Summary:

- Q3 earnings are out and mostly exceeded our previously outlined expectations.

- The internal foundry business was a homerun.

- The AI PC is coming.

- Cash flow improvement is remarkable.

- Could we see a dividend change?

JHVEPhoto/iStock Editorial via Getty Images

A few weeks ago we outlined our expectations for Intel’s (NASDAQ:INTC) third quarter. You can review our expectations here. Well, Intel delivered its Q3 earnings a few hours ago and it is hard to call the most recent earnings performance anything but encouraging. The company has certainly seen a trough in performance following its worst quarter in history in Q1 2023. Intel actually surpassed many expectations in its results including our own projections. We are seeing a recovery in PCs. We saw great progress on Foundry. We saw beats on the headline results, and we saw decent guidance. It was almost everything bulls could hope for. While there is massive competition to contend with of course, they are also making strong inroads into AI. This report was great news for the company to be sure, and great news for investors. We continue to encourage a hold here. But the cost controls are paying off, and Intel is back from the brink. Folks, it’s over. The pain is subsiding. This was almost everything bulls could hope for. David Zinsner, Intel CFO, stated:

“Our results exceeded expectations for the third consecutive quarter, with revenue above the high end of our guidance and EPS benefiting from strong operating leverage and expense discipline. As demonstrated by our recent portfolio actions, we are highly focused on being great allocators of our owners’ capital and unlocking value for shareholders. “

Pat Gelsinger, Intel CEO, added:

“We delivered a standout third quarter, underscored by across-the-board progress on our process and product roadmaps, agreements with new foundry customers, and momentum as we bring AI everywhere”

The company is continuing to control what it can control by slashing costs where it is able to through its cost savings plans, while investing to buildout its foundry model which is going well and still progressing toward IDM 2.0. With that said, the results were better than we had expected:

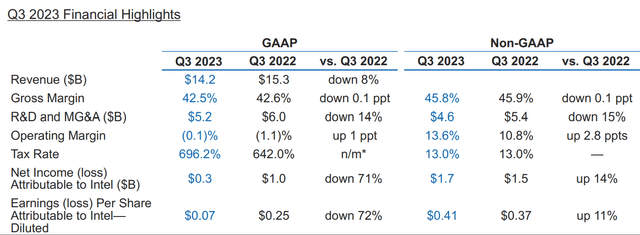

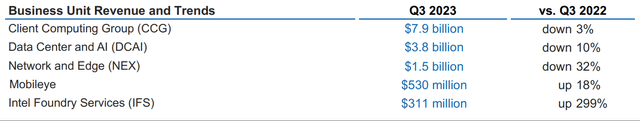

The company beat estimates on the top and bottom lines and handily did so. While better than expected, the comps with Q3 2022 show results are still down a touch, but nothing like the horrible comps we had been seeing. Once again we saw strength relative to the sequential quarter, with huge PC gains. So, as you can see, Intel’s revenue was down 8% from a year ago. On the top line, we were looking for revenue of $13.3-$14.0 billion, on 43.2%-44.0% adjusted margins. Well we saw $14.2 billion of earnings, a nice beat, and this came as adjusted gross margins blew out our expectations at 45.8%, pretty much flat from a year ago. That is a big win. Operating margins were up as well! And, thanks to strong operating margin, net income was up year-over-year, rising 14% from last year’s earnings. Outstanding performance really. Shares are going to run on this, and we think you continue to hold. The horrific results of earlier this year are over.

We are very excited about the company coming back from the brink, while the company works to deliver its AI. Folks, this is a world where AI is dominated by one player in Nvidia (NVDA), and we are starting to see other companies get their piece of the pie. Intel stands to gain significantly. We will continue to monitor progress on AI related innovation. We think this quarter confirms solidly our thesis that the trough in performance was made earlier this year. Of course risks persist. We do know that the leading economic indicators have continued to suggest recession is coming, and the yield curve is uninverting. We also have the return of student loan repayments that just started up, so the PC demand boom could face some near-term headwinds. But, we are cautiously optimistic.

With the return to some positive metrics we will see an improvement in the valuation metrics here as well, as we are swinging from losses to positive returns. Cash from operations is strong. Intel generated $5.8 billion in cash from operations and paid dividends of just $0.5 billion. Now, not every segment is killing it, we are still seeing declines, but the foundry progress was a homerun.

We think you will start to see some nice gains in Data Center and AI moving forward too as we start to come up against quarters where losses began to mount. There was a lot of operational progress in the quarter but the one thing that we really like is that in its client computing segment, Intel is working to create the ultimate AI PC with Intel Core Ultra processors, which we previously discussed, known as Meteor Lake. This officially began shipping to customers back in Q3 but the date of the official launch is here in Q4 on December 14th. Very exciting development in our opinion.

Also, to advance its IDM 2.0 strategy we also previously outlined the sale of the PSG spinoff, which it plans to IPO in a few years as well. Further, to advance IDM 2.0 and raise some cash, Intel is reached a deal to dump 10% of its IMS Nanofabrication business to Taiwan Semi (TSM), valuing IMS at approximately $4.3 billion.

Q4 2023 outlook

We are impressed with the Q3 performance, and are pleased that it lends evidence to our call that performance troughed earlier this year. However, the outlook matters more than past performance.

Folks, our biggest concern has been the margin compression we watched take place for over a year. However, margins are stabilizing and improving. For Q4, Intel guided for revenue of $14.6-$15.6 billion, on 46.5% adjusted margins, which would be further margin expansion sequentially. Management expects to deliver solid earnings of $0.44 per share in the quarter as well.

Final thoughts

After we saw the biggest losses in history early in 2023, Intel has turned the corner. The surprise PC demand was welcomed and led to a huge beat. We expect ongoing IDM 2.0 progress, and we expect big things in the AI market. Intel is back and although the stock has hit levels we generally like to sell when trading, we think you can hold here. We also think that if 2024 performance shows significant improvement from 2023, talks of bumping that dividend up again. That may be a premature thought, but the conversation may be had in H2 2024, if management continues to execute. We should also add that debt is down about $1 billion since the start of the year as well to $7.9 billion. The other big positive has been the reduction of cash burn. While there was repayment of commercial paper, issuing of new debt, payments of debt, and payments of dividends, cash is at $7.6 billion right now, up from $4.5 billion a year ago. Don’t give up on the stock. Continue to hold.

Your voice matters

What other positives in the quarter do you see? Do you think they might raise the dividend? Are you concerned with the cash flows? Do you think they will take AI market share?

Let the community know below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Get in the game and win with us!

Big gains await you with our playbook at BAD BEAT Investing. We have a Halloween special $75 off our service through this article’s link only, available to the next 6 subscribers. Take control with Seeking Alpha’s top trading service. Start making real money today.

- Winning investments each week

- Learn our playbook and use our tools to maximize your returns

- Invest in deep value situations we find through our proprietary analysis

- Generate income through capital gains and options approaches

- Understand the swings in markets under our fund analysts’ guidance.