Summary:

- Despite concerns about regulations and high fees, Airbnb is still seen as an exceptional business with growing revenues and distinctive offerings.

- Airbnb has disrupted the travel industry and has potential for further growth in underpenetrated markets, particularly in Asia.

- The company’s management team, led by co-founders Brian Chesky and Nathan Blecharczyk, has a track record of success and a focus on long-term growth.

pixdeluxe/E+ via Getty Images

Once one of the hottest IPOs of 2020, Airbnb (NASDAQ:ABNB) has since fallen from grace as all you seem to hear today is concerns about the New York regulations, high fees such as cleaning costs, and poor, non-responsive hosts.

While there is some cause for concern, I still believe this is an exceptional business. With growing revenues, brilliant co-founders still at the company, and absolutely distinctive offerings, I am a believer and think this company will be a winner for patient long-term investors.

Now, let’s dig into some details about this travel industry disrupter.

The Company

Airbnb started out as a way for some roommates to make a few extra bucks. In 2007, Brian Chesky and Joe Gebbia began renting out space in their San Francisco apartment. They offered their guests an air mattress and breakfast, thus the idea of “air bed and breakfast” was born. The next year, Chesky and Gebbia brought in the company’s third co-founder, Nathan Blecharczyk as the team looked to expand on their idea.

From these humble beginnings Airbnb has turned into a juggernaut in the travel space. As of the company’s 10K filing, there are more than four million Airbnb hosts who have welcomed over 1.4 billion guests in more than 100,000 different cities across the globe.

Speaking from personally experience, I love using Airbnb. It provides an experience which hotels often can’t provide. Many of the homes are unique and provide fun features such as bikes to ride, beach accessories and essentials for parents such as cribs and booster seats just to name a few. Our family has used Airbnb at least a few times every year over the last several years and I believe we’ll continue to use Airbnb for future travel.

Airbnb has disrupted the travel industry and has become one of the most beloved and well-known brands in the world. The COVID-19 pandemic changed the way consumers make travel plans and Airbnb was certainly one of the long-term beneficiaries. Even with the success the company has achieved over the last several years it is still one of most downloaded travel apps.

Moat and Opportunity

Airbnb was a massive disrupter in the travel industry and they have numerous advantages compared to rivals. One key advantage is the number of listings on Airbnb. With a great number of options, consumers are more likely to find an option in their price range. Additionally, with Airbnb you can rent a “shared space” such as a room with a host. Many competitors such as Vrbo don’t rent out such spaces.

With more listings, travelers have more flexibility. Using Airbnb’s search criteria it is easier to find hosts matching specific criteria such as those with last-minute cancellation policies or hosts that allow pets.

Despite the large growth in the United States and Europe, Airbnb is still under-penetrated in most countries around the world. Airbnb has experienced recent success is many of these under-penetrated markets as Chesky gave two examples on the Q2 2023 earnings call. Germany and Brazil were underachieving countries but since the pandemic Brazil has doubled in size and Germany has grown by 60%. Germany is now on track to be one of the largest countries in the world on Airbnb.

Chesky and team are hoping to bring that same success to Asia. The team is focusing on Japan and Korea first and I think there is a huge potential for growth in Asia Pacific. The hotel industry is 10 times the size of Airbnb so even outside of Asia there are significant opportunities for Airbnb to continue to grow the core business.

Another opportunity is experiences. Chesky noted on the latest earnings call, “…People love experiences. 95% of reviews that are left for experiences end in a five-star review.”

Additionally, Chesky noted how AI could help the organization as well in the future. He gave a few examples such as an AI chat interface and an AI concierge which could match a customer to local experiences and local hosts across the globe.

Competition is certainly growing in this industry, but I believe Airbnb’s moat is still intact as they have the first mover advantage. Airbnb’s offerings are unique, and many are one of a-kind such as the Barbie Malibu Dreamhouse. Airbnb partnered with the Barbie movie for this experience, and it has been a huge hit for Airbnb as it has become the most popular listing ever. These are the one-of-a-kind experiences you can share with your family and friends, and I believe Airbnb is a disrupter who will continue to provide consumers with more one-of-a-kind experiences.

Management

Brian Chesky is Airbnb’s co-founder and Chief Executive Officer. Follow co-founder Nathan Blecharczyk is the company’s Chief Strategy Officer. The last co-founder Joe Gebbia is currently Chairman of Airbnb.org which is a nonprofit helping to relocate those in crisis.

Dave Stephenson is the company’s Chief Financial Officer and Head of Employee Experience. Stephenson has been with Airbnb for over four years. He’s previously held leadership positions at Amazon.

As you can see from the below Glassdoor ratings, Airbnb is viewed as a good place to work, and the majority of employees approve of Chesky:

Glassdoor

I am a big believe in founder CEOs due to their propensity to focus on the long term. I believe this is a superb management team that has changed the travel industry while maximizing shareholder return.

Recently Chesky has given some interviews in which he cites issues with the business and how Airbnb is working to overcome them. Some may view these comments as a negative but I view them as a positive for long-term investors. Many CEOs stick to sharing the positives and painting a rosy picture of the business. I like a CEO who can learn, adapt and improve the business.

Thus far Chesky and team have shown they are willing to use profits to reinvest in the business and make further enhancements. With a return on equity of over 40% and a return on invested capital of over 15% this team knows how to reinvest profits which I believe will ultimately reward the long-term investor.

Financials

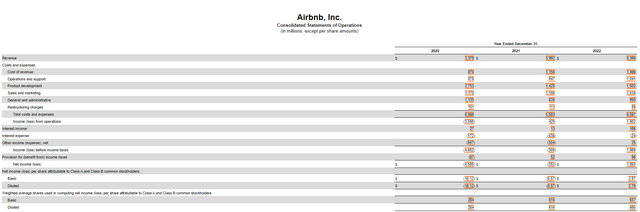

Airbnb’s growth has been impressive. As you can see from their prior 10K filing, the company has grown revenues and was able to turn profitable in 2022:

This represents a three-year revenue CAGR of over 20%.

In Q2 2023, revenue was $2.5 billion which is an increase of 18% compared to Q2 2023. Net income came in at $650 million which represented a net income margin of 26% and free cash flow for the quarter was $900, an increase of 15% compared to the prior year. Trailing 12-month free cash flow margin was an impressive 43%.

The company has a healthy balance sheet as of Q2 2023 as you can see below:

The company has nearly $8 billion in cash and total current assets of roughly $20 billion which is enough to cover all of the company’s liabilities.

Regarding key metrics for the business, in the quarter nights and experiences increased 11% compared to Q2 2022. Active bookers increased in every region. Guests traveled farther too as cross-border nights increased 16% compared to the prior year second quarter. Finally, guests are staying longer. 18% of all nights booked at for long-term stays.

Airbnb also added a record number of new listings in Q2 as the company ended the quarter will over 7 million in active listings.

Q3 2023 earnings are coming out shortly. Expectations are revenues will come in between $3.3 billion and $3.4 billion, which is implied growth of 14-18% percentage. EPS range is $1.71 – $2.49 a share. Airbnb has beaten EPS estimates over the last several quarters and I expect that trend to continue.

Even with rising rates, the consumer has been resilient. Consumption on goods may have slowed but consumer spending on services such as vacations does not have appeared to yet. My expectation is that Airbnb will continue to beat estimates and deliver 18% growth, thus revenues closer to $3.4 billion. As mentioned above, Chesky has done recent interviews suggesting the core business needs to be improved. I expect to get further insights into how the team addresses such issues, such as higher costs. Additionally, I’m expecting to hear some comments about the New York regulations and further regulations. Lastly, I hope to hear continued improvements surrounding AI.

Risks

There are certainly positive trends for Airbnb, but let’s now look at those some risks the organization is facing.

Clearly the largest risk for Airbnb is regulation. Investors have to be concerned the situation in New York doesn’t snowball and more and more cities follow suite. No city currently makes up for that 1.5% of the organization’s total business and New York isn’t even the top three largest cities for Airbnb (those cities are Paris, London, and Los Angles). As a global business this diversification is currently helpful yet investors need to keep a close eye on regulations to see if more cities places difficult restrictions on Airbnb.

Airbnb does have first mover advantage, but competition is heating up. The executive team needs to ensure Airbnb stays relevant and continues to roll out new features. Whether that’s with experiences or an AI concierge service as I’ve previously mentioned, Chesky and team will need think of ideas beyond the core business to maintain their dominant position in the industry.

Valuation

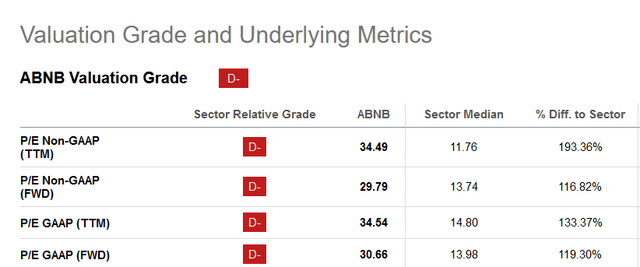

Seeking Alpha’s valuation grade for Airbnb is a “D-.”

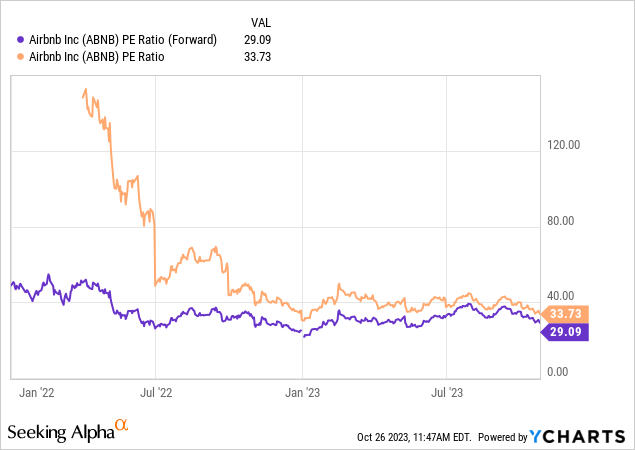

At 30X forward earnings Airbnb certainly doesn’t appear to be a cheap stock when compared to the median within the sector.

However, compared to historical data you can clearly see Airbnb is much more reasonable.

Airbnb had a massive valuation at its IPO date but the valuation was come down significantly. That it is not to say Airbnb is an inexpensive stock but it’s far more reasonable for long-term looking to accumulate shares in this company.

Conclusion

I think the three co-founders have created a stellar organization. Like Google before it, Airbnb has become a verb as this disruptive company has completely transformed the travel industry. Airbnb has over four million hosts, many with unique one-of-a-kind listings that aren’t be found elsewhere.

However, the NYC regulations are certainly concerning for Airbnb investors and if similar restrictions begin to take shape across the globe, the organization would obviously be negatively impacted.

The company also needs to continue to innovate and move beyond the core business to create a valuable experience for Airbnb consumers.

I believe in these three co-founders as they have created an industry disrupter. Despite, the regulations enacted in New York and occasional damaging remarks on social media, I think the negativity surrounding the organization is overblown. The company’s financials are impressive and many of the company’s key metrics are moving a positive direction for the organization.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.