Summary:

- Bank of America has been oversold indeed, with it suffering a similar ailment to C, where both stocks are notably trading below their book values.

- This is despite the sustained expansion in its NIY and RoTCE, implying the bank has been able to generate alpha despite the Fed’s sustained rate hike thus far.

- For now, it appears that Mr. Market is increasingly concerned about BAC’s unrealized losses, which we believe to be unwarranted since most of them belong to HTM debt securities.

- Then again, based on Powell’s pessimistic commentaries, it appears that many have adopted a sell first and think later attitude, especially since the US Treasuries Yields continue to climb.

- As a result of the potential volatility, investors may want to monitor market sentiments for a little longer and only add if the critical support levels of $25s hold through in the near term.

Lemon_tm/iStock via Getty Images

We previously covered Bank of America (NYSE:BAC) in July 2023, discussing its excellent performance in the FQ2’23 quarter, with stable deposits, robust liquidity sources, and growing profitability.

We continued to rate the stock as a Buy then, since we believed that the sell-off had been overly done, with the management’s excellent risk management proving the bears wrong.

In this article, we will be discussing the massive pessimism embedded in the BAC stock’s valuations and its mixed prospects, thanks to the mistaken perception that its unrealized losses are growing.

While we continue rating the stock as a Buy here, thanks to the outperformance of its quarterly financial reports, investors may want to brace for impact, since it remains to be seen when bullish support may materialize with the macroeconomic outlook still uncertain.

The Pessimism Embedded In BAC’s Stock Valuations Is Not Unique

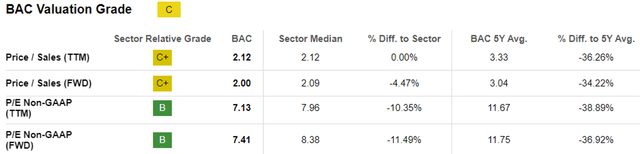

BAC Valuations

For now, BAC’s FWD P/E valuation of 7.41x appears to be discounted compared to its 5Y means of 11.75x and sector medians of 8.38x. When compared against its 3Y pre-pandemic mean of 11.53x, we believe that the correction has been overdone indeed.

Then again, investors may want to note that the same correction has also been observed with its direct peers, such as JPMorgan Chase (JPM) at FWD P/E of 8.57x/ pre-pandemic mean of 12.12x, Citigroup Inc. (C) 6.47x/ 10.30x, and Wells Fargo (WFC) at 7.72x/ 11.76x, respectively.

Perhaps much of the headwind may be attributed to Jerome Powell’s recent pessimistic commentary:

Still, the record suggests that a sustainable return to our 2 percent inflation goal is likely to require a period of below-trend growth and some further softening in labor market conditions.

Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy. (CNBC)

BAC Has Executed Well, Despite The Uncertain Macroeconomic Outlook

With the rates likely to remain elevated for a little longer and the macroeconomic outlook still uncertain, it appears that BAC’s unrealized losses may worsen from henceforth, along with the deposit flight to Treasuries/ Money Market Funds.

In FQ3’23, the bank reports a burgeoning unrealized losses of $136.22B (+24.2% QoQ/ +11.8% YoY) and normalizing net charge-off rates of 0.35% (+0.02 points QoQ/ +0.15 YoY), compared to FY2019 levels of $806M (-90.9% YoY) and 0.38% (-0.03 points YoY), respectively.

Its growing unrealized losses also imply an eye-watering loss ratio of 17.3% (+2.9 points QoQ/ +3.6 YoY), based on the amortized cost of $783.42B (+3.1% QoQ/ -11.5% YoY).

Then again, we must also remind BAC investors that it is important to differentiate between Available-For-Sale debt securities and Held-To-Maturity debt securities, with the former being “purchased with the intent of selling before they reach maturity” and the latter being “purchased to be owned until maturity.”

As a result, it may be better to only zoom in to the bank’s AFS debt securities, since the segment’s unrealized losses appear to be reasonable at $4.55B (+21.3% QoQ/ -13% YoY) and at a loss ratio of 2.6% (+1 points QoQ/ +0.4 YoY) in the latest quarter.

While the ratio may appear to be elevated compared to FY2019 loss ratio of 0.18%, we believe it is manageable since it is not too far from FY2018 levels of 2.3%.

Therefore, we believe BAC investors may rest assured that the management appears to be executing competently, especially since the elevated interest rate environment has been a net positive thus far.

The bank has consistently reported excellent growth in its Net Interest Yields to 2.64% (-0.01 points QoQ/ +0.13 YoY) and RoTCE to 15.5% (inline QoQ/ +0.3 points YoY) by the latest quarter.

This is compared to FY2019 levels of 2.91% (+0.49 points YoY) and 14.9% (-0.65 points YoY), respectively, implying BAC has been able to generate alpha despite the Fed’s sustained rate hike thus far.

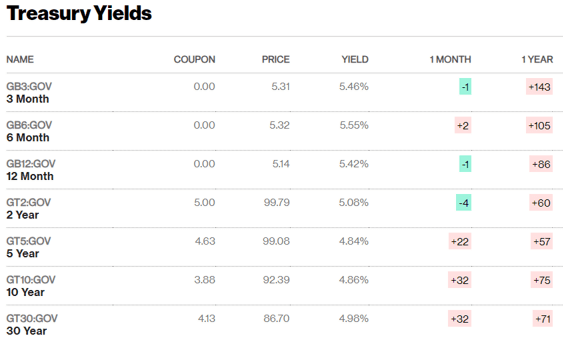

US Treasury Yields

Bloomberg

For now, the US 10Y Treasury Yields already near +4.86%, with the 6M Treasury Yields also hitting +5.55% at the time of writing.

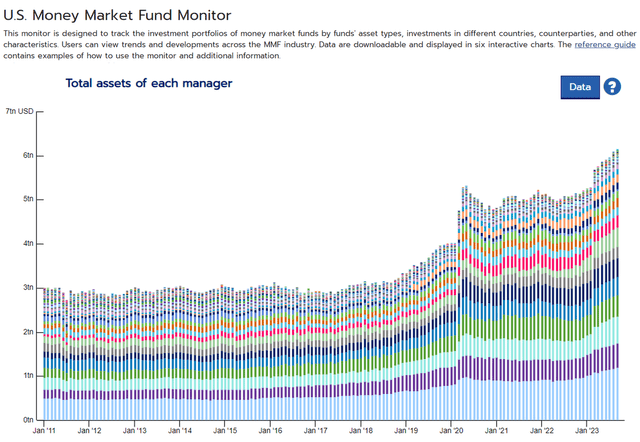

US Money Market Fund

This has partly contributed to the growing Money Market Funds to $6.16T by the end of September 2023 (+21% YoY from $5.09T/ +58.7% from 2019 levels of $3.88T).

This phenomenon has also triggered multiple banks’ minimal deposit growth and/ or increasing outflows, as witnessed in JPM at $1.71T (inline QoQ/ +1.1% YoY), C’s total deposits at $1.27T (-3% QoQ/ -2.7% YoY), and WFC at $1.34T (inline QoQ/ -4.2% YoY) in the latest quarter.

Inversely, BAC has reported a decent interest-bearing deposit growth to $1.31T by the latest quarter (+2.3% QoQ/ +8.2% YoY), going against the market trend, further demonstrating depositors’ confidence in its Big 4 Status.

While it remains to be seen if the uptrend may continue, we remain convinced about the bank’s intermediate-term prospects, as demonstrated from its FQ3’23 results.

So, Is BAC Stock A Buy, Sell, or Hold?

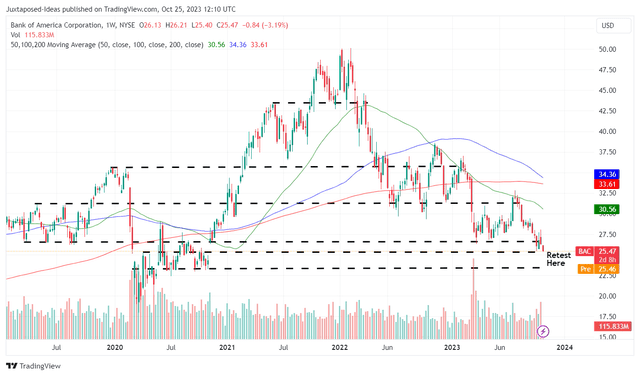

BAC 5Y Stock Price

BAC has now suffered from immense pessimism as sentiments tanked and its stock reached a new bottom since 2021. With it currently retesting its critical pandemic support level of $25s at the time of writing, it remains to be seen when bullish support may materialize and the decline may end.

Since our first coverage in March 2023, the stock has also lost another -10.69% of its value, implying that it may be a dividend trap in the near term.

However, income hunters may also want to note that BAC now offers a richer forward dividend yield of 3.77%, compared to its 4Y average of 2.43% though still lagging behind the sector median of 4.22%.

There is also a capital appreciation prospect to our long-term price target of $44.41, based on the consensus FY2026 adj EPS estimates of $3.78, once the macroeconomic outlook normalizes and its valuations are corrected to its historical P/E mean of 11.75x.

Most importantly, BAC experiences a similar phenomenon as that of C, with both stocks being notably undervalued against their book value per share of $32.65 and $99.28, respectively.

As a result of the different factors discussed above, we believe the upside potential for BAC remains excellent once market sentiments normalize.

Then again, based on the Treasuries’ excellent yields for the near future, the stock may not be suitable for everyone, especially those with lower risk tolerance.

As a result of the potential volatility, while we may rate the BAC stock as a Buy, investors may want to monitor market sentiments for a little longer, especially given the higher fear index, and only add if the critical support levels of $25s hold in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.