Summary:

- Thermo Fisher Scientific is a top wealth compounder with strong performance in the medical equipment industry.

- The company is well-positioned for long-term growth due to increasing healthcare demands and its role in research and development.

- Despite recent challenges, TMO has demonstrated resilience and adaptability, making it an attractive investment choice.

vovashevchuk

(A Lengthy) Introduction

Thermo Fisher Scientific (NYSE:TMO) has turned into one of my all-time favorite dividend growth stocks this year. While I do not own the stock in my personal portfolio, it’s one of the biggest holdings in my family’s portfolio.

The only reason why I do not own it in my 20-stock dividend (growth) portfolio is the fact that I own its highly correlated peer, Danaher (DHR).

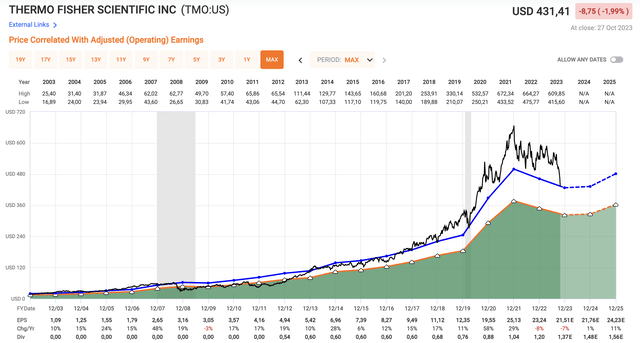

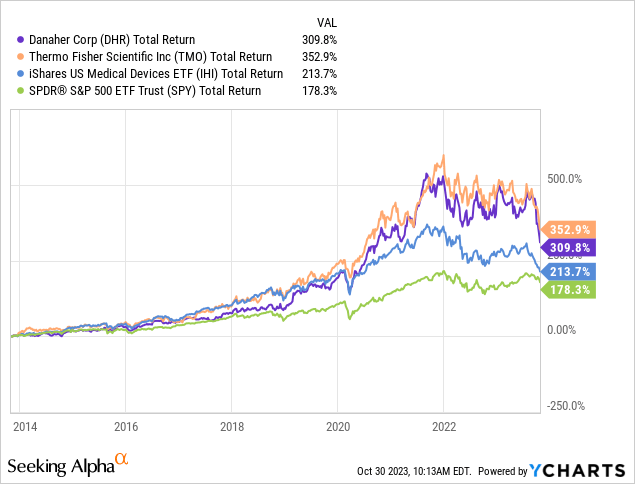

Both Thermo Fisher and Danaher have outperformed the iShares U.S. Medical Devices ETF (IHI), which outperformed the S&P 500 by more than 30 points over the past ten years.

Although its 0.3% dividend yield is hardly something to write home about, its ability to outperform the market makes it a perfect holding for my family’s portfolio, especially because it operates in one of my favorite industries: medical equipment.

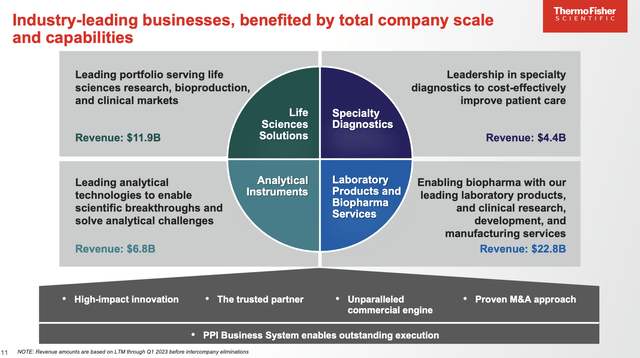

Thermo Fisher operates very high up the healthcare “supply chain,” as it sells equipment and services that help companies innovate, to put it very bluntly.

Through our Life Sciences Solutions segment, we provide an extensive portfolio of reagents, instruments and consumables used in biological and medical research, discovery and production of new drugs and vaccines as well as diagnosis of infection and disease. These products and services are used by customers in pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets. – Thermo Fisher (emphasis added)

In other words, TMO delivers the goods needed to engage in R&D.

Generally speaking, this is a bulletproof business. The global population is growing, people live longer, and we’re dealing with healthcare threats related to the way we live and grow protein – to name a few secular growth factors.

On top of that, R&D spending will likely have to be boosted.

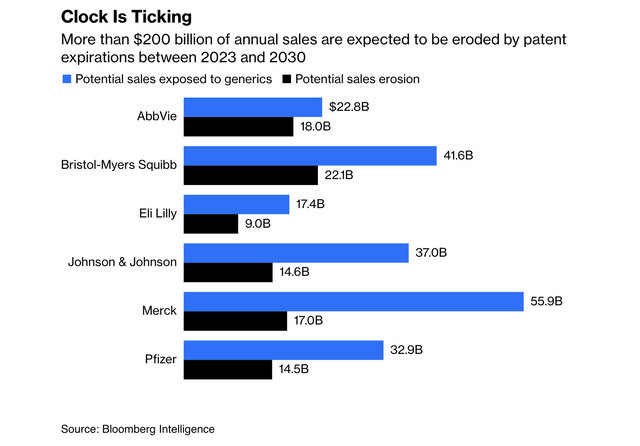

Earlier this year, Bloomberg wrote an article on the R&D and patent situation at some of the world’s largest drugmakers.

According to the article, in recent years, the pharmaceutical industry has shifted its focus away from researching new drugs due to investor sentiment that considered it unprofitable.

Instead, companies concentrated on business development, often acquiring smaller rivals that had already conducted the research.

The most infamous example may be Valeant Pharmaceuticals, which acquired various companies, raised drug prices and abandoned new product development.

Now, the U.S. pharmaceutical industry is running out of drugs with patent protection.

Between 2023 and 2030, more than $200 billion of annual sales are anticipated to erode due to patent expirations. Companies like AbbVie (ABBV), Pfizer (PFE), Bristol-Myers Squibb (BMY), and Merck (MRK) face the looming challenge of competing with generic drugmakers as their patents expire.

The only way for these pharmaceutical giants to navigate this challenging future is through acquisitions, but this approach is costly.

According to Bloomberg, takeover premiums in U.S. pharmaceutical deals averaged 72% in 2022, the highest on record and 23 percentage points higher than in 2021.

As of April, premiums this year are running at more than 50%, significantly above the typical M&A premiums of 10% to 25% above the undisturbed target price.

In other words, as we’re getting closer to a wave of patent losses, we might see a renewed focus on R&D and M&A, whereas R&D may be cheaper in light of M&A premiums.

That’s where TMO comes in.

Right now, the company is struggling with the impact of imploding COVID-related demand.

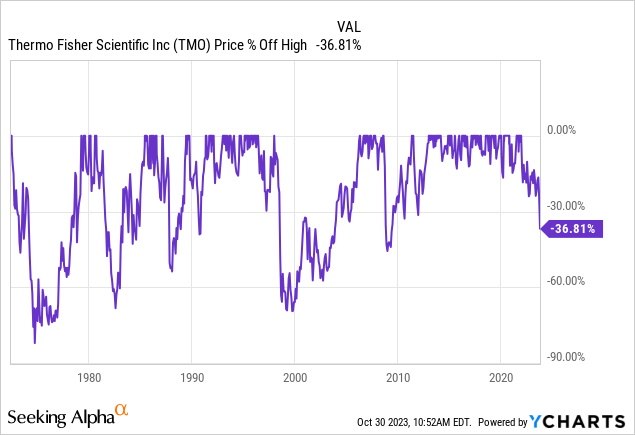

Its shares are down 37% from the all-time high, which makes it the worst sell-off since the Great Financial Crisis.

On September 28, I wrote an article titled Thermo Fisher: An Up to 35% Undervalued Healthcare Gem I Like On Weakness. Well, weakness has arrived. Since then, shares are down 16%.

In addition to explaining why we should expect a bigger focus on R&D over the next few years, which benefits TMO, I am using this article to assess TMO’s attractiveness, using its just-released quarterly results.

So, let’s get to it!

Despite Headwinds, TMO Is Doing Well

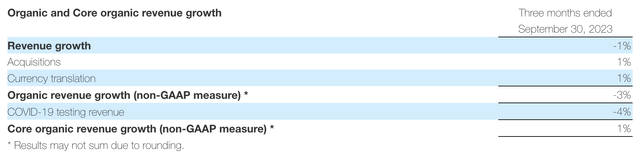

In the third quarter, Thermo Fisher Scientific reported revenue of $10.57 billion. That’s down 1% versus the same quarter in the prior year. Core organic revenue growth was 1%. This excludes a 4% organic growth decline due to COVID. Including COVID, organic revenue growth would have been negative 3%.

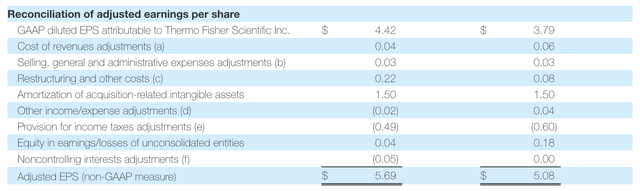

Adjusted operating income grew by 8% to reach $2.56 billion, and the adjusted operating margin expanded by 200 basis points to 24.2%. Adjusted earnings per share increased by 12% to $5.69 per share.

In light of elevated rates and post-COVID demand dynamics, the company acknowledged that the market environment became more challenging during the quarter.

Factors impacting the core market growth included cautious customer spending and low economic activity in China.

Initially, TMO expected core market growth to be in the zero to 2% range for the year. However, these challenges led to revised expectations of slightly negative core market growth for the full year.

However, despite these challenges, TMO still anticipates growing faster than the market and achieving market share gains in 2023.

Before I elaborate on its guidance, let’s take a look at some drivers of growth and market headwinds.

- Life Sciences Solutions: This segment reported an 18% decline in revenue, primarily due to the reduction in pandemic-related revenue. However, it showed its efficiency by achieving a higher adjusted operating margin of 35.9%, indicating that cost management was well-executed.

- Analytical Instruments: This segment experienced an 8% increase in revenue, driven by strong growth in the electron microscopy business. Adjusted operating income grew by 21%, and the adjusted operating margin expanded to 26.7%.

- Specialty Diagnostics: While reported revenue increased by 2%, organic revenue dropped by 6% due to the decrease in pandemic-related revenue. However, the segment managed to increase adjusted operating income by 29% and achieved an adjusted operating margin of 26.1%.

- Laboratory Products and Biopharma Services: In this segment, reported revenue increased by 3%, with organic growth at 1%. Adjusted operating income saw a substantial increase of 29%, and the adjusted operating margin expanded to 16.4%, showing strong productivity and a favorable mix.

Furthermore, the company’s operational efficiency was a standout factor.

Adjusted gross margin for the entire company reached 42%, a 30 basis point improvement compared to the previous year.

According to the company, its commitment to operational excellence and the impact of its PPI Business System was evident in its effective cost management and productivity drive.

Why We’re Buying More TMO

Looking ahead to 2024, the company provided an initial outlook.

- It anticipates core organic revenue growth of approximately 1%.

- The year is expected to start with a more challenging first half and gradually shift to moderate growth in the second half.

- Pandemic-related revenues are estimated to be around $300 million, with M&A contributing $175 million to revenue.

- Foreign exchange is likely to act as a headwind, with an estimated impact of around $375 million.

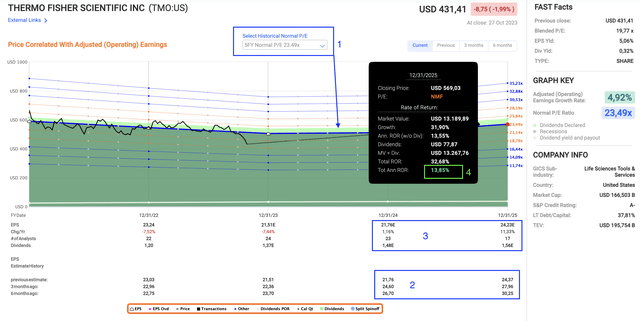

- The company aims to deliver approximately $21.75 of adjusted EPS in 2024, assuming these conditions prevail. This number is in line with analyst expectations, as seen in both FAST Graph charts below.

Valuation-wise, the stock is now trading at 19.8x earnings, which is the trimmed mean going back to 2003. This is the most attractive valuation since 2019, indicating that the COVID-19 hype has been dealt with.

Over the past five years, the average valuation was 23.5x earnings, which is fair, as the company is, generally speaking, capable of double-digit EPS growth.

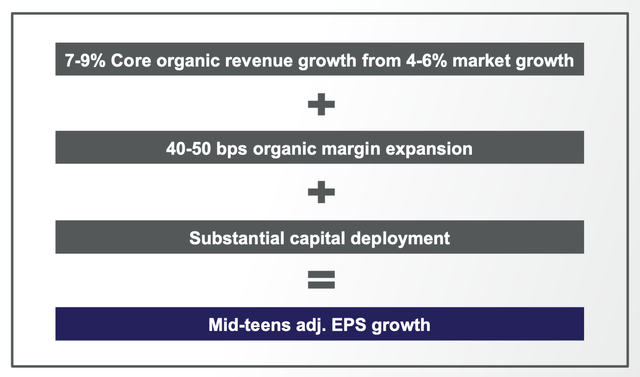

Its long-term guidance is mid-teens adjusted EPS growth, based on at least 7% annual core revenue growth, rising market shares, and a consistent uptrend in organic margins.

To assess the risk/reward, we can use the chart below.

I highlighted some key aspects with numbers.

- Over the past five years, the stock’s valuation has averaged 23.5x earnings, which I believe is a fair long-term multiple.

- The company’s EPS expectations have come down considerably for both 2024 and 2025, indicating that analysts have incorporated a lot of weakness. As I already briefly noted, 2024 expectations are in line with TMO’s guidance.

- While 2024 is expected to be another sluggish year, 2025 could see a significant rebound in EPS growth (+11%).

- If we assume that the company maintains a 23.5x multiple through 2025, it could return more than 13% per year, which is roughly what the company returned over the past ten years.

Also, the company has an A- credit rating.

So, while it’s not impossible for TMO shares to decline further, pressured by general economic and market weakness, I believe the risk/reward for this compounder has gotten very attractive.

Hence, I’ve been buying both TMO and DHR in recent months, and I will continue to do so in the next few quarters.

I truly believe that TMO will continue to outperform the market for many more years to come and be one of the biggest wealth generators in my family’s portfolio.

Takeaway

Thermo Fisher Scientific stands out as a compelling investment choice, even in the face of recent challenges.

While I don’t hold it in my personal portfolio due to its correlation with Danaher, it’s a cornerstone of my family’s holdings.

TMO’s ability to weather market fluctuations, especially within the medical equipment industry, makes it an excellent long-term choice.

With a focus on operational efficiency and growth drivers across various segments, TMO has demonstrated its resilience and adaptability.

The company’s conservative valuation, coupled with its history and outlook of strong earnings growth, offers investors an attractive risk-to-reward ratio.

I’m confident that TMO will continue to outperform the market, making it a vital wealth generator for my family’s portfolio.

Reasons To Be Bullish

- Steady Dividend Growth Stock: TMO is a reliable dividend growth stock, making it an attractive choice for income investors.

- Resilient in a Volatile Market: TMO consistently outperforms the market, especially during challenging times like the COVID-19 pandemic.

- Essential to R&D: The company provides critical equipment and services for research and development in various sectors, ensuring its long-term relevance.

- Long-Term Growth Potential: TMO is well-positioned for growth due to global population growth and increasing healthcare demands.

- Strong Financial Performance: TMO maintains strong financial performance, with growth in operating income and earnings per share.

- Attractive Valuation: TMO’s current valuation is appealing, suggesting potential for capital appreciation.

Three Risks To Consider

- Market Sensitivity: TMO’s performance can be influenced by broader market trends and economic conditions. Economic downturns or market volatility could impact the company’s financial results and stock price.

- Regulatory Challenges: As a company operating in the healthcare and life sciences sector, TMO is subject to stringent regulations and compliance requirements. Changes in regulations or unexpected legal issues could pose risks to its operations and profitability.

- Competition: TMO faces competition from other companies providing similar equipment and services in the healthcare and research industries. Intense competition could affect TMO’s market share, pricing power, and overall financial performance.

I believe all of these risks are contained.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My family is long TMO

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.