Summary:

- Exxon’s merger with Pioneer Natural Resources has been received by some institutions and analysts as a long-term positive, on growing production prospects.

- Some recent metrics such as drilling activity suggest that a decline in shale oil and gas production may be starting, making Exxon a potentially dominant shale producer in a shrinking industry.

- Pioneer’s 2023 new well production curve improvement might indicate that it used selective drilling practices to improve its performance in the short term to improve its market cap.

- If Pioneer tried to improve its short-term performance by picking the best places to drill to raise its value, then the downside risk to Exxon may be higher than expected, since it may have overpaid.

- If Exxon made this investment with expectations of higher oil & gas prices for the foreseeable future, the possibility that Pioneer’s assets are not as performant as short-term performance might suggest, will not matter as much. Having viable reserves may matter more.

grandriver

Investment thesis

Exxon’s (NYSE:XOM) merger with Pioneer Natural Resources (PXD), in an all-stock deal of almost $60 billion is seen by institutions such as Truist as a positive long-term move that can pay off for investors. On the surface, it looks like Exxon is securing reserves, and improving its production growth prospects. This should be viewed within the context of arguably solid long-term fundamentals for oil & gas upstream producers within a global market that is faced with energy scarcity. With this acquisition, it could become a dominant shale operator. This is the buy argument.

Below the surface, we should keep in mind that since the shale industry emerged about a decade and a half ago, the shale industry has been full of surprises. The first big surprise for those who did not pay close attention was the massive wave of bankruptcies last decade, mostly driven by companies sitting on low-quality acreage.

A bruised industry that consolidated its drilling in the best acreage in the past few years also arguably surprised the market by putting in some decent financial results. Some of the highlights include strong profit margins, debt reduction, as well as the start of dividend payments that shale companies increasingly tend to reward investors with, including Pioneer, which has been paying a dividend of about 2% recently.

Some early indicators, such as the declining rig activity suggest that the next big surprise, namely the start of the decline in shale oil & gas production may be upon us. Thus Exxon may become a dominant shale producer even as the shale industry starts to shrink. The implications of this thesis make for a more complex picture than the current bullish long-term thesis put forward by various institutions and analysts.

Looking at Pioneer specifically, within the wider context of a shale industry that is potentially close to peaking and may start declining, it could be argued that Exxon will be getting far less benefit out of its merger than it might be assumed. Among other things, Pioneer may have opted to drill and complete wells more selectively this year in order to improve results and its market cap. This aspect of the merger can arguably be seen as a negative, thus it cancels out the buy thesis. Taking these factors into consideration, I see this stock as a hold for now, with potentially more favorable entry points ahead in the event of a short-term oil price decline.

About the newly acquired assets and liabilities.

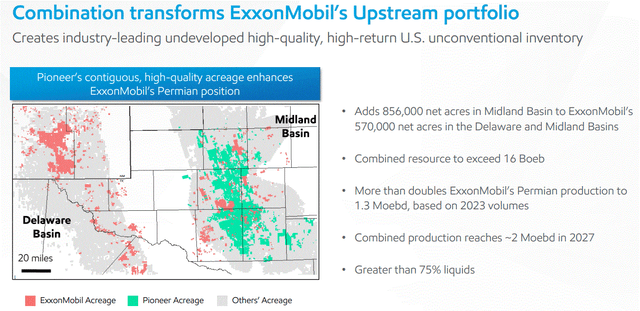

Pioneer’s assets are set to double Exxon’s acreage & production in the Permian.

Aside from the current realities of doubling the acreage, production, and the combined resources estimated at 16 billion barrels of oil equivalent, we have the forecast of production from the combined resources rising from 1.3 mb/d in oil equivalent currently to 2 mb/d. This is where we have to be cautious in taking such forecasts for granted.

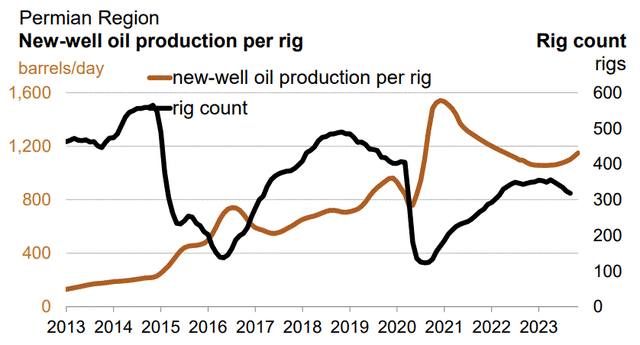

Permian rig count & productivity per rig (EIA)

As we can see, following the sharp decline in drilling post-2019, there was a rebound, followed by a resumption of what is seemingly a long-term declining trend in drilling this year. If we are to ignore the anomaly created by the COVID disruption in the 2020-2022 period, we can see that the sustained decline in drilling activities in the Permian started in 2018, and what we are seeing for the past year, seems to be a steady continuation of that trend.

An increase in productivity per rig, due to several factors, including further prime acreage consolidation, longer laterals, as well as improved execution have been counteracting the effects of less drilling. A steady decline in the number of DUI wells in the shale patch, based on EIA data, has been helping to sustain a continued increase in production, in the face of fewer wells being drilled. In other words, more wells are being completed and put into production than drilled, distorting the true effect of the decline in drilling activities in the shorter term.

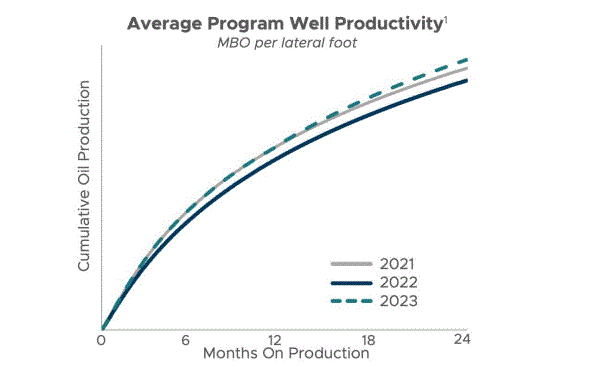

Pioneer’s well production data seems to show that shale companies can change average well performance in the short term with some ease, as long as there are enough opportunities to shift up in terms of average acreage quality being drilled at any point in time.

Pioneer

As the chart shows last year’s wells that were completed by Pioneer performed significantly below the levels seen in 2021. However, this year’s wells are slightly outperforming the levels seen in 2021. Improved execution tends to be the favorite culprit to cite for those who are generally shale optimists. The simpler explanation that tends to be far less appealing but far more plausible is that targeted choices regarding where to drill tend to provide immediate short-term improvements in average well performance. There is no way of knowing for sure how Pioneer achieved the improvement in well performance, but the upcoming merger as a motive, suggests that there was an incentive to improve well performance this year, assuming that preparation work was underway for the merger.

Logic dictates that the improvement in well performance we are seeing this year will be short-lived and the trend we saw between 2021 & 2022 will be more closely reflected in future average performance for the newly acquired assets that Exxon added to its shale portfolio than the performance we saw during the 2022-2023 period. It should be noted however that even though average well performance is likely to deteriorate in the medium term, it is unlikely to be drastic.

Pioneer’s financial results suggest that there is currently a sufficiently wide buffer in terms of profitability margins to accommodate a gradual decline in average well performance in the next few years, as long as oil & gas prices remain in the range we have seen in the past two years. Net income dropped by half in Q2, 2023, mostly due to lower realized oil & gas prices, but Pioneer still saw net income come in at just over $1.1 billion, on revenues of $4.6 billion.

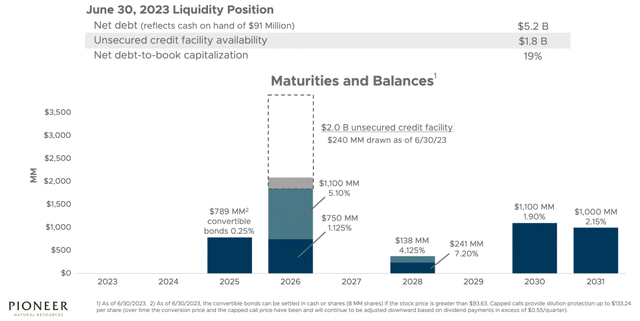

It should also be noted that along with the assets Exxon also inherited Pioneer’s debt.

Ordinarily, the debt issue would not be much of a concern. With interest rates rising, over $5 billion in additional net debt that Exxon is taking on, along with the assets and revenue stream of Pioneer, on top of the $36.5 billion in long-term debt that Exxon already has as of the end of the third quarter, does represent a potential strain on its profitability, at least in the short term. At the rate that Exxon has been reducing debt in the past two years or so, it should be able to reduce its net debt tally to pre-merger levels within a few quarters, unless we see a dramatic decline in oil & gas prices in coming months, which I see as very unlikely to occur.

As far as the overall immediate financial impact, Pioneer’s Q2 revenues amount to about 6% of Exxon’s Q2 revenues. Exxon had just under $83 billion in revenues in the corresponding quarter, compared with Pioneer’s $4.6 billion. The overall short-term impact is somewhat negligible. It is the longer term that seems to be of greater interest, within the context of a world that is discovering far fewer barrels of oil than it produces every year for many years now. Those shale reserves that it secured through the Pioneer merger can provide Exxon with the opportunity to maintain a robust level of upstream production growth, even as much of the world seems to be stagnating or perhaps worse, set to start declining.

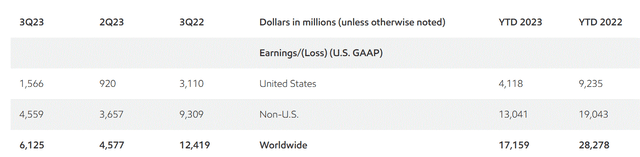

One aspect that we should be mindful of in regard to the merger, which I believe provides us with a relatively strong indication in regard to the future impact that Pioneer’s assets will have on Exxon’s financial results is Exxon’s results when it comes to its American assets versus its performance outside of the US.

As the YTD earnings data shows, Exxon’s US earnings for the first three quarters of 2023 responded far more negatively to the decline in oil prices compared with the results from the same period from last year. The US decline in earnings amounted to about 55%, versus a decline of only about 31% in earnings for its international operations. This tends to be the shale effect, where the need to constantly drill to make up for high well decline rates, as well as relatively high breakeven costs tends to translate into a strong reaction to oil & gas prices in terms of earnings.

The fact that Pioneer mostly brings upstream assets to the merger, will probably amplify those wilder swings in earnings for Exxon’s US operations, in response to oil & gas price swings. Its US operations will also contribute a larger proportion of its overall financial results going forward. Looking at Exxon’s most recent results from this perspective, in regard to what the Pioneer merger can mean, it becomes apparent that Exxon is betting on sustained higher oil & gas prices for the long term, which is what it needs for this merger to pay off.

Investment implications

The answer to whether this is a good deal for Exxon shareholders or not, given the $60 billion that Exxon paid for Pioneer, may end up being largely dependent on oil & gas price trends for the rest of this decade and beyond.

Pioneer stock price and other metrics (Seeking Alpha)

Looking at technical aspects it seems that Pioneer is by no means more expensive than Exxon, with their forward P/E rates just over 12 and just under 12 respectively. Based strictly on such metrics we could arguably see it as a net neutral from an investor’s perspective. However, if Pioneer managed to enhance its average well production for the year, not through technological improvements but rather due to selective drilling, it most likely added a few percentage points to its average market cap this year, as better well results translate in better profitability and other financial metrics. This tends to be a challenge when it comes to evaluating the real value of a shale company. Exxon may have overpaid as a result, if this is the case.

It may also be the case that Exxon is fully aware of the aspect of the merger I highlighted, but other considerations, such as perhaps future oil & gas price expectations may play a role in its willingness to overlook such factors in favor of being able to secure upstream reserves in a world where those reserves are increasingly scarce. With its global reach, Exxon most likely understands the arguably precarious nature of upstream reserve replacement that the industry is facing worldwide.

As I pointed out in an article at the beginning of the year, entitled “Exxon Ends Algae Biofuel Quest, What It Implies Long Term” Its long-term upstream prospects were not looking at all bright, given factors such as a lack of reserve replacement through exploration as well as divestments it undertook around the world. The Pioneer merger is to some extent a remedy to what seemed then a flawed business path, driven to some extent by a need to satisfy a culture of ESG pressures. Given the overall context, it may make sense to estimate Pioneer’s assets, not based on recent financial results, or current estimates of the value of its proven reserves, but rather by assuming a higher value of those reserves due to higher assumed oil & gas prices going forward and higher production volumes in the future. Those two factors combined can make for significantly improved financial results for Exxon going forward

If Exxon is assuming significantly higher oil & gas prices in the future compared with current price levels, and assuming that its bet will turn out to be correct, then it will most likely become seen as a good acquisition. The downside risk if oil & gas prices turn out to be weaker than expected going forward is that Pioneer’s future profitability prospects have been overestimated and within the hypothetical context of lower oil & gas prices, those reserves will be exposed as being partially non-viable. The bottom line seems to be that Exxon will need a steadily higher oil & gas price environment for the long term for this merger to pay off.

In order to better manage the arguably enhanced risk to Exxon’s share value in the event that oil & gas prices will be lower on a sustained basis from current levels is to opt to hold out for a better entry point. Personally, I would feel far more comfortable buying Exxon’s stock if oil prices were to decline by about 20% or more from the current levels, assuming that Exxon’s stock price would follow suit with a more or less similar decline in terms of magnitude. The reasoning behind my position is relevant to some extent for all oil & gas producers because I see an oil price between $60-$70/barrel to be the minimum that the global industry currently needs in order to keep oil flowing at least at current levels on a sustained basis. What this means is that any dip below that level is likely to be very temporary in nature.

Even though Exxon’s stock price has seen a significant decline of about $15/share from its 2023 highs as I write this, to about $105/share, I do think that the downside risk that the potential for lower oil & gas prices presents going forward needs to be better managed by seeking out a better entry point if one is looking for a long-term buy & hold position. The Pioneer merger makes Exxon’s stock price more sensitive to oil & gas price swings, therefore the risk/reward equation needs to have more risk factored in, as well as arguably more potential upside reward in the event that the oil & gas markets will perform better than expected. The risk/reward equation seems to be mostly leaning toward more risk, for the reasons I cited in the article. Some of the reasons include the possibility of yet another shale industry surprise, namely an impending permanent peak & decline in production, as well as potentially a severe deterioration in profit margins due to the low-hanging fruit effect. Pioneer’s assets will likely be no exception to the overall shale industry trend, therefore Exxon may have spent a significant amount of resources on assets that could easily produce some significant negative surprises. Taking all these considerations together, until we see a significant decline in its stock price of perhaps 20% or more from current levels, in my view Exxon’s stock remains a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.