Summary:

- We are maintaining our buy-rating on Alphabet.

- Consistent with our expectations, ad revenue started to show signs of stabilization in 2H23.

- While we understand investors’ concern over GCP growth missing consensus this quarter due to customers’ spending optimization, we expect an improved spending environment in 2024.

- We still see a favorable risk-reward profile for the stock.

- We think investors should take advantage of the post-earnings pullback and explore entry points at current levels.

400tmax

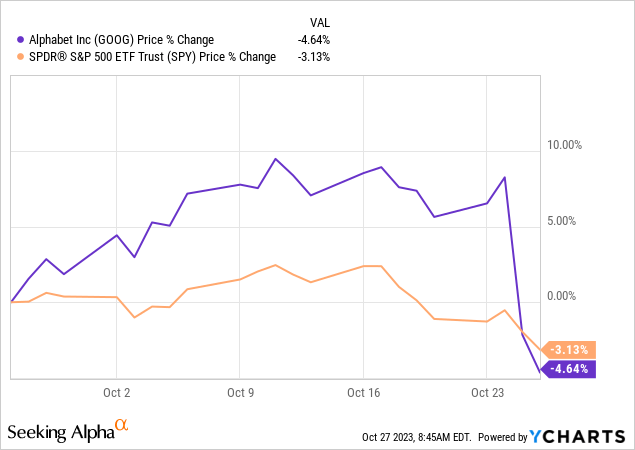

We remain buy-rated on Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG). While we understand concern over Google Cloud revenue growth missing consensus, we think investors overreacted to the 3Q23 earning results, with the stock down over 10% during the past 5D. We think the post-earnings pullback creates an attractive opportunity to buy the stock at lower levels.

The following graph outlines the stock performance against the S&P 500 over the past month.

YCharts

Improving digital ad spend

We’re seeing signs of ad revenue stabilizing in 2H23 and think Alphabet’s search engine dominance makes it better positioned to experience top-line growth acceleration driven by improving digital ad revenue. Google advertising comprised of Google Search, YouTube ads, and Google Network accounts for roughly 78% of total sales and reported revenue of $59.65B, up from $54.48B a year ago and $58.1B a quarter earlier. We think Alphabet’s ad revenue growth and that of Meta Platforms (META) and Amazon (AMZN) indicate a rebound in digital ad spend for 2024.

Google Cloud growth to rebound

We understand investors are concerned over Google Cloud growth falling short of consensus this quarter, reporting revenue of $8.41B versus consensus of $8.64B. We’re not too worried as we think about the customers’ spending optimization, and we expect the spending environment to improve from today’s level in 2024. Ruth Porat, Finance Chief, noted on the call that although cloud growth “remained strong across geographies, industries, and products,” the expansion rate “reflects the impact of customer optimization efforts.” We think the enterprise optimization cycle is nearing its end in 2H23 and see Google Cloud delivering a better growth rate in 2024.

Valuation

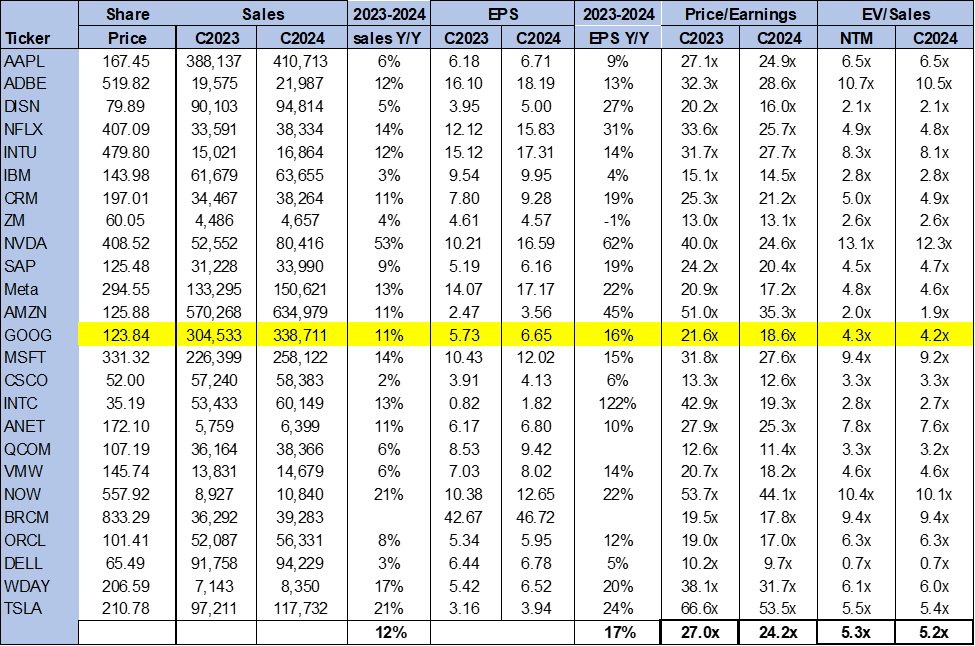

The stock is trading below the peer group and is reasonably priced, in our opinion. On a P/E basis, the stock is trading at 18.6x C2024 EPS $6.65 compared to the peer group average of 24.2x. The stock is trading at 4.2x EV/C2024 Sales versus the peer group average of 5.2x. We think investors should explore entry points at current levels.

The following chart outlines Alphabet’s valuation against the peer group.

TSP

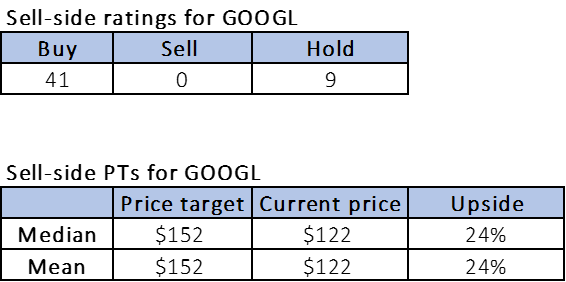

Word on Wall Street

We align with Wall Street’s bullish sentiment on the stock. Of the 50 analysts covering the stock, 41 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $122 per share. The median and mean sell-side price targets are $152, with a potential 24% upside. We see a wider upside surprise ahead in FY24, but we think Wall Street’s current expectations for the stock will enable it to outperform more meaningfully. The following charts outline sell-side ratings and price-targets.

TSP

What to do with the stock

We’re maintaining our buy-rating on Alphabet. We understand investor concern over the slower GCP growth missing estimates this quarter, but we think we’re nearing the end of the optimization cycle and see the cloud spending environment improve more substantially in 2024. This quarter’s positives were overshadowed by the cloud miss; among the positives is Alphabet’s accelerating revenue growth Y/Y, reporting double-digit growth for the first time in four quarters. We think investors should take advantage of the post-earnings pullback and explore entry points at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.