Summary:

- We are maintaining our buy rating on Meta Platforms.

- Our investment thesis of Meta’s FoA uniquely positioning it for higher ad revenue growth is playing out.

- Additionally, we like management’s disciplined execution of cost and capex controls.

- We expect Meta to continue to outperform its peer group in 2024.

Leon Neal

Meta Platforms (NASDAQ:META) continues to be our favorite name in the FAANG group for the fifth consecutive quarter; we maintain our buy-rating on the stock. We think our investment thesis in late September about Meta’s FoA uniquely positioning it for higher ad revenue growth is playing out earlier than anticipated. We now not only expect Meta to experience more upside due to a rebound in digital ad spending but also to fare better in ad revenue growth than its peers.

Meta’s ad revenue growth accelerated ahead of peers this quarter, up 19% Y/Y. We see visibility for Meta’s FoA and Threads as lucrative ad platforms will expand into next year, driven by new A.I.-enabled interactive services. We’re already seeing user engagement improve QoQ this quarter due to the successful launch of Reels; management noted on the call that “Reels has now driven more than 40% increase in time spent on Instagram since launch.”

Meta is up roughly 210% since our buy-rating in late November, outperforming the S&P 500 by around 200%. We think Zuckerberg’s “year of efficiency” is playing out with the company trimming expenses and reporting the best operating margins in two years. Management’s execution of discipline cost and capex controls has pushed profitable growth in spite of macro uncertainty. This quarter, total costs and expenses declined 7% Y/Y to $20.4B. Meta now expects 2023 capex to be lower in the range of $27B to $29B, down from previous forecasts of $27B to $30B. We also got more visibility on Meta’s capex expectations for 2024 at $30B to $35B, a bit higher than 2023 due to hiring plans and A.I. investments.

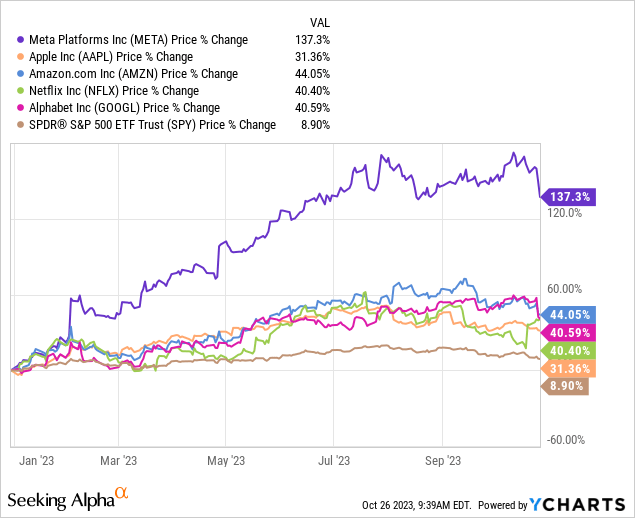

The following graph outlines Meta’s stock performance against the FAANG peer group, including Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL).

YCharts

Monetization cranking up alongside an improving digital ad market

We now expect the company to see more ad spend traction in 2024 as management reports higher user engagement on Facebook and Instagram at 7% and 6%, respectively, driven by A.I.-enable interactive services. Management noted on the call that they are “leveraging A.I. across our ads systems and suite of products, which is driving improved performance for advertisers.” The role of A.I. in Meta’s ad strategy was a crucial takeaway from the call this quarter, and we expect the intersection of A.I. and FoA will materially increase Meta’s upside in 2024. Management explained the use of A.I. features in advertising, noting the employment of 1)”multiple versions of ad text based on an advertiser’s original copy that helps highlight the selling points of their products and services”, 2) “image expansion, which helps adjust creative assets to fit different aspect ratios across multiple services like Feed or Reels” and 3) Meta A.I. that acts as an A.I. assistant that users can ask different questions to that’ll increase traction on the FoA. We think these A.I.-related features, among others, will drive upside in 2024.

Meta’s total FoA revenue was up 53% Y/Y this quarter. We think the main driver of Meta’s reaccelerating top-line growth is an improving digital ad market coupled with new A.I.-enabled features and increased ad spend ahead of the holiday season. Additionally, the company is improving the effectiveness of its digital ad targeting after Apple’s iOS privacy changes in 2021. Family monthly active people (MAP) hit 3.96B this quarter, a 7% Y/Y increase, while ad impressions across FoA increased 31% Y/Y and average price per ad decreased 6% QoQ. We’re not too concerned about the lower average price per ad as the percent of decline is slower this quarter versus 2Q23, during which the average price per ad decreased by 16% Y/Y. We see ad spending rebounding next year and expect this to drive top-line growth.

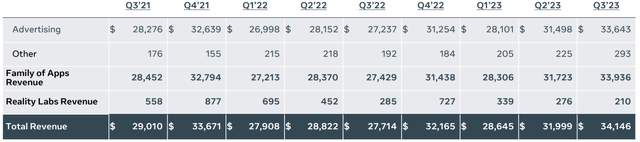

The following outlines Meta’s revenue breakdown up to 3Q23.

Meta reported total revenue of $34.15B, up 23.2% Y/Y and 6.2% sequentially, driven by an acceleration in ad revenue. The company’s ad revenue growth is notable, especially considering the peer group experienced a slower ad revenue growth rate; Alphabet (GOOG) reported a 9.5% Y/Y growth in ad revenue. We think Meta has leverage in its FoA comprised of Facebook, Instagram, Messenger, WhatsApp, and other services to drive more upside in ad revenue.

Risks to our bullish sentiment

Despite Meta’s run-up this year, we think the company is not immune to macro uncertainty. Management guided for revenue in the range of $36.5-40B next quarter, factoring in anticipations of the Middle East conflict being a near-term headwind. We see more upside ahead for Meta due to a rebound in ad spending. Still, if geopolitical tensions intensify, which is currently the case, we think the company may be at higher risk of experiencing a pullback in spending.

Additionally, Meta, similar to Alphabet and Amazon, is facing legal issues, which could possibly impact performance into 2024. Dozens of U.S. states, 33 states to be specific, are suing Meta for fueling “a youth mental health crisis by making social media platforms addictive.” We understand where the complaints are coming from; children are an appealing demographic for businesses like Meta, but we don’t see this having a major impact on top-line growth in 2024.

Valuation

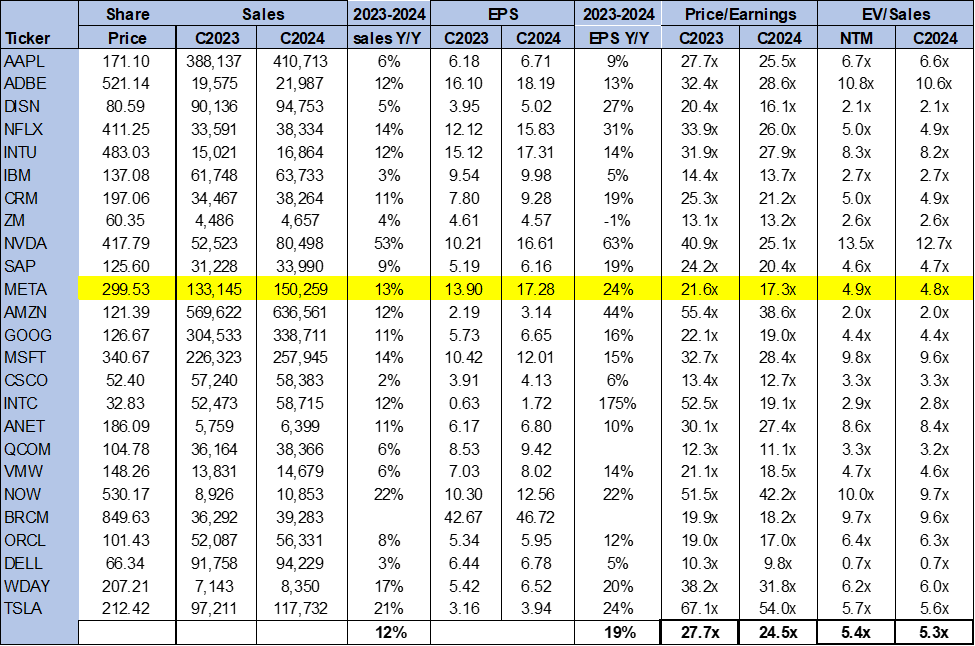

The stock remains undervalued, in our belief, trading well below the peer group average on the large-cap peer group. We think Meta’s growth rate into 2024 deserves a higher multiple and think the stock is more than fairly valued for investors exploring entry points at current levels. On a P/E basis, the stock is trading at 17.3x C2024 EPS $17.28 compared to the peer group average of 24.5x. The stock is trading at 4.8x EV/C2024 Sales versus the peer group average of 5.3x. Meta’s valuation is lowest in the FAANG group, which has been the case historically. We think Meta’s growth rate will accelerate into 2024 driven by 1) improving ad spend, 2) A.I.-enabled interactive services integrated into FoA, and 3) cost reductions to support profitable growth. We see attractive entry points to jump in on Meta’s outperformance into 2024.

The following graph outlines Meta’s valuation against the peer group.

TSP

Word on Wall Street

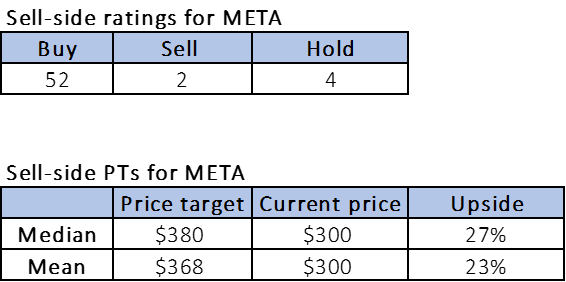

Wall Street shares our bullish sentiment on the stock. Of the 58 analysts covering the stock, 52 are buy-rated, four are hold-rated, and the remaining are sell-rated. The stock is priced at $300 at current levels. The median sell-side price-target is $368, while the mean is $380, with a potential 23-27% upside. We don’t often align with Wall Street’s sentiment on our coverage universe, but Meta acts as an exception because the stock is set up for a material upside in 2024 once ad spend rebounds.

The following charts outline sell-side ratings and price-targets.

TSP

What to do with the stock

We see more momentum for the stock as Meta edges ahead of the peer group in ad revenue growth, and management continues to reduce capital expenditure this year. We think investors overreacted to Meta’s results yesterday; the stock is down roughly 5% today. We think Meta’s longer-term growth path remains intact and think the stock is undervalued at current levels; we’re not too worried about the guidance for 4Q23 factoring headwinds from the conflict in the Middle East. We see more upside ahead for the stock in 2024 and recommend investors explore entry points into the stock on the pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.