Summary:

- Opendoor is making progress towards achieving free cash flow breakeven by H1 2024, demonstrating its sustainable business model.

- Opendoor’s partnership with Zillow highlights the value of its business model and growth potential.

- Despite its current low valuation, Opendoor’s unique business model and potential for growth suggest it is undervalued.

SDI Productions

Investment Thesis

Opendoor (NASDAQ:OPEN) has had all the reasons to sell off. Interest rates, a weak housing market, inflation, you name it.

And yet, it continues to make small strides to regain its footing after a horrendous 2022.

As I’ve been stating for a while, Opendoor believes that by H1 2024 this business will be operating at free cash flow breakeven. If that transpires to be the case, Opendoor business will have been put through the most challenging housing environment in more than a decade and will be vindicated, demonstrating to naysayers that the business model can be operated in a sustainable fashion, irrespective of any market downturn, down or up.

I remain confident that Opendoor has already seen its worst days. What’s more, given that the stock has already taken a big breather, I argue that this is not the time to give up on this stock.

Opendoor is Succeeding in a Really Tough Market

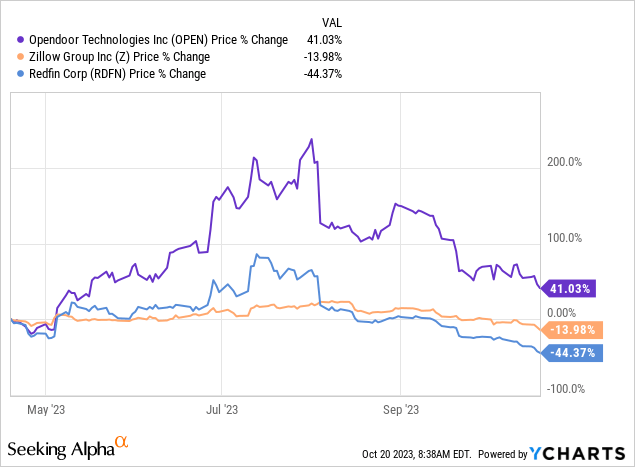

Opendoor has given back a huge amount of its gains. And yet, this story is far from over. Of course, we have to remember that at one point Opendoor fell approximately 80% in value, so its recovery should be given some consideration.

And why should Opendoor be thriving at all given the current macro environment? After all, what the Fed is categorically attempting to do by raising rates is slow down the housing market. And yet, it appears that the stock market is looking further afield and thinking about what’s next?

If You Can’t Beat? Join Them

As you may recall, Zillow had attempted to launch its own version of iBuying.

However, Zillow’s business model struggled to gain traction in that endeavor. However, Zillow must have recognized the opportunity that servicing not just buyers in the market, but sellers too must have been. Otherwise, why did Zillow deploy hundreds of millions of dollars chasing this opportunity?

However, subsequent to closing its iBuying doors, Zillow decided that its next best chance to carve out market share in iBuying’s massive total addressable market would be to partner up with Opendoor.

Along these lines, here are Zillow’s comments from its Q2 2023 earnings call,

We’ve also made progress on our other selling solutions offerings, our partnership with Opendoor which allows sellers on Zillow to request a cash offer from Opendoor is live in 25 markets as of today, compared to the 2 markets we launched initially in February.

[…] So we’re really pleased with the expansion and coverage of our seller solutions. As Rich talked about, increasing our service addressable market to the sell side and sellers who become buyers as well as accessing more types of agents, not just from your agents and listing agents, across those solutions.

I believe that Zillow sought to partner up with Opendoor and has expanded its offering beyond the initial 2 pilot market trials speaks volumes of the value that Opendoor’s business model is able to capture.

Indeed, the only reason why Zillow would even come close to Opendoor, when this business, from the outside, is perceived to be barely surviving, is that Zillow believes there’s money to be made. There’s no other reason for Zillow to reach out to its ailing peer. Zillow is not a charity.

To be clear, Zillow and Opendoor are not offering similar solutions. Opendoor provides house sellers with peace of mind. That’s the core of its value proposition. Opendoor buys up one’s property for cash, and then homeowners can sell their property online in about 2 weeks. This compares with the traditional method of preparing your home for sale, engaging with real estate agents, and having countless viewings. Opendoor provides sellers with simplicity.

Zillow is an advertising business for real estate. They are both involved in the real estate market, but they don’t compete.

OPEN Stock Valuation — Pricing in a Lot of Negativity

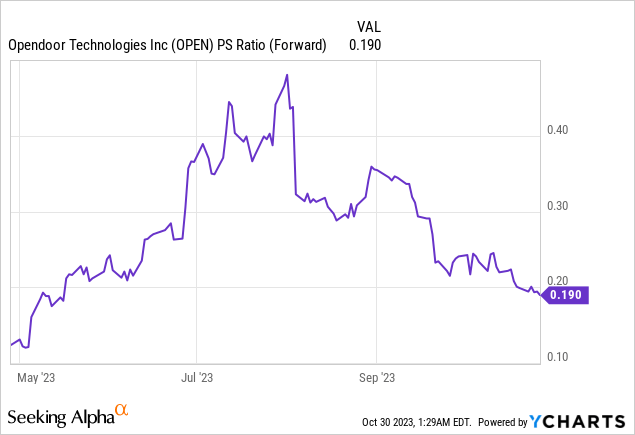

As you can see from the graphic above, Opendoor is still being priced in the bargain basement as if it’s about to go out of business.

As I’ve discussed many times in the past, Opendoor’s business model operates with razor-thin margins. I don’t believe that Opendoor’s net income margins (after substantial interest payments), will be lower than 3% to 4%.

Nevertheless, even if Opendoor ends up around at around 4% net margin, this should minimally support a 1x sales multiple on its stock, compared with the less than 0.2x it presently holds.

The Bottom Line

I’m confident that Opendoor has weathered its toughest challenges and is on a path to success. Despite a challenging housing market, the company is making strides towards achieving free cash flow breakeven by H1 2024, proving its sustainable business model. With the stock taking a breather after a strong rally, now is an excellent time to consider increasing exposure to this name.

Opendoor’s performance might seem lackluster compared to some housing market peers in the past year, but it rebounded from an 80% value drop at one point. The housing sector’s resilience despite rising interest rates is noteworthy. Opendoor’s partnership with Zillow further emphasizes the value of its business model.

Despite its current low valuation, Opendoor’s unique business model and growth potential suggest it’s undervalued. Even with narrow margins, a conservative 4%-5% net operating margin should justify a higher valuation than its current multiple of less than 0.2x sales.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.