Summary:

- Comcast has faced challenges in its traditional pay-TV business but has demonstrated adaptability by focusing on their broadband and wireless services.

- The recent spectrum deal with T-Mobile showcases their strategic acumen and ability to optimize assets for maximum value creation.

- Comcast’s wireless strategy offers substantial growth potential through cross-selling existing customers and funneling new customers into their cornerstone broadband service.

- While risks exist, Comcast’s strategic initiatives and financial position make it an attractive opportunity for investors.

Editor’s note: Seeking Alpha is proud to welcome Brad MacFee as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Joe Raedle/Getty Images News

Introduction

Comcast Corporation (NASDAQ:CMCSA) is a behemoth in the media and telecom industries, boasting ownership of the largest pay-TV and home ISP in the U.S. (Xfinity), along with holding the top spot as the largest pay-TV provider in Europe (Sky). Despite the past success that has propelled the company to its current dominance, the impact of the pandemic along with, perhaps more notably, the mass exodus of consumers from pay-TV to streaming services have continued to prove difficult headwinds for Comcast to overcome, indicated by dwindling customer bases and declining revenue from traditional video and voice offerings.

Despite these challenges, Comcast has showcased its impressive adaptability in an evolving communications landscape and ability to capture value through many strategic maneuvers. Over the past 15+ years, the primary drivers of this value capture have been the development of their broadband internet service and, more recently, the rapid growth of their wireless service.

Although still in its infancy, the success of their wireless service has displayed management’s ability to develop and execute wise and effective business strategies. Demonstrating this capability is Comcast’s recent agreement to divest a portion of their 600 MHz spectrum to T-Mobile (TMUS), where they were able to negotiate terms that maximize the upside of the deal while also eliminating virtually all associated downside.

In light of Comcast’s proven track record of strategic acumen and execution, the company is well-positioned to seize the abundant opportunities ahead. As their wireless service continues to gain momentum, Comcast has the potential to further expand its influence and profitability. With an eye toward sound business strategy and the dexterity to execute on those strategies, I believe Comcast could make a valuable addition to investment portfolios.

Cable Communications Business

From 2015 to 2022, Comcast’s total revenue grew from $74.5 billion to $121.4 billion, representing a 7.2% CAGR. Much of this growth is attributable to the cable communications segment, which represented 55% of FY 2022 revenue and has grown at a 5.1% CAGR since 2015.

NOTE: In 2023, Comcast reclassified its reported business segments, so I am not including 2023 quarterly financials for the sake of continuity and simplicity.

The cable communications segment is further broken down into six core divisions: broadband, video, voice, wireless, business services, and advertising. Over the last 10 years, Comcast’s broadband internet service has replaced the digital video service as the foundation of the cable communications business, with revenues almost tripling from $9.5 billion in 2012 (24% of total cable communications revenue) to $24.5 billion in 2022 (37% of total cable communications revenue).

In recent years, the cord-cutting trend has gained traction and continues to weigh on other parts of the cable communications business. Since 2015, revenue generated by the digital video service has declined by about 1% despite increasing prices by 13% in that period. Accounting for this disparity is the loss of video customers from 22.35 million in 2015 to 16.14 million in 2022-a customer attrition rate of over 27%. However, Comcast offers their Flex set-top boxes for a one-time installation fee of $15 to broadband customers. This has been a minor contributor to the broadband segment as customers maintain their broadband subscriptions and get all of their streaming options aggregated at no additional cost. So on the surface, Comcast may look like a pay-TV dinosaur bound to go extinct when, in reality, they are actually utilizing their vast broadband and media network to mitigate pay-TV losses and keep customers within their product/service ecosystem.

The other notable segment of their cable communications business that has been deteriorating in recent years is their voice segment, which includes their wireline telecommunications and VoIP services. This segment has experienced a 17% decline in revenue and an almost 20% deterioration in customer headcount since 2015, largely due to traditional wireline phone services being replaced with wireless phone services. However, while the performance of the voice segment has continued its downtrend, Comcast’s wireless service (Xfinity Mobile) has been blowing up. Since its launch in 2017, wireless revenue has grown at a 56% CAGR and they’ve added more than 5.3 million wireless lines. Even better, wireless generates more revenue per line ($48.17 per month in 2022) than voice ($27.02 per month).

Now that we’ve gotten an understanding of Comcast’s cable communications business, we can now get into spectrum and the recent spectrum deal between Comcast and T-Mobile.

Spectrum Overview

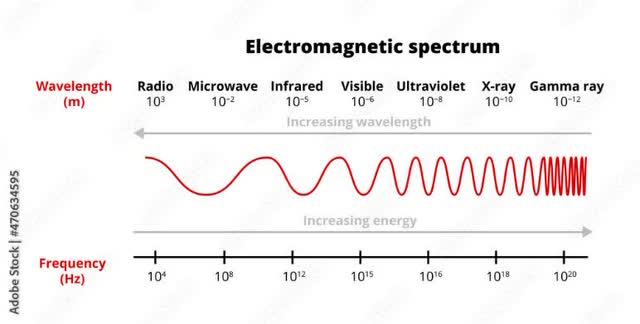

Spectrum, in the telecom industry, refers to electromagnetic waves through which signals for phone calls, radio, TV, and more are transmitted. It is classified by frequency, measured in Hertz (Hz), where 1 Hz equals 1 cycle per second.

Electromagnetic spectrum (Adobe Stock Images)

Spectrum is categorized into three bands, with specific frequency ranges varying by country. For this discussion, we’ll use the ranges specified by the U.S.

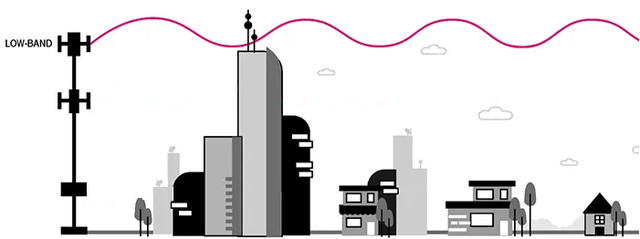

Low-Band

The first category is low-band spectrum, spanning frequencies below 1 gigahertz (GHz). Characterized by its extensive coverage capabilities, low-band spectrum efficiently covers vast areas with minimal disruption. However, it tends to meet congestion issues when many users access it simultaneously, affecting network speeds.

Low-band Spectrum (T-Mobile 5G HQ – 5G Spectrum Frequency Bands (edited))

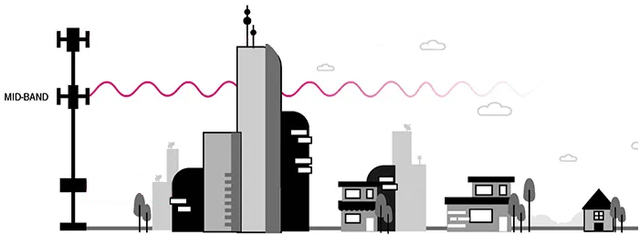

Mid-Band

Mid-band spectrum, ranging from 1GHz to 6 GHz, strikes a balance between coverage and capacity. While it doesn’t cover as large an area as low-band, it handles more traffic with fewer congestion-induced problems, presenting a good compromise between speed and reach.

Mid-band spectrum (T-Mobile 5G HQ – 5G Spectrum Frequency Bands (edited))

High-Band

High-band (mmWave) spectrum surpasses 6GHz, excelling in capacity and performance, ideal for high-density areas like urban zones and stadiums. It offers tremendous connectivity and traffic handling, albeit with limited coverage.

High-band spectrum (T-Mobile 5G HQ – 5G Spectrum Frequency Bands (edited))

Now that we’ve covered that intro into a spectrum, we can get into the deal at hand and what it means for Comcast.

Terms of the deal

In the disclosed 8-K form by T-Mobile, the deal’s specifics are outlined as follows:

- Comcast agrees to sell a portion of its 600 MHz licenses to T-Mobile for $1.2 billion.

- The deal is set to be finalized in 2027 and concluded in 2028.

- Comcast retains the right to remove any licenses they haven’t committed to selling.

- A lease-to-purchase agreement is established where T-Mobile will pay Comcast for the spectrum’s use for a minimum of two years.

- If Comcast chooses to remove “optional” licenses, T-Mobile won’t pay the lease for those licenses after the initial two-year period.

- The licenses that Comcast cannot remove cover approximately 39 million pops, including significant areas like New York, NY; Orlando, FL; and Kansas City, MO.

So what about this agreement makes it such a great move for Comcast?

1) Strategic License Selection

Comcast’s wireless service, Xfinity Mobile, is exclusively accessible to existing residential customers subscribing to their broadband services. The licenses locked in for sale by Comcast encompass areas where their broadband coverage is limited. Given the sparse presence of broadband customers in these regions, the potential user base for their wireless services would be quite small. Hence, opting to sell these licenses to T-Mobile aligns strategically with their business objectives.

You may wonder, “Why not employ the spectrum to extend their broadband network in these areas, providing both internet/cable and wireless services?” As it turns out, Comcast doesn’t believe that it’s going to need the 600 MHz spectrum it has agreed to sell.

2) 3.5 GHz CBRS Spectrum Performance

Comcast possesses a substantial portfolio of 3.5 GHz CBRS priority access spectrum, currently undergoing testing for integration into its expanding 5G network. The outcomes of these tests have exceeded expectations thus far, prompting Tom Nagel, Comcast’s SVP of Strategy & Development for Wireless to state, “This strong CBRS spectrum performance has made us realize that we are unlikely to need the 600 MHz spectrum licenses that we currently hold to support our wireless strategy.”

This revelation bodes well for the business and investors alike as it emphasizes Comcast’s adeptness in optimizing lower-cost assets to drive exemplary results. These strategic initiatives contribute to heightened profit margins and increased capital for rewarding shareholders. This leads to the next point, which illustrates how Comcast’s management has effectively used spectrum not only in developing their network, but also as an investment tool.

3) Impressive Spectrum ROI

Comcast invested $1.7 billion in acquiring the 600 MHz spectrum back in 2017. As indications from Tom Nagel suggest, the decision to sell the entire portfolio in the T-Mobile deal appears likely, hinting at a substantial ROI of $1.6 billion, marking a 94% gain. However, the potential gains elevate further when considering their procurement of the 3.5 GHz spectrum that is anticipated for significant use.

In 2020, Comcast secured 830 licenses for the 3.5 GHz spectrum at a cost of $459 million. By combining the profits from the T-Mobile deal with the cost efficiencies derived from utilizing the 3.5 GHz spectrum for 5G upgrades, the total value generated by this deal surges to an impressive $2.8 billion. This demonstrated capacity to identify and capitalize of diverse opportunities for value creation aligns with other very successful businesses. It also showcases Comcast’s adeptness in negotiating advantageous business agreements, which is the final point I am going to make on the deal.

4) Favorable Deal Terms

Comcast skillfully negotiated terms that not only enhance the deal’s potential gains but also strategically mitigate risks. The first notable risk-mitigating term involves Comcast’s right to retain or sell an uncommitted 600 MHz license. This safeguard ensures Comcast is protected, especially if they encounter challenges replicating the initial success of their 3.5 GHz spectrum as they scale their offerings.

Another crucial risk management condition is the timeline for finalizing the deal. Set for 2027, this grants Comcast a vital 4-year window to ensure the success of their 3.5 GHz spectrum before committing to sell their full 600 MHz portfolio. This timeframe allows ample opportunity for market testing, ensuring optimal outcomes to bolster their wireless strategy.

On top of risk mitigation, Comcast optimizes the deal’s potential upside through a lease-to-purchase agreement with T-Mobile. This approach allows T-Mobile to lease the 600 MHz spectrum while Comcast deploys its 3.5 GHz layer, effectively maximizing the value of their spectrum assets. This lease agreement transforms what could be a stagnant 600 MHz portfolio into an asset generating consistent and reliable cash flows for the next few years.

Opportunity

The T-Mobile deal underscored Comcast’s commitment to its existing wireless strategy, focusing on cultivating and expanding within their current customer base. While some may perceive Comcast as limiting growth by concentrating on selling wireless services to their existing customer base rather than broadening network availability to attract new customers, the reality is more nuanced.

As of December 31, 2022, Comcast boasted an extensive residential customer base of 31.8 million. However, their mobile lines numbered just 5.3 million, indicating an evident growth potential of 26.5 million additional lines (31.8 million residential customers minus 5.3 million current lines). It’s important to note that “residential customers” refer to the number of residential accounts and do not account for the number of individuals serviced by those accounts.

Considering for this distinction and the average 2.5 individuals per U.S. household published by the U.S. Census Bureau (using 2 to be more conservative), the theoretical wireless line expansion becomes even more substantial, potentially, reaching an impressive 63.6 million lines, a remarkable 12-fold increase from their current standing. Based on Comcast’s average annual wireless revenue per line of $575.42 since stabilizing in 2019, this represents an opportunity for an additional $30.5 billion in annual revenue from the wireless business (26.5 million additional lines × 2 individuals per household × $575.42 per line per year).

Outlook

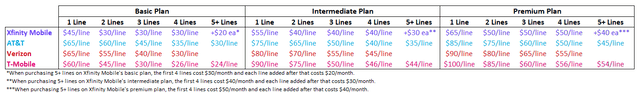

Offering Xfinity Mobile exclusively to existing broadband customers allows Comcast to offer wireless services at a lower cost compared to the “Big 3” carriers (AT&T, Verizon, and T-Mobile).

Pricing information for each wireless plan tier for wireless telecom competitors (Mobile plan pricing information from the represented companies’ websites)

With Comcast’s broadband internet establishing itself as one of the best-performing in the U.S., they have been able to increase prices while still expanding their broadband customer base. This has positioned their broadband service as a centerpiece in most of their service bundles, enabling them to undercut competitor pricing for their wireless service. I believe this strategy will enable Comcast to capture a respectable portion of their wireless opportunity and enhance their overall business for several reasons: cross-selling to current customers, incentivizing potential customers to transition to Comcast, and channeling new customers into their broadband internet service.

By leveraging the strength of their broadband service to offer competitive prices for wireless, I believe current customers will continue to realize the potential savings on their wireless bills and enjoy the convenience of consolidating their internet, phone, and other bills into one monthly payment, facilitating sustained growth in wireless lines and wireless revenues into the future.

I anticipate that the appealing value proposition for wireless bills will attract not only current Comcast subscribers but also consumers outside the Comcast network. As illustrated in the figure above, consumers can access Xfinity’s premium wireless service for a price comparable to the basic services from other carriers. I expect that the significant savings on wireless offered by Comcast will incentivize many consumers to transition to Comcast. Since wireless is exclusive to existing broadband customers, these savings will drive consumers into their broadband internet service as well, allowing Comcast to expand their broadband business in terms of customer count and revenue at rates similar to those observed in recent years. This strategy also adds complexity to switching to other providers once becoming a Comcast customer.

While switching to a different mobile carrier is relatively simple, changing internet providers can be more complex due to the required hardware and cable setup. Requiring a broadband subscription to access the wireless savings will not only continue growing Comcast’s broadband customer count but also reduce customer attrition due the switching costs associated with losing the wireless savings and the hassle of changing internet/cable providers. Significant growth in wireless revenue is also likely as Comcast adds wireless lines from current broadband customers and attracts new customers from other carriers looking to save on their wireless plan.

Valuation

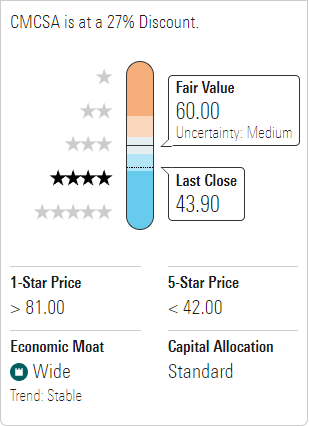

Comcast’s current valuation presents an attractive opportunity for investors. Morningstar estimates a fair value per share of $60.00, indicating a significant 28% compared to its current market price of $43.35.

Morningstar stock valuation analysis (Morningstar analysis on Comcast stock)

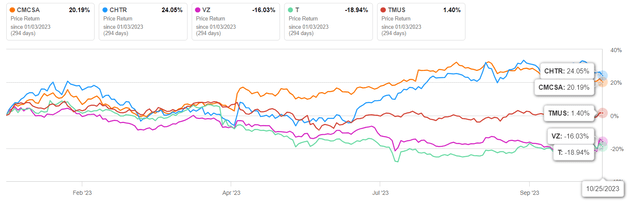

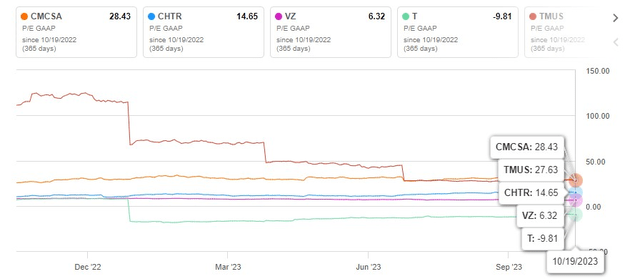

Despite a 20% YTD share price increase, Comcast’s trailing 12-month P/E ratio on a GAAP basis remains relatively stable, ranging between 27 and 33 since the start of 2023. However, when compared to some competitors, Comcast’s stock might appear relatively pricey.

YTD price appreciation among cable and telecom companies (Seeking Alpha) GAAP P/E ratio comparisons among cable and telecom companies (Seeking Alpha)

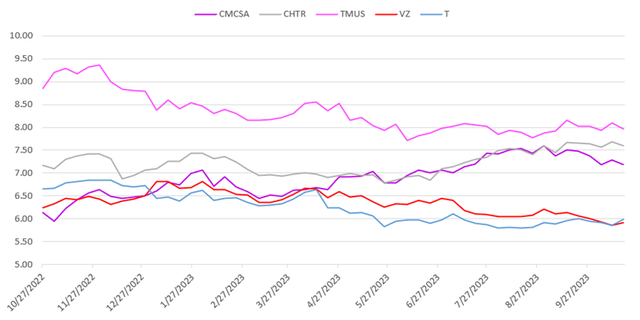

One valuation metric I find valuable for assessing telecom companies is forward EV/EBITDA. It offers a fair comparison by eliminating depreciation expenses, which are typically high in this industry due to large amounts of fixed assets (e.g., network equipment). Furthermore, enterprise value considers total debt and cash, making it useful in debt-intensive industries like cable and telecom. Currently, Comcast boasts a forward EV/EBITDA ratio of 7.23, positioning it in the middle of its cable and telecom industry peers.

1-year EV/EBITDA (FWD) trends of cable and telecom companies (YCharts.com)

Notably, Comcast’s forward EV/EBITDA multiple has been increasing over the past year, while competitors have experienced declines. This uptrend may indicate growing optimism about the company’s future performance, while sentiment surrounding its peers has deteriorated. Comcast’s forward EV/EBITDA ratio also remains below the sector median of 7.99, suggesting its current undervaluation relative to the sector as a whole.

Moreover, Comcast has seldom seen its trailing 12-month EV/EBITDA dip below 8.0 since 2012, typically oscillating between 8 and 10. The current sub-8.0 EV/EBITDA suggests that Comcast maintains a desirable valuation, relative to its past, even after the impressive stock performance this year.

Historical EV/EBITDA ratios for Comcast (Seeking Alpha)

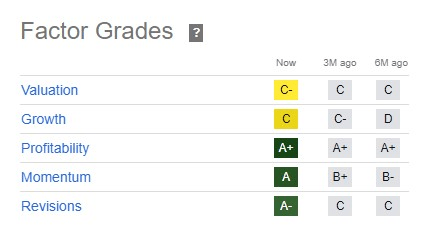

However, it’s also worth noting Seeking Alpha’s quant ratings assign Comcast a valuation grade of C-, indicating a moderate valuation.

Seeking Alpha quant factor grades for Comcast (Seeking Alpha)

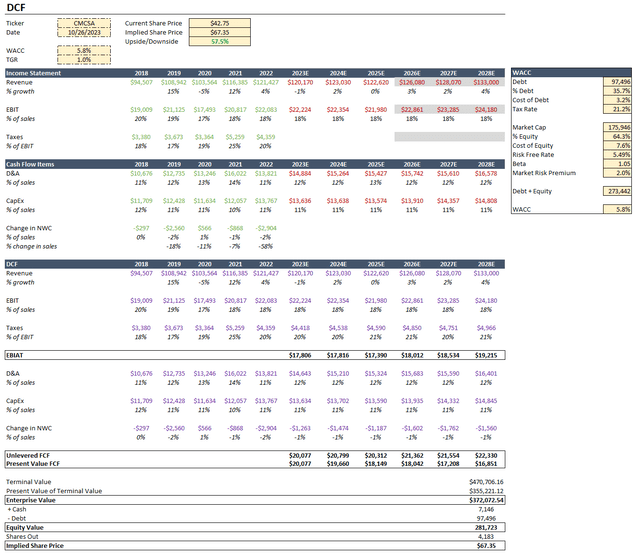

On top of these indicators, I also performed my own DCF analysis of Comcast stock.

Discounted Cash Flow Model for Comcast Corporation Author’s Calculations

For the years 2018-2022, I obtained key financial data from Comcast’s 10-K filings. Sales and EBIT percentages were calculated based on this data. Revenue estimates were sourced from Seeking Alpha. Please note that estimates highlighted in gray may be less reliable due to limited analyst coverage. However, given Comcast’s history as a public company and analyst coverage, these estimates are considered adequate for this DCF analysis.

For non-revenue line items, I calculated averages of the historical percentages to estimate future values. Given Comcast’s stability, this method is considered valid for projecting the future.

I then calculated EBIAT (earnings before interest after taxes) by subtracting the tax expense from the EBIT estimate for each future year.

Next, I computed the Weighted Average Cost of Capital (WACC). The risk-free rate was determined from the current yields on AAA-rated corporate bonds (5.48%). The market risk premium was calculated by subtracting the risk-free rate from the average annual returns of the S&P 500 since 1950 (7.5%), resulting in a 2.0% premium.

After calculating Comcast’s WACC, I computed unlevered free cash flows using the formula:

EBIAT + Depreciation & Amortization – Capital Expenditures – Change in Net Working Capital

I then used these unlevered FCF values to calculate the terminal value and its present value, which, in turn, led to the enterprise value. I opted for a conservative terminal growth rate (TGR) of 1%, in line with Comcast’s recent growth trends.

To find the equity value, I added cash & cash equivalents to the enterprise value and subtracted total debt. Dividing this by the weighted average shares outstanding (diluted) yielded an intrinsic value of $67.35 per share.

An intrinsic value of $67.35 per share represents a substantial 57.5% upside to the current share price of $42.75, indicating that Comcast’s shares are significantly undervalued. As the share price approaches this proposed intrinsic value, reaching around $60 per share, I would definitely not be buying and would consider selling some shares to recoup some of my initial capital investment. Then I would let the rest of my position continue to grow while potentially reinvesting future dividend payments to accumulate more shares at no additional cost.

Risks

Every business carries its fair share of risks, and Comcast is no exception, starting with their balance sheet. The company currently has $32.93 billion in current liabilities and only $24.92 billion in current assets, resulting in a current ratio of 0.76 and suggesting that they may struggle to meet their short-term obligations. A current ratio of less than 1.0 is not abnormal for a company in their industry, but it still leaves the door open for potential issues.

Additionally, Comcast has a net-debt-to-equity ratio of 1.12 and their debt-to-equity ratio has increased from 0.88 to 1.21 over the past 5 years. These two indicators show how Comcast has become increasingly dependent on debt to fund operations, theoretically increasing the risk associated with the company. This could be of particular concern if Comcast needs to issue more debt to cover their obligations, especially considering the federal funds rate is currently at 16-year highs and appears likely to continue rising until inflation is under control.

Another obvious risk is that the 3.5 GHz CBRS spectrum may not live up to its anticipated potential. While recent field tests have been limited to the Philadelphia area where Comcast is headquartered, there’s a chance that the 3.5 GHz CBRS spectrum might not continue to show the promise demonstrated during its relatively small-scale tests. This could result in significant setbacks, especially considering their likely sale of the alternative 600 MHz spectrum. However, this risk seems manageable given the 4-year window for evaluation.

Regarding their business strategy, Comcast could face challenges in converting current broadband customers to their wireless service. While this wouldn’t necessarily impact the business financially due to the low cost of the 3.5 GHz spectrum, it could necessitate a fundamental shift their wireless strategy, possibly nullifying a significant amount of the progress that has been made thus far.

Another risk pertains to the amount of “mobile” spectrum currently owned by Comcast, which is relatively miniscule compared to the portfolios of the industry’s leading mobile carriers. This makes it unlikely that Comcast becomes a prominent competitor in the mobile market, at least in the immediate future.

Comcast, like all communications companies, is subject to regulatory risks from both the U.S. and internationally. Some of these risks include regulations pertaining to net neutrality, content distribution, local franchise agreements, consumer privacy, and FCC oversight.

Among these risks, the current debt situation is particularly concerning. During Q2 of 2023, Comcast issued $5 billion of fixed-rate debt maturing between 2029 and 2064 and made total debt repayments of $3 billion during the same period. The concerning part is that $2.9 billion of the $3 billion debt repayment came from the $5 billion debt issuance. This suggests that Comcast’s cash flows may be insufficient to cover their debt obligations and their business ventures, necessitating further debt issuance to bridge the gap. Taking out new debt to pay off old debt is rarely a positive sign, especially in the current interest rate environment. I will be monitoring the company’s debt situation in the coming quarters and if they continue to rely on new debt issuance to pay down their existing debt, my opinion on the company will likely turn bearish until they get it under control.

Conclusion

The shifting tides within Comcast’s cable communications business segment showcase a strategic transformation, with broadband internet emerging as its cornerstone. The substantial growth in revenues from broadband services and the successful integration of Xfinity Mobile highlight Comcast’s aptitude for adapting to industry trends and consumer preferences.

The recent spectrum deal with T-Mobile stands as a strategic move that underscores Comcast’s adeptness in optimizing assets for maximal value creation. By divesting a portion of its 600 MHz licenses strategically, Comcast focuses on areas where its broadband coverage is already strong, aligning with its wireless service’s target audience. Moreover, the decision stems from Comcast’s promising results with the 3.5 GHz CBRS spectrum, illustrating their effective use of assets to drive impressive returns on investment. The deal’s favorable terms, including Comcast’s right to retain or sell uncommitted licenses and the 2027 timeline for finalization, demonstrate prudent risk management and strategic planning. The lease-to-purchase agreement with T-Mobile further amplifies the deal’s potential upside, converting what could be a dormant asset into a revenue-generating stream while Comcast advances its wireless strategy.

Comcast’s strategic initiatives, bolstered by the spectrum deal and their successful broadband-centric approach, position the company for growth and profitability. While recognizing the questionable elements of their financial health, including their current and net debt-to-equity ratios, the prudent management of debt and favorable credit rating suggests Comcast’s capability to navigate and sustain their operations.

Going forward, I will be closely monitoring Comcast’s debt trends and how they manage their financial obligations. Any signs of increasing reliance on debt may warrant a reevaluation of my current bullish stance on the company. While Comcast faces financial health challenges, its strategic maneuvers, especially in their approach to broadband and wireless, hold promise for investors. Going forward, I will be keeping a watchful eye on the company’s spectrum utilization and debt management practices, looking for the continued success of the 3.5 GHz CBRS spectrum and improving debt management. In the event that, over the next few quarters, Comcast fails to generate sufficient cash flows and continues to rely on new debt issuance to pay down existing obligations, I will probably have to reevaluate my current stance on the company; but until those red flags emerge or unless the share price appreciates that $60-$65 mark in a relatively short period of time, I believe Comcast could make a valuable addition to investors’ portfolios.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.