Summary:

- The significant revenue growth of the Secure, Agile Networks segment is one of the crucial contributions to the rise in Cisco’s operating income margin year on year.

- At the same time, at the end of the fourth quarter of fiscal 2023, the remaining authorization to buy back Cisco Systems shares amounted to $10.9 billion.

- On November 15, Cisco Systems will publish its financial report for the first quarter of the fiscal 2024.

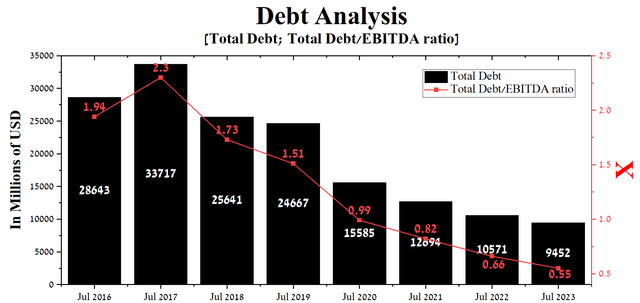

- One of the company’s advantages relative to its peers in the technology sector is its extremely low debt, standing at about $9.45 billion at the end of July 2023, down $1.12 billion from the prior year.

- We initiate our coverage of Cisco Systems with an “outperform” rating for the next 12 months.

Justin Sullivan

Cisco Systems (NASDAQ:CSCO) is one of the largest multinational technology conglomerates in the world, occupying a leading position in the global telecom equipment market.

Investment thesis

The company provides software, routers, and switches, led by the Nexus 9000 series, which are in high demand despite increased competition in the global data center equipment market. Cisco’s numerous solutions and technologies provide high performance, scalability, and reliability of data transmission, which ultimately positively impacts its EPS.

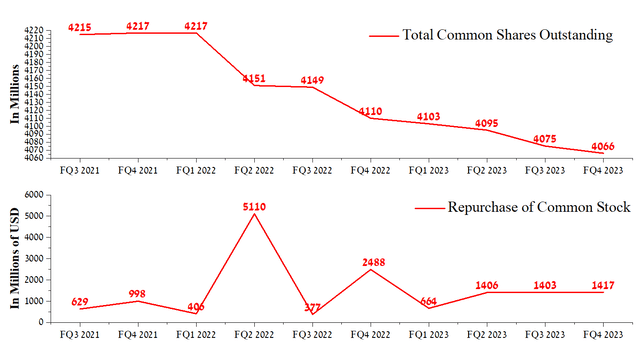

The second factor that has contributed to Cisco beating analysts’ consensus EPS estimates in recent years is the company’s management’s use of a share repurchase program.

Since the second quarter of fiscal year 2023, the amount of cash flow allocated for this purpose has continued to remain stable, and for the three months ended July 29, 2023, Cisco Systems repurchased approximately $1.42 billion of its shares. At the same time, at the end of the fourth quarter of fiscal 2023, the remaining authorization to buy back Cisco Systems shares amounted to $10.9 billion. As a result, this partially minimizes the impact of short sellers on the company’s share price if the war between Hamas and Israel, where its R&D centers are located, spreads to neighboring countries.

Author’s elaboration, based on Seeking Alpha

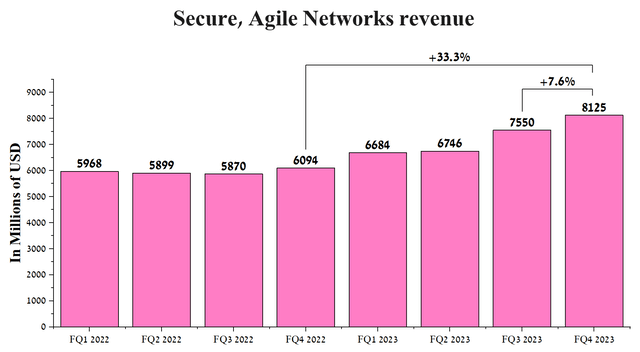

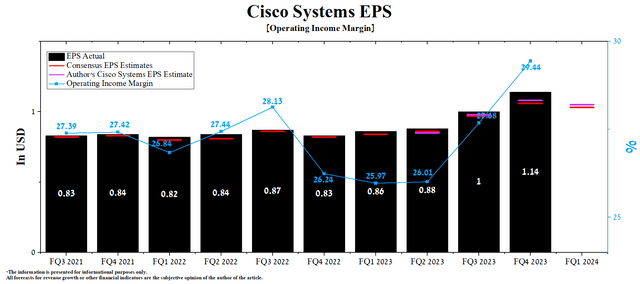

An additional investment thesis, thanks to which we initiate our coverage of Oracle with an “outperform” rating, is that the company successfully develops and implements AI-based products and services, which ultimately contributes to increased interest from retail and institutional investors. So, Secure, Agile Networks’ fourth-quarter fiscal 2023 revenue was $8,125 million, up 7.6% quarter-over-quarter and 33.3% year-over-year, primarily driven by increased demand for its wireless and enterprise routing products.

Author’s elaboration, based on quarterly securities reports

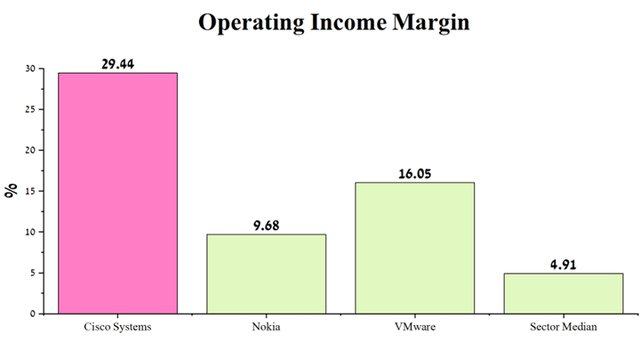

The significant revenue growth of the Secure, Agile Networks segment is one of the crucial contributions to the rise in Cisco’s operating income margin year on year. This financial metric was 29.44% for the three months ended July 2023, which is significantly higher than its competitors in the technology sector.

Author’s elaboration, based on Seeking Alpha

Cisco’s Q4 FY23 financial results and outlook for the H1 FY24

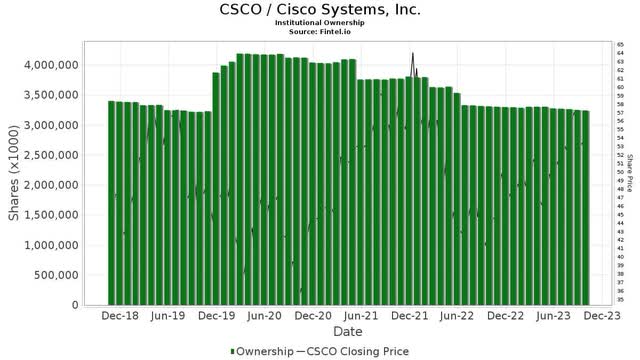

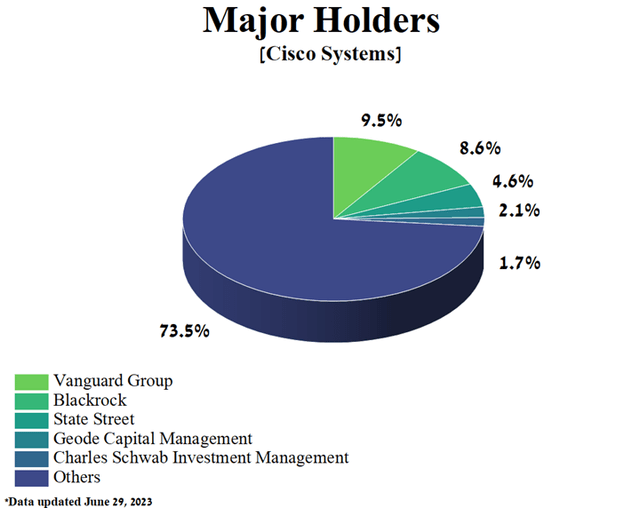

Before we discuss Cisco’s financial results for the fourth quarter of fiscal 2023 and our expectations for the first half of fiscal 2024, we’d like to focus your attention on its institutional investors.

The increase in Cisco Systems’ margins in recent quarters has contributed to maintaining interest in it from Wall Street giants. The top five shareholders of Cisco Systems, whose combined stake in the company amounts to 26.47%, include Vanguard Group, Blackrock, State Street, Geode Capital Management, and Charles Schwab Investment Management.

Author’s elaboration, based on Yahoo Finance

Despite the initial controversy surrounding Cisco’s acquisition of Splunk and skepticism from some financial market participants about how much the deal would benefit the company’s financial position, the percentage of shares owned by institutional investors has remained stable.

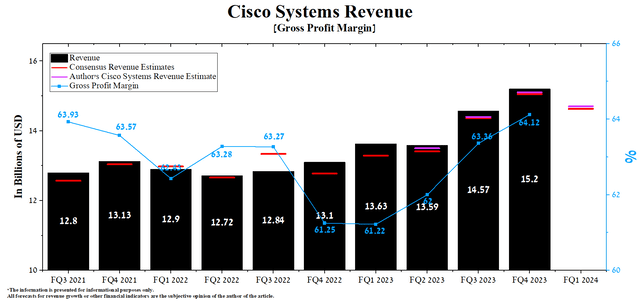

At the same time, the fourth quarter of fiscal 2023 showed outstanding results, as Cisco’s EPS was able to exceed analysts’ expectations and, more importantly, its revenue continued to grow year over year, thereby demonstrating to investors the effectiveness of the company’s business strategies even during a deteriorating global macroeconomic environment.

On November 15, Cisco Systems will publish its financial report for the first quarter of the fiscal 2024. According to Seeking Alpha, Cisco’s revenue for this quarter is expected to be $14.58 billion to $14.8 billion, up 7.3% year-over-year and 2.8% higher than analysts’ expectations for the previous quarter.

Meanwhile, under our model, the company’s total revenue will be in this range, amounting to $14.7 billion. Cisco’s year-on-year revenue growth will be driven primarily by raised demand for the Catalyst 9000 series, Nexus 9000 series, WiFi-6 products and increased service revenue in the Americas and EMEA segments.

Author’s elaboration, based on Seeking Alpha

Additionally, we forecast that Cisco Systems’ operating income margin will reach 28.7% by fiscal year 2024. Moreover, by the fiscal year 2025, this financial metric will increase to 29.2%, thanks to raised prices for the company’s equipment, optimization of labor costs, lower costs of components for the production of compute products and its equipment necessary for the deployment of 5G, and accelerating the pace of global economic recovery.

According to Seeking Alpha, Cisco Systems’ EPS for the first quarter of fiscal 2024 is expected to be $1.02-$1.05, which is 2.8% less than the consensus estimate for the fourth quarter of fiscal 2023. Simultaneously, according to our model, Cisco’s EPS will be above the median of this range and reach $1.05.

Moreover, the company’s Non-GAAP P/E [TTM] is 13.51x, 20.81% lower than the sector average and 11.77% lower than the average over the past five years. On the other hand, Cisco’s Non-GAAP P/E [FWD] is 12.92x, which is one of the many factors indicating its conservative valuation by financial market participants.

Author’s elaboration, based on Seeking Alpha

One of the company’s advantages relative to its peers in the technology sector is its extremely low debt, standing at about $9.45 billion at the end of July 2023, down $1.12 billion from the prior year. Moreover, thanks to Cisco Systems’ EBITDA growth in recent quarters, its total debt/EBITDA ratio has dropped from 0.66x to 0.55x.

Author’s elaboration, based on Seeking Alpha

Conclusion

Headquartered in San Jose, Cisco has a broad portfolio of products and services that play crucial roles in helping businesses, government agencies, and educational institutions prevent cyberattacks and protect their sensitive data.

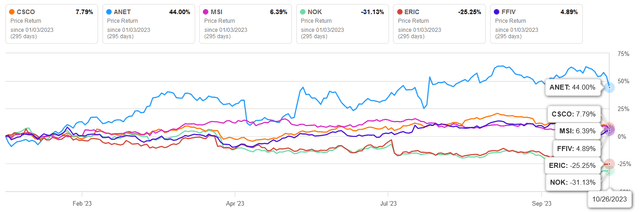

Even though the company’s revenue continues to grow year over year and quarter over quarter, the company’s share price has only risen marginally at 7.79% year-to-date, outperforming the main competitors in the technology sector, such as Motorola Solutions (MSI) and F5 (FFIV).

Author’s elaboration, based on Seeking Alpha

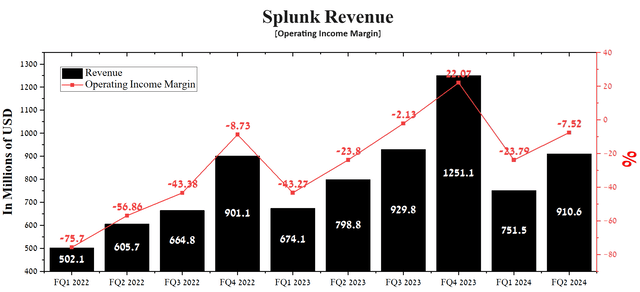

Key risks to Cisco’s financial position include its acquisitions of Splunk, whose operating income margin has remained in the negative zone for the past two quarters, rising geopolitical tensions in the Middle East, and increased competition in the global network-as-a-service market.

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Cisco Systems with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.