Summary:

- PayPal’s new CEO, Alex Chriss, faces significant challenges as it reports its third-quarter earnings.

- Competition from newer upstarts and tech giants like Apple, Amazon, and Google pose substantial threats to PayPal’s digital payments space.

- PayPal’s venture into the unbranded space has faced unforeseen challenges. The market has correctly reflected higher execution risks as PayPal attempts to recover its growth drivers.

- I explain why I have decided to move on from PYPL. With the stock in oversold zones, investors can consider capitalizing on its subsequent mean reversion to cut exposure or bid farewell.

- Beware of catching the falling knife, it might not be worth it.

Justin Sullivan

PayPal Holdings, Inc. (NASDAQ:PYPL) new CEO Alex Chriss, who took over the helm from long-time stalwart Dan Schulman on September 27, has a lot on his plate when the company reports its third-quarter or FQ3 earnings release on November 1. Chriss was formerly from Intuit (INTU), leading the company’s SMB and self-employed group. As such, it is expected to be a critical earnings call for PayPal. The market will likely assess how Chriss and his team can help PYPL overcome its worst battering in recent times, as it remains nearly 85% below its overvalued 2021 highs.

As such, PayPal Bears could argue that Schulman handed over the reins to Chriss of a company that’s a shadow of its former self as competition intensifies in PayPal’s digital payments space. Accordingly, PayPal not only faces significant challenges from newer upstarts but also tech behemoths such as Apple (AAPL), Amazon (AMZN), and Google (GOOGL) looking to leverage their massive ecosystem advantages.

PayPal’s venture into the unbranded space has also faced significant challenges as it aims to challenge the leadership of Stripe and Adyen (OTCPK:ADYEY). However, the recent selloff battered ADYEY due to a “substantial deceleration” in its North American business. As such, the market has likely reflected even higher execution risks in PayPal’s new growth area as it looks to reignite growth, given the slowdown, in its higher-margin legacy branded business.

In one of PayPal’s September conferences, an analyst likely pointed out the market’s concerns about whether the “digital payment processing business doesn’t become a race to the bottom in terms of pricing.” The market could also be concerned that if the slowdown in volume persists further, it could lead to a “deflationary business driven by competition for volume and scale.”

I believe the concerns are justified, also reflected in PYPL’s bearish price action. Now, I think my call to upgrade PYPL in early August was poorly conceived. I had anticipated dip buyers to return robustly, notwithstanding PYPL’s bearish bias. Unfortunately, I was wrong. The bears waited for enough bulls to catch the falling knife before hammering them further.

Bulls argue that PYPL remains solidly profitable. Seeking Alpha Quant’s “A-” profitability grade corroborates that view. Also, the company is expected to deliver a free cash flow of $5.22B for FY23, indicating an FCF margin of 17.6%. While it’s nowhere close to PYPL’s 2019 metric of 22%, PYPL has dropped to lows last seen in June 2017, suggesting the market has tried to price in its weakness.

Management also believes that its shares are inexpensive. Acting CFO Gabrielle Rabinovitch stressed that “PayPal expects to return 100% of its free cash flow to shareholders in the form of share repurchases” this year. She also articulated that PayPal “believes its intrinsic value is higher than its market valuation, making share repurchases an attractive option.”

Despite that, I also highlighted why PYPL could be a value trap in my mid-June update (which I should have stuck with). Also, what if the market is correct, as the unbranded battle between PayPal and its peers could lead to a race to the bottom?

These are likely questions that will be fielded by analysts to Chriss as he takes over the hot seat from Schuman in his first earnings call as PayPal’s CEO. However, the market is indicating that it doesn’t have enough confidence in PayPal’s current strategies to overcome its competitive challenges while trying to defend against further “incursions” by the tech behemoths.

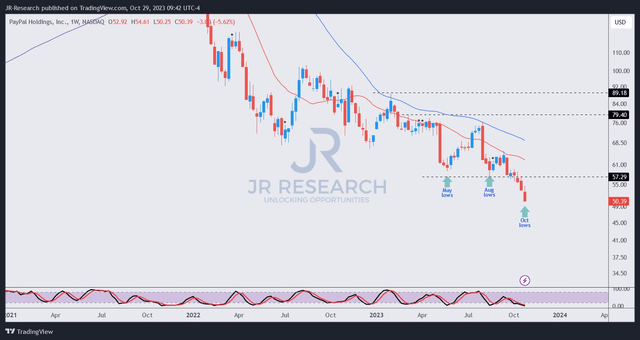

PYPL price chart (weekly) (TradingView)

As seen above, PYPL remains firmly entrenched in a downtrend bias that has not changed. The 20- (red line) and 50-week (blue line) moving average or MA continues to deny buyers a sustained bullish reversal, as they resisted with conviction.

PYPL is forming lower highs and lower lows, and its lows in October 2023 aren’t constructive for a bullish reversal thesis. Even though PYPL could stage a momentary reversal given oversold conditions, I urge investors to avoid catching PYPL’s bearish bias.

I assess that PYPL could continue to be “dead money” at best as investors consider how Chriss and his team aim to overcome its struggles. That would take time and is not expected to be a quick fix, given the structural headwinds.

However, if the market anticipates that PayPal’s recovery strategies might not be enough, the long-term downtrend could persist, leading to new multi-year lows and hitting investors who continue catching the falling knife.

It’s time to acknowledge that PYPL has been one of my worst calls this year, even as the market recovered from last year’s bottom. It’s time to say farewell.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!