Summary:

- Intel’s Q3 earnings show the first signs of upward growth in a long time, with a projected 8%-plus YoY growth in Q4.

- The company’s debt load is material, but as an American flag carrier among semi giants, it’s not likely to be a concern to lenders – nor therefore should it be to shareholders.

- We believe Intel needs to simply focus on execution to continue its success. No magic potion is needed, just careful relentless execution.

- We now rate the stock at Hold as it moves up into our “Markup” zone.

Leon Neal

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Boomers’ Boomerang Continues Its Return Path

We’ve posted two articles on Intel this year. Each argued that the US policy of reshoring semiconductor fabrication to reduce dependency upon China or on territories that China may threaten – specifically Taiwan where Taiwan Semiconductor Manufacturing Company Limited (TSM) is based – would benefit Intel Corporation (NASDAQ:INTC) as the obvious flag carrier for Western semiconductor manufacturing. Here are those notes.

This one in January:

Intel note – January 2023 (Seeking Alpha, Cestrian Capital Research, Inc)

And this one in September:

Intel note – September 2023 (Seeking Alpha, Cestrian Capital Research, Inc)

In both cases the company’s numbers looked bad, very bad. Our thesis was and is that the numbers aren’t the thing with Intel – the federal trade policy is the thing, the carrier wave holding the stock aloft – and that worked out, since our number went up even though numbers themselves remained ugly.

Intel Corporation Q3 Earnings Analysis

This just changed with the Q3 earnings print yesterday.

The trade policy argument remains. But the numbers just started to look upwards, for the first time in a long time.

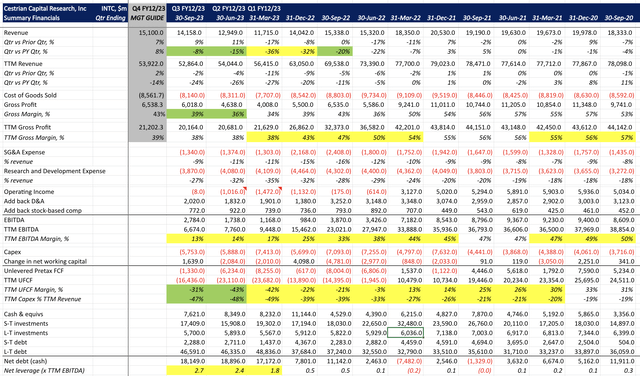

INTC Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis)

If there’s just one number you look at? Look at the Q4 revenue guide. At the midpoint (shown), the company is saying they will deliver 8%-plus YoY growth in Q4 (meaning +8% in Q4 ’23 vs. Q4 ’22). That would be the first positive growth quarter since December 2021. That’s a big deal. Keep doing that for a say two more quarters and TTM growth will be flat. That’s also a big deal.

The debt load looks a lot, but 2.7x TTM EBITDA leverage for an American flag carrier isn’t scary to lenders and nor should it be to shareholders. Cashflow is trending up, meaning, getting less negative.

On fundamentals, Intel we believe just needs to keep on executing. It has to win share in GPU. It has to not miss the market’s required timing in its move to the next smaller process node. And it has to demonstrate a return on the colossal capex it is presently spending in fab-building. This isn’t rocket science in semiconductors, it’s just what good looks like. Execution is the key. As long as execution continues, we think the stock can do well.

INTC Valuation Analysis

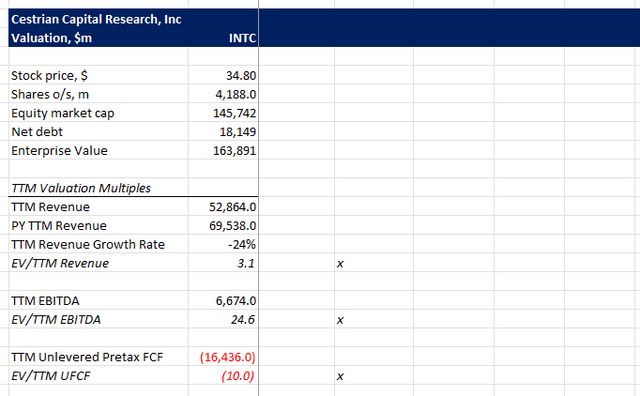

INTC Valuation Multiples (Company SEC Filings, YCharts.com, Cestrian Analysis)

With earnings and cash flow in the state they are, all you can really look to is the revenue multiple. Is 3.1x TTM revenue justifiable as the entry ticket to a future Intel which is growing and moving back to its solid cash flow margins? We believe it is.

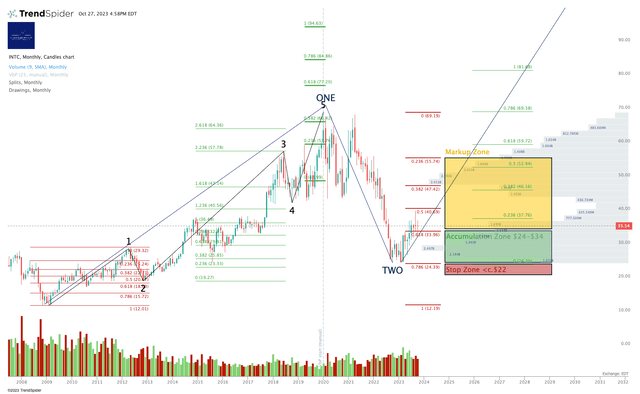

Intel Corporation Stock – Technical Analysis

This is the same chart we posted in January and in September save for time passing.

INTC Chart (Cestrian Capital Research, TrendSpider)

Intel – Stock Rating And Conclusion

Eyes on the prize. Long-term play, this one. The stock moved into our “Markup Zone” once it left $34 behind. We now rate the stock at Hold in anticipation of further gains.

Cestrian Capital Research, Inc – 27 October 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, INTC

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

GET INSTITUTIONAL GRADE BUYSIDE RESEARCH FROM CESTRIAN CAPITAL RESEARCH

We provide investment research prepared to institutional investor quality, presented in a way anyone can understand. Our work allows you to make sense of company fundamentals and stock technicals without resort to jargon or esoterica. We offer Free, Basic and Full membership tiers in our “Growth Investor Pro”. Join us! Click HERE to learn more.