Summary:

- Newly revised U.S. government regulations aim to close loopholes in restrictions on shipments of advanced AI processors to China.

- U.S. export restrictions have reportedly prompted the proliferation of China state-backed computer clusters, which stockpiled Nvidia Corporation chips.

- These Chinese cloud service providers have been renting out access to A100 technology to blacklisted companies, including China’s iFlytek.

- China accounts for 25% of Nvidia’s data center sales, potentially affecting AMD and Intel as well.

Antonio Bordunovi

I’ve written numerous Seeking Alpha articles about how U.S. Sanctions are not working, while penalizing non-Chinese semiconductor and semiconductor equipment companies. My latest article of October 23, 2023 is entitled “ACM Research: Benefiting From China Sanctions.”

Newly revised U.S. Government regulations, introduced on October 17, 2023, aim to close the loopholes that were present in the initial restrictions put forth in October of the previous year. These measures were implemented to control the development of advanced artificial intelligence in China, citing national security concerns. Nvidia Corporation (NASDAQ:NVDA) and ASML Holding N.V. (ASML) have expressed that, in the short term, these regulations are not expected to significantly affect their financial results. Nonetheless, it’s worth noting that China accounts for as much as 25% of Nvidia’s data center sales, and certain chips, including the A800 and H800, are now restricted. This change could potentially have ramifications for Advanced Micro Devices, Inc. (AMD) and Intel (INTC) as well, according to analysts.

Background of A100 and H100 Restrictions

The revised regulations aim to close the gaps in the initial restrictions set forth in October 2022, with the primary objective of mitigating the development of advanced artificial intelligence in China due to national security apprehensions.

Specifically at the end of August, 2022, the U.S. imposed a new license requirement for any future export to China (including Hong Kong) the company’s A100 “Ampere” and H100 “Hopper” integrated circuits made by Taiwan Semiconductor (TSM) without an export license, to Chinese customers address the risk that the covered products may be used in, or diverted to, a “military end use” or “military end user” in China and Russia.

These are Nvidia’s fastest processors and are used in data centers to speed up artificial intelligence tasks such as natural language processing. They are used in supercomputers, artificial intelligence and high-performing data centers for industries ranging from biotech and finance to manufacturing.

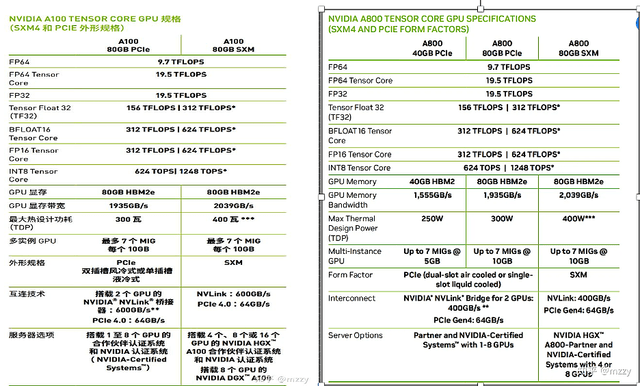

But it turns out the ban wasn’t directly focused on the A100 or H100 chips per se, but the processing speeds of the chip. That has enabled Nvidia to comply with restrictions by reducing processing speed and renaming the substitute chip the A800. Thus, the A100 and A800 are identical except for their interconnect speeds: A800 runs at 400 gigabytes per second while A100 functions at 600 gigabytes per second.

Chart 1 below shows a comparison of the properties of the two versions.

Chart 1

A100 H100 Cloud Sharing Providers

A single A100 on a card that can be slotted into an existing server, and many data centers use a system that includes eight A100 GPUs working together. Nvidia’s DGX A100 system has a suggested price of nearly $200,000.

Nvidia has an alternative money-making scheme. It’s DGX Cloud AI Factory Services can be rented, start at $37,000. The rental includes access to a cloud computer with eight Nvidia H100 or A100 GPUs and 640GB of GPU memory. The price includes the AI Enterprise software to develop AI applications and large language models such as BioNeMo.

Hyperscalar companies that have purchased NVIDIA’s services are also renting out the purchase. Microsoft Azure for a fully-loaded A100 instance with 96 CPU cores, 900GB of storage and eight A100 GPUs is priced at $20,000 per month.

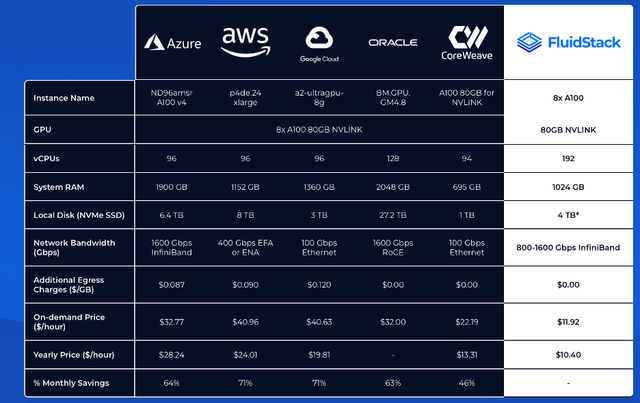

But an entire industry has emerged – data center companies that lease or rent a fully-loaded A100 instance. Chart 2 shows two such companies, FluidStack and CorWeave, and compares configurations and pricing.

Chart 2

Bypassing U.S. Sanctions by Renting A100 Nvidia Chips

Unfortunately, some of these private cloud service providers are renting out A100 chips to companies already on the U.S. sanctions list for as little as $10 per hour.

According to a March 8, 2023 article in Financial Times,

“iFlytek, a state-backed voice recognition company blacklisted by Washington in 2019, has been renting access to Nvidia’s A100 chips, which are critical in the race to develop groundbreaking AI applications and services, according to two staffers with direct knowledge of the matter. Facial recognition group SenseTime, sanctioned at the same time as iFlytek, has used intermediaries to purchase banned components from the US, according to three senior employees familiar with the situation.”

It’s now apparent that the U.S. export restrictions prompted the proliferation of state-backed computer clusters, which stockpiled Nvidia chips and rented out access of the technology to blacklisted companies.

Nvidia was quoted in the article that:

“while we can’t control every future use or downstream sale of our products, we require our distributors to follow all US export rules and sell only to appropriate commercial, consumer, and academic customers that use our products for beneficial purposes.”

Investor Takeaway

The value of the core sectors of the China’s AI industry reached $73.64 billion in 2022, up 18% YoY, according to The China Academy of Information and Communications Technology (CAICT).

China ranked first globally in terms of the number of AI-related invention patent applications. The CAICT estimated that Chinese entities submitted 389,000 such applications between 2013 and November 2022, or 53.4 percent of the world’s total, which stood at 729,000; among the 244,000 AI-related invention patents authorized in the world last year, 102,000, or 41.7 percent, came from China.

Since San Francisco-based start-up OpenAI launched ChatGPT in November, its services have been blocked on Chinese social media as scrutiny of uncensored AI increases, the country’s Big Tech firms have announced plans to fill the gap by introducing similar services. AI conversational capabilities into search engines, while others aim to turn video game characters into chatbots.

Chinese companies including hyperscalars Baidu (BIDU), Tencent Holdings (OTCPK:TCEHY), Alibaba (BABA), as well as ByteDance, the Beijing-based owner of TikTok, have purchased more than $5 billion worth of Nvidia chips in recent months. However, according to the Financial Times, most of these orders have not been delivered, according to several people familiar with the situation.

Efforts to slow progress on AI technology advancements by the U.S. government in China remain of high interest but are unlikely to be successful unless it addresses the issues presented in this article. The publicity surrounding generative AI and the plans by some nefarious Chinese companies should be a further wakeup call for U.S. Customs to further restrict advanced AI chip exports. That would be a negative for Nvidia, although the company reported that the latest sanctions will have no material impact on the near term according to an 8-K filing.

Nvidia Corporation shares are up 205% YTD. The P/E ratio is 106x compared to a U.S. semiconductor average of 24.1x. NVDA’s share price closed October 25 at $417.61. Peter Lynch fair value is $103.50. The Peter Lynch Fair Value Ratio is 4.03.

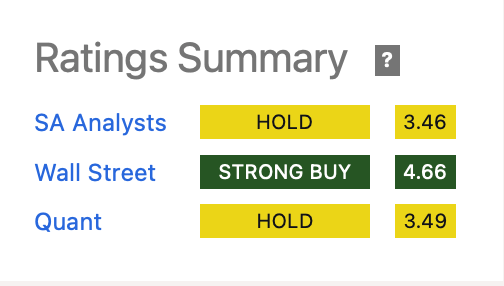

Seeking Alpha’s Quant ratings, shown in Chart 3, have the company as a Hold. I also rate it a Hold.

Seeking Alpha

Chart 3

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.