Summary:

- The Tesla, Inc. and CEO Elon Musk full self-driving story has yet to play out as promised, with adoption appearing to be decelerating, as demonstrated by Tesla’s moderating service revenues and declining gross margins.

- Sentiments have been worsened by the automaker’s impacted automotive revenues and gross margins as well, given the sustained price cuts.

- Despite this, Tesla continues to report elevated inventory levels, thanks to issues with EV demand, with it similarly delaying the construction of its Mexico plant.

- While Mr. Market continues to view Tesla stock favorably, as demonstrated by its elevated P/E of 65.91x against the sector median of 13.65x, the premium is no longer compelling here.

- We may be looking at a negative sum game here, with Tesla unlikely to recover its hyper-pandemic profit margins, thanks to the uncertain macroeconomic outlook and the intensifying EV/ADAS competition.

gremlin/E+ via Getty Images

We previously covered Tesla, Inc. (NASDAQ:TSLA) in July 2023, discussing the stock’s premium valuations and optimistic recovery since the January 2023 bottom.

It appeared that Mr. Market had been convinced about CEO Elon Musk’s Full Self-Driving [FSD] as a SaaS (Software as a Service) strategy, since the automakers’ Service gross margins had been expanding despite the impacted Automotive gross margins.

For now, we believe that Elon Musk’s SaaS strategy is starting to show cracks, since TSLA’s FSD is an optional offering in its arsenal, with the elevated interest rate environment and tightened discretionary spending likely triggering cancellations in subscriptions.

We shall discuss further.

The FSD Investment Thesis May Have Temporarily Backfired

For context, TSLA originally offered FSD for $5K in April 2019, with prices continuously raised to $8K in July 2020, $10K in 2021, $12K in 2022, and finally $15K by H1’23, before the recent discount to $12K in September 2023.

Investors may want to note that a monthly subscription option is also available for between $99 and $199, depending on the drivers’ existing packages.

The FSD story has been interesting then, since Musk previously projected an overall vehicle value of up to $200K once fully autonomous, assuming a high take rate from its drivers.

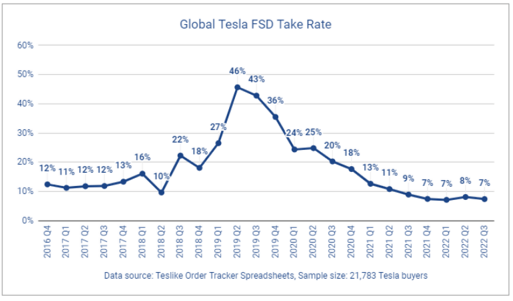

FSD Take Rate Globally

Patreon

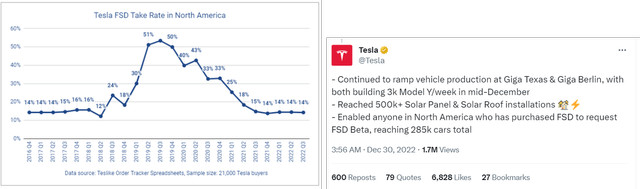

FSD Take Rate Domestically

For one moment in time, TSLA’s FSD take rate had been robust — indeed, likely convincing Mr. Market — with the North American segment reporting an immense rate of up to 51% in Q2’19, with the global segment similarly at over 40% then.

However, it appears that the value proposition has not been convincing enough, as FSD’s prices continue to rise to between $12K and $15K, since drivers will need to use the same vehicle for at least 60 months to break even to the higher-tier monthly subscription fee of $199.

These declining take rate have also been validated by TSLA’s tweet, with a total of 285K cars with FSD in North America by the end of 2022, implying a take rate of approximately 19% based on 1.5M vehicles sold in the region, with no further updates offered thus far.

This trend is unsurprising, since the automaker’s FSD is equivalent to an ADAS Level 2, a semi-autonomous driving system, instead of the full automation perceived by the term.

Existing drivers are increasingly frustrated about the actual value of FSD as well, since TSLA has not been consistent thus far. While Elon Musk has previously touted the capability as an “appreciating asset” back in 2019, it appears that the same story is no longer applicable when a used vehicle is traded in, with the automaker only valuing FSD at “less than $10K.”

The latest data from Consumer Reports also suggest that TSLA’s FSD capability is not convincing enough, with the system only scoring 61 points compared to its competitors’ outperformance. For example, Ford Motor Company’s (F) BlueCruise remains the winner in the latest round of review (ending August 2023), with Volkswagen (OTCPK:VWAGY) placing second, and TSLA far and away at eighth in rank.

These headwinds may have resulted in its stagnating FSD adoption, triggering TSLA’s underwhelming growth rate in the Services & Other Revenues at $2.16B by the latest quarter (+0.4% QoQ/ +31.7% YoY), with a declining gross margin of 5.9% (-1.8 points QoQ/ +1.9 YoY).

This is why we believe that Elon Musk’s hyper-optimism surrounding FSD’s prospects has backfired, with it remaining to be seen when TSLA may achieve full autonomous capabilities and when the system may be approved legally, worsened by the CEO’s pessimistic commentary in the recent Q3 earnings call:

Obviously, in the past, I’ve been overly optimistic about this.

The reason I’ve been overly optimistic is that the progress tends to sort of look like a log curve, which is that you have kind of rapid initial improvements that if you were to extrapolate that rapid fairly linear rate of improvement, you get to self-driving quite quickly, but then the rate of improvement curves over logarithmically as such to asymptote. That’s now happened several times. (Seeking Alpha.)

As a result of the different factors discussed above, we believe that TSLA’s prospects seem to be murky moving forward, with EV adoption appearing to be peaking thanks to the uncertain macroeconomic outlook.

This has consequently triggered multiple automakers’ deceleration in the EV production ramp-up, with Elon Musk similarly delaying the construction of its Mexico plant.

Even then, we are uncertain if the bleeding may stop, with TSLA’s sustained price cuts triggering the moderation in its automotive revenues to $18.58B (-8.9% QoQ/ +4.4% YoY) and automotive gross margins to 15.7% (-6.6 points QoQ/ -10.6 YoY) in FQ3’23.

Investors may want to note that the automaker’s inventory remains high at $13.72B as well (-4.3% QoQ/ +32.9% YoY), with 16 days of supply (inline QoQ/ +8 days YoY).

While TSLA’s cash from operations have been decent at $8.87B (-22.1% YoY) over the first three quarters of 2023, its Free Cash Flow (“FCF”) margins have been impacted to 3.2% as well (-7.5 points YoY).

This is compared to its FY2022 FCF margins of 9.3% (inline YoY), thanks to the intensified capex of $6.59B (+24.3% YoY) and lowered ASPs.

With the automaker projecting FY2023 capital expenditure at $9B (+25.6% YoY), we may see TSLA’s FCF generation/ margins further impacted, triggering more pessimism in its stock prices.

With more EV models and ADAS options in the market, consequently diluting its US EV market share to 50% by Q3’23 (-9 points QoQ/ -12 YoY), we believe that TSLA may no longer be the king of EVs indeed.

This is especially since BYD Company Limited (OTCPK:BYDDF) is poised to become the world’s top-selling EV maker with approximately 3.01M deliveries in 2023 (+62.7% YoY), compared to TSLA’s reiterated guidance of 1.8M vehicles in 2023 (+32.3% YoY).

It appears that we are looking at a negative sum game here, with TSLA unlikely to recover its hyper-pandemic profit margins in the intermediate term. This is thanks to the management’s drastic price cuts, the Fed’s rate tightening thus far, and the intensifying EV competition:

A negative sum game is one where the value is destroyed by either parties or an outside source. Throughout the game, the parties deplete the value such that the overall outcome combined for the parties is less than the value which they started. The value may also be depleted by outside forces removing some of the value. (ADR Times.)

So, Is TSLA Stock A Buy, Sell, or Hold?

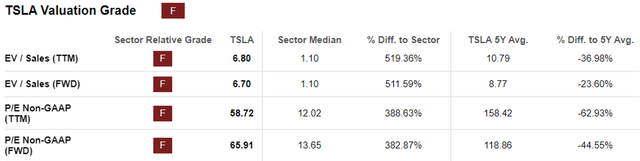

TSLA Valuations

As a result of these headwinds, we are not surprised with the correction witnessed in the TSLA stock’s FWD P/E valuation to 65.91x, compared to its 5Y average of 118.86x.

While Mr. Market continues to view the stock favorably, as demonstrated by the difference in valuations to the sector median of 13.65x, we believe that the premium is no longer compelling at this time of uncertain macroeconomic outlook.

This is especially since the Fed expects a normalized economy only by 2026, with the elevated interest rate environment likely to be prolonged for a few more quarters.

While the Fed has opted for a rate freeze in the previous September 2023 FOMC meeting, it remains to be seen when we may see a pivot, with the September 2023 CPI still elevated and the “labor market still persistently strong.”

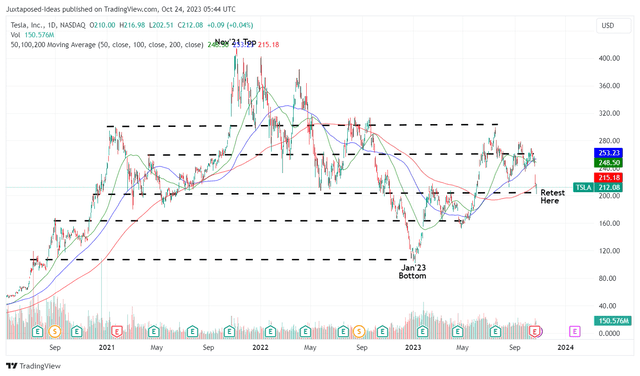

TSLA 3Y Stock Price

The TSLA stock has dramatically plunged post earnings call, with it currently retesting its critical support levels of $200s. It remains to be seen if bullish support may be sustained here, based on the growing fear index in the stock market.

As a result of the potential volatility, we prefer to rate TSLA as a Hold (Neutral) here.

Anyone looking to add Tesla, Inc. may want to monitor the stock’s movement for a little longer before adding according to their dollar cost averages and risk appetite. Even then, they must also temper their expectations, since Tesla, Inc. stock may trade sideways for an indeterminate period as the automaker’s margins are unlikely to recover in the near term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.