Summary:

- AT&T reported better-than-expected Q3 earnings last week, with strong growth in broadband revenues.

- The broadband business is performing well, with strong subscriber growth and increasing average revenue per user.

- AT&T’s improved free cash flow situation resulted in the telecom raising its guidance for FY 2023 by $500M.

- Higher expected free cash flow translates to lower investment and dividend risks, making the stock an unbeatable bargain in the telecom industry.

Brandon Bell

AT&T (NYSE:T) reported much better than expected third quarter earnings last week which benefited from robust growth in the fiber broadband business, but the telecom also saw an uptick in free cash flow and raised its FCF guidance for FY 2023. AT&T added 296,000 fiber net adds in the third-quarter and reported a double-digit increase in average revenue per user in the broadband business. AT&T’s free cash flow strength as well as raised guidance significantly lower (dividend) risks associated with an investment in AT&T (due to better free cash flow coverage). Shares of AT&T, despite a post-earnings bounce, are still cheap and represent deep value for dividend investors with a long term investment focus!

Previous rating

I rated AT&T a strong buy in May: AT&T: Enough Is Enough, The 7.3% Yield Is Dirt Cheap. I recommended AT&T back then because of the irrational sell-off that took place related to Dish Network partnering up with Amazon (AMZN) to sell wireless plans. Given that AT&T raised its free cash flow guidance and improved its dividend coverage, investors have one more reason to buy the telecom’s shares (or hold on to those they already own).

AT&T submitted a strong Q3’23 earnings sheet

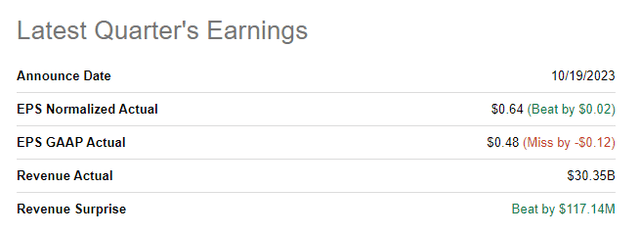

AT&T reported better than expected results regarding revenues and adjusted earnings: the telecom achieved $0.64 per-share in adjusted earnings compared against an average estimate of $0.62 per-share. In terms of the top line, AT&T beat estimates by $117M and reported revenues of $30.4B.

Broadband business is performing very well, strong ARPU gains

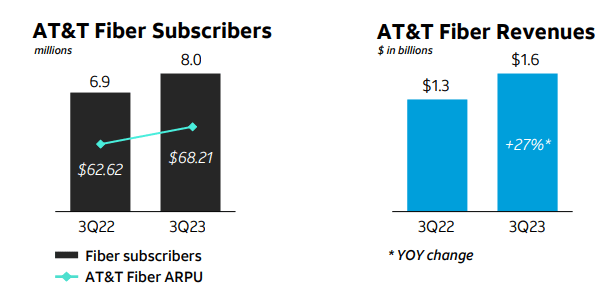

AT&T’s fiber segment is seeing both strong subscriber growth as well as growing average revenue per user/ARPU, a key measure for monetization success. In the most recent quarter, Q3’23, AT&T added 296 thousand new subscribers in its fiber segment and the telecom’s fiber business had 8.0M paying subscribers at the end of the third-quarter.

Source: AT&T

Additionally, AT&T’s fiber ARPU continued to expand, reaching $68.21 in Q3’23 and showing 8.9% year over year growth. Total broadband ARPU gained almost 11% to $64.91 per user. Fiber growth especially has fueled AT&T’s broadband results in recent quarters with fiber revenues rising 27% year over year.

| Broadband KPIs | Q3’22 | Q4’22 | Q1’23 | Q2’23 | Q3’23 | Y/Y Growth |

| Revenue | ||||||

| Fiber | $1,271 | $1,376 | $1,453 | $1,523 | $1,613 | 26.91% |

| Non-Fiber | $1,158 | $1,116 | $1,074 | $1,038 | $1,054 | -8.98% |

| Total Revenue | $2,429 | $2,492 | $2,527 | $2,561 | $2,667 | 9.80% |

| Net adds | ||||||

| Fiber (in thousands) | 338 | 280 | 272 | 251 | 296 | -12.43% |

| Non-Fiber (in thousands) | -367 | -323 | -295 | -286 | -281 | -23.43% |

| ARPU | ||||||

| Fiber | $62.62 | $64.82 | $65.92 | $66.70 | $68.21 | 8.93% |

| Non-Fiber | $54.80 | $55.54 | $56.00 | $56.71 | $60.43 | 10.27% |

| Total Broadband ARPU | $58.63 | $60.31 | $61.31 | $62.26 | $64.91 | 10.71% |

(Source: Author)

Q3’23 free cash flow, upgraded FCF guidance for FY 2023 and dividend coverage

Strong momentum in broadband improved AT&T’s free cash flow situation quite dramatically in the third-quarter. The telecom reported $5.2B in free cash flow in Q3’23 compared to $4.2B in Q2’23. The $5.2B in free cash flow in Q3’23 included a $0.9B payment from DIRECTV.

Year-to-date, AT&T’s free cash flow totaled $10.4B. In the same period last year, AT&T generated $8.0B in free cash flow, meaning the telecom generated $2.4B more in total YTD free cash flow than in the same period last year. The dividend coverage ratio in the first three quarters of FY 2023 was a massive 170%, suggesting that investors don’t need to be worried about AT&T’s dividend going forward.

The improved free cash flow situation has profound implication for AT&T‘s dividend stability and dividend coverage ratio because the dividend is now much better covered than it was at the beginning of the year.

AT&T also raised its free cash flow forecast for FY 2023 from “$16.0B or better” to $16.5B, reflecting a $500M increase compared to the previous guidance. Verizon (VZ) raised its free cash flow forecast by $1.0B to a new range of $18B. Based off of AT&T’s new free cash flow guidance, and calculating with $2.0B in quarterly dividend payments, AT&T is on track to achieve a forward dividend coverage ratio of 202%. For comparison, Verizon has a leading dividend coverage ratio of 161%, so AT&T has the better metrics on its side here… and therefore the dividend should be safer as well.

AT&T is an unbeatable bargain

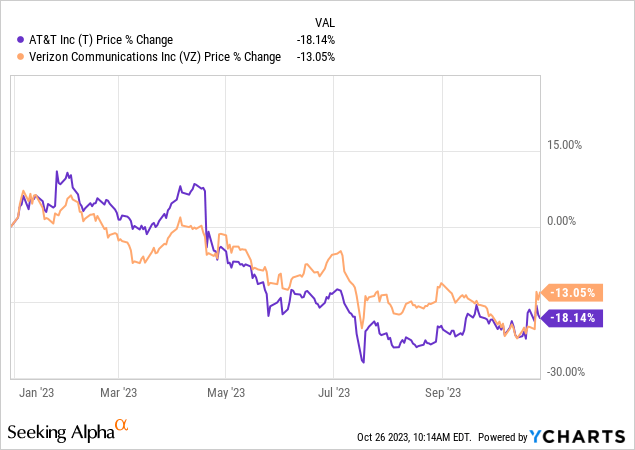

AT&T remains undervalued, in my opinion, and represents an unbeatable bargain, even in a direct comparison to Verizon… which itself has a low valuation based off of free cash flow and earnings. In my opinion, AT&T currently represents the best value in the telecom sector based off of dividend coverage ratio and valuation.

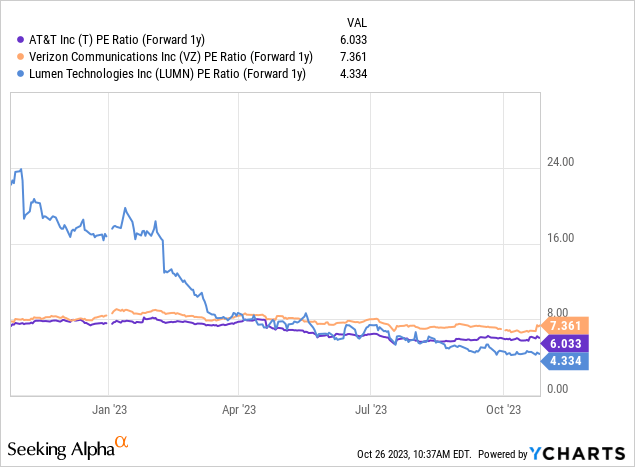

Verizon expects $18.0B in free cash flow, implying a P/FCF ratio of 8.0X while AT&T is trading at 6.6X FCF. Verizon’s P/E ratio is 7.4X while AT&T is trading at 6.0X FY 2024 earnings. I don’t see a real justification for the difference in valuation ratios, either based off of free cash flow or earnings, since both companies see the same momentum in broadband and offer a comparable dividend. Both companies saw a surge in FCF in Q3’23 and both telecoms raised their forecasts.

The value proposition for Verizon is also great — The Suffering May Finally End — but not as great as with AT&T, in my opinion. Lumen (LUMN) has the lowest P/E ratio, but the telecom is suffering a huge decline in EBITDA and free cash flow due to asset divestments: Rapidly Deteriorating Situation.

Risks

AT&T is a mature telecom and the company is not going to see strong top line growth going forward. However, AT&T (as well as Verizon) achieves a very significant amount of free cash flow from its legacy telecom assets and investors should see AT&T chiefly as a capital return play, not as a growth investment. What would change my mind about AT&T, however, is if the company were to report decelerating momentum in its fiber broadband business or saw a drop-off in free cash flow.

Final thoughts

AT&T proved all the naysayers wrong with its third-quarter earnings release. Post-earnings, AT&T’s dividend carries less risk… as the firm’s free cash flow coverage ratio improved. Based off of the current full-year FCF outlook, dividend investors can expect more than 200% dividend coverage which, theoretically at least, would allow for a dividend increase. Since AT&T’s free cash flow supports the dividend and fiber broadband is likely to remain AT&T’s bright spot, I believe AT&T shares represent the best deal in the large-cap telecom business for investors right now. From a valuation perspective, I continue to see AT&T as an unbeatable bargain: with a P/FCF ratio of 6.6X, the free cash flow yield exceeds 15% and investors can collect a reasonably safe 7.3% dividend yield as well!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.