Summary:

- Valuation and fundamentals always matter, driving 97% of long-term stock returns.

- The market is capable of incredible “fat pitch” discounts and also creates insane bubbles.

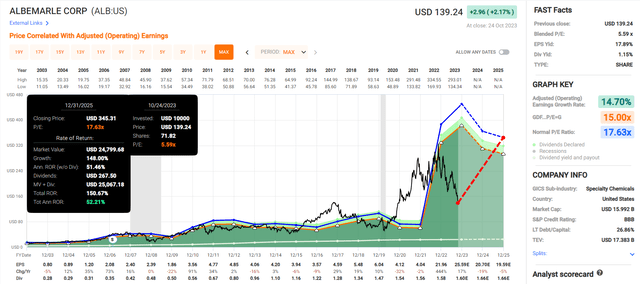

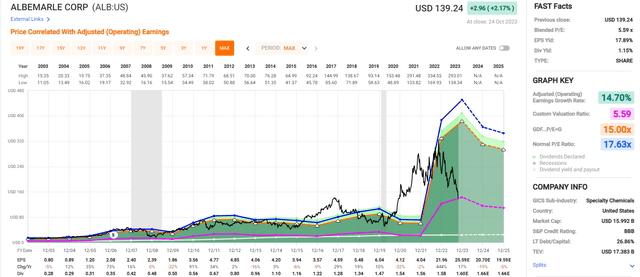

- Albemarle Corporation is the world’s leading lithium miner and is 65% undervalued, trading at less than 6X earnings, the lowest P/E in over 20 years.

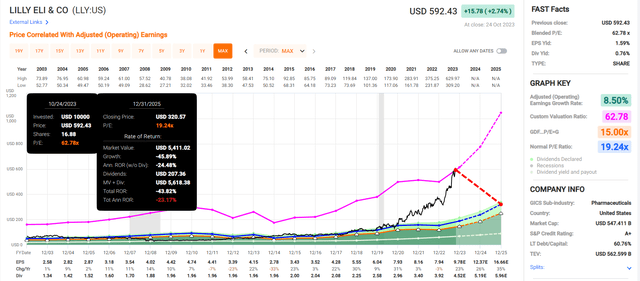

- In contrast, Eli Lilly and Company, thanks to Mounjaro-mania, is 150% overvalued, trading at its highest P/E in history, pricing in long-term growth of 60% that not even Amazon can hope to achieve.

- While Eli Lilly is likely to earn a decent return within a decade (if Mounjaro sales come in as expected), it also has the potential to crash 40% by the end of 2025, and that’s assuming nearly 100% earnings growth!

choness

This article was co-produced with Kody Kester of Kody’s Dividends.

———————————————————————————-

Successful investing centers on the principles of quality first, valuation second, and smart risk management invariably.

Albemarle Corporation (NYSE:ALB) is a best-of-breed specialty chemicals company mostly focused on the white gold of the 21st century, lithium.

Eli Lilly and Company (NYSE:LLY) is a diversified pharmaceutical that has skyrocketed thanks to its diabetes and weight loss drug with massive potential, Mounjaro.

The two companies are both ultra SWANs but significantly diverge in valuation. Albemarle is 65% undervalued, while a staggering 147% overvalues Eli Lilly!

If the market came to its senses, Albemarle could have a 144% upside from its current valuation, while Eli Lilly could have a 60% downside.

True to the investing strategy of my colleagues, I have an approach to investing that insists on quality above all else. That is because volatility is a fact of life in the stock market.

Thus, the best way to keep your emotions in check and sleep well at night is to know what you own and to be comfortable with owning it. In my six years of real-money investing, owning world-class businesses has provided me with a peace of mind that can withstand the human emotions evoked by market volatility.

But while quality itself is the best starting point, it isn’t the only consideration necessary to achieve success. My investing blueprint (and investing group’s) is also consistent with Warren Buffett’s principle of buying wonderful companies at or below fair value. That is because as a valuation reverts to its historical norm, it is a coiled spring that can either work in your favor or snap back at you at any moment.

Finally, the third and final principle that I deploy in investing is savvy risk management. That revolves around my belief that no matter my conviction, I will never be right 100% of the time. This is why I own just over 100 (mostly) dividend growth stocks to hedge my bets appropriately.

But with that aside, I especially want to emphasize the valuation principle. That is because I have found two ultra SWANs to be an exciting tale of two stocks. On one side of the valuation coin, there is the beaten-down lithium giant and Dividend Aristocrat Albemarle, down 58% from its 52-week high. On the flip side, we have the pharmaceutical juggernaut Eli Lilly, 91% above its 52-week low and not far off its 52-week high.

Without further ado, I will dig into both stocks as a case study to illustrate why valuation matters greatly. I’ll also highlight why Albemarle is a no-brainer buy right now and why I would steer clear of Eli Lilly stock for now.

Why Albemarle Is Currently An Ultra-Value Buy

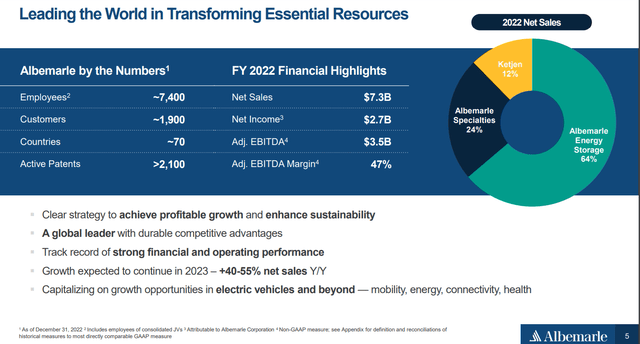

Albemarle October 2023 Investor Presentation

Albemarle is the market-leading player in lithium. The company derived 64% of its $7.3 billion in 2022 net sales from its Energy Storage (formerly Lithium) segment, which develops and manufactures lithium compounds like lithium carbonate, lithium hydroxide, and lithium chloride. These are used as essential inputs in consumer electronics, electric vehicles, pharmaceutical products, and so many other things we take for granted every day.

The Albemarle Specialties (previously Bromine) segment sells products used in fire safety solutions, such as plastic enclosures from consumer electronics, wire and cable products, and foam insulation. The segment comprised 24% of 2022 net sales.

Finally, the Ketjen (formerly Catalysts) segment sells clean fuels technologies, fluidized catalytic cracking, and performance catalyst solutions products. This segment made up the remaining 12% of net sales in 2022.

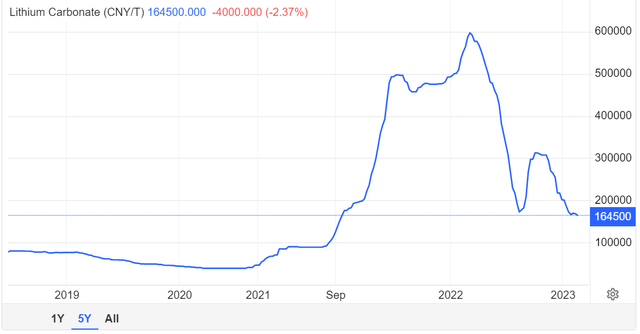

Trading Economics

Analyst downgrades amid slumping Chinese lithium prices due to near-term oversupply issues have weighed on Albemarle as of late.

However, this weakness provides a substantial buying opportunity, with Albemarle trading at a 65% discount to its estimated fair value of $399 a share (based on the $140 share price on October 24, 2023). For one, the global lithium market is expected to quadruple from $22.2 billion in 2023 to $89.9 billion by 2030, according to Fortune Business Insights. That is because as the global economy grows more affluent, demand for electric vehicles and consumer electronics will explode higher. As the lowest-cost producer of lithium, Albemarle believes it can grow volume at a 20% to 30% clip annually moving forward to meet rising global demand.

Better yet, the company also has the financial resources to execute this aggressive investment plan. Albemarle enjoys an investment-grade BBB credit rating from S&P, which puts it at a 7.5% risk of going bankrupt in the next 30 years.

For these reasons, FactSet Research anticipates that the company’s earnings will rise by 21.4% annually in the years ahead. Thanks to its battered valuation, the company could deliver 144% total returns in the next year if it were to revert to fair value.

Beyond the near term, Albemarle has the following total return potential for the next ten years:

-

1.2% yield (with a 28-year dividend growth streak) + 21.4% annual earnings growth + 11% annual valuation multiple expansion = 33.6% annual total returns versus 10% annual total returns from the S&P 500 (SP500).

This means that if ALB grows as expected and returns to historical fair value, it could deliver 1711% returns in the next decade vs 160% for the S&P.

Lowest P/E in over 20 years!

The Last Time ALB Was Close To This Undervalued (March 2009, P/E 7), This Happened

| Time Frame (Years) | Annual Returns | Total Returns |

| 1 | 178% | 178% |

| 3 | 68% | 378% |

| 5 | 31% | 280% |

| 7 | 31% | 561% |

| 10 | 22% | 655% |

| 15 | 19% | 1268% |

(Source: Gurufocus Premium.)

Mounjaro-Mania Is Sending Eli Lilly Stock To The Moon

Founded in 1876 by Colonel Eli Lilly, Eli Lilly hardly needs an introduction. Here’s one anyway: Among its drug portfolio consisting of dozens of medicines, seven are on pace to be blockbusters and/or mega-blockbusters ($1 billion-plus and $5 billion-plus in annual sales) in 2023. These include the CVRM hits Trulicity and Jardiance, as well as the oncology star Verzenio.

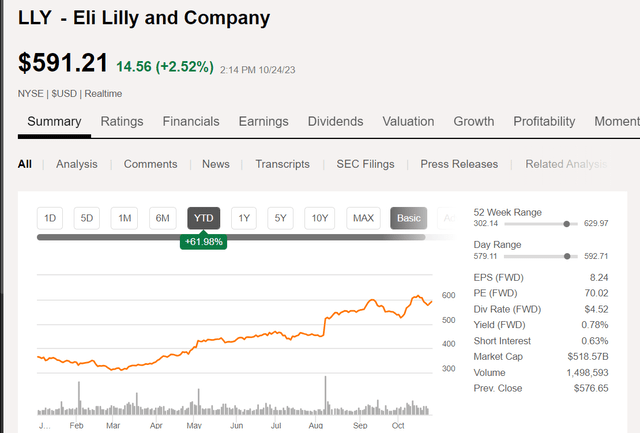

Seeking Alpha

But the chief reason for Eli Lilly’s whopping 62% rally year to date is the type 2 diabetes and weight loss drug Mounjaro, which was approved for the former indication in May 2022. In that short time, the drug has logged $1.5 billion in sales in the first half of 2023 for Eli Lilly. As you’d imagine, from a drug of this magnitude, it has been flying off the shelves faster than Lilly can make it. That’s the problem every drugmaker dreams of having.

Over a year and a half phase 3 clinical trial, the average percent of weight loss was 26.6%. That is why Mounjaro is likely to be approved by the FDA for weight loss by the end of this year. When this happens, the drug is expected to take off even further. Analysts have peak annual Mounjaro sales pegged at anywhere from $35 billion to $70 billion. For perspective, it’s projected that the company’s revenue will come in at $33.4 billion in 2023. Mounjaro’s peak sales alone would represent a doubling or tripling of total revenue from this year.

Throw in its exceptionally strong pipeline, and it’s not hard to understand why FactSet Research predicts 23.4% annual earnings growth from Eli Lilly. Unfortunately, the stock has gotten way too far ahead of itself. Eli Lilly’s $592 share price is trading at a 147% premium to its fair value of $239 a share.

If Eli Lilly can grow as expected, returns could still be strong:

-

0.7% dividend yield + 23.4% annual earnings growth – 8.7% annual valuation multiple contractions = 15.4% annual total returns

But in the near term, a precipitous 40% plunge in the share price is justified by fundamentals. When there are so many other world-class stocks trading at cheap valuations that provide a margin of safety, Eli Lilly is arguably a hard pass.

Highest P/E In Its History

Takeaways: Never Forget Valuation, Buy Albemarle Hand Over Fist, And Don’t Fall Into The Eli Lilly Bubble Trap

Dividend Kings Zen Research Terminal

As the math in this article demonstrates, valuation matters a lot in the investing business. For the best chance at success, investors must always consider valuation as a close second to quality. Albemarle and Eli Lilly both enjoy investment-grade credit ratings, pay modest but safe and growing dividends and have excellent long-term growth prospects.

But valuation is where the two part ways, taking different forks in the road. I don’t know how far Albemarle will fall or how high Eli Lilly will soar in the short term. However, those buying the former have an undeniable margin of safety over the long haul, whereas those buying the latter have quite the opposite. That is why I rate Albemarle as a strong buy and suggest investors stay on the sidelines of Eli Lilly stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and more.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my family’s $2.5 million charity hedge fund.

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.