Summary:

- Texas Instruments Incorporated reported bad Q3 earnings last week and the stock dropped significantly, continuing its poor year-to-date performance.

- Management continues with its plan to invest in increased capacity, but the market is unsure if these investments make sense. We explain why.

- Cash flows continued to be weak but that should change significantly next year.

- We give our opinion on the “China risk” and how it might impact Texas Instruments Incorporated.

blackdovfx

Introduction

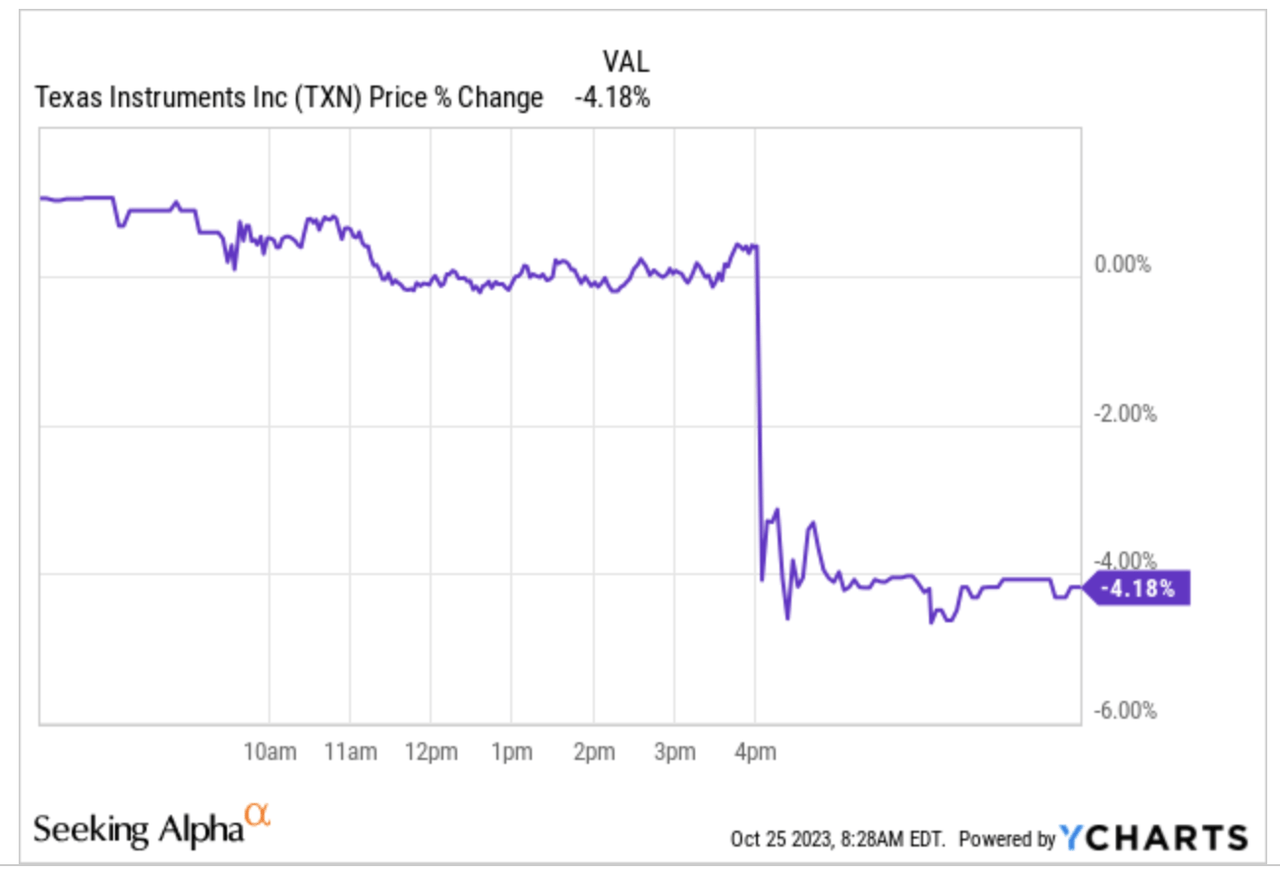

Texas Instruments Incorporated (NASDAQ:TXN) [TI] reported Q3 2023 earnings this week, and they were pretty rough. We must admit that our conviction is being tested. The market did not like these earnings much, and the company’s stock sold off as much as 5% after hours:

YCharts

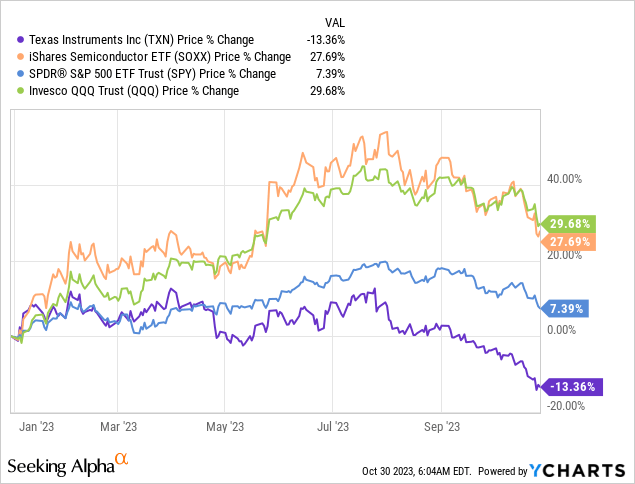

This drop has come on top of a significant drop the stock has suffered this year, massively underperforming the iShares Semiconductor ETF (SOXX) and both major U.S. indices:

We must say that our conviction is probably being tested more by the external noise than the results, as it’s old news that we are currently in a semiconductor downcycle and that the company would invest aggressively regardless of the demand landscape. What’s unfolding now is a “perfect storm” for Texas Instruments, but one that has been a deliberate choice more than anything. The company could stop spending on capex and would enjoy better margins and significantly higher cash flow, but management has chosen to invest for the future.

Many investors worry that this future might not be as pretty as the past, meaning management might be investing in low-return initiatives. There are reasonable arguments to believe in this scenario, but there’s also little data to support the strong claims we are seeing across social media. We’ll go over these topics in this article, giving our honest view.

So, without further ado, let’s get on with it.

The Q3 numbers

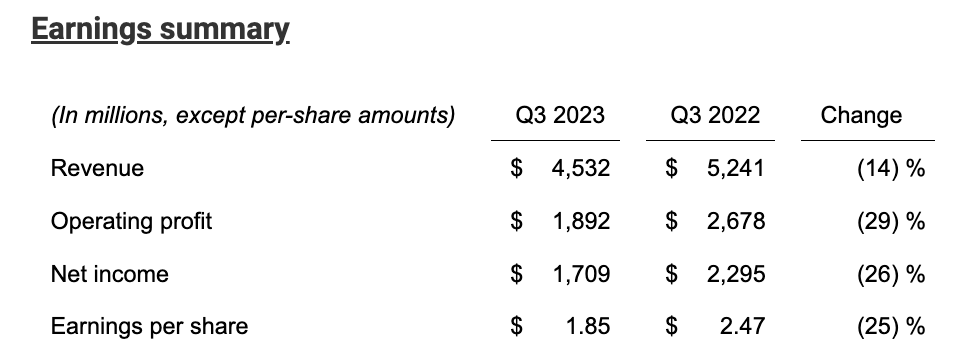

The headline results

Last quarter showed some signs of bottoming, but not enough to grow complacent with a cycle turning point. It’s been a special cycle because it has been asynchronous. While Q2 was strong because expectations were low, Q3 was not.

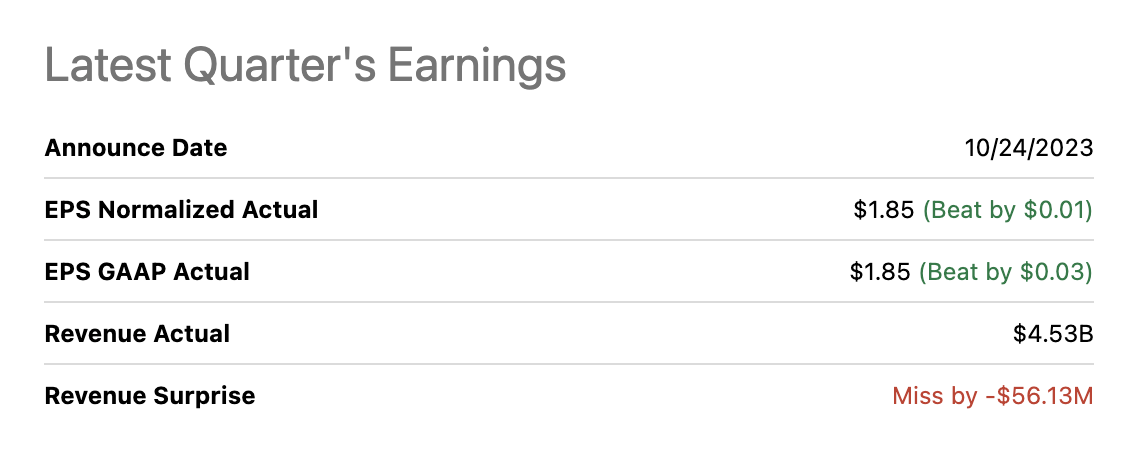

Texas Instruments beat bottom-line estimates by a small margin, due to a 5-cent benefit that was not taken into account in guidance, but slightly missed top-line expectations:

Seeking Alpha

The pace of the “recovery” has slowed down, with revenue flat sequentially compared to revenue being up sequentially last quarter. At first sight, this does not look too bad, but we’ll see later on in guidance how the landscape is about to worsen further next quarter.

The different moving parts

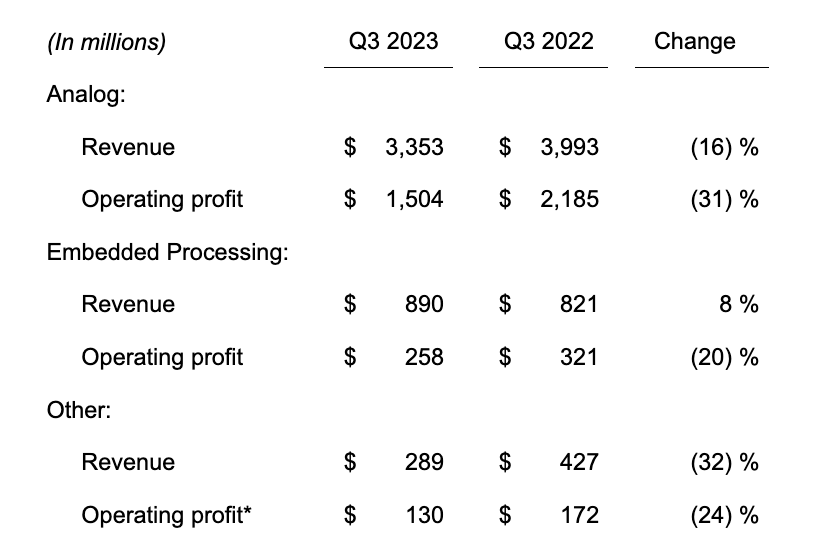

There was not much news on the segments’ performance: analog continued its recent weak performance, whereas embedded continued growing:

Texas Instruments Q3 Earnings Release

In both of these segments, we continued to see operating deleverage kick in, a concept that we’ll discuss later on in the article to explain why it should be spoken about cautiously.

We have discussed the reasons why embedded is doing better than analog in other articles. In just a few words, this stems from the company’s change of strategy in that segment after many years of poor performance. The strategy seems to be playing out well.

What about the end markets?

As most of you know, Texas Instruments caters to many end markets like automotive, industrial (which, by the way, is sub-segmented in many markets), personal electronics, etc.

Similarly to last quarter, automotive was the bright spot. We did not expect this strength at all. TSMC mentioned automotive as a lowlight in its most recent earnings call, saying they expected the downcycle to start in this segment, but Texas Instruments reported growth once again (emphasis added):

During the quarter, automotive growth continued and industrial weakness broadened. Similar to last quarter, I’ll focus on sequential performance, as it is more informative at this time. First, the industrial market was down mid-single digits, with weakness broadening across nearly all sectors. The automotive market continued to grow and was up mid-single digits. Personal electronics was up about 20% off of a low base. And next, communications equipment was down upper teens. And finally, enterprise systems grew upper-single digits.

Source: Dave Pahl, Head of Investor Relations, during the Q3 2023 earnings call.

The fact that automotive continues to be strong is also one of the reasons we would be cautious in claiming that the situation in China is already impacting the company enormously. More on this later.

As you can see, the asynchronous nature of the cycle continued. Personal electronics seems to have already turned, coherent with the timing of the downturn (emphasis added):

The one thing that is unique, of course, with the cycle is how the markets have behaved differently. We’ve seen bifurcation and really lined up very well with when markets recovered. So PE was the first to recover and was very strong early on. The other markets followed very shortly after that and Automotive was last. As you remember, many automotive manufacturers struggled to restart their factories and people weren’t going to showrooms when we are in the midst of the pandemic.

So really, as we’ve seen things begin to roll over, Personal Electronics was first. It was then followed by the other markets, and yet we still have automotive that’s hanging in there. So I think that’s the one thing that’s unique.

Source: Dave Pahl, Head of Investor Relations, during the Q3 2023 earnings call

It’s pretty clear by now that automotive will eventually roll over (it’s a question of when and not if), although it’s unclear what the state of other end markets will be at that time. The most notable change in this quarter’s end markets was that industrial weakness broadened.

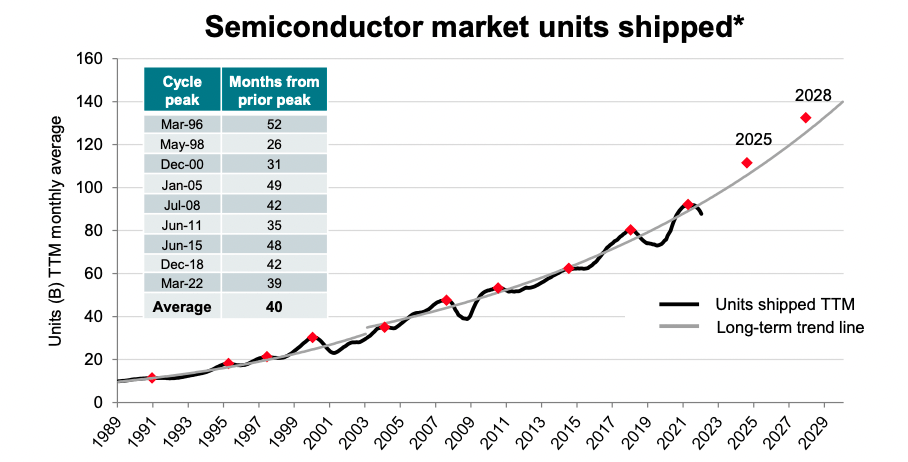

What’s important in cyclical industries is not in what part of the cycle we are in today but rather where the next peak will be. We think it’s pretty clear Texas Instruments operates in a secular industry despite the cycles:

Texas Instruments Capital Management Update

This said we must not ignore that the competitive landscape might be changing and that, while we will inevitably see another peak in the cycle, we must also assess if the economics will be favorable to Texas Instruments in that scenario.

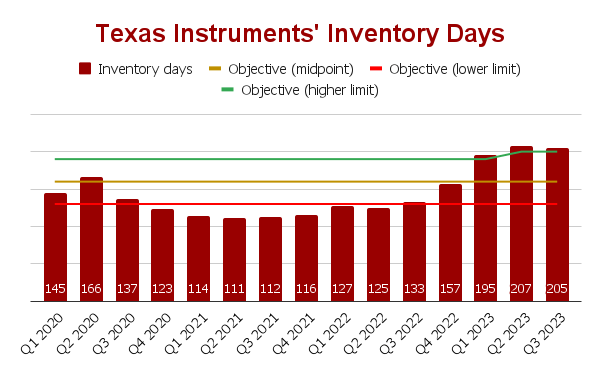

Inventories stopped climbing

The company’s management has been vocal about preparing for the next upcycle through capex investments and inventory buildup. Their rationale (which makes sense) is that, when the upcycle starts, there will be no time to manufacture all the demand, and they want to be prepared for that moment. This, together with the low obsolescence risk of their products, made them choose this path. Note that other companies depend on foundries, meaning that they might be faced with bottlenecks once the cycle turns. That’s not the case for Texas Instruments, as it has its own foundries.

Inventory had been growing for quite some time, but management now feels it’s at appropriate levels and has slowed down this buildup. In fact, inventory days were down 2 days sequentially to 205 days:

Made by Best Anchor Stocks

Management feels this is an appropriate level because there are now no lead times for most of the catalog products. This means that if the upcycle resumes and it will eventually, customers will be able to access these products immediately, helping Texas Instruments gain share against those competitors that have not prepared in advance. We saw these dynamics play out coming out of the pandemic.

As we’ll see in the next section, the underutilization related to the end of the inventory buildup is also negatively impacting margins. Investors had been asking for some time about the inventory levels management would be comfortable with, and it seems they got their awaited answer this quarter.

Profitability – The double-edge nature of a fixed-cost model

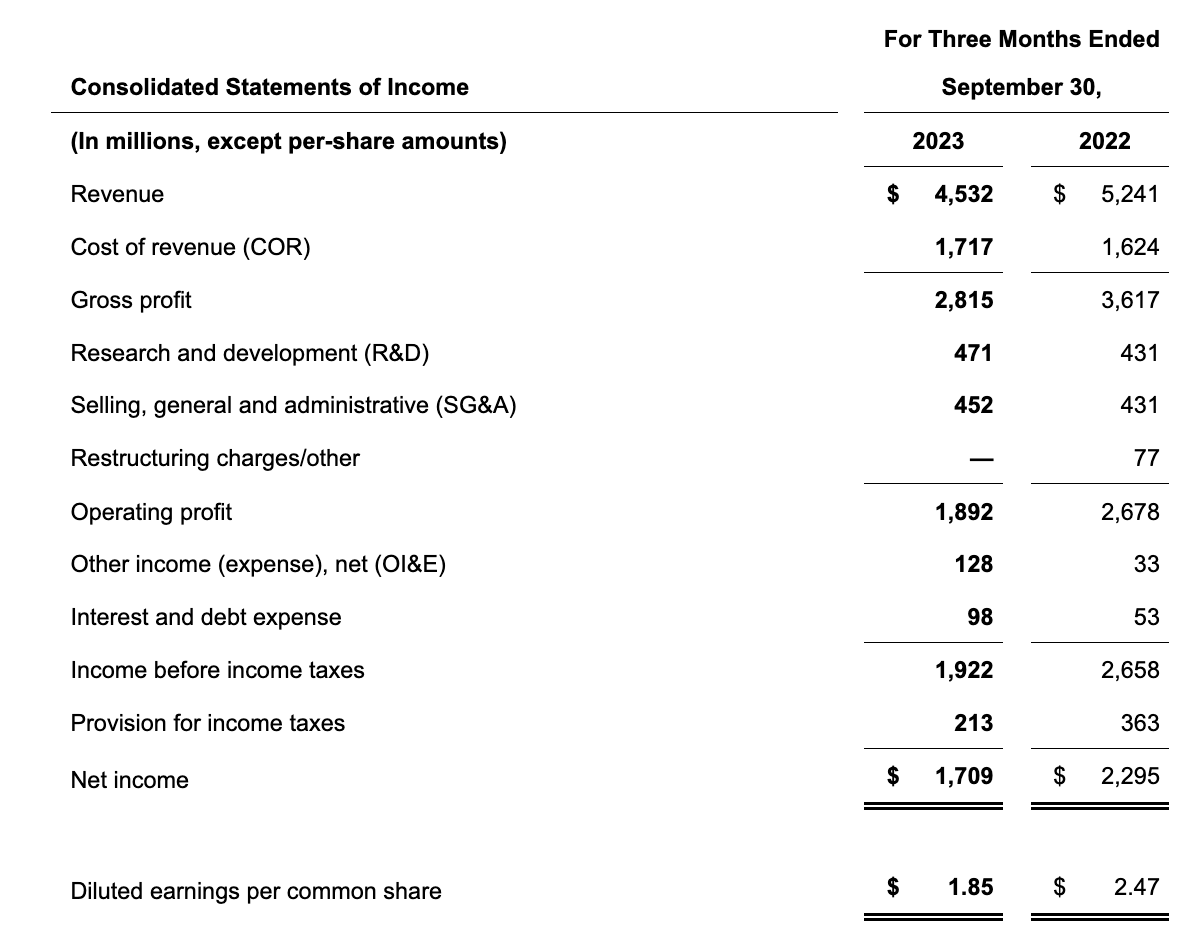

We have mentioned in several previous articles, like this one and this one, that Texas Instruments follows a fixed-cost model due to its internal manufacturing footprint. These fabs run daily and have high fixed costs, so lower revenue caused by a cycle makes the margins plummet. This is called operating deleverage, and it continued this quarter:

Texas Instruments Q3 Earnings Release

We are not worried about this, considering that Texas Instruments continues to be immensely profitable even after this operating deleverage. The company posted a net income margin of 37.7% this quarter. The landscape in cash flows is different, but we’ll go over that later.

Many are citing this operating deleverage as a risk for Texas Instruments, but we believe it’s simply part of the model and it’s a double-edged sword: in the same way, profits are falling significantly faster than revenue, they will also rise significantly faster than revenue when the cycle turns. Note that all of the inventory has already been manufactured and will inevitably flow into revenue at some point. What matters are not the financials during the top or bottom of the cycle but the normalized financials.

Management continues to invest in the future irrespective of current demand; gross margin is not the only line that has contracted. Both SG&A and R&D increased year-over-year despite the drop in revenue, and we highly doubt this will change going forward:

Texas Instruments Q3 Press Release

This is not just our perception. Management claimed that investments will not stop due to the cycle (emphasis added):

So on OpEx, we’ve held a steady hand on OpEx for many years and we’ll continue to do so. So as an example, to illustrate the point, from 2017 to 2021 we ran at about $3.2 billion of OpEx. And then in 2022, it ticked off to $3.4 billion. And now we’re running at about $3.7 billion on a trailing 12-month basis. So you can see the steady hand and just a bit of an increase over the last few years. And that’s, as we have has a steady hand with our hires, new college hires, and as we make investments to continue to strengthen the company in the case of R&D, the broad portfolio in the case with sales and TI.com on the reach of our channels.

Source: Dave Pahl, Head of Investor Relations, during the Q3 2023 earnings call.

Of course, this countercyclicality is a “luxury” that only a company that is so profitable, like Texas Instruments, can enjoy.

Underutilization also played an important role in the margin drop this quarter because the company is taking an underutilization charge. Rafael Lizardi, Texas Instruments’ CFO, explained how this works during the call (emphasis added):

So it’s an accounting process and it’s essentially when you’re below what’s considered normal utilization, that percent that you’re below that — and that is generally determined by wafer and the fab is wafer starts and out in the assembly test operation as your — the number of units that you’re producing and you divide that by the capacity that you can get, the maximum capacity. You establish a normal, which is where you normally expect to be. That could be 85%, 90%, 95%, depending on the situation. And whenever you’re below that, then you take that percent that you’re below and then you take those fixed costs and go straight to the P&L instead of going into inventory.

The good news is that he also remains confident in reaching normalized gross margins once the cycle changes, something that not many investors believe at this point (emphasis added):

So you start with revenue, then you fold that through at 70% to 75%, which by the way, that is reflective of the great, not only geopolitically dependable capacity that we’re putting in place, but it is all that new fab capacity is 300 millimeters. So it has a structural cost advantage, not to mention that we’re getting ITC and grants benefits that is installed in the United States.

This doesn’t rhyme with the competitive environment getting much worse for Texas Instruments, but we shouldn’t take it at face value either, as it’s what one should expect management to claim.

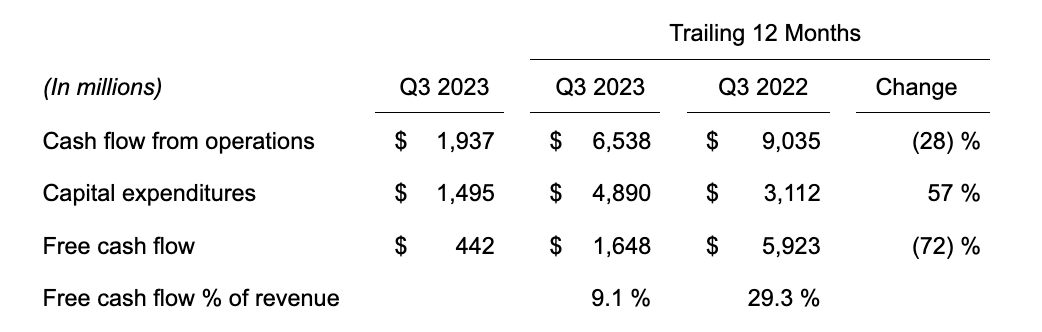

Cash flows – Continued weakness and need context

Cash flow improved slightly on a sequential basis but remained substantially depressed. Lower revenue and margins have weighed on operating cash flow, and the company’s countercyclical capacity investments have amplified this impact on Free Cash Flow:

Texas Instruments Q3 Earnings Release

Despite the operating cash flow drop and the surge in Capex, the company has remained free cash flow positive for the last 12 months, but as we’ll see later on, these cash flows are not enough to cover the dividend.

Of course, let’s not forget that capex is not a business need but rather management’s choice to reinvest into capacity. This means that if things end up being tougher than anticipated, you should expect capex to drop significantly. This is not the plan at the moment.

Something important to consider is that so far, Texas Instruments has only seen the outflows in the capacity expansion plans, not the inflows. As announced during their Capital Management Update, they plan to spend around $5 billion in capex per year up until 2026, but this is the gross number. The company will get tax credits for its investments in the U.S., and we should see these flowing in next year (emphasis added):

So roughly about $4 billion of that we’re going to get back on ITC about one year offset. Of that, we have already accrued $1.2 billion on the balance sheet. So you’ll see that on our balance sheet on the long-term assets. A portion of that, we will get some time next year, probably by fourth quarter next year is when we expect to get that cash, so that’s when the cash will start flowing in.

Source: Rafael Lizardi, Texas Instrument’s CFO, during the Q3 2023 earnings call.

This means that next year’s cash conversion should look significantly better than this year’s as the company accrues these cash inflows. Also note that there’s another benefit besides the ITC that the company might benefit from, although management is not counting on it (emphasis added):

On an earlier question, we are actively applying for the grant. So that’s going to be in addition to the ITC. We’re not counting on that. We don’t have any numbers on that because you have to apply, you have to wait until the Department of Commerce makes that decision. But we are — we’re planning on receiving the funding from the CHIPS Act grant was comprehended in our decision, and we firmly believe we are very well positioned to receive those funds, and we’re a great candidate for that, and we believe there will be meaningful to manufacturing operations in Texas and Utah to support semiconductor growth and the objectives of the CHIPS program office.

Source: Rafael Lizardi, Texas Instrument’s CFO, during the Q3 2023 earnings call.

This means that we might see even better cash conversion next year, irrespective of the continued reinvestment in capacity.

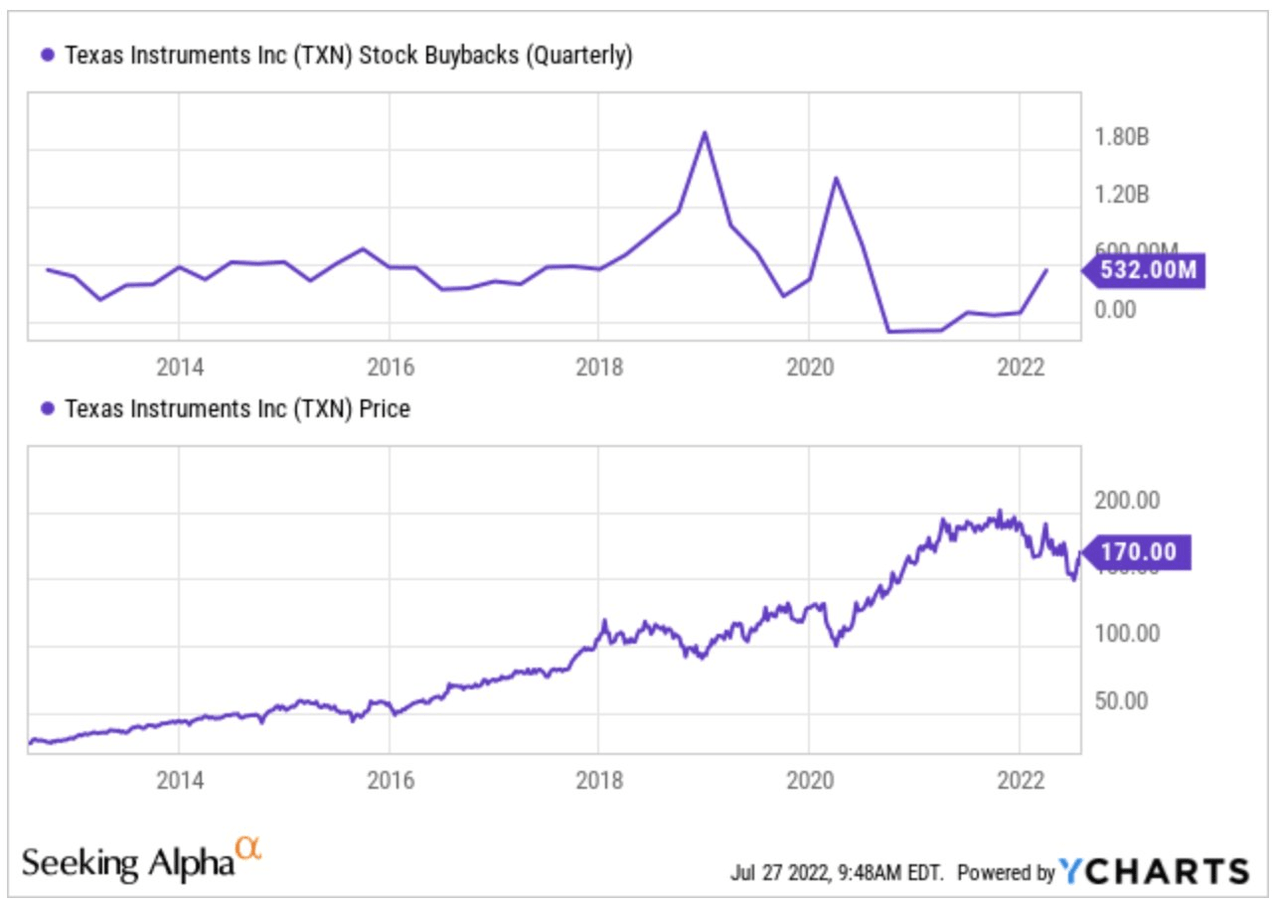

Strong balance sheet and continued buyback cooldown

Something that has also caught the eye of many investors is the continued buyback cooldown the company has seen. The company has a track record of being countercyclical with buybacks:

YCharts

So, why isn’t Texas Instruments doing buybacks? Doesn’t management believe the stock is cheap? We think this is because there’s now a trade-off. The company must choose to invest either in capacity expansion, return dividends to shareholders, or repurchase stock, and it has decided to do the first two.

If they are investing in capacity expansion, then they must believe the return from that venture is higher than buying back stock at this price (something we might agree with considering historical returns). Note that as we have just seen, free cash flow is not high now, so the company does not have money to undertake the capacity expansion while repurchasing shares. This might have been different than in other cycles through which Texas Instruments remained immensely profitable on a cash flow basis.

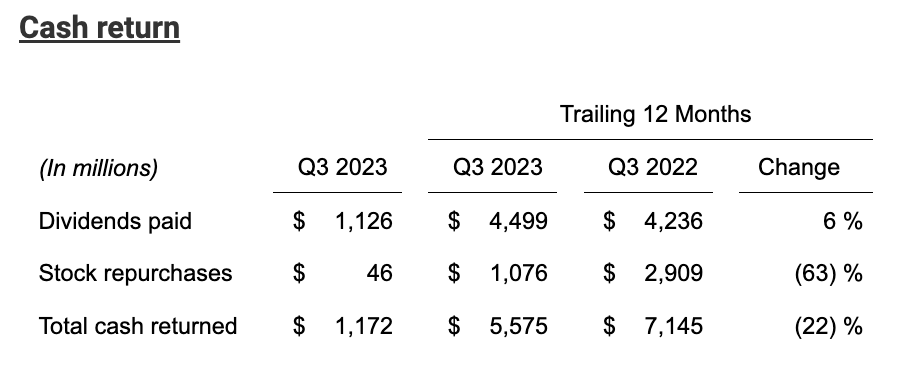

But, if this is the case, why are they maintaining (and even growing) the dividend? Well, this is a matter of choice. Texas Instruments has historically been a dividend stock and many people depend on the recurring income from this dividend, so we understand why they would not choose to cut the dividend to buy back stock. It’s pretty evident that the company is spending more than its free cash flow on the dividend:

Texas Instruments Q3 Press Release

The company is using debt to pay this. Debt rose to $11.3 billion, but its cash position remains solid at $8.9 billion, meaning its net debt position is now around $2.4 billion. Is this worrying? Well, we think we must monitor the situation closely, but there are reasons to be optimistic. We outline some of these below:

-

The company’s cash position is significant and the average coupon rate on the debt is 3.5%

-

The company can choose to slow down capex to generate more cash

-

Cash conversion will be better next year

-

The cycle will eventually turn

Of course, we could go under the scenario where #4 takes more time than previously anticipated, but always remember that #2 will always be under management’s control regardless of the timing of the cycle. Either way, it’s a situation to monitor.

Some thoughts on the China risk

The China risk probably remains the most controversial and relevant topic for Texas Instruments. ASML’s commentary around Chinese semiconductor manufacturers trading down to the trailing edge due to export restrictions promised to have an impact on Texas Instruments’ business in China. The rationale is that Chinese customers have been left no choice but to pursue this “trade-down”, and they will do so while being subsidized by the Chinese government. This will create an influx of supply from competitors who are not afraid to lose money, thereby worsening the competitive landscape.

Before going into the matter, let’s see what’s at stake for Texas Instruments. Many investors read the company’s filings and claim that Texas Instruments’ exposure to China is huge. It’s indeed large, but not as large as the numbers portray. As per its 2022 annual report, Texas Instruments technically derives 49% of its revenue from China. However, “only” 25% of this revenue is derived from customers headquartered in China; the rest goes through distributors:

Revenue from end customers headquartered in China represents about 25% of our revenue.

This, together with the company’s strategy to go more direct through TI.com, means that what’s really at stake is something around 25%, not the 49% that many investors claim. It’s true, though, that analog growth in China will also be substantial going forward, so a good portion of the future revenue growth the company expects might be at stake too.

With this context out of our way, let’s explore the signs that point out to TI’s supposed losing battle in China. We read this article some time ago, which claims that Chinese players will make hefty investments into trailing edge manufacturing and that Chinese EV players prefer to vertically integrate the designs in-house. It’s a good article, and we believe the thesis behind it makes quite a bit of sense. What the article discusses is the beginning of a price war in China.

We spoke to a former Texas Instruments employee who told us that he believed that entering into a price war with the company is very tough because it’s the lowest-cost producer. Still, if this Chinese capacity is subsidized by the government, then the landscape is different because costs don’t matter as much in that case. It is also worth noting that product breadth is a unique competitive advantage that not only takes money to replicate but also time. We discussed this in that article, too.

The article quoted above goes specifically around the landscape in EVs (Electric Vehicles), but if a competitive landscape in China were causing the recent lousy performance, wouldn’t automotive be down? It’s the only segment that is currently up. It’s true, though, that we only have visibility on its revenue, not on margins. If the competitive landscape worsens, Texas Instruments may well make more sales, but at what margin these sales are made is also key. As we don’t have this information, we don’t think we should assume this is the case. The bottom line here is that it’s challenging to know if the current weakness comes from the situation in China or cyclicality. If we were in the middle of an upcycle, then one could argue that competitive pressures in China are behind the weakness, but we don’t think there’s enough information to make such a claim at this point.

Another thing here is that the geopolitical battle might have unforeseen consequences. While it might make China less accessible for Western companies, Western companies might also be wary of doing business with Chinese suppliers. Analog chips tend to make up a small portion of the total cost of a system and not having access to them can pose serious disruption risks. These dynamics are what are encompassed in what management refers to as “geopolitical dependable capacity.” Something similar is also taking place at an accelerated pace in the leading-edge market, much more exposed to the geopolitical battle today.

This China topic has tested our conviction. Knowing what will happen in the future is impossible (nobody has a crystal ball), but we don’t think this risk is as evident as many people claim it to be. Said in another way, we don’t think there’s enough data to claim that a more intense competitive landscape in China is starting to weigh on results. We could well be wrong, of course.

What we do know is that not because many people repeat the same thing means it’s true. We are choosing to be contrarians here until proven otherwise. The good news about investing is that if we manage risks accordingly, sometimes we’ll make money, and other times we’ll learn. It’s too early to tell if Texas Instruments will belong to the former or the latter, but we prefer to remain cautious.

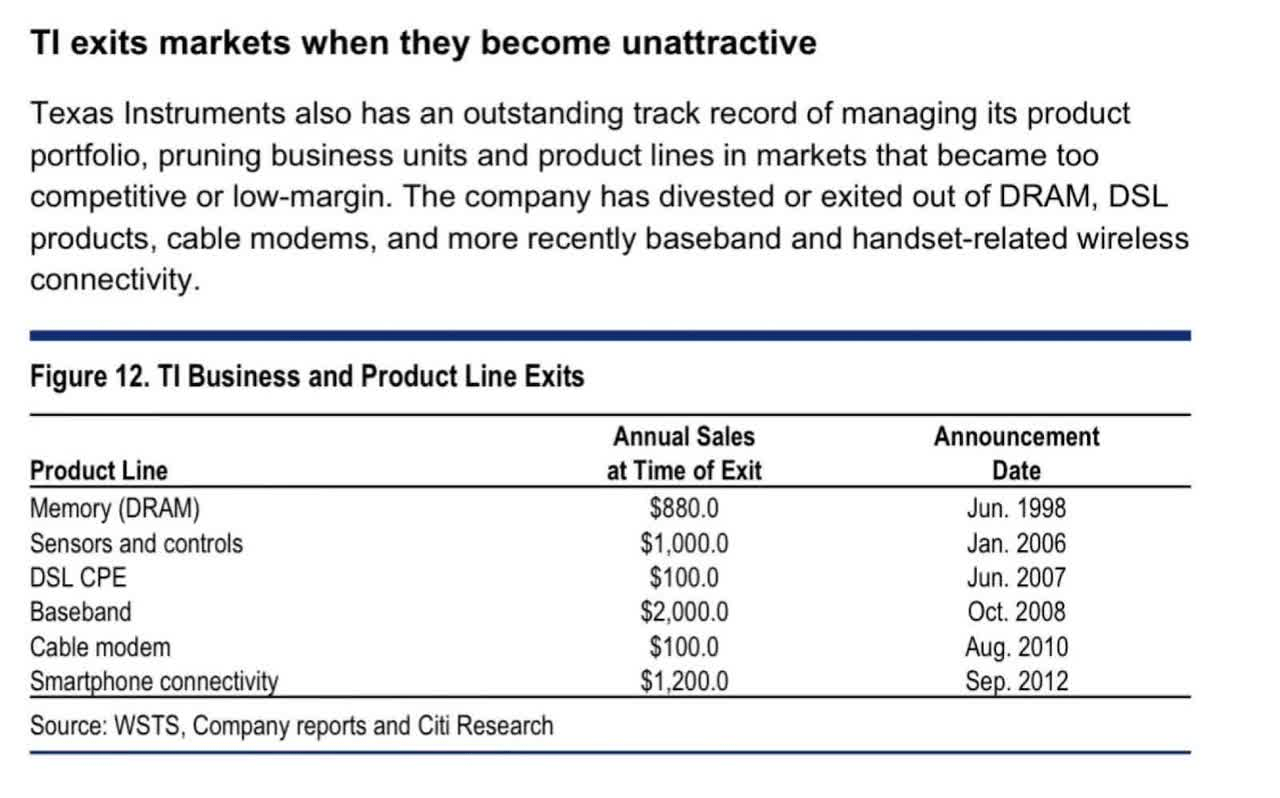

Also, note that it’s in moments like this when trust in management becomes so important. If one doesn’t trust the management team of a company, the best thing is to sell and move on, but we do trust Texas Instruments’ management team. Could they be wrong by investing in a deteriorating market? Definitely, but we believe they have more information than us to make that decision. They have also demonstrated through the years that they are not afraid to exit markets they do not find attractive:

WSTS

We should never take management’s words at face value, but trust is obviously an essential part of any investment thesis. The company’s management has not given us any reason to distrust them. The stock’s performance is obviously not great this year, but it is what it is. We’ll continue to see weakness as the cycle doesn’t turn. Still, it’s impossible for us or anyone else to know when the cycle will turn and if this will evidence that, indeed, the environment in China is worsening.

It’s also a stretch to assume that China has gotten up to date so fast. It has been barely 3-6 months since ASML mentioned that Chinese customers were transitioning to the trailing edge. Considering the long lead times of the systems and high switching costs, it’s a stretch to think that they are already having a significant impact on the company’s numbers.

Guidance

We won’t spend too much on guidance: it was not great. The company expects $4.1 billion in revenue at the midpoint, which is a sequential decrease of 9.5%. They mentioned that it had to do with industrial weakness broadening.

As for EPS, management expects $1.46 at the midpoint, a drop of 21%. This means that we should continue to expect operating deleverage.

We must say that the range was quite wide both for revenue and EPS, meaning that management believes uncertainty is high.

Conclusion

We hope this article helped you put Texas Instruments’ Q3 earnings into context, especially in what related to the China risk. Texas Instruments is in a perfect storm and is being met with fears of terminal risk in China, probably motivated in part by the poor stock price performance this year.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We are also long ASML

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has outperformed the S&P 500 by almost 28% (on 10-20-2023).

At Best Anchor Stocks, we follow up our quality compounders meticulously, so you don’t have to worry about your portfolio.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!