Summary:

- Adobe is driving innovation with generative AI and other applications, attracting new users to its platform.

- AI monetization and price increases should drive growth next year.

- That said, the stock is now one of the more expensive stocks among its peers after a strong run.

gorodenkoff

Back in May, I placed a “Buy” rating on Adobe (NASDAQ:ADBE) saying that with a near monopoly on creative software and with generative AI looking like a potential growth driver that the stocked looked attractively priced. With the stock up over 47% since then versus about breakeven for the S&P, let’s take a closer look at the name.

Company Profile

As a refresher, ADBE offers software solutions designed for creative professionals such as graphic designers, video editors, photographers marketers, and content creators, among others. Its Adobe Creative Cloud portfolio, which is part of its Digital Media offering, houses a number of well-known programs including Photoshop, Lightroom, InDesign and Illustrator, among others. Its Adobe Document Cloud, which includes offerings such as Acrobat, Acrobat Reader, Acrobat Scan, and Acrobat Sign, are also found in its Digital Media segment.

The company also offers products aimed at helping manage the customer experience, through its Digital Experience Offerings. Products in this segment include Adobe Experience Platform; Data, Insights and Audiences; Content and Commerce; Customer Journeys; Marketing Workflow; and Digital Enrollment and Onboarding.

ADBE’s products are usually sold through a software as service (SaaS) subscription model, but it also offers some managed services, term subscriptions, and pay per use offerings.

Fiscal Q3 Results and Investor Day

ADBE posted solid Q3 results last month, with revenue increasing 10% to $4.89 billion. That topped the consensus of $4.87 billion. Adjusted EPS rose 20% to $4.09, beating analyst estimates by 11 cents.

Digital Media segment revenue rose 11%, or 14% in constant currencies to $3.59 billion. Creative revenue was up 11%, or 14% in constant currency, to $2.91 billion, while Document Cloud revenue climbed 13%, or 15% in constant currencies, to $685 million.

Management said that digital content creation and consumption was strong across categories, media types, and customer segments. It noted that it saw a lot of single app subscriptions for Photoshop given the interest in Firefly and generative AI. It also said that demand for Adobe stock photos was strong.

Digital Experience segment revenue rose 10%, or 11% in constant currencies, to $1.23 billion, with Digital Experience subscription up 12%, or 13% in constant currency, to $1.10 billion. The company called out the Adobe Experience Platform as being particularly strong, with subscription revenue up 60% year over year.

Digital Media Annualized Recurring Revenue jumped to $14.6 billion, with new ARR of $464 million. Creative ARR was $11.97 billion, with new ARR of $332 million, while Document Cloud ARR came in at $2.63 billion, with $132 million in new ARR.

Looking forward, ADBE forecast fiscal Q4 revenue of between $4.975-5.025 billion. The consensus was for $5.0 billion in revenue at the time.

It expects Digital Media segment revenue of between $3.67-3.70 billion and Digital Experience segment revenue of between $1.25-1.27 billion. It guided for adjusted EPS of between $4.10-4.15. The consensus at the time was for adjusted EPS of $4.06.

ADBE’s Firefly models web application are now commercially available. The company began offering new generative AI credits that will allow customers to turn text-based prompts into images, vectors and text effects. Free and trial plans include a small number of monthly generative credits, while paid subscriptions will include more. Once used, subs will have the option to buy additional credits subscription packs. The company will also increase some prices starting November 1st.

At its investor day, ADBE talked more about its innovation with its Firefly AI platform, as well as Adobe Express, which is a media creation app that can help users create things such a social media graphics and promo videos. The latter looks like it competes with Canva.

Discussing the opportunity with Firefly and Express at its Investor Day, President of Digital Media David Wadhwani said:

“We’re very excited about both Firefly and Express. …. One of the things that we’ve talked about is that these really represent great expansion opportunities in terms of the top of funnel, right? 9 out of 10 Firefly users are not Adobe subscribers. That gives you a sense of like how much these things are resonating with a base of people that we weren’t able to resonate before. 25% and all of this stuff has also driven a 25% increase in terms of traffic to Adobe year-over-year. So we’re very excited about how this positions us and what we can do to reach audiences that we’ve never been able to reach in the past. And Firefly is great because it’s a playground for anyone that wants to come in and try generative AI. And the more serious they get, the more we use — they use it, we’re going to journey them over to Express, which, by the way, also is benefiting from all the work that we’ve deployed here. Express grew 20% quarter-over-quarter monthly active users, right? We just launched Express, and we immediately saw this incredible ramp because of the new architecture, the performance, the speed and all of the generative work that’s been put in there. And the other thing that we’ve always talked about, but it was great to see, was this massive jump in terms of Creative Cloud users that are also using Express. You heard Scott this morning, if you were at the show, talk about how Express is not just for the masses, but it’s also a great value to Creative Cloud subscribers. And that’s going to drive more engagement and more collaboration between those Creative Cloud subscribers that are creative professionals and their marketing organizations.”

ADBE put up some solid numbers last quarter, but what is more exciting is how the company is driving innovation with generative AI and other applications. The company already has a solid plan to monetize its Firefly platform, but just as importantly, it’s driving users who are new to ADBE to the platform. Given ADBE’s position in the creative space, that’s quite an accomplishment. Meanwhile, Express looks like another innovation that has strong potential given the role Tik Tok and Instagram play in many people’s lives.

The company’s price increase, meanwhile, should help boost results next fiscal year, as well. While customers may not like that prices are going up, they certainly must like the pace of innovation that ADBE is delivering.

Valuation

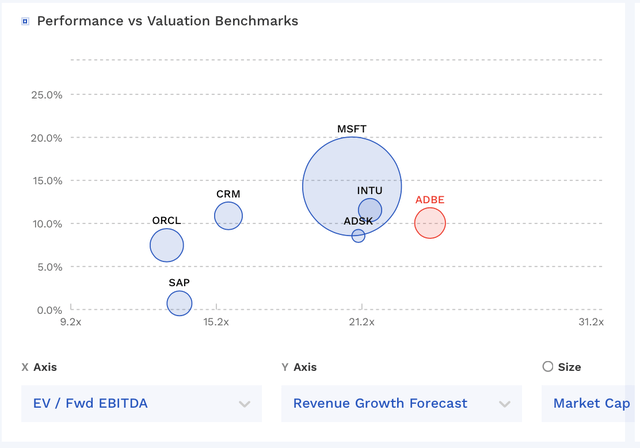

ADBE stock currently trades around 16.4x the FY2024 (ending November) consensus EBITDA of $10.8 billion and 14.7x the FY2025 consensus of $12.0 billion.

It trades at a forward PE of nearly 22x the FY24 consensus of $17.95.

Revenue growth is expected to be up 12.2% in FY2024 and up 12.5% fiscal year 20254.

The stock trades towards the higher end of where other large software firms trade.

ADBE Valuation Vs Peers (FinBox)

Conclusion

I really like the direction ADBE has been heading, pushing innovation with things like AI, as well as into other areas like media creation through Express. The company has a solid monetization plan with AI and selling token plans, which along with price increases should drive results next fiscal year.

That said, the company has gone from being one of the least expensive large software firms to one of the most expensive in the last several months. As such, it is no longer the value it was when I first looked at the name and placed a “Buy” rating on the stock. As such, while I like the stock and would continue to “Hold,” and wouldn’t be a new money buyer at these levels. I think the stock looks appropriately value at current levels and is pricing in what will likely be some nice guidance for next fiscal year. As such, I’m going to take the stock down to “Hold.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.