Summary:

- Walt Disney’s stock price has been falling for almost three years. Yet, there are reasons why investors keep selling.

- Factors such as poor financial performance, ineffective management, lack of clear strategy, and negative sentiment contribute to the company’s valuation.

- Disney needs a hard catalyst, which is a tangible event that exerts an immediate and straightforward influence on a company’s stock price.

- While Disney holds the potential to reclaim its brilliance, it grapples with inherent challenges.

Charley Gallay

Introduction

Many investors tend to overly emphasize the discounted price a company trades at and focus on their own perception of the value of the business. They often fail to consider that certain companies are priced low due to underlying issues. This corresponds with life’s principle that one gets what he pays for. Numerous cheap public companies are available in the market, and investors sometimes acquire them and face a bitter reality when the price of their stock fails to rise or declines.

Walt Disney (NYSE:DIS) is one of those well-known, big companies popular among retail investors. However, it has some serious issues. Its stock price has been falling for almost three years and one may think that now it’s finally time to buy. Yet, numerous valuation metrics suggest that it isn’t undervalued. The article aims to give a perspective if Disney is worth betting on with all the troubles and negativity around a stock. To answer this question, it’s important to recognize certain important, sometimes overlooked, factors that contribute to companies’ valuation.

- Stocks with fundamental weaknesses, such as poor financial performance, declining sales, or excessive debt, can struggle to capture the interest of investors. Consequently, they may experience sluggish, stagnant, or even declining price growth.

- The absence of a well-defined and cohesive business strategy frequently stems from poor management choices. Investors highly prize effective leadership capable of steering the company toward growth and profitability.

- Sometimes a company gets hit with bad press, gets involved in disputes, and radically alters its products or services which damages its reputation. The negative sentiment transfers into the investment space, where the business loses its investor base.

These factors certainly apply to Disney. Even if the valuation was reasonable, not delivering on these fronts may keep investors away from buying shares of the entertainment giant.

Fundamental Weakness

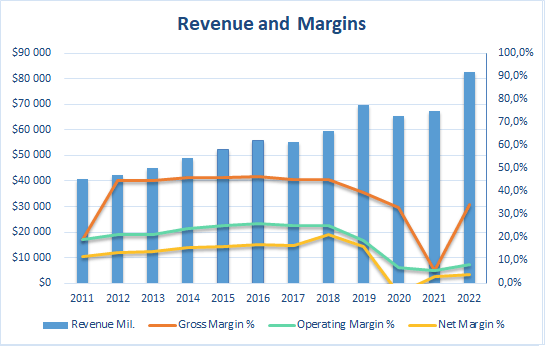

There is a lot to be concerned about when it comes to Disney’s financials. On a positive note, revenues are growing. Yet, it doesn’t translate to an increase in profits. All margins have been volatile since the pandemic broke out and the recovery is sluggish.

Walt Disney’s Revenues and Margins (Author – Financial Data from Seeking Alpha)

The management calms investors down and prognoses stabilization at Disney Parks, Experiences and Products (DPEP), but the main problem lies in the Disney Media and Entertainment Distribution (DMED) segment.

“However, we still expect all-in Q4 operating margins at DPEP to exceed the prior year due to the ongoing strength of recovery at our international parks and Cruise Line.” Source: Q3 Earnings Call.

For the nine months, the operating margin of the DMED segment dropped from 9.8% in 2022 to 5.2% in 2023 which only magnifies concerns regarding the Direct-to-Consumer business and its profitability. Yet, Bob Iger projects improvement in the near-term future, as indicated also in the Q3 earnings call.

“So I’m reasonably optimistic and hopeful that we will be improving our margins in this business significantly over the next few years.”

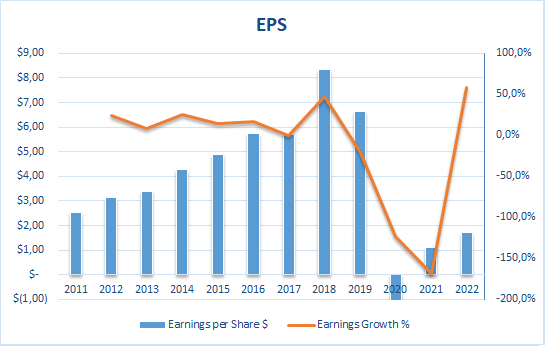

Walt Disney’s bottom line has been obliterated and it remains at much lower levels compared to the pre-pandemic times.

Walt Disney’s EPS and Earnings Growth (Author – Data from Seeking Alpha)

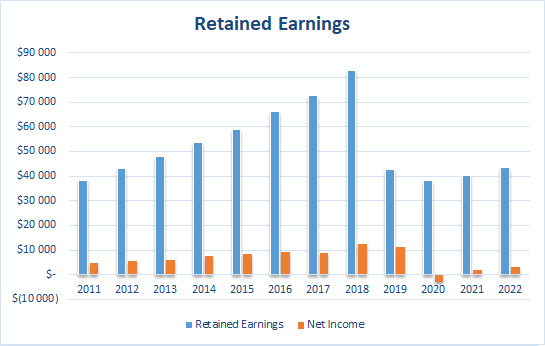

Retained earnings which represent a portion of a company’s net income that is not distributed as dividends to its shareholders also took a hit.

Walt Disney’s Retained Earnings (Author – Data from Seeking Alpha)

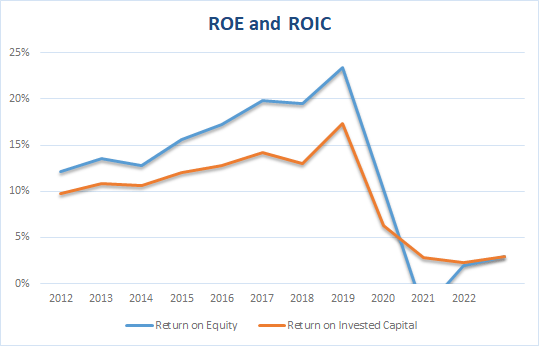

Other key metrics for evaluating a business and its profitability such as Return on Equity and Return on Invested Capital collapsed as well.

Walt Disney’s Returns on Equity and on Invested Capital (Author – Data from Seeking Alpha)

“The primary test of economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in earnings per share.”

– Warren Buffett

Unfortunately, the deeper one digs into the company’s financials, the more fundamental issues emerge. Some of the most substantial include:

- A pile of debt exceeding $52.0 billion weighs on the entertainment giant whose market capitalization equals $154.4 billion.

- Operating cash flow ratio which determines the number of times the current liabilities can be paid off from net operating cash flow hit the second to the lowest values in the last 10 years and equals now 0.21.

- Enterprise Value to Free Cash Flow (EV/FCF) which compares the total valuation of the company with its ability to generate cash flow, is as high as 182.9 for FY 2022. The lower the ratio, the faster the business can generate cash to reinvest or pay back the costs of acquisitions. This metric is the inverse of the Free Cash Flow Yield which is now 0.5%.

- Growing stock-based compensation has exceeded $1.0 billion on a trailing twelve-month basis.

Indeed, Disney’s financials indicate multiple issues. It will need time to handle them. Management’s decisions and consistency will likely play a crucial role in returning to solid margins and profitability. The company needs to navigate through these difficult times with caution and a clear business strategy which seems to be lacking.

Business Strategy and Negative Sentiment

Disney investors must have been scratching their heads in the last years while observing the developments taking place in front of their eyes. There were highly questionable decisions, personnel reshuffling, internal and external conflicts, involvement in matters beyond the scope of the business, etc. They were all adding negativity to an already scratched image of Disney.

What has been concerning to investors for years, is surely Bob Iger’s retirement process which turned out to be a failure after designating Bob Chapek as a new CEO. The entire succession procedure encountered significant turbulence. To begin with, Iger repeatedly postponed his retirement. In 2013, 2014, and on two occasions in 2017, he extended his contract despite initially expressing his intention to step down. Shortly after Iger revealed his departure plans, Chapek began to think whether Iger had second thoughts. Simultaneously, Iger himself started to question if he had made a mistake in his decision.

During Bob Chapek’s tenure as the CEO of Disney, the stock price soared to its all-time high of $196.75 which was just a year after Bob Iger’s departure. However, problems were starting to mount. Challenging times for Disney exposed Bob Chapek’s inability to handle difficult situations which were negatively impacting the company and his position in the firm.

- 2020: Chapek’s dealing with the COVID-19 pandemic was controversial. He was accused of being slow to react to the health crisis, and of making decisions that put employees and guests at risk.

- 2021: Chapek’s handling of the dispute with Scarlett Johansson over the release of the film “Black Widow” on Disney+ was also polarizing and it was met with criticism from some actors and filmmakers. Johansson was one of the most vocal critics of Chapek’s decision, and she ultimately sued Disney for breach of contract.

- 2022: Chapek’s approach to the “Don’t Say Gay” bill in Florida was another major issue. He initially tried to remain neutral on the bill, which was widely seen as discriminatory against LGBTQ+ people. This angered many Disney employees and fans, and Chapek eventually came out against the bill. However, his handling of the situation was widely condemned, and it damaged his reputation.

- 2022: Chapek implemented a number of cost-cutting measures at Disney, including hiring freezes, layoffs, and salary reductions. These measures were unpopular with employees and led to morale problems.

- 2022: Chapek’s management style was also criticized. He was known for being a micromanager and for being difficult to work with. This led to tensions with employees and executives.

These aspects combined with unclear strategy eventually damaged Chapek’s reputation and contributed to his abrupt exit from Disney. Each time another conflict or dispute occurred, the negative sentiment around the company continued to grow. It translated into a slow stock sell-off which hasn’t ended. To turn around the negative sentiment, reducing operating losses in the DTC segment isn’t enough. The same applies to an earnings beat or, as investors experienced with Bob Iger’s return, a major change in the management. These events caused only a momentary upbeat mood resulting in buyers acquiring the company’s shares.

Disney needs a hard catalyst, which refers to a tangible event that exerts an immediate and straightforward influence on a company’s stock price. Such an event is often more predictable and has more immediate repercussions. In the case of Disney, examples of hard catalysts could include a major improvement in an earnings report, a launch or a substantial advancement of a current service, an acquisition, restructuring business units, or restating the dividend. In essence, the primary distinction between a minor and a hard catalyst lies in the degree of immediacy and predictability of their impact on stock price. Soft catalysts have a slower and more uncertain impact, while hard catalysts have a clear, direct, and often instantaneous impact on a company’s valuation.

Valuation

While potential buyers are waiting for hard catalysts, they probably also hope for a lower valuation of Disney stock. Several valuation models were tested and delivered consistent results across different scenarios.

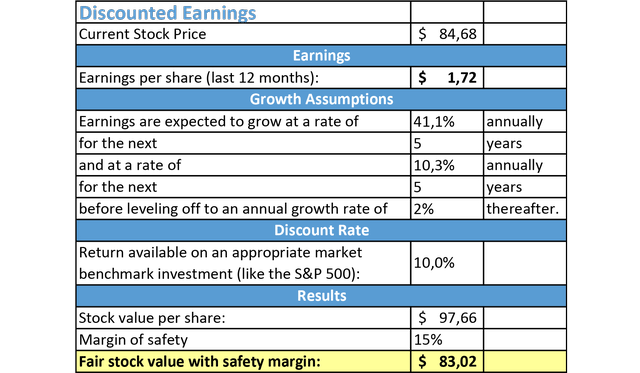

Discounted Earnings (Perpetual Growth)

In this model based on earnings, the following assumptions were made.

Discounted Earnings Model (Author – Data: Seeking Alpha, SimplyWall.St)

The estimated growth rate needs some explanation. According to analysts from the S&P Global future GAAP earnings per share (EPS) are as follows:

| Fiscal Year | 2023 | 2024 | 2025 | 2026 |

| EPS | $1.81 | $4.16 | $5.18 | $6.17 |

Based on the earnings growth provided by Seeking Alpha, non-GAAP EPS in 2027 is supposed to grow by 16.5% compared to the prior year. Assuming that the same growth is valid for the GAAP earnings, Disney should record a profit of $7.18. This gives a 41.1% growth CAGR over the next five years. The assumption is that the profits increase at a slower pace in the following five years with a 10.3% CAGR. Estimating a 2.0% perpetual growth, a discount rate of 10.0%, and a 15% margin of safety, Disney’s fair value equals $83.02 per share.

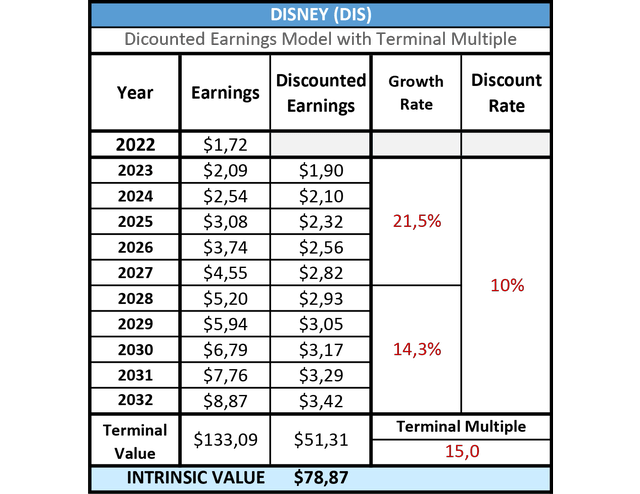

Discounted Earnings (Terminal Multiple)

Another discounted earnings model assumes profit growth of 21.5% over the next five years as suggested by Seeking Alpha. In the following years, the income per share increase gets cut by 33% to 14.3% CAGR.

Discounted Earnings Model (Author – Data: Seeking Alpha)

Assuming a terminal P/E ratio of 15, as historically for the broad market over a long period of time, and a discount rate of 10.0%, Disney’s intrinsic value is $78.87 per share.

Benjamin Graham Formula

The father of value investing – Benjamin Graham came up with a simple valuation formula for growth stocks.

“After exploring several approaches, we propose a condensed and straightforward formula for assessing growth stocks, aimed at generating figures closely aligned with those derived from more intricate mathematical computations.“

The formula, initially outlined by Graham in the 1962 edition of Security Analysis and reiterated in the 1973 edition of The Intelligent Investor, is detailed as follows:

Benjamin Graham Formula (Wikipedia)

Although Disney is not considered a growth stock, one may try to use the formula as a quick estimate of Disney’s fair price. By applying an FY 2022 EPS of $1.72, and a growth rate of 21.5%, the fair value of Disney would be $75.18 per share.

EV/EBIT

Unlike the previous valuation models, the EV/EBIT multiple doesn’t use net profit. It takes into account the enterprise value (EV) and the earnings before interest and taxes (EBIT). In 2020, before the pandemic hit, Disney’s 5-year-average EV/EBIT ratio was 15.41. In FY 2022 this metric almost doubled to 28.56 indicating a severe overvaluation.

By applying the 5-year average from before the DTC era and the EBIT of $6.832 billion for FY2022, the company’s fair value should be $35.46 per share. Currently, EBIT suffers from significant operating expenses related to the DTC segment. If the operating loss generated by the streaming offerings was excluded from the calculation, the EV/EBIT would be at 19.02, which is closer to the historical value of the ratio.

Valuation Summary

Disney’s current valuation presents a clear picture. When considering its earnings growth estimates, the company appears to be in the fair value range. However, an evaluation based on its enterprise value suggests that Disney is significantly overvalued. This valuation discrepancy is notably influenced by the performance and potential of its direct-to-consumer segment. Considering the results delivered by all four models there is no indication that Disney is trading at a discount.

Conclusion

Disney remains a pioneer in the entertainment industry, with a strong business foundation fortified by a strong competitive advantage. While the company holds the potential to reclaim its brilliance, it grapples with inherent challenges. These include persistently low margins, operating losses attributed to the Direct-to-Consumer segment, a considerable debt burden, and negative sentiment resulting from controversial recent decisions. Moreover, uncertainties surrounding the quality of content on its streaming platforms, the return of Bob Iger without a clear successor plan, and a lack of a coherent business strategy add to the pile of issues. As economic headwinds loom, there’s a possibility that Disney’s stock price might face a substantial decline, echoing the broader market’s trajectory. While the road ahead seems challenging, Disney’s strong core and historical resilience could pave the way for strategic transformations, potentially steering the company toward a brighter future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.