Summary:

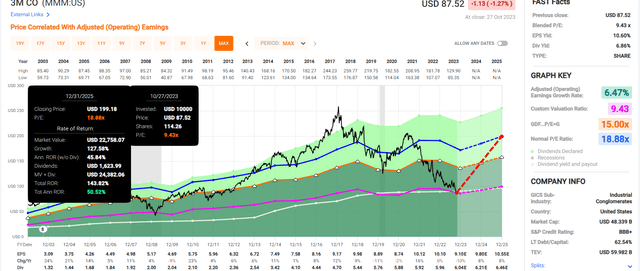

- 3M Company’s travails continue, with an earnings pop fading and the yield once more approaching a record high.

- 3M’s growth outlook has been cut in half following earnings as analysts adjust for tens of billions of dollars in long-term legal costs.

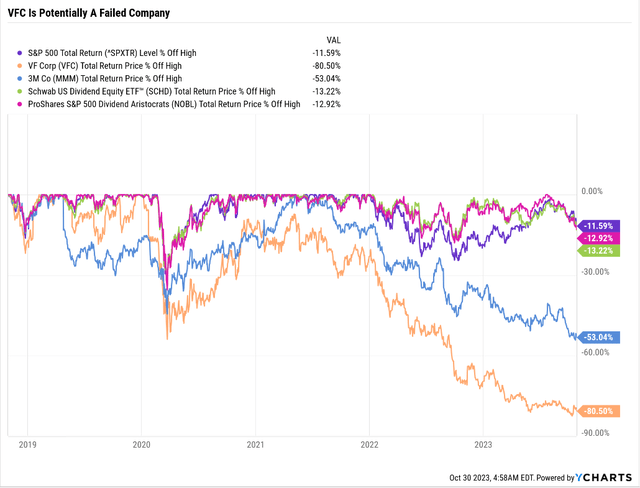

- V.F. Corporation was a dividend king that cut its dividend in February and is down 40% since then.

- In a recession (96% likely), 3M’s earnings could fall 23%, triggering a dividend cut and a 40% to 50% decline from here. If its growth outlook falls close to zero, the fair value P/E drops to 8.5, and it could fall 50% and then languish for years.

- Here are two 8% yielding Ultra SWAN world-beaters growing almost twice as fast as 3M, yielding more, and having a 0.5% risk of a dividend cut in the coming recession. They offer 66% to 89% upside potential in the short term and 400% or better return potential over the coming decade.

PUGUN SJ

3M Company (NYSE:MMM) is a legendary dividend king with a storied 101-year history and a laudable dividend growth streak of 64 years.

Last time, I warned that the facts on 3M had changed and that the risks were rising of a potentially significant dividend cut.

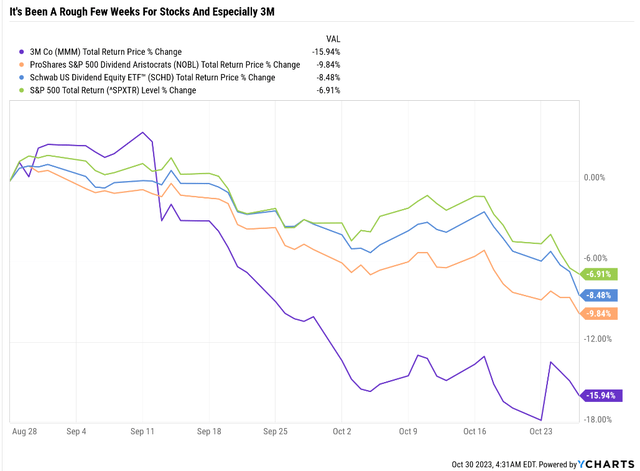

Since then, 3M’s stock has fallen almost 20%, and we’ve gotten new earnings, management guidance, and the bond market. Analysts have weighed in on what they think about the future of Minnesota Mining and Manufacturing (what 3M stands for).

That slide includes a 5% single-day earnings pop, which has rapidly faded.

3M is now trading at a forward P/E of 9, a nearly anti-bubble valuation that some might consider a Warren Buffett-style “greedy when others are fearful” opportunity.

However, after crunching the earnings numbers, I have bad news about 3M’s 7% yield.

And there are two legendary dividend Ultra SWANs (sleep well at night) world-beaters who have very secure 8% yields you should be able to trust today, tomorrow, and for whatever might come in the next few decades.

Bottom Line Up Front: Even If 3M’s Dividend Survives, It’s Not Necessarily A Great Long-Term Investment

At first glance, this might seem like good news.

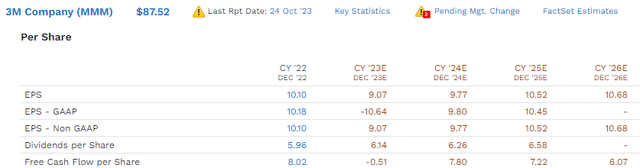

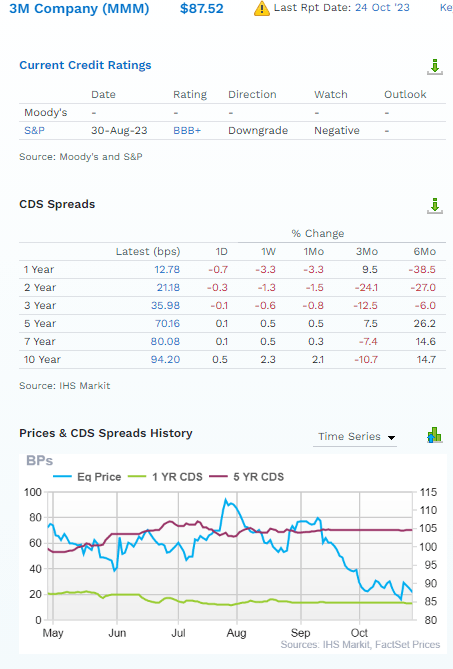

20 analysts cover MMM for a living. Combined with the bond market and rating agencies, this expert consensus knows this company better than anyone other than management (and possibly even better).

Analysts expect 3M’s dividend to remain the same and grow at 3.4% annually through 2025.

That’s certainly better news than a forecasted cut…but there are two important things to know.

First, 9 months ago, 3M’s dividend consensus forecast went out to 2028.

6 months ago, 2027.

3 months ago 2026.

Now it only goes to 2025.

That’s because no analyst is willing to gamble their reputation about 3M’s dividend in 2026.

For a dividend king that’s been raising its dividend since 1959, that’s a potentially disturbing decline in dividend visibility.

The most troubling thing of all, though?

That 3.4% dividend growth rate might not be just for the next few years due to legal liabilities.

Before earnings, 3M’s growth outlook was 6.3%.

It’s been cut in half since earnings, indicating that analysts think the dividend won’t be growing at a token rate just for a few years but potentially forever.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Schwab US Dividend Equity ETF | 3.9% | 9.70% | 13.6% | 9.5% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| REITs | 4.6% | 7.0% | 11.6% | 8.1% |

| Dividend Aristocrats | 2.3% | 8.5% | 10.8% | 7.6% |

| 3M | 6.9% | 3.70% | 10.6% | 7.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| JEPI (Management Guidance) | 5% | 3.00% | 8.0% | 5.6% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Sources: FactSet, Morningstar.)

3M’s dividend cut risk is 4% in a mild recession and 16% in a severe recession.

But even though it has the financial capacity to probably keep the streak alive, that 7% yield isn’t necessarily going to sufficiently pay you for the risk of owning this company.

The growth outlook looks to have fallen low enough that 3M can now offer long-term market-level returns… in exchange for the risk of becoming the next failed aristocrat.

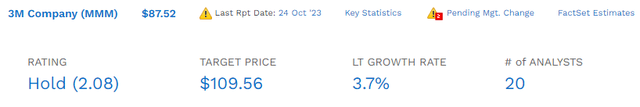

- V.F. Corp. (VFC) cut its dividend and has fallen 38% since then.

V.F. Corp’s Lesson To Dividend Aristocrat Investors: When The Dividend Is Cut, It’s Time To Sell

I warned DK members and Seeking Alpha premium readers to sell VFC and not pray for a turnaround.

- Special Report: Why We’re Selling VF Corp And 15 Better Alternatives

- Sell V.F. Corp And Buy These 7.6+% Yielding Dividend Aristocrats Instead.

Almost 40% Decline Since The Dividend Cut

How was I able to perfectly “time” that 40% crash? How was I able to help investors avoid further pain from what could be another failed dividend aristocrat?

I’m not a market timer; I don’t have a crystal ball; I’m just a disciplined financial scientist with good historical data.

The Past, Present, And Likely Future

Ben Graham, the father of securities analysis valuation, Buffett’s mentor, and one of history’s greatest investors, said that it was important to use both a qualitative and quantitative analysis method and multiple time frames through history.

In other words, a holistic approach to the “story” behind a company and the math backing up that story.

And not just today, but the past, present, and likely future.

This is why he and Buffett became legends and even the greatest investors of all time.

This is why Buffett says most investors should just own the S&P

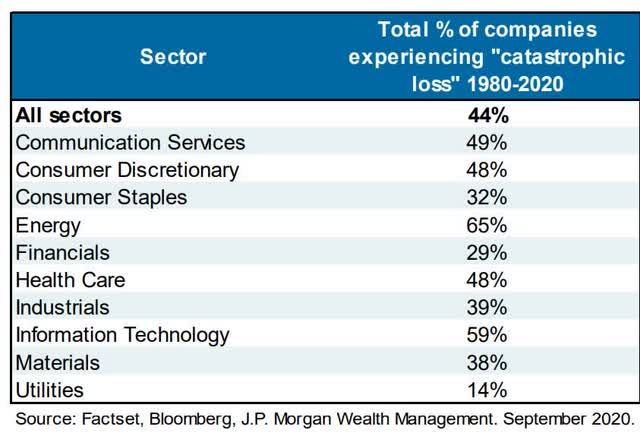

Historically, almost 50% of stocks will fall 70% or more and never recover. They might go to zero…or, like Japan’s stock market, languish for decades while investors pray to break even in their lifetimes.

| Sector |

% Of Companies That Suffer Permanent 70+% Declines Since 1980 |

| Energy | 65% |

| Tech | 59% |

| Communications | 49% |

| Consumer Discretionary | 48% |

| Healthcare | 48% |

| All Sectors | 44% |

| Industrials | 39% |

| Materials | 38% |

| Financials | 29% |

| Utilities | 14% |

(Source: JPMorgan Asset Management.)

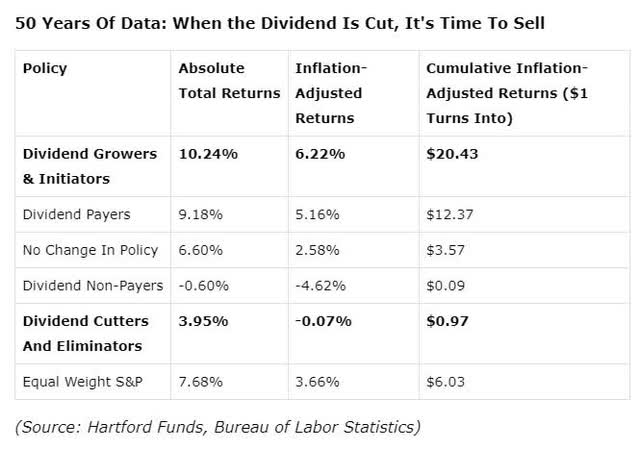

But here’s why recommending a “sell” on a dividend cut, especially a dividend king payout cut, is such an easy way to seem like a genius.

Over the last 50 years, after adjusting for inflation, dividend growth stocks turned $1 into $20 while dividend cutters lost money.

When a company cuts its dividend, it’s signaling that the fundamentals are terrible and the company’s existence is at risk if it doesn’t.

- short-term stock prices are vanity, cash flow is sanity and dividends are reality.

What does a company with a 52-year streak like VFC had cutting its dividend really mean?

Effectively, “our company hasn’t been this in trouble since 1971.”

Management will put a positive spin on things and discuss how the money will go toward the turnaround, but the wheels have fallen off the bus.

I don’t recommend investors stick around and join management, hoping and praying that the new dividend will avoid being cut.

Most Companies That Fall 80% Never Recover…Ever. But If VFC Does…You Can earn 12% to 13% Long-Term Returns

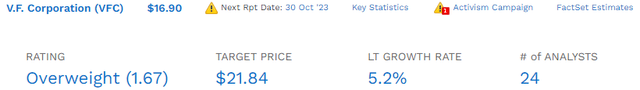

Can you see why I’m not a fan of VFC? Even after an 80% collapse, Nasdaq, during the tech crash level decline, analysts think that the 7% yield will combine with long-term growth half its historical level to deliver 12% long-term returns.

That’s market-beating…but less than Schwab U.S. Dividend Equity ETF™ (SCHD), and only if VFC pulls out of its dive and grows as expected.

If 3M Is Shrinking In A Booming Economy, What Happens In A Recession?

Okay, so we’ve seen how 3M’s stock price has continued to sink, and its valuation keeps falling. Sure, the P/E is at the lowest level in 14 years.

Yes, theoretically, if 3M grows as expected and returns to historical fair value by 2025, you could make 150% gains. But here is some historical context to consider.

In the Great Recession, the economy fell almost 5%. It was the worst economic catastrophe since the Great Depression.

Eight million people lost their jobs, 10 million lost their homes, and the stock market fell as much as 58%, the 2nd biggest market crash in history.

3M’s earnings fell 9%.

In an economy growing at 5%, 3M’s earnings have fallen 10%.

That’s how bad things have gotten for this dividend legend.

Why You Shouldn’t Be Complacent About 3M’s Dividend Safety

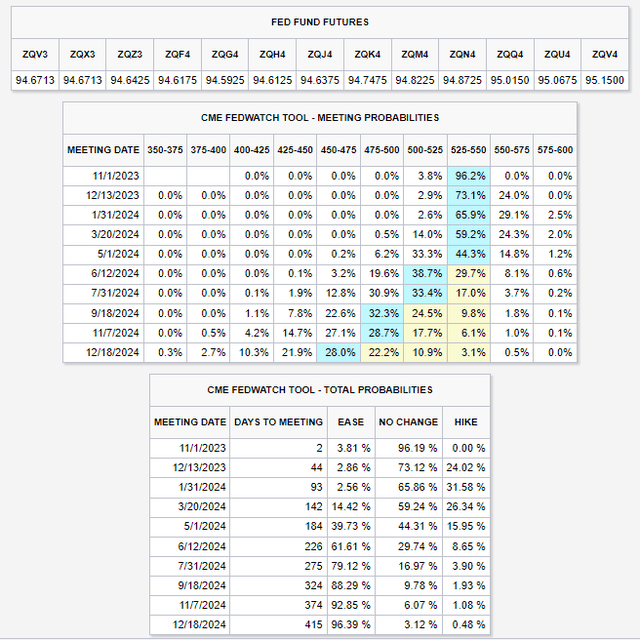

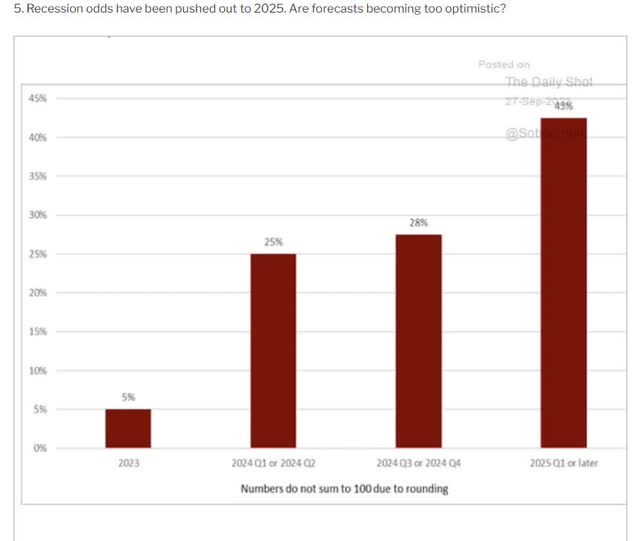

The bond market estimates a 96.39% chance of recession in 2024, and if we avoid one?

Almost half of economists expect a recession in 2025.

In a booming economy where Coca-Cola (KO) can raise prices by 9% and see sales volumes grow by 2% and PepsiCo (PEP) can raise prices by 14% and see a decline of just 2%, 3M’s earnings are not likely to grow by 8% in 2024 and 2025 if the U.S. falls into recession.

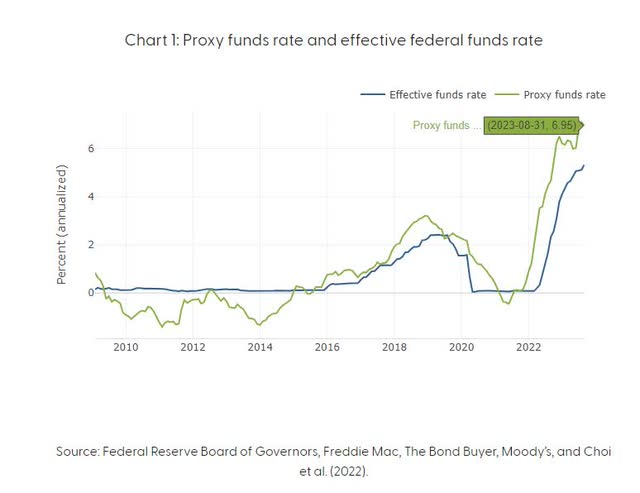

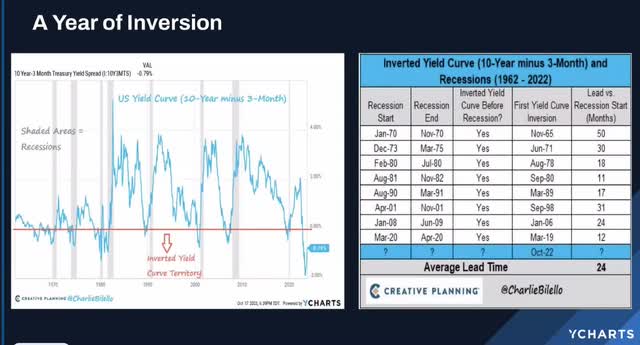

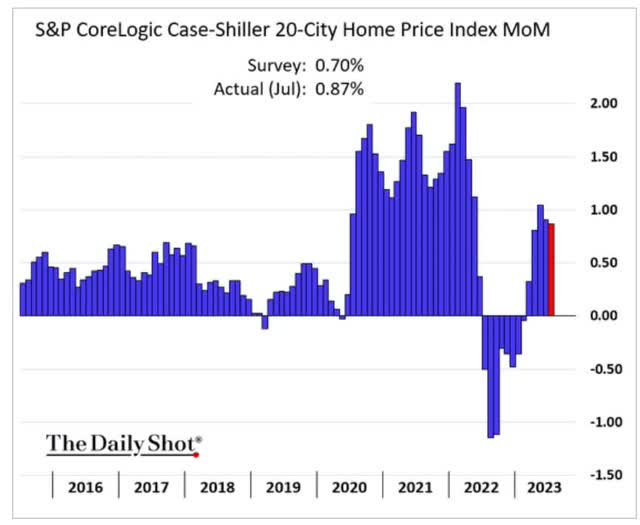

Why the Bond Market Is So Confident Recession Is Unavoidable

This hasn’t been updated since August, and Bloomberg estimates the effective Fed rate accounting for reverse money printing (QT) and tightening financial conditions is now about 8%.

From -0.5% in the Pandemic to 8% today, that’s an 8.5% increase in real short-term interest rates.

Just once in history has the Fed raised rates more (1970s) and never this fast.

And never in history have we avoided a recession after rates have soared this much.

So, where is the recession?

The yield curve inversion usually signals a recession coming around two years later.

That would be October 2024 this time.

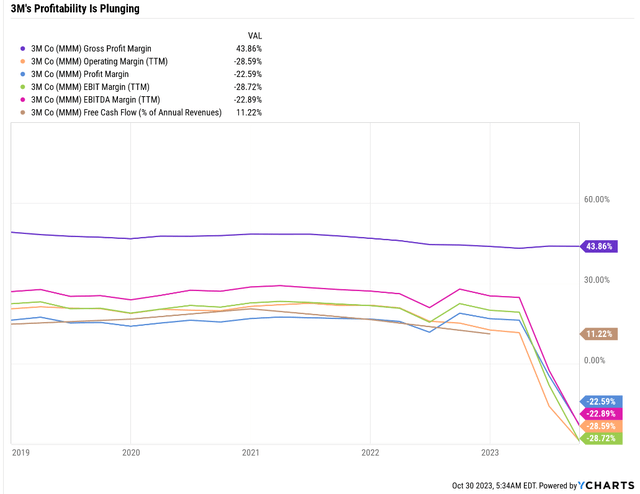

What Earnings Showed

Nothing in narrow-moat-rated 3M’s third-quarter results materially alters our long-term view. We raised our fair value estimate to $124 from $123 following our Oct. 24 valuation change, when we downgraded 3M’s moat to narrow from wide. 3M’s third-quarter earnings beat our expectations; however, quarterly adjusted revenue was right in line, and business segment operating profits dipped slightly below what we had penciled in.” – Morningstar (emphasis added).

Morningstar increased its fair value due to a tax implication but no longer considers 3M a wide moat company.

The historical profitability is still in the top 80% of industrials so I wouldn’t go that far, but the trend isn’t 3M’s friend.

3M’s profitability has been collapsing this year, and that’s in a booming economy.

Now imagine a weaker economy in 2024 or even a shrinking one.

Or worse yet…a weaker economy in 2024 with barely any growth and a recession in 2025.

Imagine what the dividend safety will do…and the stock price if that 17% expected earnings growth doesn’t happen.

Like VFC, a MMM that cuts its dividend could see the price crater by 40%.

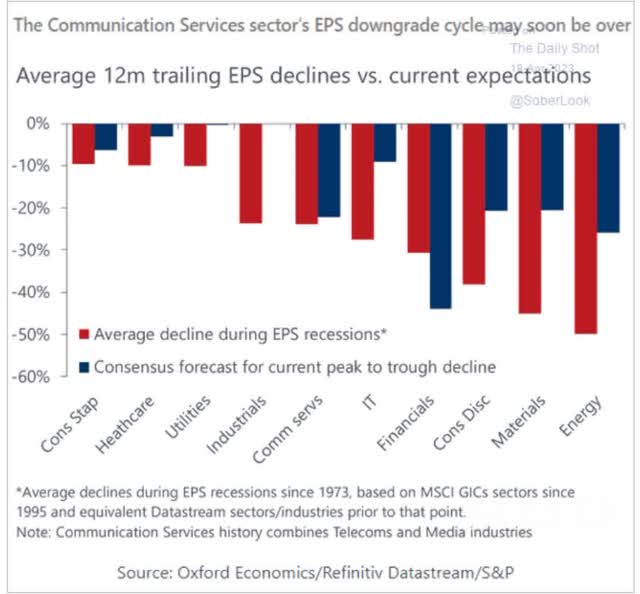

During the average recession, industrial earnings tend to fall about 23%.

What if 3M’s earnings fall 23% in the coming recession?

- In a recession 3M could fall 38% just like VFC did.

Now imagine what happens to 3M’s dividend in a recession if earnings fall 23%.

The 20% to 50% cut I warned about could end up 50%.

Imagine you’re a dividend growth investor who has hung on to 3M or kept buying and reinvesting dividends, trying to be “greedy when others are fearful”.

Why did you stick with 3M? Because of that 64-year dividend growth streak.

As long as that streak was intact, you were confident 3M wasn’t a broken company.

Now, management announced a 50% dividend cut after a perfect storm of events caused free cash flow to go negative while debt is soaring.

Will you hold onto 3M? Or sell in disgust? Just like 50 years of data is screaming at you to do, and I am recommending?

- in a recession, 3M’s fundamentals might require a 50% dividend cut

- and the stock price might get cut in half from here.

Would 3M be cheap at the time? Sure, 8X earnings in the scenario just described.

But would you care for a non-aristocrat with a failing business and incompetent management, and what might, by that point, be little to any long-term growth prospects?

Do you know what Ben Graham said a company growing at zero forever is worth? 8.5X earnings.

That means that in a recession, 3M has a real chance of falling another 50%…and then staying there for years or even decades.

- 53% decline X 50% further decline is about a 75% total decline

- historically speaking, companies that fall 70+% never recover all-time highs.

Management’s Silence Is Deafening

Two quarters ago when the CFO was asked in the conference call about the dividend, instead of declaring it a top priority, MMM management said the dividend was important but refused to commit to it.

This earnings? After the stock price was down 20% lower…management didn’t mention the dividend at all, other than to say they paid one.

It wasn’t a question from analysts, but for a dividend king with a record-high yield? Maybe a few words of encouragement about the security of that yield might be in order?

I’m not saying 3M is going to zero. The chance of 3M going bust is about 3% over the next 30 years, according to the bond market.

FactSet Research Terminal

S&P downgraded MMM from A- to BBB+, and there is a 33% chance of another downgrade to BBB.

- S&P estimates a 5% chance MMM is going to zero within 30 years

- bond market says 3% chance.

But just because 3M isn’t likely going to zero doesn’t mean it’s not potentially going to fall a lot lower (like a 50% decline) and then stay at those levels for several decades.

Why take that risk when you can buy two thriving 8% yielding Ultra Sleep Well At Night world-beater blue-chips trading at the best valuations since the Pandemic?

8% Ultra SWAN Yields You Can Trust

With recession 96% likely next year, it’s very important to not just look at yield but safe yield that you can trust in all economic conditions.

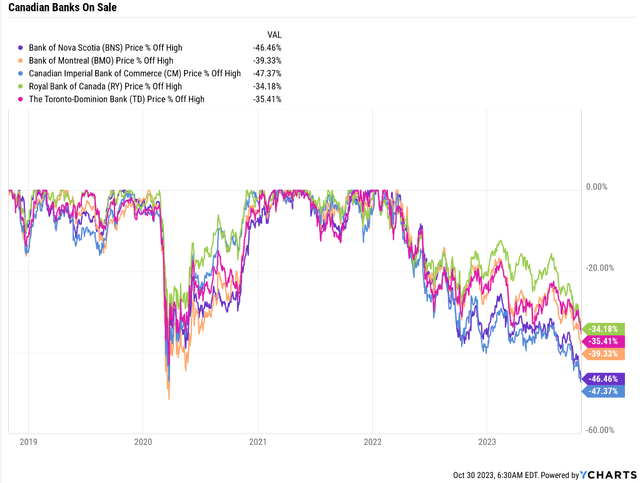

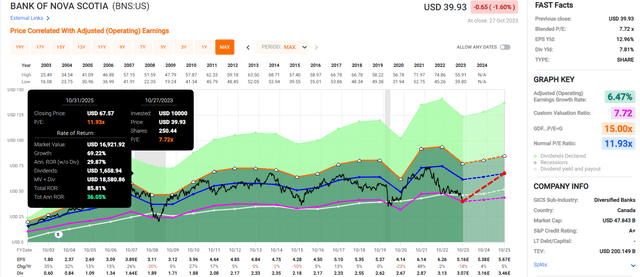

The Bank of Nova Scotia (BNS): A Dividend Legend You Can Trust

Further Reading

BNS is facing some modest earnings pressure in the short-term.

- -18% growth in 2023

- 4% in 2024

- 5% in 2025

But its potential for higher for longer interest rates slamming the housing market has many investors worried about Canadian banks.

Scotiabank getting almost cut in half is ridiculous.

In the Pandemic, we locked down the world economy, triggering a GDP collapse of 8% in a quarter and 32% annually.

That’s worse than the Depression.

Today, we’re likely headed for what most economists consider the mildest recession in history.

But what about Canada’s housing bubble popping and triggering a Great Recession-level crash in its banking system?

That’s a very low risk.

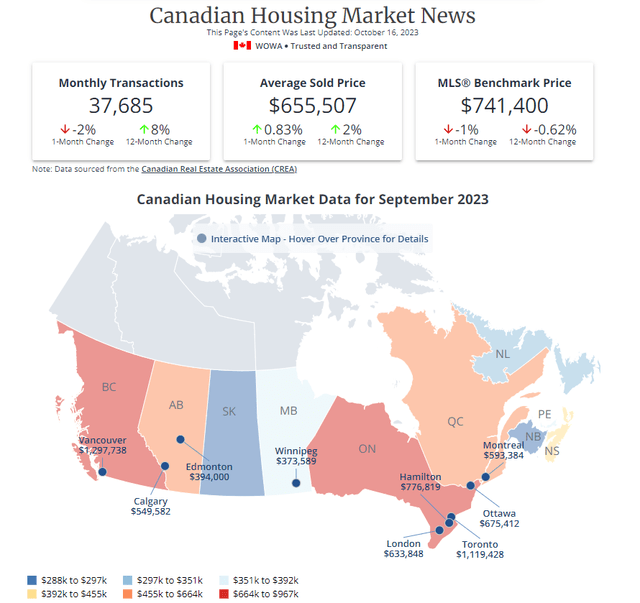

In September 2023, the average price of a resale home in Canada was $741,400, a 1.2% increase from the previous year. The national average home price in September 2023 was $655,507, a 1% increase from the previous month and a 2% increase year-over-year. – WOWA (emphasis added).

There is no housing crash in Canada, and there isn’t likely to be one.

For the same reason, U.S. home prices are also rising.

Around 500,000 immigrants are arriving in Canada each year, and the supply of new homes to absorb them is likely to keep the housing market exceptionally tight.

In the US, its lack of supply combined with 150 million Millennials and GenZers starting families are preventing a correction in home prices.

And let me be very clear.

- home price corrections DO NOT usually lead to financial collapses.

A decline in home prices didn’t cause the Great Recession it was caused by big banks leveraging toxic loans at as much as 40X using derivatives.

- reckless gambling caused the crisis, not home price declines.

Canadian banks never have and will never undertake such reckless gambling because regulators don’t allow it.

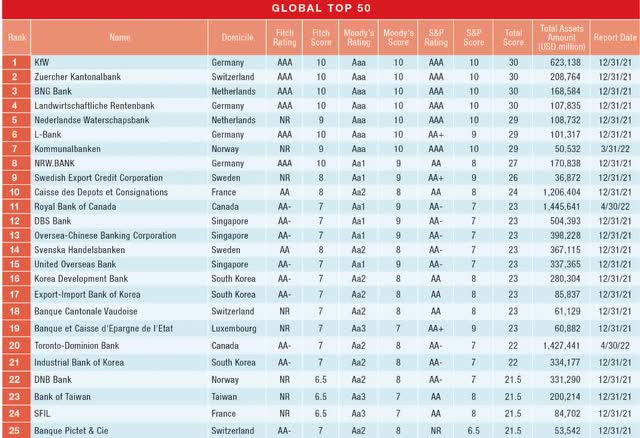

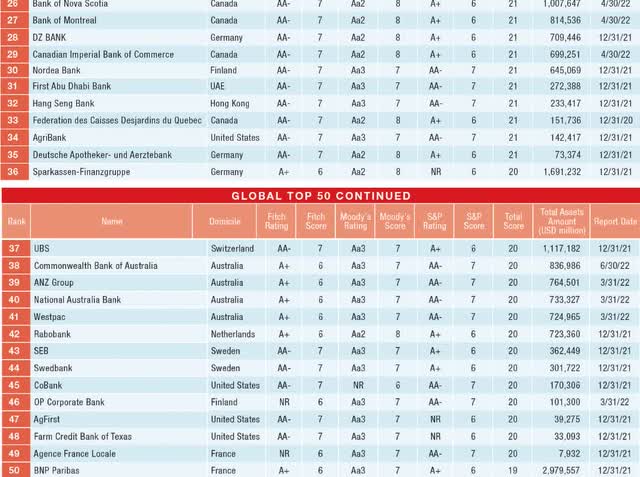

The industry in Canada is a regulated utility in which the top 5 super banks have a 90% market share and some of the best profitability in the world in exchange for the most conservative banking practices of any banks not owned by governments.

The Canadian Banks Are The Safest Non-Government Banks

BNS is the 26th safest bank in the world and the 16th safest non-government-owned bank.

That’s according to not one, not two, but all three major global credit rating agencies.

What is the risk of BNS suffering a Great Recession-like collapse that threatens its survival? About 0.6%, according to rating agencies.

What about the dividend’s safety?

BNS will sometimes freeze its dividend under the command of regulators. But those regulators aren’t going to force it to cut its dividend.

How can we know? Because BNS was founded in 1832, 191 years ago.

It began paying a dividend one year later, in 1833. In 190 years, how often has it missed a dividend payment or cut its dividend? Zero.

Not even in the Great Depression, when 9,000 US banks collapsed and our stock market fell 87%, did BNS cut its dividend.

Not in the Great Recession, Pandemic, WWI, WWII, a global flu pandemic that wiped out 5% of humanity.

Not even in the 1840 Canadian banking panic, the last financial crisis in Canada.

Can I tell you with 100% certainty that BNS’s dividend will never be cut?

No, but I can tell you that based on our 3,000-point safety and quality model, the statistical chance of BNS’s dividend being cut in any recession, even another GFC meltdown, is 1%.

For context, Goldman Sachs estimates a 2.5% risk that the US and Russia get into a nuclear exchange that takes the stock market to zero.

You’re almost 3X more likely to die in nuclear hell-fire than Scotiabank is to cut its dividend in a severe recession.

- 6X more likely in an average recession

Fundamental Summary

- Yield: 7.8%

- Dividend safety: 100% very safe (1% dividend cut risk)

- Overall quality: 87% very low-risk Ultra SWAN

- Credit rating: A+ stable (0.6% 30-year bankruptcy risk)

- Long-term growth consensus: 6.5%

- Long-term total return potential: 14.3% vs 10.2% S&P 500

- Current Price: $39.93

- Historical Fair Value: $62.09

- Discount to fair value: 36% discount (ultra value buy) vs 1% overvaluation on S&P

- 10-year valuation boost: 4.6% annually

- 10-year consensus total return potential: 7.8% yield + 6.5% growth + 4.6% valuation boost = 18.9% vs 10.2% S&P

- 10-year consensus total return potential: = 465% vs 164% S&P 500.

BNS is trading so darn cheap it could potentially turn $1 into $5.65 in the next decade, tripling the market’s returns.

But you don’t have to wait a decade to make Buffett-like returns from this dividend legend.

If BNS grows as expected and turns to a historical fair value of 12X earnings, you’ll almost double your money. While locking in one of the world’s safest 8% yields.

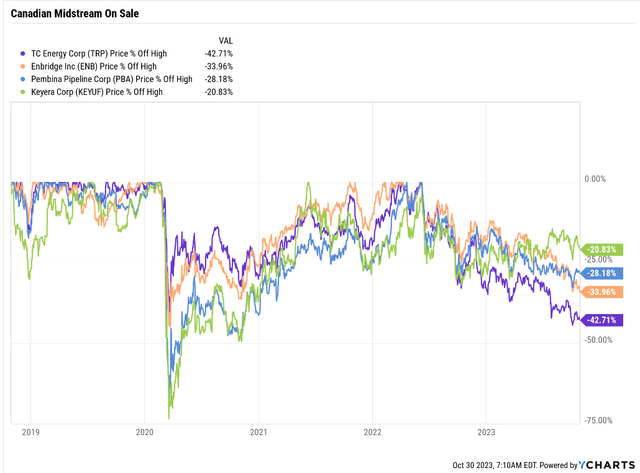

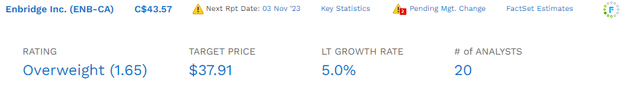

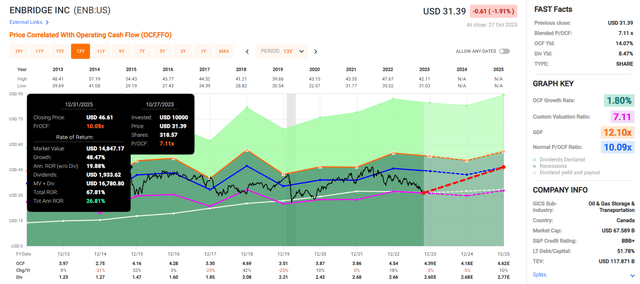

Enbridge Inc. (ENB): The Ultimate Sleep Well At Night Midstream

Further Reading

Canadian midstreams have been hit by a twin storm of worries.

Rising rates and stricter government regulations result in potentially costly project overruns (like what TRP was just hit with).

But here’s what you have to remember about Enbridge.

Founded in 1949, it’s not just one of the oldest midstreams in Canada; it’s one of the oldest midstreams in the world.

This is only one of two midstream aristocrats (EPD is the other) with a 28-year dividend growth streak; ENB is the #1 dependable dividend in its industry.

Management is guiding for 5% growth long-term, and when ENB talks long-term, they don’t just mean a few years.

Analysts think ENB can reach that growth target because this is a regulated utility with just a 2% exposure to commodity prices.

ENB was the first midstream to start investing in the green energy transition.

As a result, the bond market is confident that ENB will be around 30 years from now. And 60 years from now, and even 90 years from now.

ENB’s 2112 maturing bonds yield 6.2%.

Do you think the US government could borrow for 90 years at 6% interest rates? Given that 30-year US Treasury bonds yield 5.05%, I think not.

This means the bond market, the most conservative income investing group in the world, and the “smart money” on Wall Street are effectively telling us that ENB will not just survive higher rates; it will likely outlive us all.

- I intend to prove them wrong by living to at least age 128;)

Fundamental Summary

- Yield: 8.3%

- Dividend safety: 100% very safe (2% dividend cut risk)

- Overall quality: 97% very low-risk Ultra SWAN aristocrat

- Credit rating: BBB+ stable (5% 30-year bankruptcy risk)

- Long-term growth consensus: 5%

- Long-term total return potential: 13.3% vs 10.2% S&P 500

- Current Price: $31.39

- Historical Fair value: $44.72

- Discount to fair value: 30% discount (very strong buy) vs 1% overvaluation on S&P

- 10-year valuation boost: 3.6% annually

- 10-year consensus total return potential: 6.6% yield + 3.8% growth + 4.6% valuation boost = 16.9% vs 10.2% S&P

- 10-year consensus total return potential: = 377% vs 164% S&P 500.

Bottom Line: 3M Could Potentially Get Cut In Half, So Why Not Buy 8% Yielding Ultra SWANs Instead?

I’m not saying that a 50% reduction in 3M’s price from here is the base-case. It’s not a high-probability scenario (about 15%, in fact).

But the chances that ENB or BNS fall 50% from here are negligible.

They are already trading at Pandemic level valuations, and the economy isn’t on fire.

ENB and BNS now yield more than MMM and are growing significantly faster (about twice as fast).

3M’s long-term growth prospects are now so burdened by long-term lawsuit costs that even if it can avoid a dividend cut 10% to 11% long-term returns is all you should expect.

BNS and ENB offer 13% to 14% long-term return potential that’s superior to the S&P, aristocrats, and even the Nasdaq.

In the short term, ENB and BNS offer between 66% and 89% short-term upside potential and the potential to deliver almost 400% or better returns in the next decade.

The data is clear: don’t buy 3M when there are thriving ultra-swans yielding more and growing much faster.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and more.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.