Summary:

- PayPal stock continues to decline, down over 80% from 2021 highs.

- For Q3, I see little upside in the key Bull vs. Bear debate on PayPal.

- Market penetration of key merchants remains strong but shows little additional growth.

- Mixed e-commerce data suggests flat in-logo penetration and potential pressure on transaction margins.

- With PayPal’s current valuation at 12x 2024 earnings, I see it as an attractive long-term entry opportunity.

chameleonseye

PayPal stock (NASDAQ:PYPL) continues to trend lower, with shares now down more than 80% from 2021 highs. In 2023 alone, shares lost close to 30% in value, while the S&P 500 (SP500) is up more than 10%.

It is no understatement to say that PayPal shareholders are suffering. And those investors, myself included, who hoped that Q3 will bring some relieve will likely be disappointed. For Q3, I see little upside in the key Bull vs. Bear debate on PayPal. Reflecting on various alternative data points, it is suggested that PayPal’s new logo penetration of key merchants has remained flat through 2023, while Bank of America e-commerce data projects mixed signals on the in-logo penetration trajectory vs. Q2. Lastly, PayPal’s transaction margins should have remained under pressure. All that said, analyst consensus provides a relatively reasonable earnings projection to top; and thus, there won’t likely be much downside either.

Considering PayPal’s current valuation, which is quoted at approximately 12 times 2024 earnings, I believe the present share price at $52 can be seen as an attractive entry opportunity.

Market Penetration Strong, But Stalling

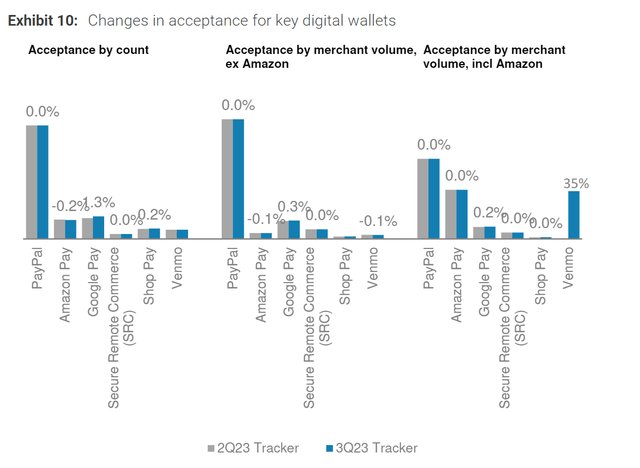

The good news is that PayPal’s market penetration of key merchants should have remained strong through Q3. The bad news is that there was likely little additional growth materialized. According to data compiled by Morgan Stanley (Morgan Stanley equity research: 3Q23 Acceptance Tracker, dated 9th October) PayPal’s acceptance share of the top 500 merchants in the U.S continues to remain at 83%. On a volume weighted perspective, this share jumps to 88%, underscoring PayPal’s widespread usage among the U.S. largest retailers. But here again, the share did not move even the slightest since Q2 2023. That said, investors who are concerned about PayPal’s competitive threats will take comfort in the observation that neither PayPal’s major competitors managed to gain share. This insight extends to buy-now-pay-later pioneers such as Affirm, Afterpay and Klarna.

Morgan Stanley equity research

In-logo Penetration Likely Flattish, On Mixed E-Commerce Data

As an online payment platform and enabler, PayPal’s commercial success is quite closely anchored on e-commerce volume and retail consumer sentiment. And I see mixed data here. Based on an analysis of Bank of America’s aggregated credit and debit card data (BofA equity research: PYPL note dated 13 October), the growth in U.S. e-commerce spending, transactions where the card is not physically present, has modestly improvement in the September quarter. According to BofA insights, transactions in the third quarter of 2023 increased 0.8% YoY, which compares to a decline in Q2 of 0.9% YoY, and a decline in Q1 of 1.3% YoY. BofA insights are broadly confirmatory with what ex-CEO Daniel Schulman said during the Q2 conference call:

[our] checkout volume growth accelerated again to over 8%, our highest monthly growth rate since the end of the pandemic. We expect branded checkout volumes will strengthen throughout the back half of the year, supported by traction from our key strategic initiatives

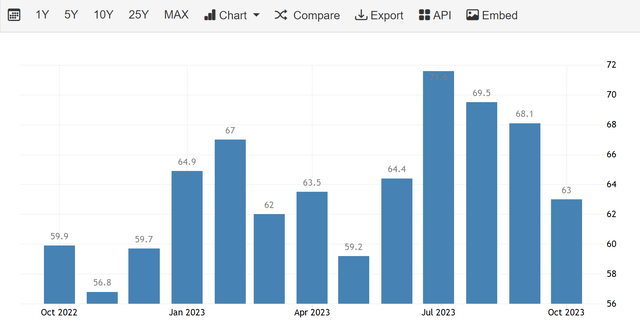

However, looking at the U.S Michigan consumer confidence indicator, it is suggested that the July transaction volume may have been an unsustainable benchmark for August and September, with the index dropping. And in October the index is lower still, likely setting the conference call up for a bearish management voice over.

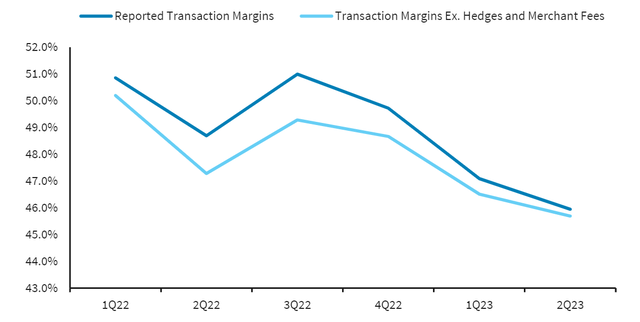

Transaction Margins

On transaction margins, which remains a hotly debated topic for investors, I see little upside for Q3. Investors should consider that both reported transaction margin, as well as margin excluding hedges, has been trending downwards for some time now — as the shift towards unbranded checkout at lower margins looks more structural than transitory. Moreover, I point out that management has been quite clear in its guidance that there may be further pressure through Q3, and a gradual improvement should likely not be expected before Q4.

When we think about the back half in Q3, we’ll still see some pressure on transaction margin performance. In Q4, we expect to see an improvement.

PayPal’s Q3 Preview

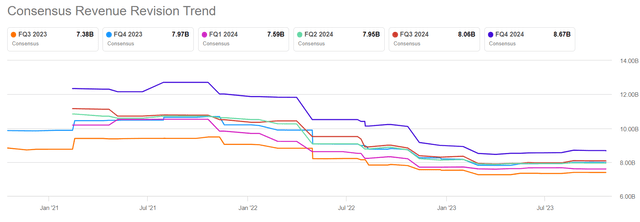

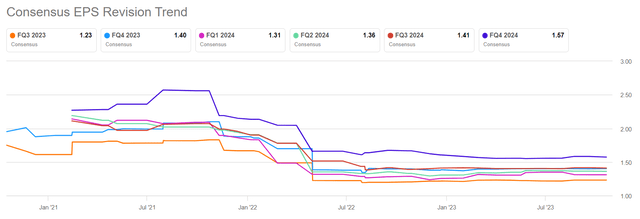

Based on data collected by Seeking Alpha as of October 22nd, 36 analysts have provided their projections for PayPal’s Q3 results. The estimates for total sales range from $7.25 billion to $7.45 billion, with an average estimate of $7.38 billion. Using the average estimate as a reference, it suggests that PayPal’s Q3 sales may grow by approximately 7.8% compared to the same quarter in 2022.

Regarding profitability, PayPal’s earnings per share are estimated to fall within the range of $1.18 to $1.32, with an average of $1.28. At average, the projections imply a 14% YoY growth. And annualizing PayPal’s quarterly earnings would suggest an implied P/E of close to 10x.

Discussing these revenue and earnings projections, it’s worth noting that PayPal’s Q3 estimates have remained relatively stable since the end of the June quarter; however, compared to estimates from a year ago, expectations are down about 20%. This indicates to me that sentiment should be broadly de-risked.

Conclusion

PayPal is reporting earnings on a very bearish backdrop, with PayPal stock having dropped over 80% from its 2021 peak and experienced a 30% decrease in 2023 alone, while the broader market, represented by the S&P 500, has performed well. The upcoming Q3 results are not expected to provide much relief, as several key indicators suggest a challenging path ahead. Market penetration among key merchants has remained strong but with limited growth, while e-commerce data presents a mixed picture of modest improvements in consumer sentiment, which may, however, not be sustainable through Q4. Lastly, transaction margins have been under pressure, and management guidance indicates continued challenges.

Analyst consensus provides relatively stable earnings projections, but expectations have decreased by about 20% from a year ago. All that said, however, given the current valuation at approximately 12 times 2024 earnings, the current share price of $52 may be seen as an appealing long-term entry point for investors — just don’t expect the turnaround with Q3 reporting.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.