Summary:

- We remain buy-rated on Microsoft.

- We think 1Q24 results and outlook confirm that IT spending is stabilizing and the enterprise optimization cycle is nearing its end.

- We continue to expect Office 365 Copilot, priced at $30/month, to boost top-line growth towards 2HFY24 due to the A.I. monetization roadmap.

- Additionally, we believe Microsoft has the economic moat to successfully enter the SSE market and see a more material security revenue reacceleration once pricing becomes clear.

- We still see an attractive risk-reward profile for the stock into 2024.

Abstract Aerial Art/DigitalVision via Getty Images

We maintain our buy-rating on Microsoft (NASDAQ:MSFT). We think 1Q24 results and outlook confirm our belief that IT spending is stabilizing after months of tightening enterprise budgets. Management reported revenue of $56.5B, up 12.8% Y/Y, and GAAP EPS of $2.99, beating top and bottom lines; top-line growth is accelerating into higher double-digits, up from 8.3% Y/Y growth last quarter, and we see this trend continuing into 2HFY24. Additionally, we think macro weakness has been priced into the stock and outlook; we think expectations reset last quarter after Azure’s slower revenue growth, making Microsoft better positioned to outperform. Microsoft’s Intelligent Cloud segment reported revenue of $24.3B, ahead of Wall Street consensus of $23.6B; Azure and other cloud services revenue grew 29%, comfortably beating estimates of 27%. We expect cloud capex to expand in 2024 and see more growth ahead for Azure in response. We believe Microsoft has an attractive risk-reward profile as we see multiple growth drivers playing out towards 2H24.

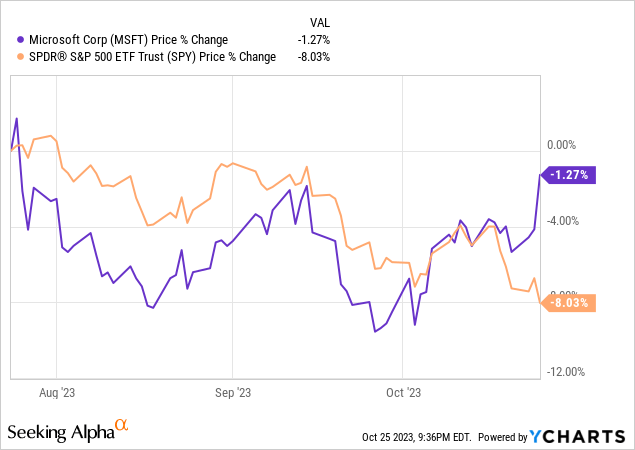

The following outlines MSFT’s stock performance against the S&P 500 over the past three months.

YCharts

What’s driving FY24?

We’re seeing signs of gradual recovery across Microsoft’s Productivity and Business Processes, Intelligent Cloud, and More Personal Computing; Y/Y revenue growth is accelerating across all three segments. We think this quarter’s results reflected the enterprise spending environment is changing; we think the optimization cycle is ending in 2H23. The following table outlines the financial results of Microsoft this quarter.

Our bullish sentiment is driven by our belief that Microsoft is better positioned to outperform due to the recovering IT spending environment, but also equally important, it’s driven by near-term growth catalysts at play for the company. The two main catalysts we see on the horizon are the new Microsoft 365 Copilot, now priced at $30/month, and management entering the SSE market within cybersecurity. We expect the former will push top-line growth into the higher double-digit percentage due to A.I. tailwinds, and the latter will drive mid-to-long term growth as Microsoft yields economic moat in the cybersecurity market over smaller players like Palo Alto Networks (PANW), Cloudflare (NET), Zscaler (ZS) among others. This quarter, the company introduced new cybersecurity services and announced new Surface PCs that would integrate Microsoft 365 Copilot A.I. add-on to the enterprise. We’re constructive on Microsoft building out its ecosystem and consolidating enterprise customer needs end to end through its services.

Additionally, we believe the PC market is stabilizing and should recover in 2024 regardless of the macro environment. Gartner reported worldwide PC shipments declined 9% in the third quarter of the year compared to 30% in the first quarter. Microsoft reported a 4% growth in sales of Windows operating system licenses to device makers – this breaks the streak of five quarters of Y/Y decline; management noted on the call that “the PC market unit volumes were at roughly pre-pandemic levels, and we continue to innovate across Windows, adding differentiated AI-powered experiences to the operating system.” We now estimate the 2024 PC TAM to be between 5-8% growth Y/Y. We think the stock ran up on A.I. hype with no monetization plan and macro weakness, and now, after the pullback, we see the stock outperforming driven by fundamentals, not market noise.

Valuation

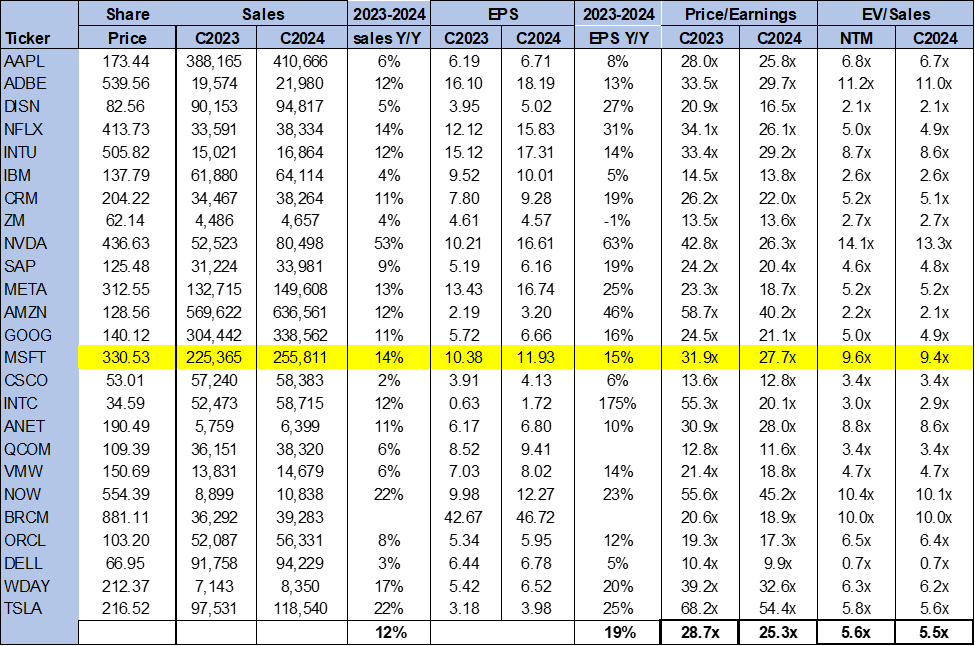

The stock is trading well above the peer group average, but we think the higher multiple is justified for Microsoft’s anticipated growth rate. On a P/E basis, the stock is trading at 27.7x C2024 EPS $11.93 compared to the peer group average of 25.3x. The stock is trading at 9.4x EV/C2024 Sales versus the peer group average of 5.5x. We expect the stock to outperform the peer group in 2024 and recommend investors explore attractive entry points at current levels.

The following chart outlines MSFT’s valuation against the peer group.

TSP

Word on Wall Street

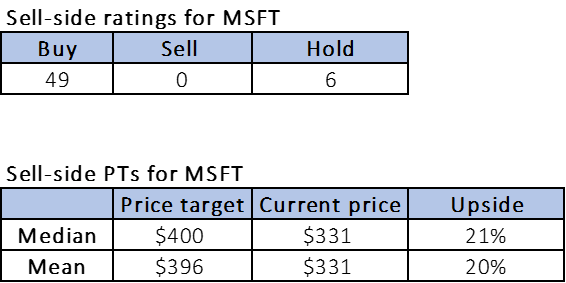

Wall Street shares our bullish sentiment on the stock. Of the 55 analysts covering the stock, 49 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $331 per share. The median sell-side price target is $400, while the mean is $396. The following charts outline MSFT’s sell-sided ratings and price targets.

TSP

What to do with the stock

We’re still buy-rated on Microsoft. We believe this quarter’s results and outlook for next quarter signal that IT spending is stabilizing; we think the optimization cycle is causing the tighter enterprise spending environment to be complete by the end of 2023. We’re more constructive on Microsoft’s outperformance in 2024 due to its economic moat in the SSE market and the pricing power for Copilot integration into Microsoft Office 365. We think investors exploring entry points into the stock at current levels will be well rewarded in 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.