Summary:

- Exxon Mobil is a dividend zombie, having paid uninterrupted dividends for 141 years.

- Despite missing Q3 earnings estimates, Exxon Mobil’s share price rose due to a 9.5% increase in revenue from the previous quarter.

- Exxon Mobil has a strong history of increasing shareholder returns, with 41 consecutive years of dividend increases and significant share buybacks.

- The company has been making acquisitions, the latest in Pioneer, which is expected to deliver double-digit returns.

Andrii Iemelyanenko/iStock via Getty Images

Introduction

It’s almost that time of the year. One of everyone’s favorite holidays, Halloween. Where people get to dress up as their favorite characters and go out to have fun. I remember as a kid being really excited to go out and get a bunch of candy to come home and eat it all within a few days. But Halloween just isn’t for kids. Adults enjoy it just as much as children. And with it approaching soon, I felt compelled to write an article on the dividend zombie Exxon Mobil (NYSE:XOM).

I assume many are familiar with the term dividend zombie. But you don’t hear about those too often. It’s usually dividend aristocrats & kings that are mentioned. For those who don’t know, dividend zombies are those who have paid uninterrupted dividends for a century. There’s a few companies that are a part of that prestigious list and XOM is one of those. XOM is a well-known company but their dividend record is rarely mentioned when talking about dividend stocks. Let’s get into why I think XOM may deserve a spot in your portfolio.

Dividend History & Earnings Performance

XOM traces its roots all the way back into the 1800’s when the company was known as Standard Oil of New Jersey. They were founded in 1882 but ordered to split by the Supreme Court in 1911 because of antitrust laws. They traded as XON during the 70’s until 1999 when they merged with Mobil to form the present name XOM. A mix of dividend aristocrats, kings, & zombies should be a part of any long-term dividend investor’s portfolio. And I know past performance doesn’t necessarily predict future performance but a company that has been paying a dividend for 141 years is something to be recognized and praised.

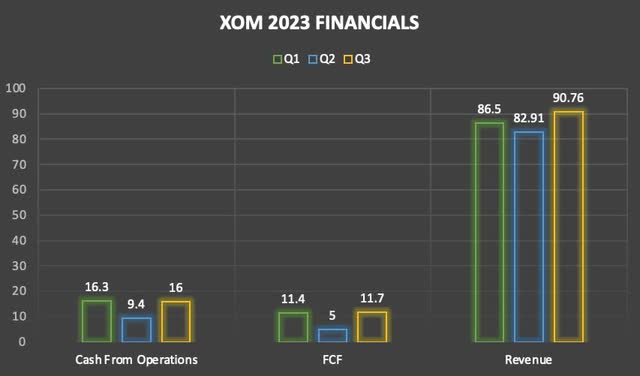

XOM reported its Q3 earnings today and missed on both the top and bottom line. But despite the miss their share price rose. Why was that? Usually when companies miss, especially on both, the share price tumbles as investors are disappointed. And to be fair, the Q3 miss wasn’t exactly a small one. Revenue missed estimates by $1.81 billion, coming in at $90.76 billion. But this was up nearly 9.5% from the prior quarter of $82.91 billion.

The revenue drop was attested to a 60% decrease in natural gas realizations and a 14% decrease in crude realizations. Year-over-year, revenue fell more than 23% from $112.07 billion. But during Q3 2022, XOM achieved their best-ever refining throughout North America and globally since the GFC in 2008.

Non-GAAP EPS of $2.27 also missed analysts’ estimates by $0.09, but was up from $1.94 in the prior quarter. Earnings fell by more than half from a year earlier where XOM reported earnings of $18.7 billion, more than 105% higher than Q3’s $9.1 billion reported. So, although 2022 was a spectacular year for the company, 2023 has shaped up to be not so bad considering 2022 was a record year for XOM. Below is a look at XOM’s financials YTD. As you can see cash from operations, free cash flow, & revenue were all down in Q2. As I previously mentioned this was due to decreases in natural gas and crude realizations. Furthermore, XOM had higher seasonal tax payments in Q2 as well.

Growing Shareholder Returns

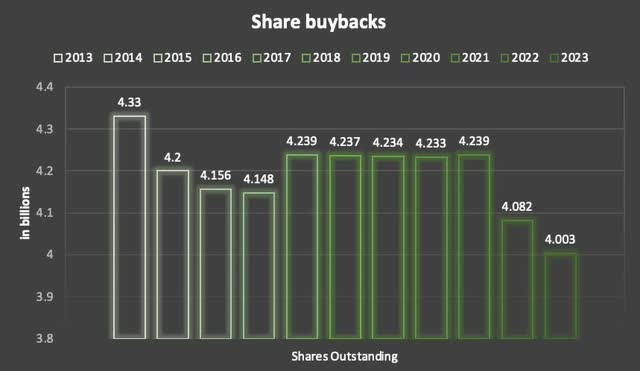

Despite a down year in comparison to 2022, XOM rewarded shareholders with another dividend increase, raising the dividend by 4.4% from $0.91 to $0.95 cents a share. YTD XOM has paid out $11.2 billion in dividends while repurchasing $12 billion worth of shares. Additionally, the company raised the dividend every year since 2001 with the exception of the pandemic year 2020.

XOM still held it steady while peers BP (BP) & Equinor ASA (EQNR) were forced to cut theirs during COVID. I like that management seems shareholder friendly returning cash to its shareholders every year. And this has been more apparent in the last two years as they have bought a significant amount of shares than they have in the past decade. Since 2021, XOM has taken roughly 5.5% of its shares off the market compared to the 2% in the years prior.

Balance Sheet Health & Future Growth Outlook

In Q1, XOM managed to decrease their Net debt to Capital ratio to 4%, further strengthening their balance sheet. They’ve also managed to increase their cash & cash equivalents by $3.4 billion this year. At the end of 2022 this balance stood at $29.6 billion. They’ve also managed to decreased their debt by roughly $4 billion from $40.5 billion to $36.5 billion at the end of Q3. So, XOM has been returning cash to shareholders via buybacks, increased the dividend by 4.4%, and managed to decrease their debt while growing their cash. You can’t ask for much more from a company, especially considering the current macro environment.

And management expects this to continue throughout the next several years. As previously mentioned the company has delivered more than $7.2 billion in cost savings in Q1 and expects this to be $9 billion for the year. One way they plan to do this is through reorganization, continuing what have been doing over the years. And they plan to capture a lot of efficiencies across the enterprise.

They’re also planning to reduce emissions. XOM is on track to close on the Denbury acquisition next month. With building this new business, low carbon solutions, XOM positions themselves as a leader in the energy transitions as seen by the Denbury acquisition announced this summer. Denbury’s advantaged CO2 structure is expected to provide Exxon with significant opportunities to expand and accelerate their low-carbon leadership across the Gulf Coast value chains.

Valuation & Risks

Since September, XOM is down by double-digits offering a great buying opportunity and a margin of safety. Additionally, they offer 21% upside to its price target of $128. Although the current dividend yield sits below its 5-year average of 5.21%, indicating it may be overvalued, investors with a long-term outlook are getting a great starting to price to dollar-cost average in my opinion. As the recession approaches, shares may continue to show weakness and investors should take advantage of the dip.

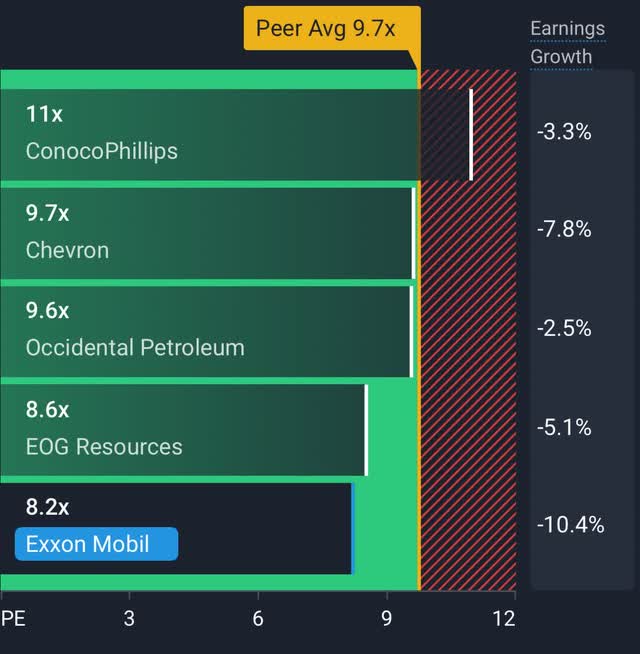

Furthermore, their P/E of 8.5x is lower than the sector median and the peer average of 9.7x. Since October 2020, the price has appreciated from a low of $33 to $105 where it trades currently. But as the stock continues to make acquisitions and buyback its shares, I expect them to continue trending higher.

As far as risks, XOM’s biggest risk is the decline of petroleum and natural gas prices in the future. With climate change, several countries are pushing towards a greener environment as seen by the rise in electric vehicles. This decline in natural gas prices could impact XOM’s financials leading to lower earnings and cash flows in the future. But Exxon is well aware of this, attempting to strengthen its business with the recent acquisition of Pioneer. This is expected to pay off in the long-term and caused the stock to receive an upgrade to buy at Truist. The acquisition is expected to deliver double-digit returns by recovering resources & lowering emissions more efficiently. Exxon’s peer Chevron (CVX) also recently acquired Hess Corporation (HES) in an all-stock transaction valued at $53 billion. This was to gain a bigger oil footprint in the U.S and a stake in XOM’s Guyana acquisition which is expected to close in November.

Investor Takeaway

Although Exxon missed on the top & bottom line, the company still managed to raise the dividend. Exxon was coming off a recent record 2022 so the numbers they have shown in 2023 are impressive considering the current macro environment. Additionally, they have been returning cash to shareholders in recent years and strengthening their business with recent acquisitions. XOM plans to lead the transition in energy and low-carbon emissions. Furthermore, they have been paying a dividend for 141 years, has been increasing their cash balance while maintaining a fortress balance sheet. For those reasons I rate the stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.