Summary:

- Alphabet Inc., aka Google, recently reported better-than-expected earnings results.

- However, its stock was punished because cloud revenue grew slightly less than expected.

- Google’s recent 15% stock correction presents a buying opportunity, as the company’s earnings and profitability potential remain strong.

- Google stock is undervalued and could go substantially higher in the long term.

Justin Sullivan/Getty Images News

Did you know that Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), also known as Google, made a folding phone? Google does. It starts at $1,799, and it looks excellent. Google also makes more practical hardware devices, including its flagship $999 Pixel 8 Pro, worthy of competing with any Samsung or iPhone, in my view. However, while hardware may remain a significant growth area for Google, it makes most of its profits on the software side.

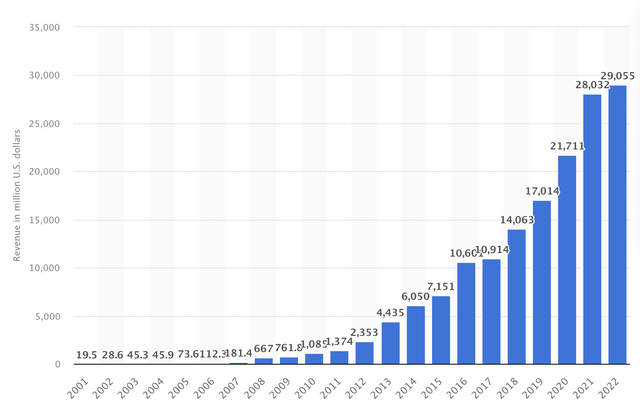

Google’s Digital Content & Hardware Revenue

Digital content and hardware (Statista.com)

Google generates enormous revenues through its Android operating platform and the Google Play Store. While we’ve seen a slight slowdown in growth here and in Google’s other businesses, it is likely a transitory downtick.

Alphabet recently reported Q3 earnings, beating on both top and bottom lines. However, its stock got chopped down unfairly due to some calling Google’s recent earnings a “mixed bag.”

I am still determining what a mixed bag is, but if it includes Google reporting 11% YoY revenue growth and expanding EPS by 46% YoY, I am in. While Google’s Cloud business growth is important, a temporary decline in the growth rate could have a minimal and transitory impact on Google’s long-term profitability potential.

Thank You For The Rare Buying Opportunity

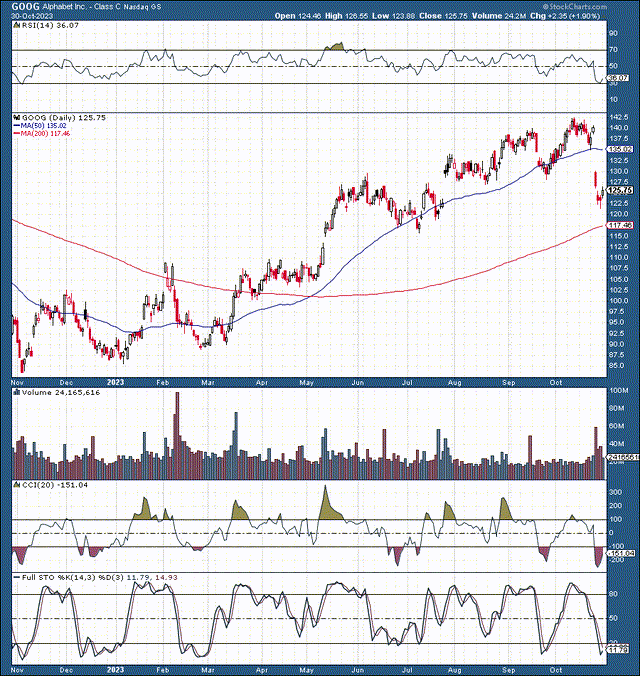

Google’s stock just went through a 15% correction due to the slightly slower-than-expected growth in its cloud space. The mixed bag cost the company about $180 billion in market cap losses. This dynamic may illustrate an overreaction due to elevated volatility because of the macroeconomic elements.

In addition to the excellent correction, the stock closed the $120-130 gap from its previous earnings announcement. The RSI hit the 30 level, illustrating the most oversold technical conditions since Google bottomed last November. Other technical gauges support that this temporary downdraft is likely a buying opportunity. Moreover, Google is finally cheap.

Finally, Google is Cheap

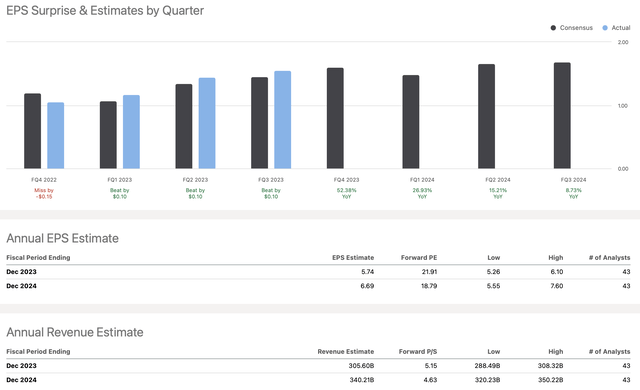

EPS estimates (SeekingAlpha.com)

We’ve seen a steady improvement in earnings since the tech sector’s crash landing in the fall of last year. Google’s consensus 2024 EPS estimate is $6.69. While there is some concern that EPS growth could decline due to slower cloud growth, other segments could produce better growth and higher profitability, making up for any shortcomings in the cloud segment. Also, Google’s cloud growth downturn could be temporary, and the segment should continue generating considerable growth, helping harvest profitability as we advance.

Therefore, if Google earns around the consensus $6.70, it’s trading at 18.6 times forward EPS estimates. For Google, this valuation is very cheap. Alphabet is a dominant, high-quality, market-leading company that should continue increasing revenues and improving profitability in the coming years. Google could surprise EPS higher, earning about $7 in 2024, putting its forward P/E multiple around 17.

Seventeen times forward earnings is a cheap valuation, as we should see solid double-digit revenue and EPS growth from Alphabet in future years. Typically, we expect a P/E ratio of around 22-25 for a company in Google’s advantageous position. However, due to the tight monetary environment, decreased risk appetite, and poor sentiment, we can buy Google at a considerable discount here for 17 times future earnings.

Google’s Solid Earnings Announcement

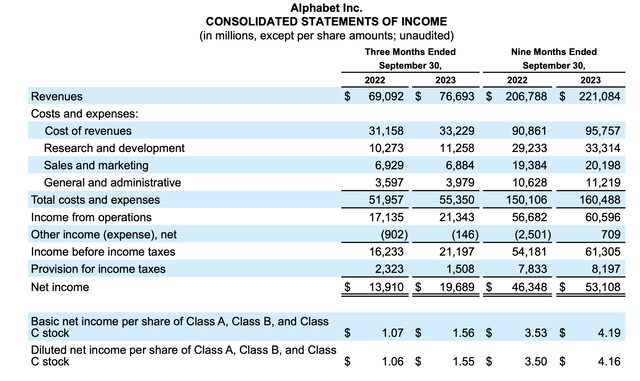

Google delivered GAAP EPS of $1.55, beating the consensus estimates by 10 cents. Q3 revenue reached $76.79, an 11% rise YoY and a $980 million beat over the forecast.

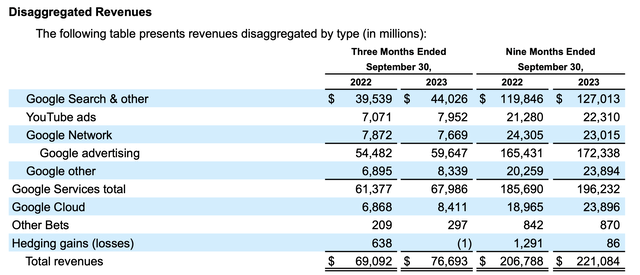

Alphabet Segment Revenues

- Google search and other revenues increased by 11.4% YoY.

- YouTube ads grew at 12.4% YoY.

- Google Network declined by 2.7% YoY.

- Google Other grew by 21% YoY.

- Google Cloud expanded revenues by 22.6%.

Income Statement

- Operating income surged by 25%.

- Net income skyrocketed by 42%.

The Takeaway

Despite the cloud segment growth not being as high as anticipated, Alphabet’s other critical segments continue functioning well, growing, expanding revenues, and improving profitability. Additionally, cloud growth issues may be transitory and could be linked with the broad slowdown effect. Therefore, we could see an acceleration in the cloud segment and other revenue growth as the macroeconomic landscape normalizes in 2024 and the following years.

Where Google’s stock could be in future years:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $340 | $380 | $420 | $460 | $500 | $540 | $585 |

| Revenue growth | 11% | 12% | 11% | 10% | 9% | 8% | 8% |

| EPS | $7 | $8.20 | $9.40 | $11 | $12.8 | $14.7 | $16.7 |

| EPS growth | 22% | 17% | 15% | 17% | 16% | 15% | 14% |

| Forward P/E | 19 | 20 | 21 | 22 | 21 | 22 | 21 |

| Stock price | $156 | $188 | $231 | $282 | $309 | $367 | $420 |

Source: The Financial Prophet.

Risks Exist – Don’t Want to Become The Next Roadkill

Google is right to fear becoming the next Yahoo. Google has become enormous, but it can’t sit still, as it must continuously innovate to generate growth. This dynamic is why Google’s cloud growth is so crucial. Google must keep up with its competitors in AI and continue optimizing growth and profitability in its core business. There is a risk to future growth and profitability due to macroeconomic factors that may persist for longer than anticipated. Additionally, Alphabet risks becoming too big, bureaucratic, and inefficient, a dynamic that could cause its multiple to contract. Market participants should examine these and other threats before investing in Google.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!