Summary:

- NFLX’s laser focus on profitable growth has been highly apparent in the management’s cautious execution thus far, similarly demonstrated by the sustained expansion in its adj EBITDA.

- Its FY2024 margin guidance of 23% (+3 points YoY) at the midpoint is highly encouraging as well, especially aided by the improving performance of its ad-supported tier.

- NFLX’s dominance in the global streaming market cannot be ignored indeed, since more third party contents will soon be available on its platform.

- This has contributed to its growing subscriber base and stable ARM, with the streaming company’s prospects likely to remain robust through the uncertain macroeconomic outlook.

- Then again, these promising factors have contributed to the NFLX stock’s extreme rally, with investors better off waiting for a moderate pull back for an improved entry point.

imaginima

We previously covered Netflix, Inc. (NASDAQ:NFLX) in April 2023, discussing its excellent prospects thanks to the password-sharing crackdown and ongoing SAG-AFTRA/ WGA strike, contributing to its improved top and bottom lines then.

The management had also projected an expanded FY2023 Free Cash Flow generation of $5B (+210.5% YoY), potentially resulting in increased share repurchases, and therefore, returning value to existing shareholders while improving its profitability per share metric.

In this article, we will be discussing why NFLX continues to deserve its premium valuations compared to its peers, thanks to its highly profitable growth trend, growing subscriber base, and robust demand for its ad-supported tier.

The NFLX Investment Thesis Remains Robust, With A Great Upside Potential

For now, NFLX has recorded an excellent FQ3’23 quarter while beating the consensus profit estimates, with revenues of $8.54B (+4.4% QoQ/ +7.8% YoY) and GAAP EPS of $3.73 (+13.3% QoQ/ +20.3% YoY).

We suppose part of the top and bottom line tailwinds is attributed to One Piece’s successful live action, with it being one of the best-selling comic/ manga series of all time with 517M volumes sold as of August 2023.

This number well eclipses the next best-seller, Asterix at 385M copies, while nearing DC’s Superman at approximately 600M volumes and Batman at 484M volumes (based on March 2022 data). This naturally explaining the immense interest surrounding One Piece, further amplified by the company’s strategic marketing efforts.

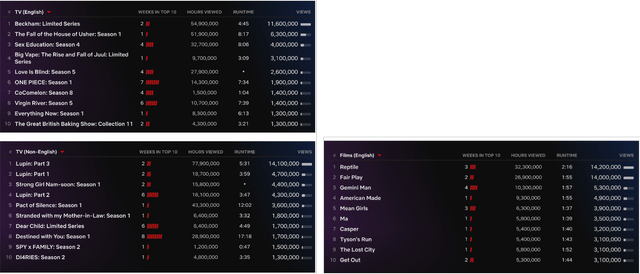

NFLX’s Popular Offerings For The Week Of October 9 and 15, 2023

One Piece also built upon NFLX’s well-diversified offerings across different genres/ format/ culture & languages, aided by the licensing of third-party contents from its streaming competitors, while the strike was still going on and productions delayed.

This has contributed to the excellent expansion in its Global Streaming Paid Memberships to 247.15M (+8.76M QoQ/ +24.06M YoY) and stable Average Revenue per Membership of $11.52 in the latest quarter (+0.6% QoQ/ -2.7% YoY).

It appears that NFLX has been able to counter the uncertain macroeconomic outlook through its excellent offerings, naturally contributing in its Paid Net Additions across four regions.

This is on top of the streaming company’s intensified push into show/ movie themed video games across phones, TVs, and PCs, with it likely generating a more than decent advertising revenue, on top of increased fan appeal and consumer stickiness on its platform.

In addition, NFLX’s advertising strategy has worked out extremely well, with FQ3’23 bringing forth a sequential +70% expansion in its ad plan membership, building upon the previous quarter of +100% growth.

We believe that adoption may continue to accelerate, since “30% of its new sign-ups” in the latest quarter apparently preferred the value proposition offered by the ad-supported tier, thanks to the expanded features, such as the improved video resolution and downloads.

It appears that the NFLX management continues to enhance its advertising targeting as well, with it launching a partnership with Nielsen in the US from October 2023 onwards, while introducing multiple ad products to appeal to more ad buyers moving forward.

Most importantly, the management remains laser focused on “profitable growth,” with it unlikely to sacrifice margins while chasing subscriptions, based on the Spence Neumann’s commentary (CFO of NFLX) in the recent earnings call:

There’s no change in our financial objectives and also no change in our long-term margin expectations… and we don’t think we’re anywhere near a margin ceiling. We’ve got a long runway of margin growth… But, given our current profitability and scale, we think it’s prudent to balance that historical pace of margin improvement with growth investments… We’ll continue to drive healthy margin expansion. (Seeking Alpha)

These commentaries are highly encouraging indeed, especially when the management guides FY2024 operating margins of between 22% and 24%, with the midpoint being +2 points YoY from the recently raised FY2023 margin guidance of 20%.

Thanks to the strike, NFLX also reports an excellent YTD FCF generation of $5.32B (+315.6% YoY), well exceeding its FY2023 target of $5B. While the WGA strike has ended, investors must also note that the SAG-AFTRA strike is still ongoing, likely to trigger another excellent quarter of FCF profitability.

As a result, we may see the management further expand its share repurchases, with $2.5B already spent in FQ3’23 alone, on top of the $1.04B recorded in H1’23.

While NFLX does not payout dividends, we believe that its shareholder returns have been highly promising indeed, with 1.65M of shares retired over the past three quarters.

The robust profitability has also contributed to its net debt of -$6.04B by the latest quarter, compared to -$5.5B in FQ2’23 and -$7.77B in FQ3’22.

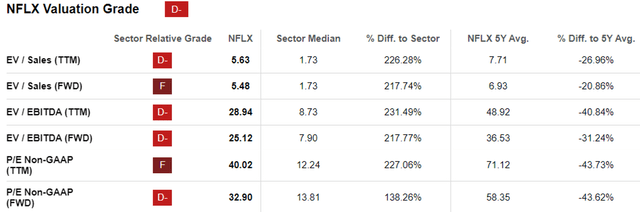

NFLX Valuations

As a result of the promising factors discussed above, it is unsurprising that the same profitable growth premium has also been embedded in NFLX’s FWD EV/ EBITDA valuation of 25.12x, against the sector median of 7.90x.

This number is not overly aggressive indeed, due to its offerings’ robust pricing power despite the uncertain macroeconomic outlook.

Perhaps this is why the management has also offered an optimistic FQ4’23 revenue guidance of $8.7B (+1.8% QoQ/ +10.8% YoY), bringing its FY2023 top-line to a projected sum of $33.58B (+6.2% YoY).

Based on its YTD adj EBITDA margins of 21.8% (+1.1 points from FY2022 levels) and its FQ3’23 share count of 450.01M (-1.64M from FQ4’22 levels), we may see FY2023 bring forth an estimated adj EBITDA of $7.32B (+11.9% YoY) and adj EBITDA per share of $16.26 (+12.2% YoY).

Combined with its FWD EV/ EBITDA valuation of 25.12x, it appears that the NFLX stock is also trading near its fair value of $408.45.

Based on the consensus FY2025 adj EBITDA estimates of $11.26B and an estimated adj EBITDA per share of $25.02 (expanding at a CAGR of +19.8%), we believe that there is still an excellent upside potential of +53.8% to our long-term price target of $628.50.

So, Is NFLX Stock A Buy, Sell, or Hold?

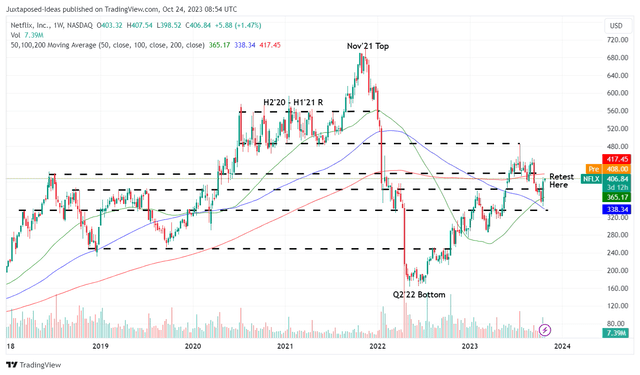

NFLX 5Y Stock Price

This profitable growth trend further underscores why NFLX has dramatically climbed out of the Q2’22 bottom, while recording an impressive recovery of +134.8% since then.

This is also the reason why we believe that the stock deserves its premium tech-like valuations, for so long that the same trend persists moving forward.

As a result of the attractive risk/ reward ratio, we continue to rate NFLX stock as a Buy. Then again, this buy rating does not come with a specific entry point, since it depends on individual investors’ dollar cost average.

The FQ3’23 outperformance has naturally triggered its extreme +17.5% rally at the time of writing, with it remaining to be seen if the stock is able to hold on to most of these gains.

Based on the market’s worsening fear index, we may see some traders cash out at these levels, potentially triggering the stock’s moderate retracements to its next support levels of $380s in the near term.

Bottom fishing may consider waiting and observing the NFLX stock movement for a little longer, before adding according to their risk appetite. There is no need to chase this rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.