong Payment Volume and Processed Transactions

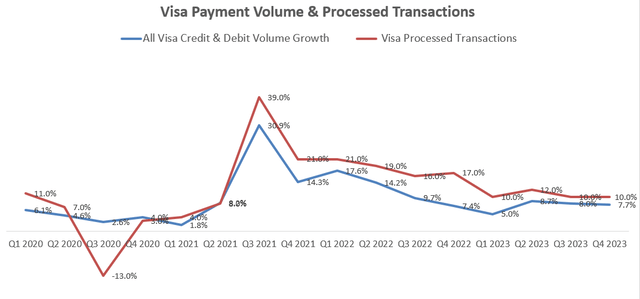

Visa’s credit and debit volume, along with processed transactions, serve as the primary metrics for measuring Visa’s growth. Payment volume reflects the total dollar value of purchases made using Visa-related cards, while processed transactions encompass all card-based transactions. Both of these metrics have shown robust growth in the post-pandemic era.

I believe Visa’s robust growth in payment volume and transactions can be attributed to several factors. Firstly, Visa has benefited significantly from the widespread adoption of credit cards. According to Moneyzine, cash and physical banknotes accounted for only 44% of point-of-sale transactions in the U.S. in 2021. With the increasing popularity of digital wallets, credit cards have become the preferred method of payment for many consumers.

Secondly, a large number of merchants have embraced omni-channel strategies, offering both online and offline sales to their customers. For online transactions, credit card payments are particularly convenient for customers, driving the growth in Visa’s digital transactions.

Lastly, Visa’s strategic investment in Visa Direct over the past few years has played a pivotal role. In Q4 FY23, Visa disclosed that Visa Direct processed 7.5 billion transactions, marking a 19% year-over-year increase, and nearly 30% growth when excluding Russia. Visa Direct facilitates direct money transfers for individuals and businesses in over 190 markets and 160 currencies. This innovative payment method has allowed Visa to expand its service network and forge new partnerships globally.

Cross-Border Payment Recovery

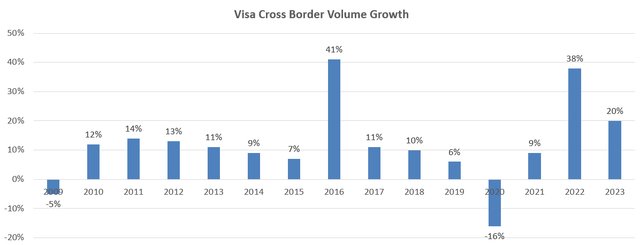

During the pandemic period, Visa’s cross-border payments took a hit as many countries closed their borders. Cross-border payments are crucial for Visa because they constitute a high-margin business, often accompanied by additional foreign exchange fees. Under normal circumstances, the volume of cross-border payments typically grows at a double-digit rate as more people choose to travel abroad.

During the Covid breakout period, cross-border payment volumes declined by 16%. However, they have since begun to rebound. In Q4 FY23, the cross-border volume grew by 16% year over year on a constant currency basis.

I expect Visa’s cross-border volume to continue growing in the future for several reasons. Firstly, the rise of the middle-class population is expected to lead to increased international leisure tourism. Bloomberg has predicted that more than 1 billion Asians will join the global middle class by 2030. This growing middle-class population is likely to drive international tourism.

Secondly, cross-border e-commerce is on the rise. According to Market Data Forecast, the global cross-border e-commerce market was valued at around $1.28 trillion in 2022 and is forecast to reach $4.8 trillion by 2028, with a CAGR of 27%. The expansion of cross-border e-commerce is expected to boost Visa’s cross-border payment volumes significantly.

Q4 FY23 Review and Outlook

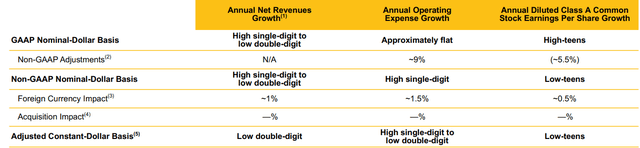

In Q4 FY23, Visa achieved a remarkable 10.3% growth in adjusted revenue in constant currency, alongside an impressive 21.3% increase in adjusted EPS year over year. The payment volume showed a strong growth of 7.7% year over year, and processed transactions increased by 10%. Overall, it was an exceptionally strong quarter for the company.

Additionally, Visa provided robust guidance for FY24, anticipating low-double-digit growth in the top line and low-teens growth in EPS on an adjusted and constant currency basis. For detailed guidance, please refer to the table below.

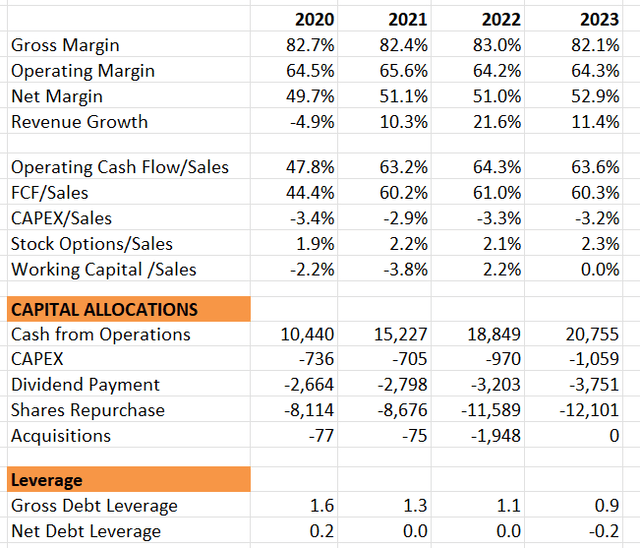

In FY23, Visa generated $19.6 billion in free cash flow, compared to $17.8 billion in FY22. During the same period, they repurchased $12 billion of their own stocks and paid out $3.7 billion in dividends. Visa’s capital allocation policy has proven to be robust, marked by consistent dividends and stock buybacks. Over the past five years, they have repurchased a total of $49 billion in shares and distributed more than $14 billion in dividends. Furthermore, Visa maintains a healthy balance sheet, with a gross debt leverage of only 0.9x at the end of FY23.

I believe Visa’s FY24 guidance is achievable for several reasons. During the Q4 FY24 earnings call, the company’s management expressed confidence in both payments volume and processed transactions, expecting them to grow in the low double-digits for the fiscal year. This confidence in underlying volume and transaction growth is a positive indicator.

Additionally, Visa’s growth is significantly driven by its value-added services, including issuing solutions, acceptance solutions, risk and identity solutions, open banking, and advisory services. These services have been the growth engine for the company, evidenced by an impressive 18% revenue growth in FY23 in constant currency. Notably, value-added services contribute to more than 20% of the group’s revenue and have been consistently growing at a high-teen rate.

In the earnings call, the management emphasized that value-added services are pivotal to their growth strategy, underscoring their commitment to this lucrative segment.

Key Risks

Alternative Payment: In recent years, various alternative payment methods have emerged, with Buy Now Pay Later (BNPL) being one of the most significant trends. Several companies have entered this market, raising concerns about potential risks. To address this, Visa launched its BNPL technology platform and partnered with key service providers such as ACI Worldwide, Carts.com, and ChargeAfter. While some customers opt for BNPL services without using credit cards, others link their credit cards for payment. Although the adoption of BNPL is not widespread, it poses minimal risk in Visa’s view. Notably, many BNPL providers lack a sustainable economic model and often lead consumers to purchase items they cannot afford.

High Interest Rate: A weak nominal consumer consumption trend is unfavorable for Visa since it indicates reduced spending. High-interest rates have a dual impact on Visa’s business. On one hand, they boost the pricing of goods and services, which can be beneficial. However, persistent high-interest rates pose a risk to the overall economy, potentially leading to a recession. Any economic downturn could adversely affect Visa’s growth prospects, highlighting the complexity of the situation.

Valuations

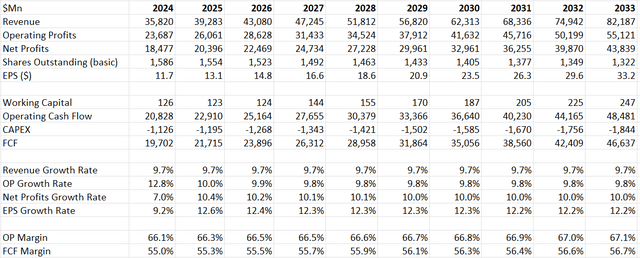

In the DCF model, I have assumed a 9% organic revenue growth driven by payment volume and processed transactions growth. I believe this assumption is in line with Visa’s historical growth trajectory. Given Visa’s already high operating margin, exceeding 60%, I do not forecast significant margin expansion. There might be a marginal 10-20 basis points margin expansion driven by operating leverage, but the substantial growth is expected to come from the increased transaction volume and payment activities.

Visa DCF – Author’s Calculations

In the model, a 10% discount rate, a 4% terminal growth rate, and a 20% tax rate have been deployed. Based on these assumptions, the fair value of Visa’s stock price is calculated to be $320 per share. This valuation suggests that the current stock price is undervalued. Investors might find this information valuable for making investment decisions.

Verdicts

I like Visa’s strong payment volume and processed transactions growth with strong cross-border payment recovery. I view the company as a double-digit compounder and the stock price is undervalued. I initiate Visa with a “Strong Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.