Summary:

- Google’s stock has experienced a significant correction due to poor revenue growth in its cloud business.

- However, the company has seen improved operating income within its cloud division, which will help improve overall margins.

- Google’s steady buyback pace and strong cash flow position make it a good option for long-term investors.

400tmax

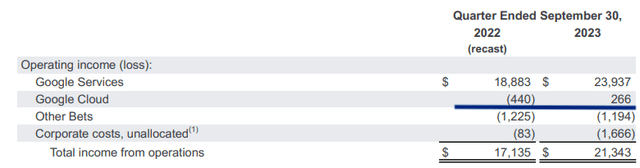

Google (NASDAQ:GOOG) stock has suffered one of the biggest corrections since the pandemic in March 2020. Most of the blame goes to poor revenue growth performance in cloud business. However, the positive trend in the recent quarterly earnings was the operating profit reported within the cloud business. In the year-ago quarter, Google Cloud reported negative $440 million in operating income compared to positive $266 million in the recent quarter. This improved operating income by over $700 million for the recent quarter or close to $3 billion annually. Overall, there was $4 billion improvement in operating income as headcount reduction improved efficiency. This trend will help the company in reporting better margins in the near term. As mentioned in a previous article, YouTube is also showing improvement in advertising and subscriptions which will improve the overall growth trajectory for the company.

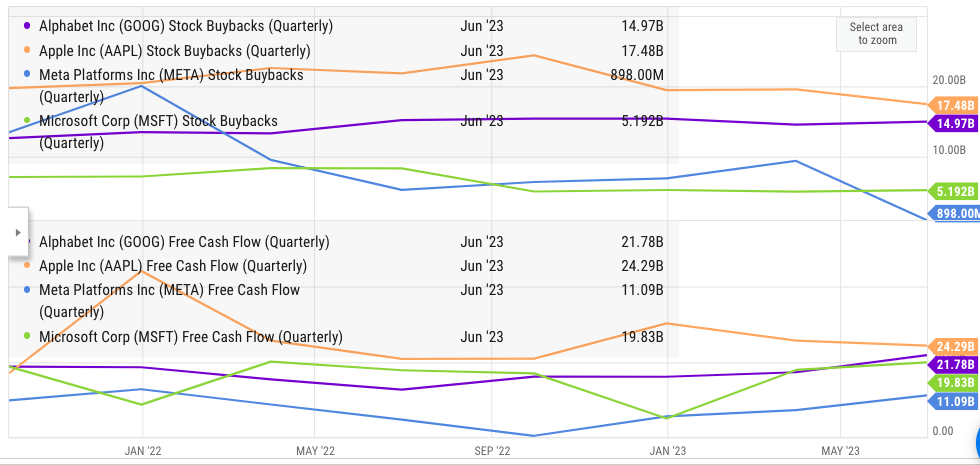

Google is investing this massive cash flow in buybacks. In the recent quarter, the company spent another $15.8 billion on buybacks. The steady buyback pace is a more sustainable strategy as the company can forecast where resources need to be diverted in the future. At the current stock price, this pace of buybacks will boost EPS by 4% annually.

Google does not have massive investment needs unlike Amazon (AMZN) in logistics or Apple (AAPL) in streaming business. Google Cloud has turned profitable, reducing the need for higher cash flows. The company also has over $100 billion in net cash position with a quarterly free cash flow of over $20 billion. Hence, the company could easily sustain the current buyback pace for the next few years. Steady growth in Google Cloud and Google Other segment should help in improving overall revenue growth. Even with modest high-single digit revenue growth and good buybacks, the stock could deliver over 15% EPS growth making it a good bet for buy and hold option for long-term investors.

Steady and strong buyback pace

Google has bought back stocks at a steady pace over the last few years despite big swings in the stock price. This shows that the management is not trying to support the stock price or buying stocks at advantageous positions. It is instead trying to invest a stable share of the free cash flow in reducing the share count. In the recent quarter, Google’s FCF was over $20 billion and it could easily cover the stock buybacks.

YCharts

Figure: Google’s stable FCF and buyback compared to swings in other big tech peers. Source: YCharts

Google has a lot more stable FCF and buybacks compared to other big tech companies like Apple, Microsoft, and Meta. This should allow Google to maintain a healthy buyback pace in the next few years. At the current stock price and buyback pace, the company is able to show 4% annual EPS growth through buybacks alone.

Figure: Improvement in operating income within Google Cloud. Source: Company Filings

There has been a big focus on the drop in revenue growth within Google Cloud. This seems shortsighted because the long-term trend is still quite positive. Google has improved the operating income within the cloud division by $700 million compared to the year-ago period, which is equal to almost $3 billion on an annualized basis.

Good revenue growth potential

There have been many stocks with healthy buybacks that have given poor returns to investors over the long term. Hence, it is important to gauge the revenue growth potential of the company as well.

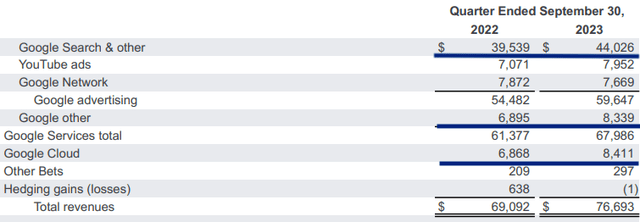

Figure: Google has several high-growth businesses beyond the core search business. Source: Company Filings

In the recent quarter, the company reported double-digit growth in revenue in constant currency. Google Other segment is also performing quite well. The Google Other segment consists of hardware, YouTube subscription, Google Play, and other services. The revenue share of these high-growth segments will increase over the decade making them more important for the overall revenue growth.

The revenue share of Google Cloud and Google Other has increased to 21%. Both these segments have very high growth potential and we could see their revenue share increase to over 40% in the next few years. Despite slower growth in the ad business, Google has other high-growth segments which can boost the overall revenue growth for the company.

A trillion-dollar question

Apple has spent over $500 billion on buybacks in the last decade. It has also spent a big chunk on dividends which Google does not pay. It is likely that Google could spend close to a trillion dollars on buybacks in this decade as its revenue and net income continue to grow. This could add a significant tailwind to the stock price. In the recent quarter, Google reported 11% YoY revenue growth in constant currency. This is despite the fact that the company is facing macroeconomic headwinds.

Taking a very cautious estimate, Google should be able to deliver 8-10% annual revenue growth till 2030 with stable margins. Adding 4-5% tailwind from buyback should help the company deliver more than 15% annual EPS growth over the long term. This makes it a good bet for investors looking for a growth stock with good moat.

Apple’s revenue growth has been a modest 125% over the last ten years which is equal to a mere 8.4% compound annual growth rate. The net income has also grown at close to a similar level, which shows that there has not been a big margin expansion. However, Apple stock has delivered total returns a lot higher than S&P 500. A major reason has been the massive buybacks. This has allowed the EPS to grow at CAGR of 15.5% over the last ten years.

Google is a more mature company compared to ten years ago. However, it is still very likely that it will outperform S&P 500 over the next few years due to good revenue growth potential and with a tailwind of strong buybacks.

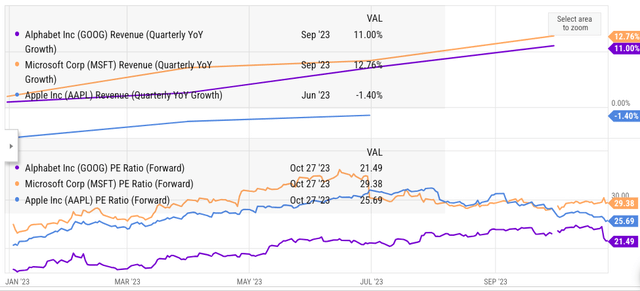

Impact on Google stock

Google stock is trading at a forward PE of 21 compared to 30 for Microsoft and Apple. The historical average PE of Google stock for the last ten years has been over 30. This shows that Google stock is quite reasonably priced. On the other hand, Google’s YoY revenue growth has been a lot better than Apple and has been close to Microsoft for the last few quarters. The forward revenue growth estimate for Google looks better than many other tech peers.

Figure: Comparison of key metrics for Google, Microsoft, and Apple. Source: YCharts

We can see from the above image that Google stock is trading at a discount compared to Microsoft and Apple in terms of forward PE ratio. Google Cloud and Google Other segments could improve the revenue growth trajectory and also improve margins for the company. Google still enjoys an overwhelming market share in search business and has a strong moat. The tailwind of buybacks will further help the stock deliver better returns over the long term.

Investor Takeaway

Google is spending close to $60 billion annually on buybacks. These buybacks are easily covered by the FCF and the company has another $100 billion in net cash. Google Cloud has started showing positive margins which can help in improving the overall profitability of the company. We could see further increase in buybacks over the next few years. It is likely that Google will spend close to a trillion on buybacks in this decade which should help improve the EPS growth trajectory.

Even with modest revenue growth, the stock could deliver over 15% CAGR returns in the next few years making it a good buy-and-hold option.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.