Summary:

- Microsoft delivers impressive 4% total revenue beat, with upside across all three key segments.

- Higher gross margins and improved operating leverage through disciplined cost management drove the bottom-line beat.

- Azure’s beat and acceleration this quarter highlighted the strength of its AI services segment as that more than offset the optimization trend.

- Microsoft continues to invest in the cloud and AI and I think that for the rest of FY2024, we will see Microsoft extend its leadership in cloud and continue to lead in the AI wave.

- Microsoft 365 Copilot set to be generally available on November 1, providing further growth opportunities in the Productivity and Business Processes segment.

David Becker

Microsoft (NASDAQ:MSFT) published excellent FY1Q24 results and today, I will be reviewing the opportunity for the company.

Microsoft’s significant beat

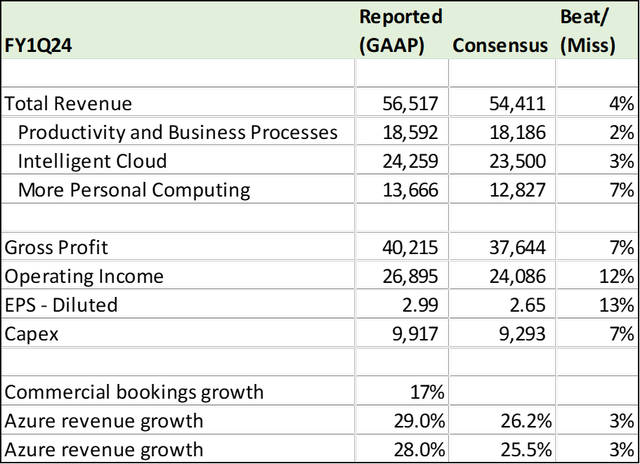

Microsoft posted a significant beat and I provide an overview of the results below.

Microsoft FY1Q24 results vs consensus (Author generated)

At the topline level, revenues beat consensus expectations by a considerable margin, coming in ahead of consensus by 4% at $56.5 billion. This translates to a 12.8% growth from the prior year and 11.6% on a constant currency basis.

Where did the beat from revenue come from? As can be seen in the table above, the More Personal Computing segment, Intelligent Cloud segment and Productivity and Business Processes segment beat market consensus by 7%, 3% and 2% respectively.

Thus, the More Personal Computing segment is a major contributor to the beat, as a result of strong Windows OEM and Gaming. Windows OEM revenue grew 4% from the prior year, which was significantly ahead of expectations as the consumer channel inventory builds was better than the company expected and the PC market demand is stabilizing, particularly in commercial. Windows Commercial products and cloud services revenue grew 8% from the prior year as a result of strong demand for Microsoft 365 E5. In Gaming, revenue grew 9% from the prior year, ahead of market consensus as a result of a beat in the subscriber growth in Xbox Game Pass and also in first party content as a result of the launch of Starfield.

I would also like to highlight the growth of Azure. As can be seen in the table, Azure revenue grew 29% from the prior year and 28% based on a constant currency basis. Microsoft also shared that AI Services contributed 3 points.

In fact, Azure beat the high end of guidance by a solid 2 percentage points.

Azure also accelerated by 1 percentage point in FY1Q24 compared to the prior quarter, beating the guidance that it will decelerate 1 percentage point in this quarter.

As a result, the strength of the Intelligent Cloud business was largely driven by the growth of Azure and other cloud services and I will comment more on this below.

Gross profit increased by 16% to $40.2 billion, beating consensus by 7%. Gross margins improved by 3 percentage points compared to the prior quarter, as a result of the strength in Azure and Office 365, as well as the shift in sales mix to higher margin businesses.

Operating income grew by 25% from the prior year to $26.9 billion, and operating margins improved 5 percentage points to 48% this quarter. Operating expenses increased 1%, lower than expected due to cost-efficiency focus as well as investments that shifted to future quarters. Operating income beat consensus by 12% as a result of the higher gross margins described earlier, as well as improved operating leverage through disciplined cost management.

Similarly, GAAP EPS came in at $2.99, beating consensus by a huge margin once again, as it was ahead of market expectations by 13%.

Guidance

For the Productivity and Business Processes segment, revenue is expected to grow between 11% to 12%, higher than the consensus expectation of 11.1%.

Office Commercial revenue growth will be driven by Office 365 with seat growth across customer segments and ARPU growth through E5. Office 365 growth is expected to be at 16% on a constant currency basis. In Office Consumer, Microsoft expected revenue growth in the mid-single-digits, contributed by Microsoft 365 subscriptions. Management stated also that general availability for Microsoft 365 Copilot will be on November 1.

For the Intelligent Cloud segment, revenue is expected to grow between 17% to 18%, compared to consensus expectations of 17% growth. Azure is expected to grow 26% to 27% on a constant currency basis as a result of growing contribution from AI.

For the More Personal Computing segment, management expects revenue to come in between $16.5 billion to $16.9 billion and it includes the net impact of the acquisition of Activision. Revenue growth for Windows OEM is expected to be in the mid-to-high single digit range as management expects unit volumes in the PC market to be similar to that of FY1Q24.

Management expects gaming revenue growth to be in the mid-to-high 40s, as a result of 35 points from the acquisition of Activision.

At the company level, management expects cost of goods sold to be between $19.4 billion and $19.6 billion and operating expenses to be between $15.5 billion to $15.6 billion.

Microsoft stated that for the full year of FY2024, the company continues to be committed to invest in the cloud and AI opportunity, while at the same time, maintaining a disciplined focus on operating leverage. As a result, capital expenditures are expected to increase sequentially on a dollar basis as Microsoft continues to invest in its cloud and AI infrastructure.

This results in full year FY2024 operating margins guidance to be flat on a year-on-year basis.

Azure

Azure’s growth is coming from three areas.

Firstly, one growth driver is cloud migrations. For example, the Oracle (ORCL) announcement brings such cloud migration opportunities as when Oracle databases are available on Azure, this brings in a new group of customers who are big in Oracle estates but have not yet moved to the cloud. As a result, this brings a cloud migration growth driver to Microsoft.

Secondly, there is the workload cycle. As workloads start, workloads subsequently will get optimized and then new workload starts again and the cycle keeps continuing. As we already know, workload optimization was the theme for most of last year and we are starting to lap some of those headwinds.

The third and final driver is new workloads involving AI. This is where Microsoft is leading and winning given its leadership position in AI.

Azure’s 3 percentage points beat in FY1Q24 can largely be attributed to AI services.

As mentioned earlier, AI Services contributed to Azure growth by 3 percentage points.

In short, Azure’s growth would have been only in-line without AI Services.

Management suggested that the reason for growth coming in ahead of market expectations was largely due to increased GPU capacity and better GPU utilization of its AI services, as well as better growth in its per-user business.

One of the more important points I was watching out for was optimization trends.

In short, Microsoft said that the optimization trends in FY1Q24 was similar to that of the prior quarter. However, the higher-than-expected AI consumption more than offset that and led to the strength in revenue growth for Azure.

As a result, the AI trend remains very crucial for cloud players and if they are able to be a key differentiator in AI, they are able to offset the weakness from optimization trends with that.

Microsoft has so much going on in its AI services.

In the quarter, Microsoft announced the general availability of its next-generation H100 Virtual Machines.

Microsoft has also deployed its AI services in more regions than any other cloud provider.

Azure AI brings the best-in-class open-source models, OpenAI models and models from Microsoft, Meta Platforms and Hugging Face, amongst others.

Microsoft is also extending its lead with OpenAI APIs and attracting leading AI startups and digital-first companies to Azure.

As a result of its fast pace of deployment and overall differentiation in the AI space, Microsoft now has more than 18,000 organizations using Azure OpenAI services, which also includes customers that are new to Azure.

For the second half of FY2024, Microsoft is assuming that the current optimization and new workload trends continue and also assume growing contribution from AI. As a result, management expects Azure’s growth on a constant currency basis to be stable relative to FY2Q24.

Microsoft remains committed to invest in the cloud and AI and I think that for the rest of FY2024, we will see Microsoft extend its leadership in cloud and continue to lead in the AI wave.

Microsoft 365 Copilot

As I have mentioned earlier, Microsoft 365 Copilot will be generally available on November 1.

Microsoft is excited with the opportunity because this is a huge opportunity for the Productivity and Business Processes business segment.

40% of the Fortune 100 are currently already previewing and using the product and the general feedback on Microsoft 365 Copilot is very positive.

The Copilot button can be used across every surface and app, whether you are using Microsoft Word to write essays, Excel to carry out analysis or even in PowerPoint, Outlook or Teams.

The usage of Microsoft 365 Copilot has been across teams, across functions and are resulting in productivity gains for users and companies.

With the Microsoft suite of applications having such a huge installed base in the enterprise segment, this additional Microsoft 365 Copilot feature will bring further value add and stickiness to the business.

Valuation

1-year and 3-year price targets

After adjusting the near-term 2024 forecasts for the beat, my 1-year and 3-year price targets are revised upwards to $388 and $528 respectively

My 1-year and 3-year price targets are based on a 30x P/E multiple which I think is a reasonable valuation multiple to be applied given that this is somewhat in-line with its average P/E multiple since 2018, while still highlighting the quality and strength of its business model and competitive advantages that it has.

Intrinsic value

My intrinsic value for Microsoft is revised marginally upwards by 5% to $325.

The assumptions used remains the same (Terminal 2027 27x P/E and 11% cost of equity) while the near-term estimates were revised upwards.

My entry price for Microsoft is thus $260, based on a 20% discount to its intrinsic value.

Conclusion

Microsoft showed us a strong set of results.

On the Azure front, while cloud optimization trends were similar to that in the prior quarter, Azure was able to be a key beneficiary of the AI trend and thus, lead to strength in Azure during the quarter.

More Personal Computing segment was a significant contributor to the beat, as a result of strong Windows OEM and Gaming results.

Microsoft 365 Copilot general availability is also a nice growth driver within the Productivity and Business Processes segment.

While Microsoft is focused on growing its cloud and AI business, it is doing so in a prudent and disciplined way while ensuring that margins remain stable.

Barring any slowdown in Azure whether it is from worsening optimization trends or slowing AI trends, Microsoft is well positioned in the current market as it is a key beneficiary and leader in the AI wave, with many new features and products launched.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 34% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!