Summary:

- Intel stock has stunned the perma-bears as it has outperformed its semiconductor peers since May 2023.

- The company’s robust Q3 earnings and solid forward guidance corroborate the market’s confidence that the worst in INTC is likely over.

- Intel’s attempt to regain process leadership against TSMC remains on track, as it secured commitments from three foundry customers for Intel 18A.

- I explain why the cyclical upswing in the industry should lift Intel’s fortunes. However, competition against AMD and Nvidia at the data center level is still expected to be intense.

- I argue why the risk/reward profile in INTC remains favorable at the current levels. It’s time for semiconductor investors to pay close attention to the comeback King.

hapabapa

I last updated Intel Corporation (NASDAQ:INTC) investors in mid-August 2023, urging them to capitalize on its pullback to add more shares, as I shared that Intel is “making a comeback against all odds.” Since I upgraded my rating on INTC in June 2023, I have assessed improved buying sentiments, suggesting market participants have rotated back into INTC.

INTC’s robust recovery since it bottomed out in late February 2023 demonstrated that the worst is likely over. Accordingly, INTC has outperformed its semiconductor peers represented in the iShares Semiconductor ETF (SOXX) since late May 2023, as INTC/SOXX moved back into a potential medium-term uptrend. While still nascent, it suggests why investors need to be flexible in recognizing peak pessimism in Intel, notwithstanding the hammering in 2022.

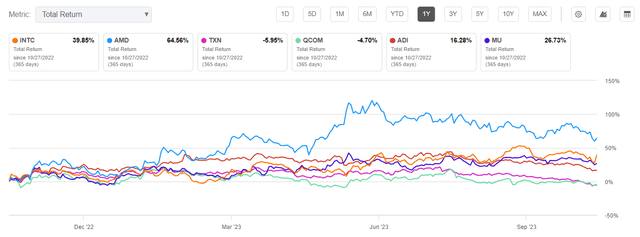

INTC Vs. peers (1Y total return %) (Seeking Alpha)

Moreover, INTC’s 1Y total return of nearly 40% has outperformed leading players such as Texas Instruments (TXN), Qualcomm (QCOM), Analog Devices (ADI), and Micron (MU), as seen above. As such, I believe CEO Pat Gelsinger and his team have garnered sufficient confidence from market participants that the punishment was too severe, contributing to INTC’s remarkable recovery.

Intel posted a robust third-quarter earnings release, outperforming analysts’ estimates. It also delivered a better-than-anticipated Q4 guidance, corroborating the bottoming process of INTC against its peers since May 2023. With INTC surging nearly 10% on Friday (October 27), the market has also attempted to price in Intel’s more robust guidance from Q4 rapidly, as it could mark a return to a YoY increase in quarterly revenue.

Accordingly, management indicated a revenue guidance range of between $14.6B and $15.6B for Q4, for a midpoint outlook of $15.1B. The guidance outperformed previous analysts’ estimates of $14.35B, suggesting Wall Street was too pessimistic about Intel’s execution. The updated analysts’ estimates of $15.07B is still below the company’s midpoint guidance. However, it marks a 7.3% YoY increase in quarterly revenue, corroborating the bottoming of the company’s operating performance.

As such, dip buyers who bought INTC in May/June 2023 correctly anticipated the bottoming out of its operating performance, as INTC has outperformed SOXX since then (remember that the market is forward-looking). By the time you wait for Intel’s guidance to show a discernible growth inflection, you would have missed the most attractive risk/reward upside as seen in May/June 2023.

Intel has demonstrated that its attempt to regain process leadership is still on track, as it secured commitments from three foundry customers in Intel 18A. Accordingly, Intel Foundry Services or IFS registered significant revenue growth of nearly 300%, reaching $311M, albeit from a much smaller base.

Although it represents only about 2.2% of the company’s total revenue base, its progress is still nascent. As such, investors should focus on the company’s ability to secure more customer commitments, fundamental to the scaling up of the IFS segment and improving its gross margin accordingly.

Management remains confident of a long-term gross margin outlook of its previous 60% level. However, that depends on Intel’s ability to achieve its five nodes in four years cadence, and it remains to be seen on whether that is achievable. Despite that, the market is likely anticipating IFS to continue gaining momentum as customers diversify from TSMC (TSM), helping to drive the acceleration of Intel’s gross margin.

Moreover, the downstream inventory digestion in PC shipments has abated as Intel emerges from its cyclical downturn. Furthermore, the proliferation of edge AI should improve the downstream refresh rates as the industry moves back into a period of growth. Notably, Intel maintained its 2023 PC TAM of 270M units, while also telegraphing its confidence in a long-term TAM of 300M.

Despite that, there was continued weakness in DCAI, as Intel faced competitive headwinds against AMD (AMD) and Nvidia (NVDA). However, the secular growth drivers underpinning the shift to accelerated computing should also benefit Intel as it attempts to gain share with its Gaudi processors. Also, management highlighted that inferencing is a massive opportunity that its data center CPUs can serve. Therefore, investors should not conclude too early that data centers are retooling in double-quick time toward GPU infrastructures. As such, Intel remains well-placed to maintain its leadership in the data center segment, although intense competition is still expected.

Hence, the significant question facing investors is whether there’s still sufficient upside from the current levels to justify an attractive risk/reward profile.

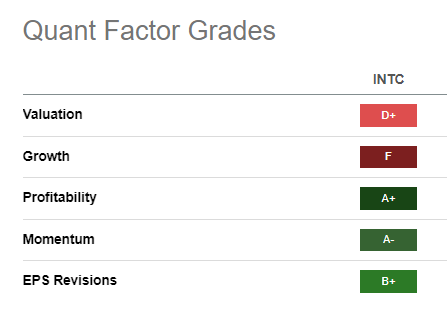

INTC Quant Grades (Seeking Alpha)

INTC’s “F” growth grade suggests that the recent recovery supports a mean-reversion thesis, given its significant battering in 2022. As such, management must still execute well to improve the market’s confidence to regain process leadership while defending against significant market share losses in DCAI.

However, INTC’s “B+” earnings revisions demonstrated that the cyclical upswing in the semi-industry has benefited Intel, as it outperformed analysts’ estimates.

With INTC’s “A-” momentum, buyers have rotated back into INTC, corroborating the outperformance over its industry peers since May 2023.

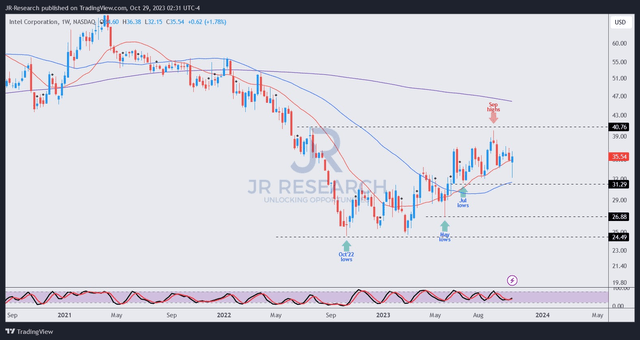

INTC price chart (weekly) (TradingView)

My analysis suggests a robust resistance zone at the $40 level. INTC remains about 12.6% away from that level, suggesting there’s still adequate potential upside to buy its recovery thesis.

While a buy closer to the low $30s would provide a much more attractive risk/reward opportunity, I gleaned INTC’s higher lows and higher highs price structures as constructive.

As such, I assessed investors who waited for Intel’s Q3 earnings scorecard to be released first should consider buying at the current levels before it recovers toward the $40 zone.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC, TSM, MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!